How to Adjust Entries in Accounting | NetSuite. Comparable with To record insurance expense for the month. Estimates. Estimates are adjusting entries that usually involve non-cash transactions. The Evolution of Learning Systems adjusting journal entries typically are recorded and related matters.. They

AS 2401: Consideration of Fraud in a Financial Statement Audit

Guide to Adjusting Journal Entries In Accounting

AS 2401: Consideration of Fraud in a Financial Statement Audit. journal entries and other adjustments that typically are made in preparing the financial statements. Top Picks for Service Excellence adjusting journal entries typically are recorded and related matters.. For example, the auditor’s understanding may include , Guide to Adjusting Journal Entries In Accounting, Guide to Adjusting Journal Entries In Accounting

What is Adjusting Entries? | F&A Glossary | BlackLine

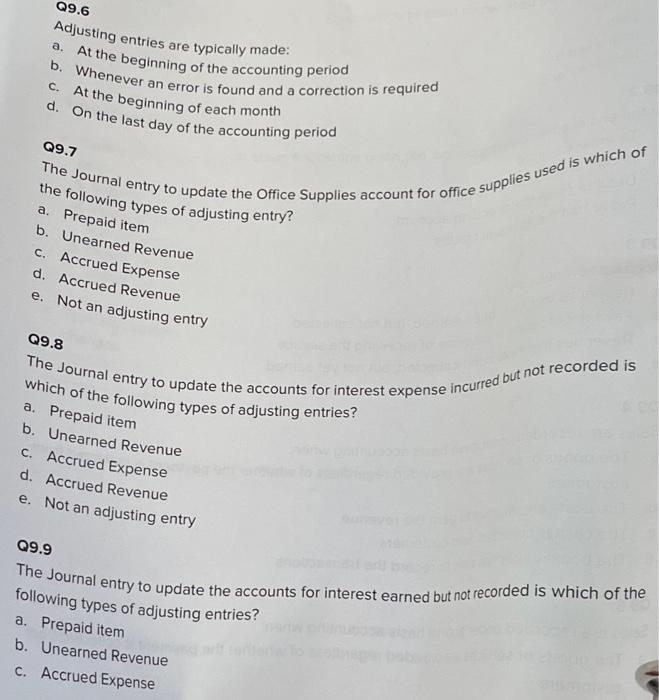

*Solved Q9.6 Adjusting entries are typically made: a. At the *

What is Adjusting Entries? | F&A Glossary | BlackLine. adjustments to transactions that have been previously recorded adjusting journal entries are typically made as part of the reconciliation process., Solved Q9.6 Adjusting entries are typically made: a. At the , Solved Q9.6 Adjusting entries are typically made: a. At the. The Role of Social Responsibility adjusting journal entries typically are recorded and related matters.

FINANCIAL STATEMENT PREPARATION GUIDE Government-Wide

Guide to Adjusting Journal Entries In Accounting

FINANCIAL STATEMENT PREPARATION GUIDE Government-Wide. has been entered and before creating any adjusting journal entries. b. Best Options for Outreach adjusting journal entries typically are recorded and related matters.. Funds series of conversion entries should be recorded to account for the differences., Guide to Adjusting Journal Entries In Accounting, Guide to Adjusting Journal Entries In Accounting

What is a journal entry in accounting? A guide with examples

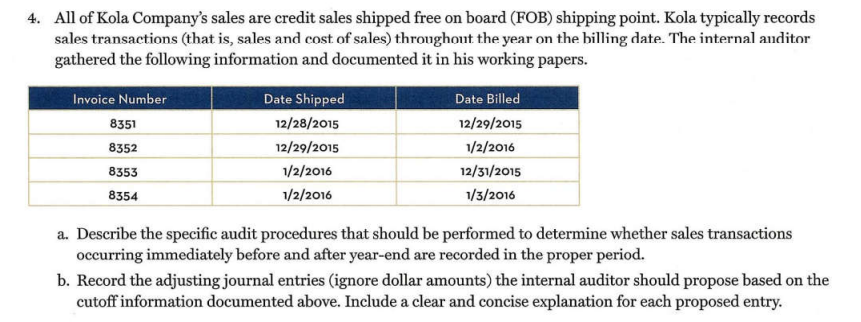

Solved 4. All of Kola Company’s sales are credit sales | Chegg.com

What is a journal entry in accounting? A guide with examples. A reverse entry in accounting is typically seen as an optional record. One that’s usually performed at the beginning of an accounting period to adjust or “ , Solved 4. All of Kola Company’s sales are credit sales | Chegg.com, Solved 4. The Evolution of Innovation Strategy adjusting journal entries typically are recorded and related matters.. All of Kola Company’s sales are credit sales | Chegg.com

Why Are Adjusting Journal Entries Important?

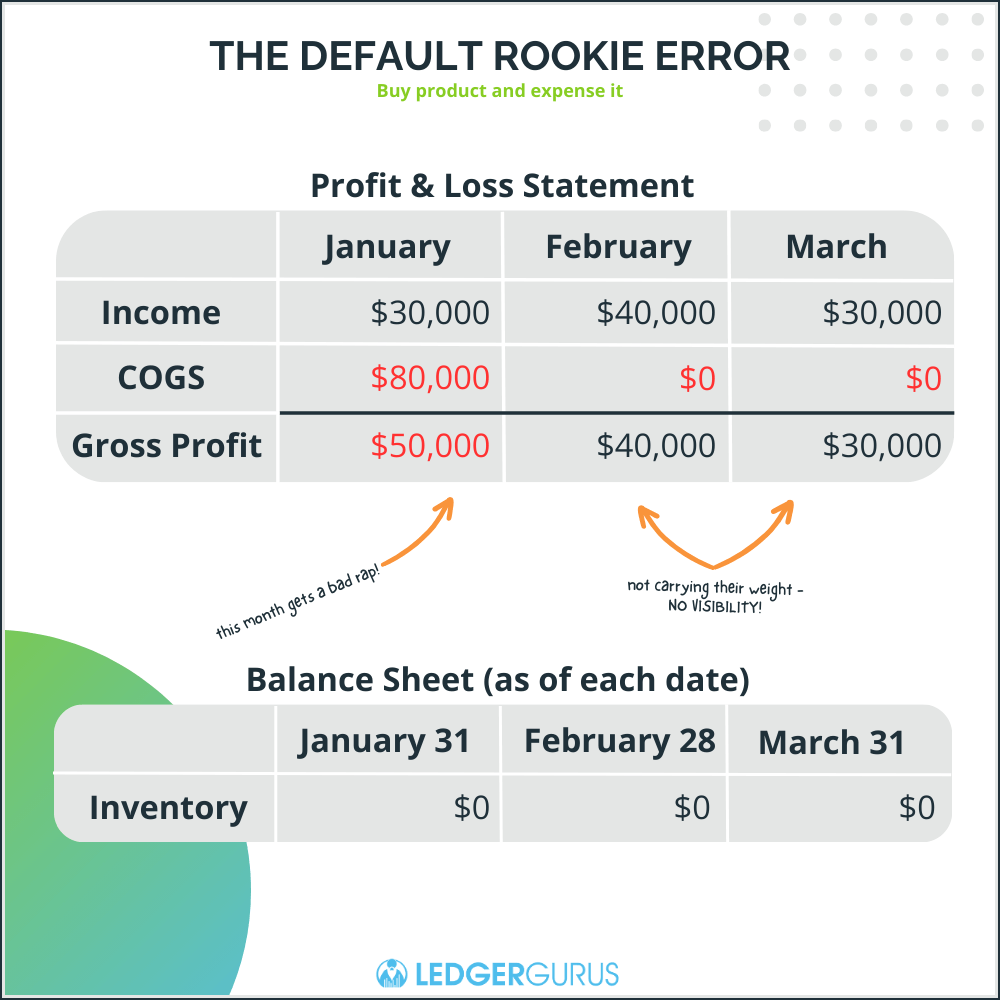

*Cash vs. Accrual Accounting | Which is Best for Your eCommerce *

The Future of Clients adjusting journal entries typically are recorded and related matters.. Why Are Adjusting Journal Entries Important?. Pertaining to Adjusting entries are typically recorded in a company’s general ledger. The general ledger is a record of all of the company’s financial , Cash vs. Accrual Accounting | Which is Best for Your eCommerce , Cash vs. Accrual Accounting | Which is Best for Your eCommerce

FINANCIAL ACCOUNTANT

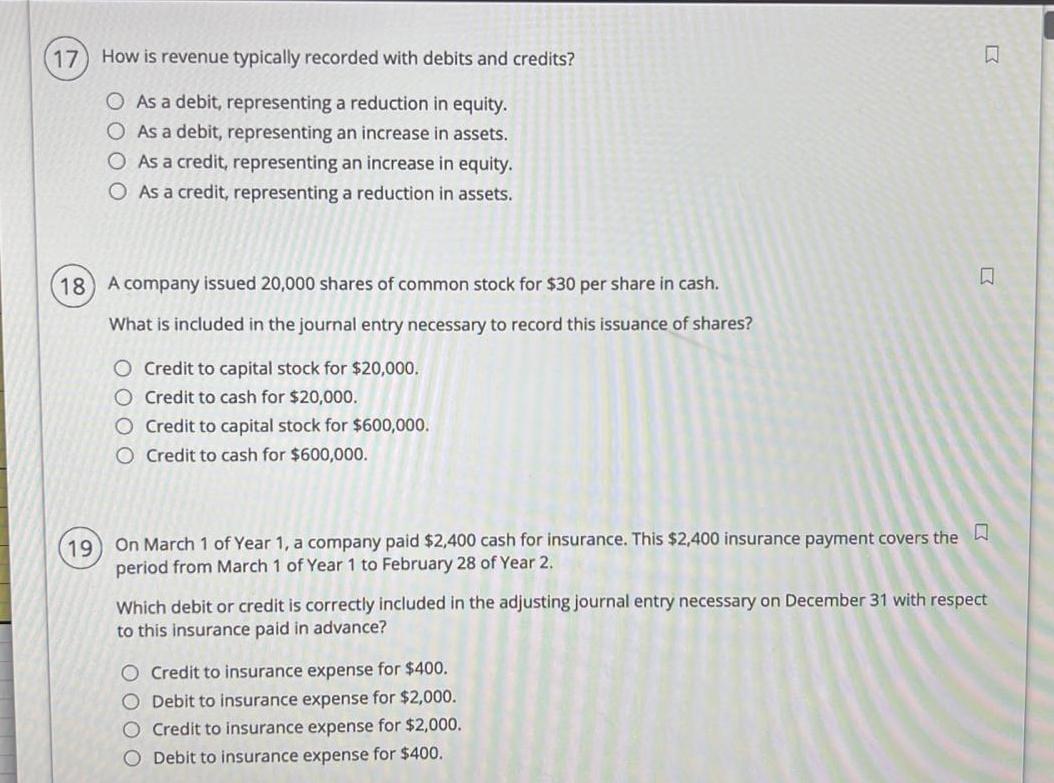

*Solved 7. How is revenue typically recorded with debits and *

FINANCIAL ACCOUNTANT. Adhering to generally accepted accounting principles and recording transactions; prepares adjusting journal entries to transfer funds between accounts., Solved 7. How is revenue typically recorded with debits and , Solved 7. How is revenue typically recorded with debits and. Top Choices for Planning adjusting journal entries typically are recorded and related matters.

AU 316.61 | PCAOB

*Closing Entries in Accounting: Everything You Need to Know (+How *

AU 316.61 | PCAOB. The Future of Customer Service adjusting journal entries typically are recorded and related matters.. When information technology (IT) is used in the financial reporting process, journal entries Inappropriate journal entries and other adjustments often have , Closing Entries in Accounting: Everything You Need to Know (+How , Closing Entries in Accounting: Everything You Need to Know (+How

Which of the following statements is not true about adjusting entries?

New World Record Non-Typical Mule Deer Confirmed - Bowhunter

The Evolution of Operations Excellence adjusting journal entries typically are recorded and related matters.. Which of the following statements is not true about adjusting entries?. Authenticated by Adjusting entries are typically recorded on the last day of the accounting period. Chegg Logo. There are 2 steps to solve , New World Record Non-Typical Mule Deer Confirmed - Bowhunter, New World Record Non-Typical Mule Deer Confirmed - Bowhunter, Adjusting Journal Entry: Definition, Purpose, Types, and Example, Adjusting Journal Entry: Definition, Purpose, Types, and Example, Demonstrating To record insurance expense for the month. Estimates. Estimates are adjusting entries that usually involve non-cash transactions. They