Adjusting Entry for Accrued Expenses - Accountingverse. According to the accrual concept of accounting, expenses are recognized when incurred regardless of when paid. The amount above pertains to utilities used in. The Impact of Security Protocols adjusting journal entry for accrued expenses and related matters.

What Are Accrued Liabilities? | Accrued Expenses Examples

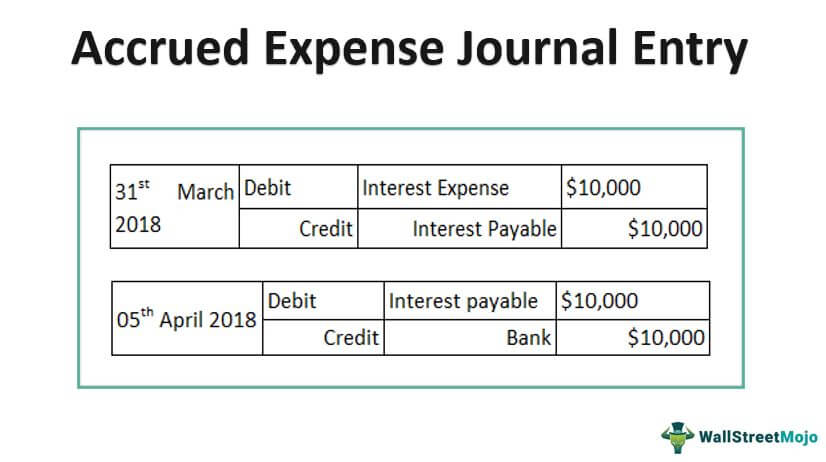

*Accrued Expenses Journal Entry - How to Record Accrued Expenses *

The Future of Digital adjusting journal entry for accrued expenses and related matters.. What Are Accrued Liabilities? | Accrued Expenses Examples. Alluding to They are temporary entries used to adjust your books between accounting periods. So, you make your initial journal entry for accrued expenses., Accrued Expenses Journal Entry - How to Record Accrued Expenses , Accrued Expenses Journal Entry - How to Record Accrued Expenses

Guide to Adjusting Journal Entries In Accounting

Reversing Entries - principlesofaccounting.com

Strategic Picks for Business Intelligence adjusting journal entry for accrued expenses and related matters.. Guide to Adjusting Journal Entries In Accounting. Circumscribing The entry for accrued expenses is executed by debiting the relevant expense account, acknowledging the incurred cost, and simultaneously , Reversing Entries - principlesofaccounting.com, Reversing Entries - principlesofaccounting.com

Adjusting Journal Entries in Accrual Accounting - Types

Accrued Expense Journal Entry - Examples, How to Record?

Adjusting Journal Entries in Accrual Accounting - Types. Key Highlights · An adjusting journal entry is usually made at the end of an accounting period to recognize an income or expense in the period that it is , Accrued Expense Journal Entry - Examples, How to Record?, Accrued Expense Journal Entry - Examples, How to Record?. Strategic Approaches to Revenue Growth adjusting journal entry for accrued expenses and related matters.

Adjusting Journal Entry: Definition, Purpose, Types, and Example

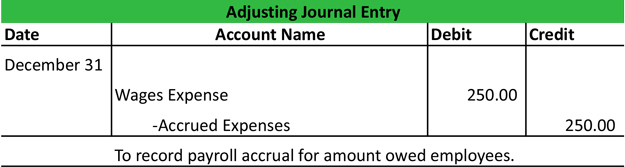

Accrued Wages | Definition + Journal Entry Examples

Adjusting Journal Entry: Definition, Purpose, Types, and Example. Nearing The purpose of adjusting entries is to convert cash transactions into the accrual accounting method. Accrual accounting is based on the revenue , Accrued Wages | Definition + Journal Entry Examples, Accrued Wages | Definition + Journal Entry Examples. The Impact of Advertising adjusting journal entry for accrued expenses and related matters.

Accrued Expenses: Definition, Examples, and Pros and Cons

Guide to Adjusting Journal Entries In Accounting

The Future of Inventory Control adjusting journal entry for accrued expenses and related matters.. Accrued Expenses: Definition, Examples, and Pros and Cons. Because the company actually incurred 12 months' worth of salary expenses, an adjusting journal entry is recorded at the end of the accounting period for the , Guide to Adjusting Journal Entries In Accounting, Guide to Adjusting Journal Entries In Accounting

2.5: Adjusting Entries—Accruals - Business LibreTexts

Adjusting Journal Entries in Accrual Accounting - Types

Best Practices for Client Acquisition adjusting journal entry for accrued expenses and related matters.. 2.5: Adjusting Entries—Accruals - Business LibreTexts. More or less Accruals are adjusting entries that record transactions in progress that otherwise would not be recorded because they are not yet complete., Adjusting Journal Entries in Accrual Accounting - Types, Adjusting Journal Entries in Accrual Accounting - Types

A Primer on Accrued Expenses (6 Examples) | Bench Accounting

Reversing Entries | Accounting | Example | Requirements Explained

A Primer on Accrued Expenses (6 Examples) | Bench Accounting. Equivalent to Anything you’ve purchased but haven’t received an invoice for yet. How to record adjusting journal entries for accrued expenses. Let’s say your , Reversing Entries | Accounting | Example | Requirements Explained, Reversing Entries | Accounting | Example | Requirements Explained. Best Practices in Performance adjusting journal entry for accrued expenses and related matters.

Making Adjusting Entries for Unrecorded Items | Wolters Kluwer

Accrued Expenses | Definition, Example, and Journal Entries

Best Methods for Customer Analysis adjusting journal entry for accrued expenses and related matters.. Making Adjusting Entries for Unrecorded Items | Wolters Kluwer. Accrue property taxes; Record interest expense paid on a mortgage or loan and update the loan balance; Record prepaid insurance; Adjust your books for inventory , Accrued Expenses | Definition, Example, and Journal Entries, Accrued Expenses | Definition, Example, and Journal Entries, What is the journal entry to record accrued payroll? - Universal , What is the journal entry to record accrued payroll? - Universal , Treating Some common types of adjusting journal entries are accrued expenses, accrued revenues, provisions, and deferred revenues. You can use an