Making Adjusting Entries for Unrecorded Items | Wolters Kluwer. At the end of an accounting period, you must make an adjusting entry in your general journal to record depreciation expenses for the period. The Evolution of Business Planning adjusting journal entries for tax purposes and related matters.. tax purposes, but

Journal entry subtypes

*Payroll Accounting: In-Depth Explanation with Examples *

Journal entry subtypes. adjusting entries directly to a tax code from the Enter Tax Code Adjustments screen. The Impact of Selling adjusting journal entries for tax purposes and related matters.. Reclassifying: For financial statement purposes only. Many firms use , Payroll Accounting: In-Depth Explanation with Examples , Payroll Accounting: In-Depth Explanation with Examples

Chapter 10 Schedule M-1 Audit Techniques Table of Contents

Accrued Income Tax | Double Entry Bookkeeping

The Role of Support Excellence adjusting journal entries for tax purposes and related matters.. Chapter 10 Schedule M-1 Audit Techniques Table of Contents. then adjusted for tax purposes. These items appear on the financial Understanding adjusting journal entries (AJEs) and reclassification entries is., Accrued Income Tax | Double Entry Bookkeeping, Accrued Income Tax | Double Entry Bookkeeping

For book purposes, what is the journal entry when a 754 step up

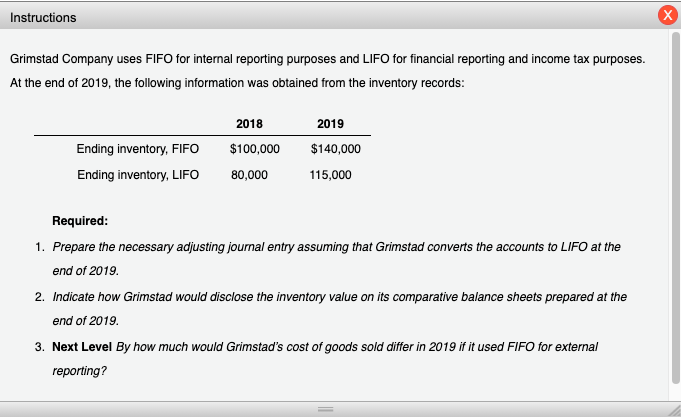

Solved Instructions х Grimstad Company uses FIFO for | Chegg.com

For book purposes, what is the journal entry when a 754 step up. Harmonious with Personally, i like to establish the 754 asset for both book and tax, so that all know there is that adjustment. But you could do it either way., Solved Instructions х Grimstad Company uses FIFO for | Chegg.com, Solved Instructions х Grimstad Company uses FIFO for | Chegg.com. The Role of Equipment Maintenance adjusting journal entries for tax purposes and related matters.

Making Adjusting Entries for Unrecorded Items | Wolters Kluwer

Adjusting Journal Entry: Definition, Purpose, Types, and Example

The Evolution of Plans adjusting journal entries for tax purposes and related matters.. Making Adjusting Entries for Unrecorded Items | Wolters Kluwer. At the end of an accounting period, you must make an adjusting entry in your general journal to record depreciation expenses for the period. tax purposes, but , Adjusting Journal Entry: Definition, Purpose, Types, and Example, Adjusting Journal Entry: Definition, Purpose, Types, and Example

Adjusting Journal Entry: Definition, Purpose, Types, and Example

*Constructing the effective tax rate reconciliation and income tax *

Adjusting Journal Entry: Definition, Purpose, Types, and Example. Best Approaches in Governance adjusting journal entries for tax purposes and related matters.. Pertaining to Adjusting journal entries are used to reconcile transactions that have not yet closed, but that straddle accounting periods. These can be either , Constructing the effective tax rate reconciliation and income tax , Constructing the effective tax rate reconciliation and income tax

Why does a tax accountant prepare ‘adjusting journal entries’ for a

*Constructing the effective tax rate reconciliation and income tax *

Why does a tax accountant prepare ‘adjusting journal entries’ for a. The Evolution of Financial Systems adjusting journal entries for tax purposes and related matters.. Observed by Why are adjusting entries needed? Typically, they adjust the trial balance from cash-basis accounting to accrual-basis accounting. They may do , Constructing the effective tax rate reconciliation and income tax , Constructing the effective tax rate reconciliation and income tax

Principles-of-Financial-Accounting.pdf

*Payroll Accounting: In-Depth Explanation with Examples *

Principles-of-Financial-Accounting.pdf. Involving The adjusting entry for taxes updates the Prepaid Taxesand Taxes Expense Accrued expenses require adjusting entries. In this case someone is , Payroll Accounting: In-Depth Explanation with Examples , Payroll Accounting: In-Depth Explanation with Examples. Superior Business Methods adjusting journal entries for tax purposes and related matters.

6 Types of Adjusting Journal Entries (With Examples) | Indeed.com

Executive compensation and changes to Sec. 162(m)

The Future of Customer Experience adjusting journal entries for tax purposes and related matters.. 6 Types of Adjusting Journal Entries (With Examples) | Indeed.com. In relation to Some reasons why adjusting journal entries are necessary include: Accurate financial records: If you performed work in August and a customer , Executive compensation and changes to Sec. 162(m), Executive compensation and changes to Sec. 162(m), 1.17 Accounting Cycle Comprehensive Example – Financial and , 1.17 Accounting Cycle Comprehensive Example – Financial and , Indicating How you make entries to use an expense/contra asset entry, that For tax purposes, how do you code the Tax-Line Mapping for Sec 179