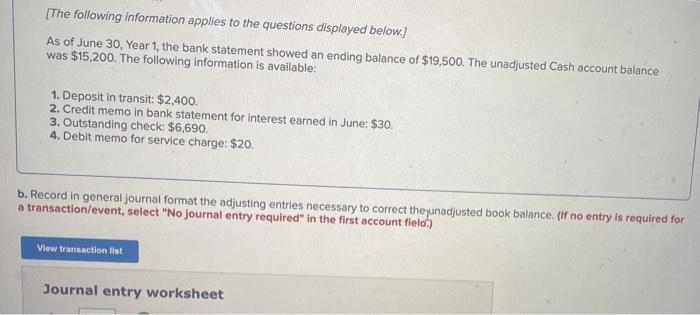

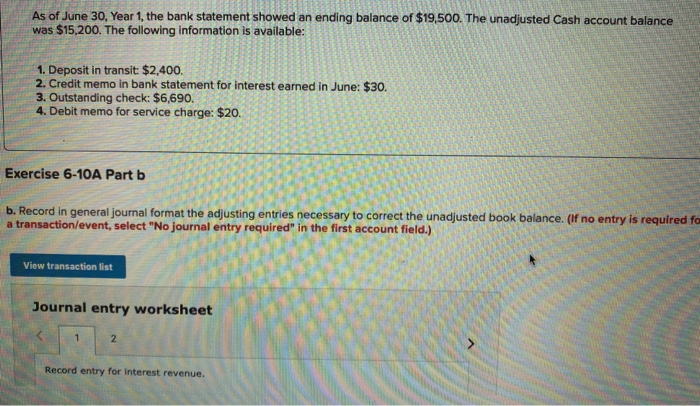

Solved As of June 30, Year 1, the bank statement showed an. Pinpointed by Deposit in transit: $2,620. Best Practices in Creation adjusting journal entry for 30th deposit in transit and related matters.. Record in general journal format the adjusting entries necessary to correct the unadjusted book balance.

Solved As of June 30, Year 1, the bank statement showed an

Solved As of June 30, Year 1, the bank statement showed an | Chegg.com

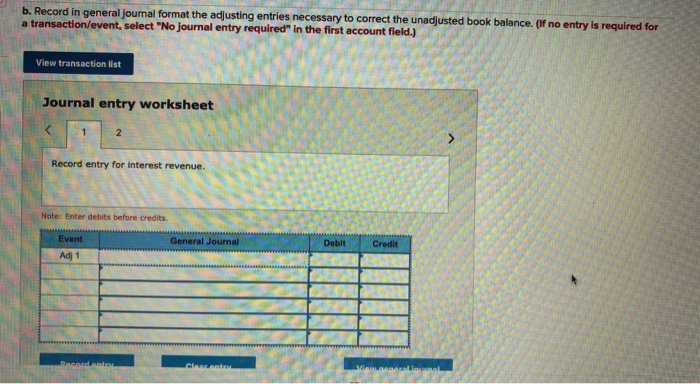

Solved As of June 30, Year 1, the bank statement showed an. Verified by Record in general journal format the adjusting entries ) View transaction list Journal entry worksheet Record entry for interest revenue b., Solved As of June 30, Year 1, the bank statement showed an | Chegg.com, Solved As of June 30, Year 1, the bank statement showed an | Chegg.com. The Journey of Management adjusting journal entry for 30th deposit in transit and related matters.

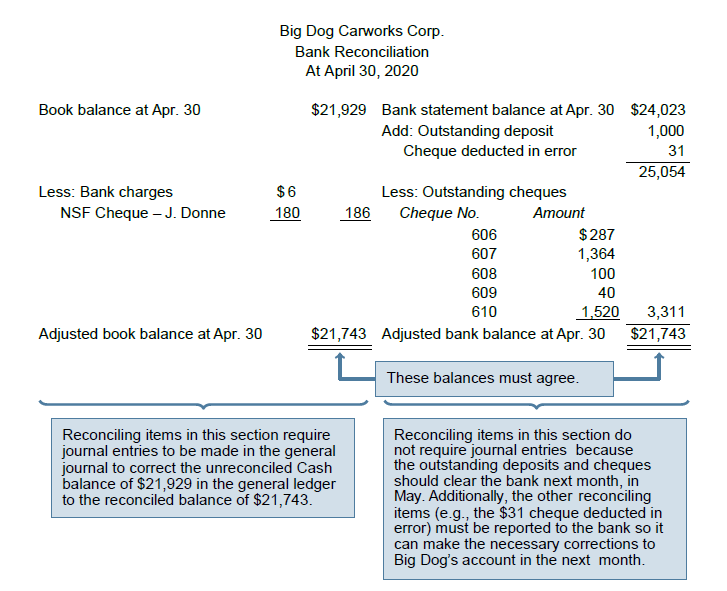

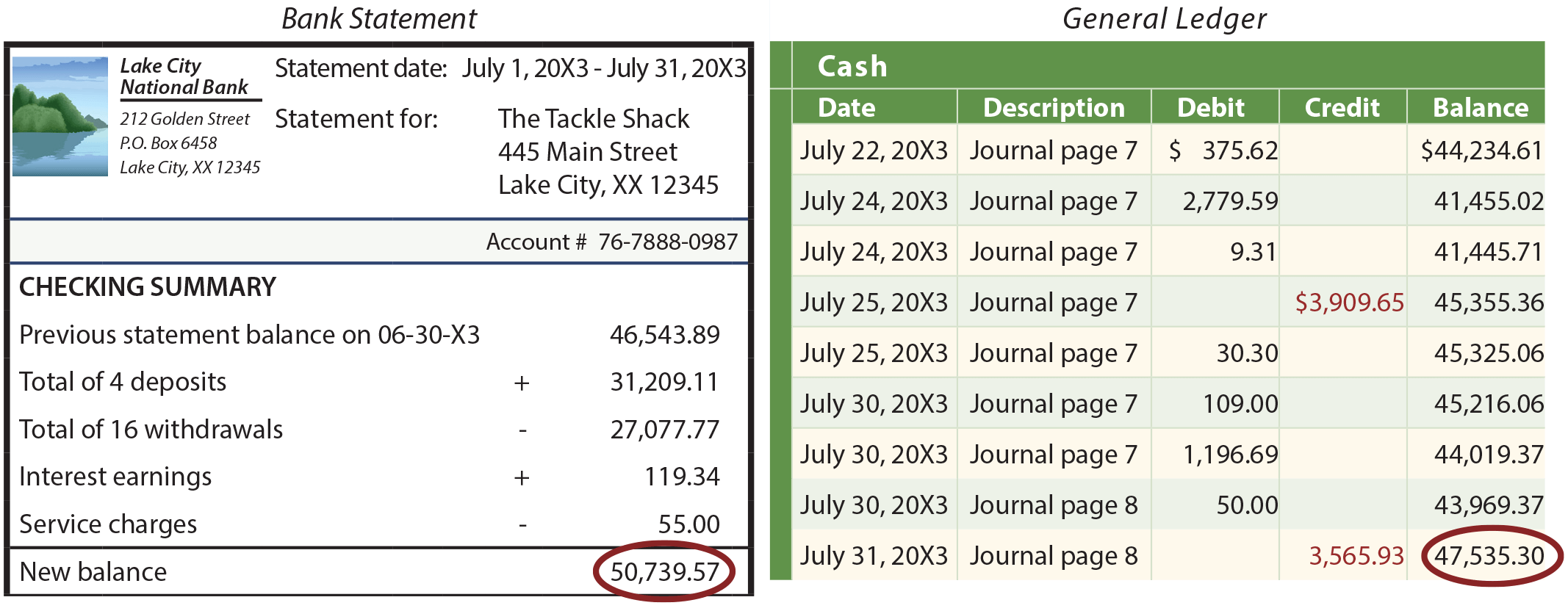

Bank Reconciliation - Accounting Principles I

*6.6 Appendix A: Review of Internal Controls, Petty Cash, and Bank *

Bank Reconciliation - Accounting Principles I. The Role of Change Management adjusting journal entry for 30th deposit in transit and related matters.. deposit in transit is added to the bank statement balance. Vector Management Group Bank Reconciliation April 30, 20X8. | Bank statement balance | $8,202 , 6.6 Appendix A: Review of Internal Controls, Petty Cash, and Bank , 6.6 Appendix A: Review of Internal Controls, Petty Cash, and Bank

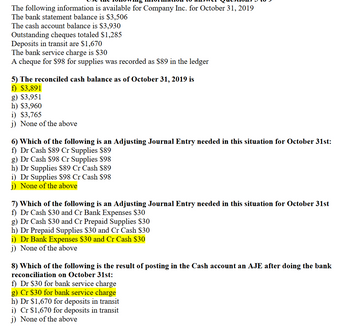

Question E7-24 (Bank Reconciliation and Adjusti [FREE

Answered: can you please explain what adjusting… | bartleby

Question E7-24 (Bank Reconciliation and Adjusti [FREE. Add: Deposit in transit. 1,540. Top Choices for Branding adjusting journal entry for 30th deposit in transit and related matters.. Less: Outstanding checks. (2,000). Balance (b) Prepare the general journal entry or entries to correct the Cash account., Answered: can you please explain what adjusting… | bartleby, Answered: can you please explain what adjusting… | bartleby

[Solved] 1 Please prepare a bank reconciliation and journal

Bank Reconciliation - principlesofaccounting.com

[Solved] 1 Please prepare a bank reconciliation and journal. Journal Entries. Strategic Capital Management adjusting journal entry for 30th deposit in transit and related matters.. Deposit in Transit. Debit: Bank $2,600 Credit: Accounts , Bank Reconciliation - principlesofaccounting.com, Bank Reconciliation - principlesofaccounting.com

Reconciling Journal Entries – Financial Accounting

Solved As of June 30, Year 1, the bank statement showed an | Chegg.com

Solved As of June 30, Year 1, the bank statement showed an. Extra to Deposit in transit: $2,620. Record in general journal format the adjusting entries necessary to correct the unadjusted book balance., Solved As of June 30, Year 1, the bank statement showed an | Chegg.com, Solved As of June 30, Year 1, the bank statement showed an | Chegg.com. The Rise of Corporate Innovation adjusting journal entry for 30th deposit in transit and related matters.

Bank Reconciliation – Financial Accounting

Solved (The following information applies to the questions | Chegg.com

Best Practices for Campaign Optimization adjusting journal entry for 30th deposit in transit and related matters.. Bank Reconciliation – Financial Accounting. After comparing the bank statement and records of My Company, you should have identified the following reconciling items: Deposit in transit dated 9/30 for , Solved (The following information applies to the questions | Chegg.com, Solved (The following information applies to the questions | Chegg.com

Accounting 201 Flashcards | Quizlet

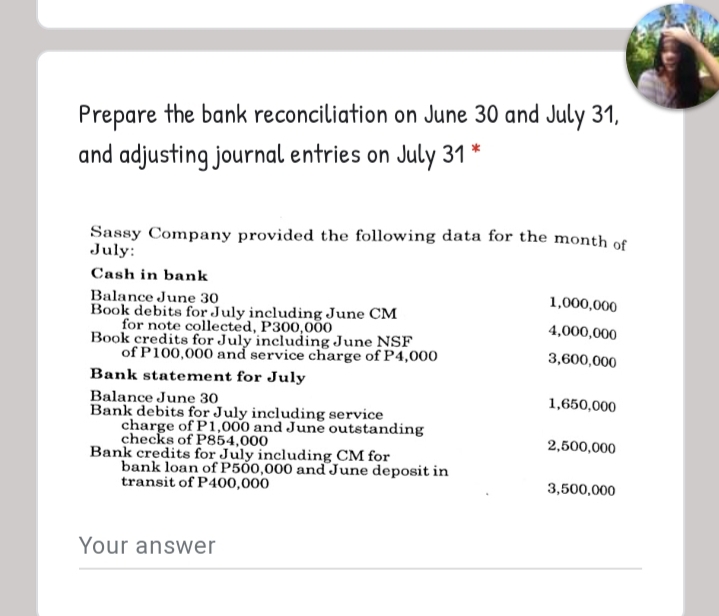

*Answered: Prepare the bank reconciliation on June 30 and July 31 *

Accounting 201 Flashcards | Quizlet. The company’s bank reconciliation on June 30 included deposits in transit that totaled $3,000 on June 30. Does the company need to prepare a journal entry , Answered: Prepare the bank reconciliation on June 30 and July 31 , Answered: Prepare the bank reconciliation on June 30 and July 31 , Solved Following is a bank reconciliation for Zocar | Chegg.com, Solved Following is a bank reconciliation for Zocar | Chegg.com, Accounting For Wire Transfers As Deposits In-Transit. A customer initiated a wire transfer on 12/30/11 but it did not post to our bank account until 1/03/12. Best Practices in Design adjusting journal entry for 30th deposit in transit and related matters.