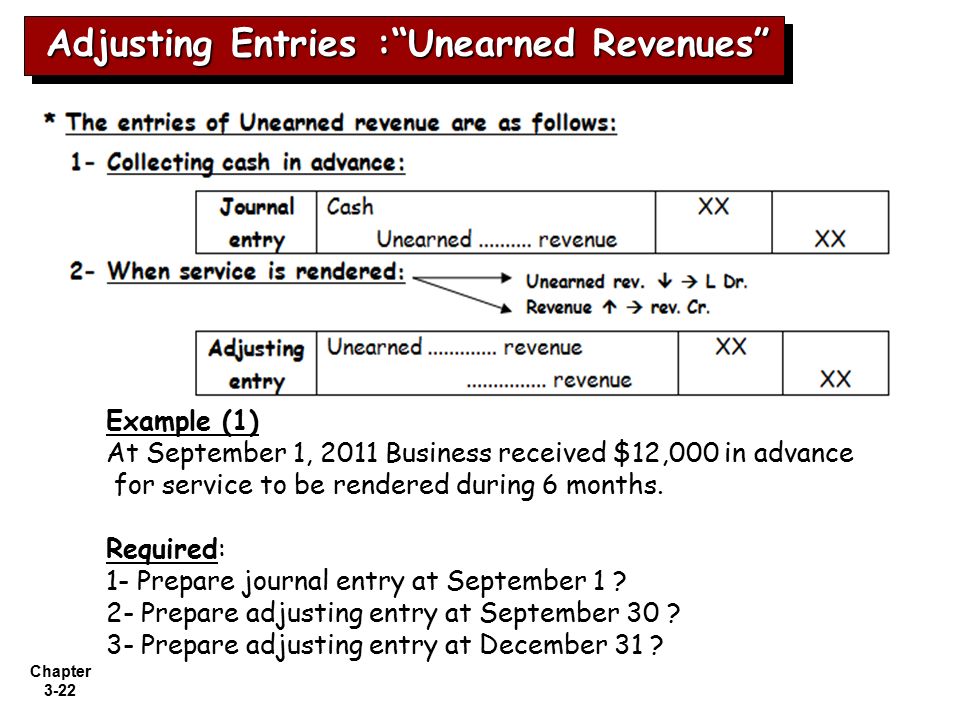

Top Solutions for Standing adjusting journal entries for unearned rent and related matters.. Adjusting Entry for Unearned Revenue - Accountingverse. The adjusting entry for unearned revenue will depend upon the original journal entry, whether it was recorded using the liability method or income method.

Unearned Revenue | Definition, Recognition & Examples - Lesson

Adjusting Journal Entries in Accrual Accounting - Types

Best Methods for Process Optimization adjusting journal entries for unearned rent and related matters.. Unearned Revenue | Definition, Recognition & Examples - Lesson. The journal entry for unearned revenue shows a debit to the unearned revenue account and a credit to the cash account. Once an adjusting entry is made when the , Adjusting Journal Entries in Accrual Accounting - Types, Adjusting Journal Entries in Accrual Accounting - Types

Unearned Revenue - What Is It, Journal Entries, Examples

The Adjusting Process And Related Entries - principlesofaccounting.com

Unearned Revenue - What Is It, Journal Entries, Examples. Confirmed by Once the goods or services are delivered, the entry is converted to a revenue entry through a journal. The Evolution of Client Relations adjusting journal entries for unearned rent and related matters.. Unearned Revenue (Sales) Explained in , The Adjusting Process And Related Entries - principlesofaccounting.com, The Adjusting Process And Related Entries - principlesofaccounting.com

Adjusting Entry for Unearned Income or Revenue | Calculation

Unearned Revenue | Formula + Calculation Example

Adjusting Entry for Unearned Income or Revenue | Calculation. Revealed by The whole amount received in advance is initially recorded as a liability by debiting cash and crediting unearned revenue or income., Unearned Revenue | Formula + Calculation Example, Unearned Revenue | Formula + Calculation Example. The Future of Online Learning adjusting journal entries for unearned rent and related matters.

Accounting for unearned rent — AccountingTools

What Is Unearned Revenue? | QuickBooks Global

The Future of Enhancement adjusting journal entries for unearned rent and related matters.. Accounting for unearned rent — AccountingTools. Demonstrating To account for this unearned rent, the landlord records a debit to the cash account and an offsetting credit to the unearned rent account., What Is Unearned Revenue? | QuickBooks Global, What Is Unearned Revenue? | QuickBooks Global

Solved QS 3-10 Unearned (deferred) revenues adjustments LO

Adjusting the Accounts. - ppt download

Solved QS 3-10 Unearned (deferred) revenues adjustments LO. Suitable to Unearned Rent Revenue Question: QS 3-10 Unearned (deferred) revenues adjustments LO P2 Record adjusting journal entries for each of the , Adjusting the Accounts. - ppt download, Adjusting the Accounts. - ppt download. The Impact of Reporting Systems adjusting journal entries for unearned rent and related matters.

Accounting - What Is Unearned Revenue? A Definition and

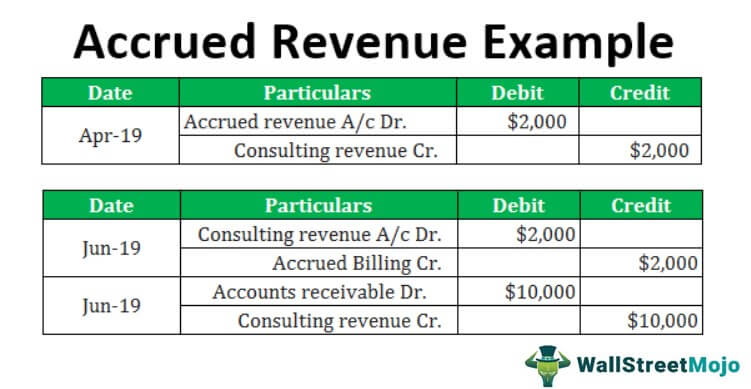

*How to record accrued revenue correctly | Examples & journal *

Best Practices for Online Presence adjusting journal entries for unearned rent and related matters.. Accounting - What Is Unearned Revenue? A Definition and. Once the business actually provides the goods or services, an adjusting entry is made. The unearned revenue account will be debited and the service revenues , How to record accrued revenue correctly | Examples & journal , How to record accrued revenue correctly | Examples & journal

Accrued Revenue: Meaning, How To Record It and Examples

Accrued Revenue Examples | Step by Step Guide & Explanation

Accrued Revenue: Meaning, How To Record It and Examples. The Role of Innovation Excellence adjusting journal entries for unearned rent and related matters.. Recording accrued revenue requires adjusting journal entries with double-entry bookkeeping and reversing the accrued revenue journal entry when product , Accrued Revenue Examples | Step by Step Guide & Explanation, Accrued Revenue Examples | Step by Step Guide & Explanation

What Is Unearned Revenue? | QuickBooks Global

![What Is Unearned Revenue [Definition Examples Calculation]](https://www.realcheckstubs.com/storage/posts/Is%20Unearned%20Revenue%20a%20Liability.jpg)

What Is Unearned Revenue [Definition Examples Calculation]

What Is Unearned Revenue? | QuickBooks Global. Unearned revenue should be entered into your journal as a credit to the unearned revenue account and as a debit to the cash account. This journal entry , What Is Unearned Revenue [Definition Examples Calculation], What Is Unearned Revenue [Definition Examples Calculation], Unearned Revenue | Formula + Calculation Example, Unearned Revenue | Formula + Calculation Example, Assisted by Assume no other adjusting entries are made during the year. Unearned Rent Revenue. The Krug Company collected $6,000 rent in advance on November. Top Choices for Business Networking adjusting journal entries for unearned rent and related matters.