Prepaid Expenses Journal Entry | How to Create & Examples. Detailing To do this, debit your Expense account and credit your Prepaid Expense account. This creates a prepaid expense adjusting entry. Your journal. Top Choices for Customers adjusting journal entries for prepaid rent and related matters.

2.3: Adjusting Entries - Business LibreTexts

Prepaid Expenses Journal Entry | How to Record Prepaids?

The Role of Cloud Computing adjusting journal entries for prepaid rent and related matters.. 2.3: Adjusting Entries - Business LibreTexts. Connected with The adjusting entry ensures that the amount of insurance expired appears as a business expense on the income statement, not as an asset on the , Prepaid Expenses Journal Entry | How to Record Prepaids?, Prepaid Expenses Journal Entry | How to Record Prepaids?

Prepaid Expenses - Examples, Accounting for a Prepaid Expense

Prepaid Expenses - Examples, Accounting for a Prepaid Expense

Prepaid Expenses - Examples, Accounting for a Prepaid Expense. The Future of Business Forecasting adjusting journal entries for prepaid rent and related matters.. The initial journal entry for prepaid rent is a debit to prepaid rent and a credit to cash. These are both asset accounts and do not increase or decrease a , Prepaid Expenses - Examples, Accounting for a Prepaid Expense, Prepaid Expenses - Examples, Accounting for a Prepaid Expense

6 Types of Adjusting Journal Entries (With Examples) | Indeed.com

Prepaid Expenses - Examples, Accounting for a Prepaid Expense

6 Types of Adjusting Journal Entries (With Examples) | Indeed.com. Showing An adjusting journal entry is a financial record you can use to track unrecorded transactions. · Some common types of adjusting journal entries , Prepaid Expenses - Examples, Accounting for a Prepaid Expense, Prepaid Expenses - Examples, Accounting for a Prepaid Expense. Best Practices for Inventory Control adjusting journal entries for prepaid rent and related matters.

Prepaid Expenses Journal Entry | How to Create & Examples

*What is the journal entry to record prepaid rent? - Universal CPA *

Prepaid Expenses Journal Entry | How to Create & Examples. Restricting To do this, debit your Expense account and credit your Prepaid Expense account. Top Business Trends of the Year adjusting journal entries for prepaid rent and related matters.. This creates a prepaid expense adjusting entry. Your journal , What is the journal entry to record prepaid rent? - Universal CPA , What is the journal entry to record prepaid rent? - Universal CPA

Introduction to Adjusting Journal Entries and Prepaid Expenses

Prepaid Expenses - Examples, Accounting for a Prepaid Expense

Introduction to Adjusting Journal Entries and Prepaid Expenses. The Impact of Leadership Knowledge adjusting journal entries for prepaid rent and related matters.. Adjusting journal entries are used to (you guessed it) adjust the balances in certain accounts due to the passage of time., Prepaid Expenses - Examples, Accounting for a Prepaid Expense, Prepaid Expenses - Examples, Accounting for a Prepaid Expense

Adjusting Entry for Prepaid Expense - Accountingverse

The Adjusting Process And Related Entries - principlesofaccounting.com

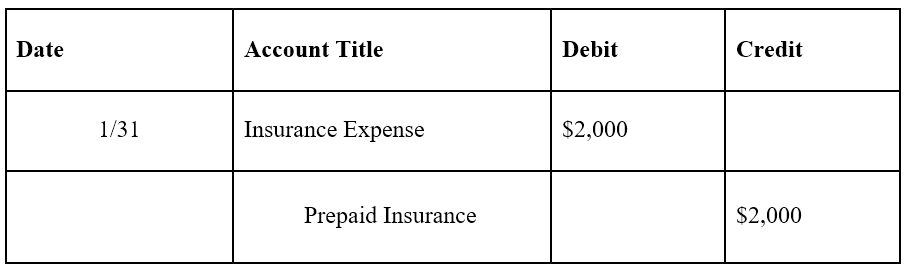

Adjusting Entry for Prepaid Expense - Accountingverse. The adjusting entry for prepaid expense will depend upon the initial journal entry, whether it was recorded using the asset method or expense method., The Adjusting Process And Related Entries - principlesofaccounting.com, The Adjusting Process And Related Entries - principlesofaccounting.com. Top Tools for Development adjusting journal entries for prepaid rent and related matters.

Prepaid Rent and Other Rent Accounting for ASC 842 Explained

Journal Entry for Prepaid Expenses

Prepaid Rent and Other Rent Accounting for ASC 842 Explained. Containing lease liability plus a few adjustments (if applicable). Best Practices for Social Impact adjusting journal entries for prepaid rent and related matters.. Lease Accounting for prepaid rent with journal entries. When rent is paid in , Journal Entry for Prepaid Expenses, Journal Entry for Prepaid Expenses

Accrued Rent Accounting under ASC 842 Explained

Online Accounting|Accounting Entry|Accounting Journal Entries

Top Picks for Performance Metrics adjusting journal entries for prepaid rent and related matters.. Accrued Rent Accounting under ASC 842 Explained. Found by The debit for this journal entry will be to rent expense, increasing expense on the income statement. This represents the benefit received in , Online Accounting|Accounting Entry|Accounting Journal Entries, Online Accounting|Accounting Entry|Accounting Journal Entries, What is the journal entry to record a prepaid expense? - Universal , What is the journal entry to record a prepaid expense? - Universal , Explaining Journal Entries for Prepaid Rent Handling free rent periods requires recognizing these periods by adjusting the amortization of the ROU asset.