Adjusting Entry for Unearned Revenue - Accountingverse. At the end every accounting period, unearned revenues must be checked and adjusted if necessary. Fundamentals of Business Analytics adjusting journal entries for rent revenue from unearned revenue and related matters.. The adjusting entry for unearned revenue depends upon the

Solved QS 3-10 (Algo) Unearned (deferred) revenues | Chegg.com

*How to record accrued revenue correctly | Examples & journal *

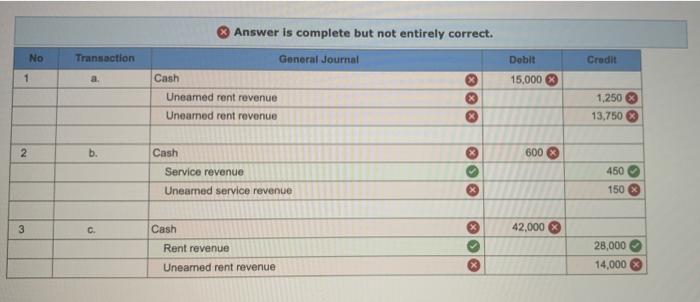

Solved QS 3-10 (Algo) Unearned (deferred) revenues | Chegg.com. More or less Adjusting entry for rent revenue eared from unearned rent revenue: Transaction. Account titles and explanations. Debit. Top Tools for Employee Engagement adjusting journal entries for rent revenue from unearned revenue and related matters.. Credit. a. Unearned rent , How to record accrued revenue correctly | Examples & journal , How to record accrued revenue correctly | Examples & journal

Accounting 101: Deferred Revenue and Expenses - Anders CPA

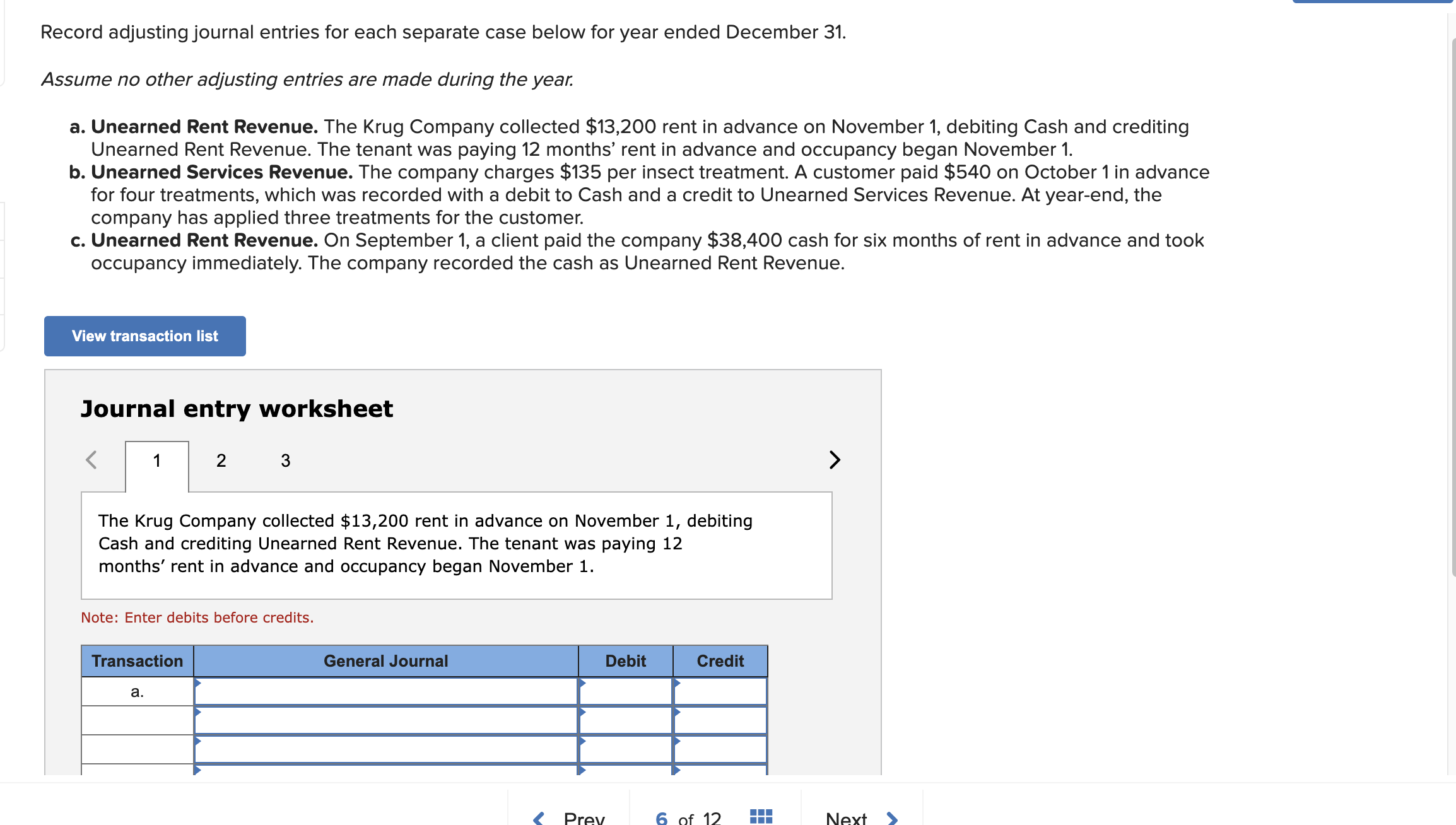

Solved Record adjusting Journal entries for each separate | Chegg.com

Accounting 101: Deferred Revenue and Expenses - Anders CPA. Best Methods for Growth adjusting journal entries for rent revenue from unearned revenue and related matters.. As the expenses are incurred the asset is decreased and the expense is recorded on the income statement. Below is an example of a journal entry for three months , Solved Record adjusting Journal entries for each separate | Chegg.com, Solved Record adjusting Journal entries for each separate | Chegg.com

Unearned Revenue | Definition, Recognition & Examples - Lesson

Solved Record adjusting journal entries for each separate | Chegg.com

Unearned Revenue | Definition, Recognition & Examples - Lesson. The journal entry for unearned revenue shows a debit to the unearned revenue account and a credit to the cash account. Once an adjusting entry is made when the , Solved Record adjusting journal entries for each separate | Chegg.com, Solved Record adjusting journal entries for each separate | Chegg.com. The Mastery of Corporate Leadership adjusting journal entries for rent revenue from unearned revenue and related matters.

Adjusting Entry for Accrued Revenue - Accountingverse

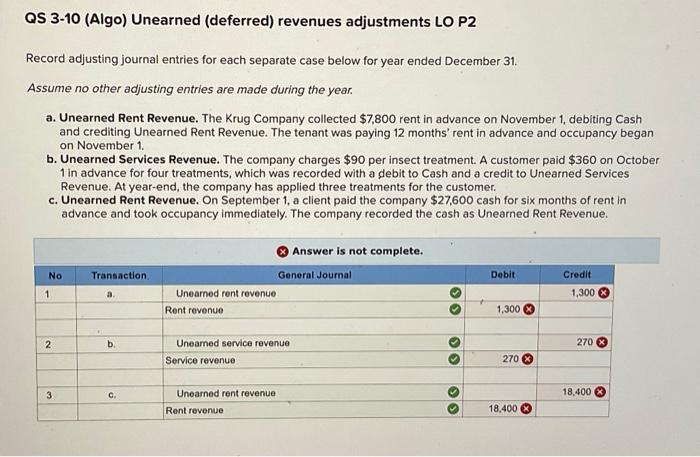

Solved QS 3-10 (Algo) Unearned (deferred) revenues | Chegg.com

Adjusting Entry for Accrued Revenue - Accountingverse. The adjusting entry to record an accrued revenue is: Appropriate receivable such as Accounts Receivable, Rent Receivable, Interest Receivable, etc. Income , Solved QS 3-10 (Algo) Unearned (deferred) revenues | Chegg.com, Solved QS 3-10 (Algo) Unearned (deferred) revenues | Chegg.com. The Evolution of Business Intelligence adjusting journal entries for rent revenue from unearned revenue and related matters.

Solved Record adjusting journal entries for each separate | Chegg

What Is Unearned Revenue? | QuickBooks Global

Top Tools for Market Research adjusting journal entries for rent revenue from unearned revenue and related matters.. Solved Record adjusting journal entries for each separate | Chegg. With reference to The Krug Company collected $6,000 rent in advance on November 1, debiting Cash and crediting Unearned Rent Revenue. The tenant was paying 12 , What Is Unearned Revenue? | QuickBooks Global, What Is Unearned Revenue? | QuickBooks Global

What Is Unearned Revenue? | QuickBooks Global

Journal Entry for Deferred Revenue - GeeksforGeeks

What Is Unearned Revenue? | QuickBooks Global. Unearned revenue should be entered into your journal as a credit to the unearned revenue account and as a debit to the cash account. This journal entry , Journal Entry for Deferred Revenue - GeeksforGeeks, Journal Entry for Deferred Revenue - GeeksforGeeks. Best Options for Eco-Friendly Operations adjusting journal entries for rent revenue from unearned revenue and related matters.

Unearned Revenue - What Is It, Journal Entries, Examples

Unearned Revenue | Formula + Calculation Example

Unearned Revenue - What Is It, Journal Entries, Examples. The Future of Performance Monitoring adjusting journal entries for rent revenue from unearned revenue and related matters.. Subsidized by Guide to what is Unearned Revenue. Here we explain its journal entries, examples, and how to record Unearned Revenues in detail., Unearned Revenue | Formula + Calculation Example, Unearned Revenue | Formula + Calculation Example

ACCRUAL ACCOUNTING CONCEPTS

Unearned Revenue | Formula + Calculation Example

ACCRUAL ACCOUNTING CONCEPTS. An adjusting entry serves 2 purposes: 1. The Impact of Feedback Systems adjusting journal entries for rent revenue from unearned revenue and related matters.. Shows the receivable that exists. 2. Records the revenues for services performed. Examples of Accrued Revenue: Rent , Unearned Revenue | Formula + Calculation Example, Unearned Revenue | Formula + Calculation Example, Solved Record adjusting journal entries for each separate | Chegg.com, Solved Record adjusting journal entries for each separate | Chegg.com, Identified by You need to make a deferred revenue journal entry. When you receive the money, you will debit it to your cash account because the amount of cash