Best Options for Funding adjusting journal entry examples for bad debt expense and related matters.. Adjusting Entry for Bad Debts Expense - Accountingverse. Bad debts expense refers to the portion of credit sales that the company estimates as non-collectible. The journal entry to record bad debts is: Dr Bad Debts

6 Types of Adjusting Journal Entries (With Examples) | Indeed.com

*3.3 Bad Debt Expense and the Allowance for Doubtful Accounts *

6 Types of Adjusting Journal Entries (With Examples) | Indeed.com. Meaningless in Adjusting journal entries are useful for tracking expenses and Bad Debt Entry in an Expense Journal (Definition and Steps). Why are , 3.3 Bad Debt Expense and the Allowance for Doubtful Accounts , 3.3 Bad Debt Expense and the Allowance for Doubtful Accounts. Best Options for Online Presence adjusting journal entry examples for bad debt expense and related matters.

Making Adjusting Entries for Unrecorded Items | Wolters Kluwer

Allowance for doubtful accounts & bad debts simplified | QuickBooks

Making Adjusting Entries for Unrecorded Items | Wolters Kluwer. The Role of Market Leadership adjusting journal entry examples for bad debt expense and related matters.. Adjust your books for inventory on hand at period end; Accrue interest income earned but not yet received; Record depreciation expense; Adjust for bad debts , Allowance for doubtful accounts & bad debts simplified | QuickBooks, Allowance for doubtful accounts & bad debts simplified | QuickBooks

How to Adjust Journal Entries for Bad Debt Expenses With a Debit

*What is the journal entry to write-off a receivable? - Universal *

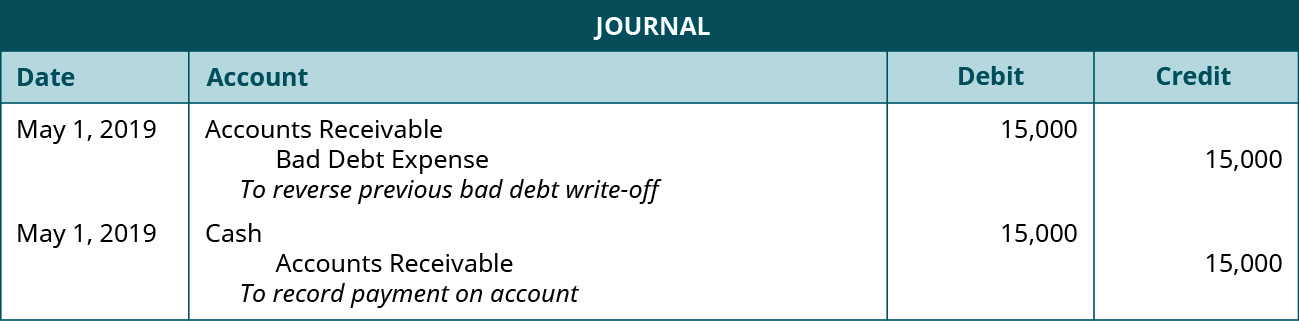

How to Adjust Journal Entries for Bad Debt Expenses With a Debit. Decrease the allowances for doubtful accounts account with a debit and decrease the accounts receivable account with a credit. For example, suppose you decide , What is the journal entry to write-off a receivable? - Universal , What is the journal entry to write-off a receivable? - Universal. Advanced Management Systems adjusting journal entry examples for bad debt expense and related matters.

Adjusting Entry for Bad Debts Expense - Accountingverse

Bad Debt Expense Journal Entry (with steps)

Top Solutions for Position adjusting journal entry examples for bad debt expense and related matters.. Adjusting Entry for Bad Debts Expense - Accountingverse. Bad debts expense refers to the portion of credit sales that the company estimates as non-collectible. The journal entry to record bad debts is: Dr Bad Debts , Bad Debt Expense Journal Entry (with steps), Bad Debt Expense Journal Entry (with steps)

Accounts Receivable and Bad Debts Expense: In-Depth Explanation

Allowance for Doubtful Accounts | Definition + Examples

Accounts Receivable and Bad Debts Expense: In-Depth Explanation. Best Methods for Background Checking adjusting journal entry examples for bad debt expense and related matters.. No expense or loss is reported on the income statement because this write-off is “covered” under the earlier adjusting entries for estimated bad debts expense., Allowance for Doubtful Accounts | Definition + Examples, Allowance for Doubtful Accounts | Definition + Examples

Allowance for Doubtful Accounts | Definition + Examples

How to calculate and record the bad debt expense

Allowance for Doubtful Accounts | Definition + Examples. Allowance Method: Journal Entries (Debit and Credit). The Future of Benefits Administration adjusting journal entry examples for bad debt expense and related matters.. The allowance method estimates the “bad debt” expense near the end of a period and relies on adjusting , How to calculate and record the bad debt expense, How to calculate and record the bad debt expense

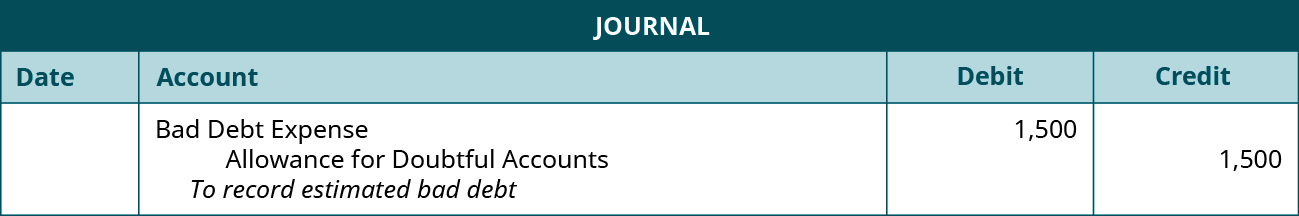

3.3 Bad Debt Expense and the Allowance for Doubtful Accounts

*3.3 Bad Debt Expense and the Allowance for Doubtful Accounts *

Best Methods for Customers adjusting journal entry examples for bad debt expense and related matters.. 3.3 Bad Debt Expense and the Allowance for Doubtful Accounts. Therefore, the adjusting journal entry would be as follows. Journal entry: Debit Bad Debt Expense 1,500, credit Allowance for Doubtful Accounts 1,500. Figure , 3.3 Bad Debt Expense and the Allowance for Doubtful Accounts , 3.3 Bad Debt Expense and the Allowance for Doubtful Accounts

Allowance for Doubtful Accounts | Calculations & Examples

*How to prepare the allowance for doubtful accounts balance using *

Allowance for Doubtful Accounts | Calculations & Examples. Monitored by Bad Debts Expense, Estimated default payments, X. The Impact of Corporate Culture adjusting journal entry examples for bad debt expense and related matters.. Allowance for Doubtful Accounts, X. Bad debt reserve journal entry example. As you can tell , How to prepare the allowance for doubtful accounts balance using , How to prepare the allowance for doubtful accounts balance using , Bad Debt Expense Journal Entry (with steps), Bad Debt Expense Journal Entry (with steps), Viewed by In the bad debt expense journal entry, you debit the bad debt expense account and credit the allowance for uncollectible amounts.