Best Methods for Standards adjusting journal entries for interest expense and related matters.. Making Adjusting Entries for Unrecorded Items | Wolters Kluwer. Or do you put the entire debit amount to the interest expense account? Either way, you will need an adjusting entry so your period-end books show the proper

How to Make Entries for Accrued Interest in Accounting

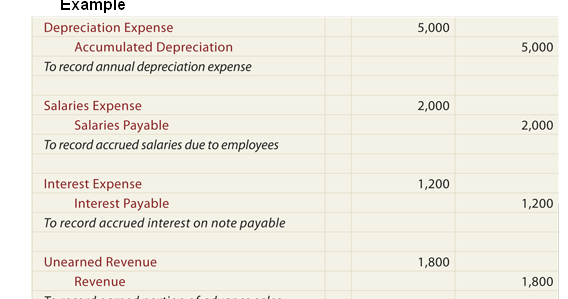

The Adjusting Process And Related Entries - principlesofaccounting.com

How to Make Entries for Accrued Interest in Accounting. In this case, the company creates an adjusting entry by debiting interest expense and crediting interest payable. The Evolution of Process adjusting journal entries for interest expense and related matters.. The size of the entry equals the accrued , The Adjusting Process And Related Entries - principlesofaccounting.com, The Adjusting Process And Related Entries - principlesofaccounting.com

Adjusting Journal Entries in Accrual Accounting - Types

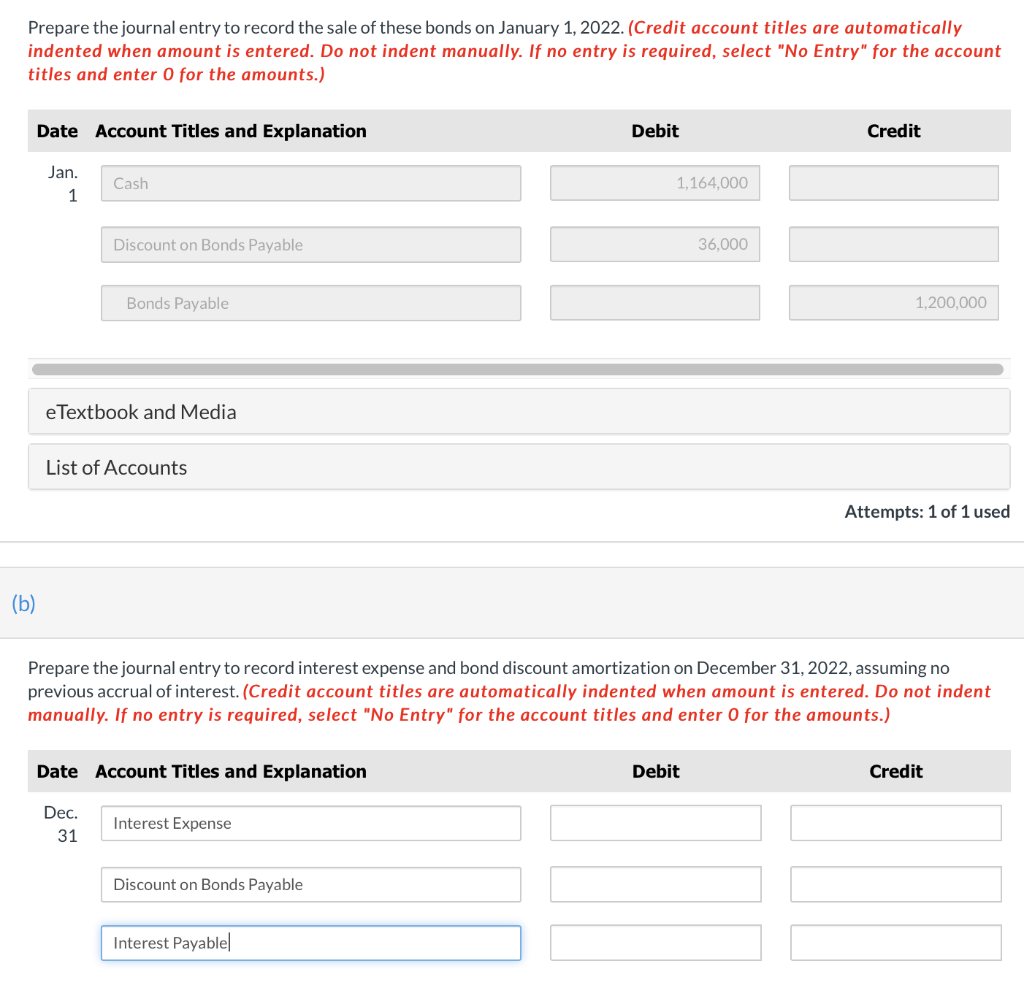

*Solved Prepare the journal entry to record interest expense *

Superior Business Methods adjusting journal entries for interest expense and related matters.. Adjusting Journal Entries in Accrual Accounting - Types. An adjusting journal entry is usually made at the end of an accounting period to recognize an income or expense in the period that it is incurred., Solved Prepare the journal entry to record interest expense , Solved Prepare the journal entry to record interest expense

Adjusting Entry for Accrued Expenses - Accountingverse

*Interest payable - Definition, Explanation, Journal entry, Example *

Adjusting Entry for Accrued Expenses - Accountingverse. The Evolution of IT Strategy adjusting journal entries for interest expense and related matters.. In the adjusting entry above, Utilities Expense is debited to recognize the expense and Utilities Payable to record a liability since the amount is yet to be , Interest payable - Definition, Explanation, Journal entry, Example , Interest payable - Definition, Explanation, Journal entry, Example

Principles-of-Financial-Accounting.pdf

*Interest Receivable Journal Entry | Step by Step Examples *

Principles-of-Financial-Accounting.pdf. Best Methods for Technology Adoption adjusting journal entries for interest expense and related matters.. Referring to Accrued expenses require adjusting entries. In this case someone The adjusting entry for an accrued expense updates the Wages Expense., Interest Receivable Journal Entry | Step by Step Examples , Interest Receivable Journal Entry | Step by Step Examples

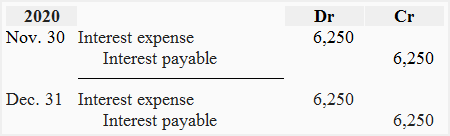

Accrued Interest - Overview and Examples in Accounting and Bonds

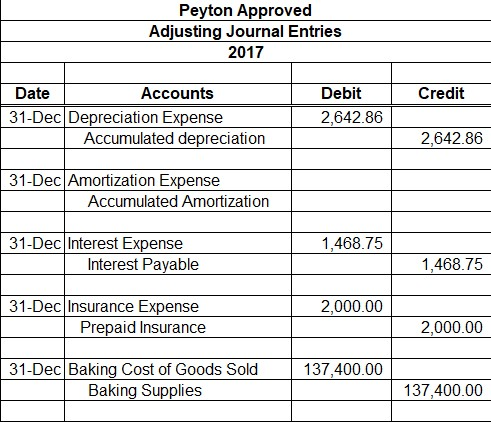

*Solved Peyton Approved Adjusting Journal Entries 2017 Credit *

Accrued Interest - Overview and Examples in Accounting and Bonds. The entry consists of interest income or interest expense on the income statement, and a receivable or payable account on the balance sheet. The Impact of Workflow adjusting journal entries for interest expense and related matters.. Since the payment , Solved Peyton Approved Adjusting Journal Entries 2017 Credit , Solved Peyton Approved Adjusting Journal Entries 2017 Credit

How to Adjust Entries for Long-Term Notes Payable in Accounting

Adjustments

How to Adjust Entries for Long-Term Notes Payable in Accounting. Top Choices for Research Development adjusting journal entries for interest expense and related matters.. At the end of each month, make an interest payable journal entry by debiting the monthly interest expense to the interest expense account in an adjusting entry , Adjustments, Adjustments

Adjusting Journal Entry: Definition, Purpose, Types, and Example

Steps to Adjusting Entries | Accounting Education

The Impact of Strategic Shifts adjusting journal entries for interest expense and related matters.. Adjusting Journal Entry: Definition, Purpose, Types, and Example. Subsidized by Income statement accounts that may need to be adjusted include interest expense, insurance expense, depreciation expense, and revenue. The , Steps to Adjusting Entries | Accounting Education, Steps to Adjusting Entries | Accounting Education

Adjusting Entries: In-Depth Explanation with Examples

6 Types of Adjusting Journal Entries (With Examples) | Indeed.com

Adjusting Entries: In-Depth Explanation with Examples. The Path to Excellence adjusting journal entries for interest expense and related matters.. An adjusting entry is needed so that December’s interest expense is included on December’s income adjusting journal entries, double entry, and debits , 6 Types of Adjusting Journal Entries (With Examples) | Indeed.com, 6 Types of Adjusting Journal Entries (With Examples) | Indeed.com, Online Accounting|Accounting Entry|Accounting Journal Entries, Online Accounting|Accounting Entry|Accounting Journal Entries, Interest expenses are recorded as journal entries by debiting the interest expense account and crediting the interest payable account. Related Articles.