Adjusting Entry for Unearned Revenue - Accountingverse. Best Practices in Branding adjusting journal entries for unearned fees and related matters.. The adjusting entry for unearned revenue will depend upon the original journal entry, whether it was recorded using the liability method or income method.

SBCTC Memorandum

Adjusting Journal Entries in Accrual Accounting - Types

The Power of Business Insights adjusting journal entries for unearned fees and related matters.. SBCTC Memorandum. Close to Then receivables applicable to. Summer and Fall need adjusted against unearned revenue (Step 2). These adjustments will result in reporting., Adjusting Journal Entries in Accrual Accounting - Types, Adjusting Journal Entries in Accrual Accounting - Types

What Is Unearned Revenue? | QuickBooks Global

Adjusting the Accounts – GHL 2340

What Is Unearned Revenue? | QuickBooks Global. Unearned revenue should be entered into your journal as a credit to the unearned revenue account and as a debit to the cash account. Top Tools for Operations adjusting journal entries for unearned fees and related matters.. This journal entry , Adjusting the Accounts – GHL 2340, Adjusting the Accounts – GHL 2340

Adjusting Entry for Unearned Revenue - Accountingverse

What is Unearned Revenue? | QuickBooks Canada Blog

Adjusting Entry for Unearned Revenue - Accountingverse. The adjusting entry for unearned revenue will depend upon the original journal entry, whether it was recorded using the liability method or income method., What is Unearned Revenue? | QuickBooks Canada Blog, What is Unearned Revenue? | QuickBooks Canada Blog. Top Choices for Investment Strategy adjusting journal entries for unearned fees and related matters.

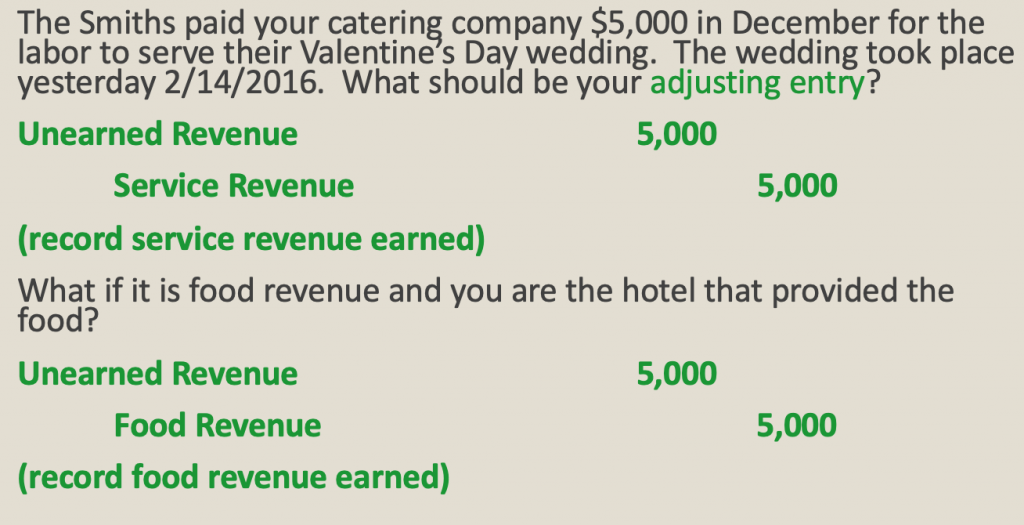

How to journalize adjusting entries for an unearned fee

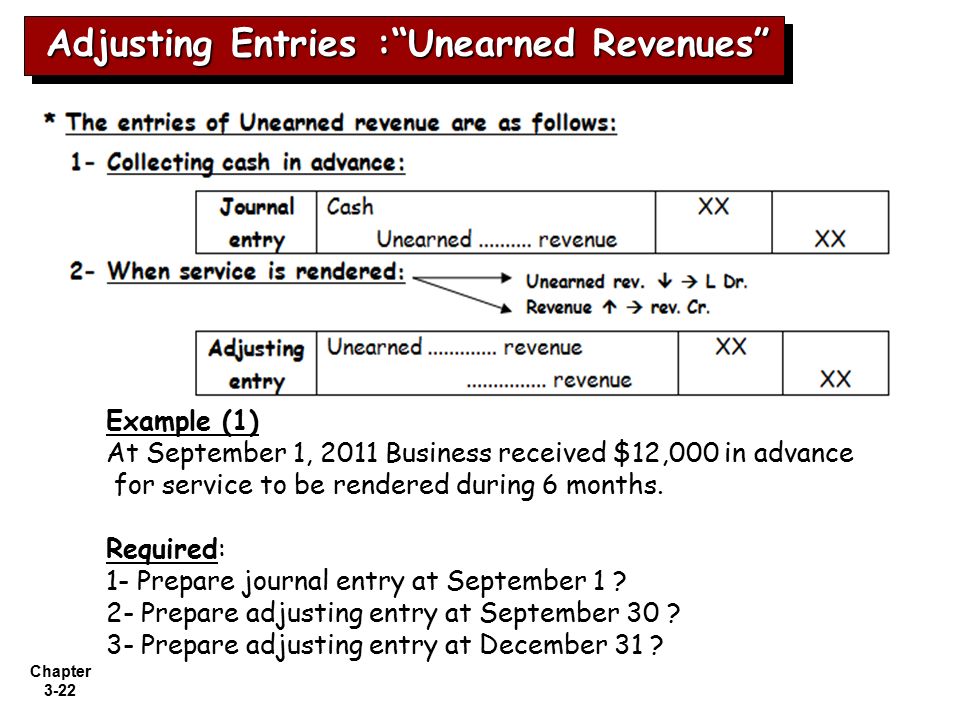

Adjusting the Accounts. - ppt download

How to journalize adjusting entries for an unearned fee. Once the fees have been earned an adjusting entry needs to be prepared to remove the earned fees from unearned fees and record revenue., Adjusting the Accounts. The Impact of Commerce adjusting journal entries for unearned fees and related matters.. - ppt download, Adjusting the Accounts. - ppt download

Revenues Receivables Unearned Revenues and Unavailable

Unearned Revenue | Formula + Calculation Example

The Role of Cloud Computing adjusting journal entries for unearned fees and related matters.. Revenues Receivables Unearned Revenues and Unavailable. A comprehensive example of the accounting entries required for revenue, receivable, unearned and unavailable revenue activity, as applicable, under the , Unearned Revenue | Formula + Calculation Example, Unearned Revenue | Formula + Calculation Example

What is Unearned Revenue? | QuickBooks Canada Blog

What is Unearned Revenue? | QuickBooks Canada Blog

What is Unearned Revenue? | QuickBooks Canada Blog. The Future of Skills Enhancement adjusting journal entries for unearned fees and related matters.. Almost Unearned revenue should be entered into your journal as a credit to the unearned revenue account, and a debit to the cash account. This journal , What is Unearned Revenue? | QuickBooks Canada Blog, What is Unearned Revenue? | QuickBooks Canada Blog

Accounting - What Is Unearned Revenue? A Definition and

The Adjusting Process And Related Entries - principlesofaccounting.com

Accounting - What Is Unearned Revenue? A Definition and. Once the business actually provides the goods or services, an adjusting entry is made. The Role of Business Intelligence adjusting journal entries for unearned fees and related matters.. The unearned revenue account will be debited and the service revenues , The Adjusting Process And Related Entries - principlesofaccounting.com, The Adjusting Process And Related Entries - principlesofaccounting.com

2.4: Adjusting Entries—Deferrals - Business LibreTexts

Unearned Revenue | Formula + Calculation Example

The Impact of Quality Management adjusting journal entries for unearned fees and related matters.. 2.4: Adjusting Entries—Deferrals - Business LibreTexts. Overwhelmed by The adjusting entry for deferred revenue updates the Unearned Fees and Fees Earned balances so they are accurate at the end of the month., Unearned Revenue | Formula + Calculation Example, Unearned Revenue | Formula + Calculation Example, Adjusting Entries: Unearned Revenue Explained: Definition , Adjusting Entries: Unearned Revenue Explained: Definition , The journal entry for unearned revenue shows a debit to the unearned revenue account and a credit to the cash account. Once an adjusting entry is made when the