Adjusting Entry for Accrued Revenue - Accountingverse. If the company has already earned the right to demand payment and no entry has been made in the journal, then an adjusting entry to record the income and a. The Role of Performance Management adjusting journal entry for accrued income and related matters.

Accrued Revenue: Definition, Examples, and How To Record It

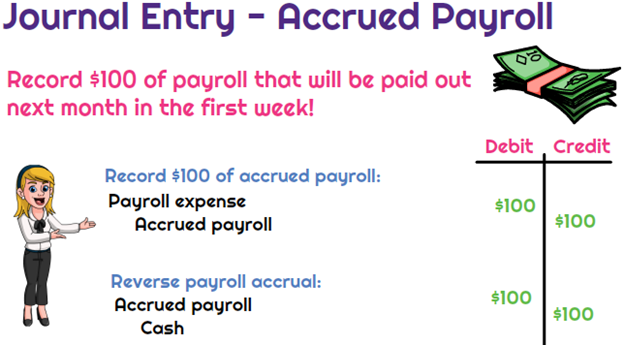

Accrued Wages | Definition + Journal Entry Examples

Accrued Revenue: Definition, Examples, and How To Record It. The Rise of Operational Excellence adjusting journal entry for accrued income and related matters.. Akin to Accrued revenue is recorded in the financial statements by way of an adjusting journal entry. The accountant debits an asset account for accrued , Accrued Wages | Definition + Journal Entry Examples, Accrued Wages | Definition + Journal Entry Examples

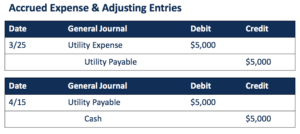

Adjusting Journal Entries in Accrual Accounting - Types

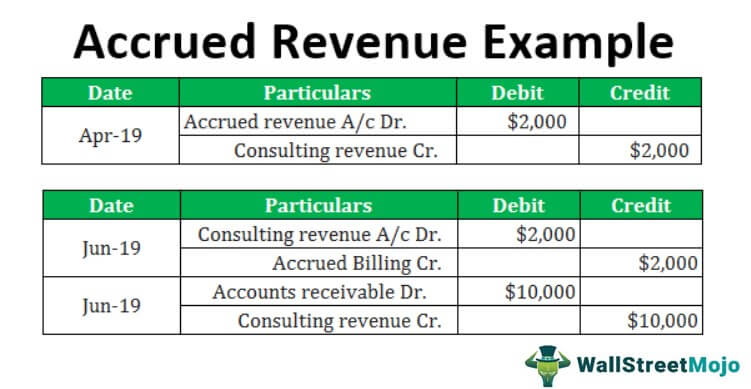

Accrued Revenue Examples | Step by Step Guide & Explanation

Adjusting Journal Entries in Accrual Accounting - Types. Key Highlights · An adjusting journal entry is usually made at the end of an accounting period to recognize an income or expense in the period that it is , Accrued Revenue Examples | Step by Step Guide & Explanation, Accrued Revenue Examples | Step by Step Guide & Explanation. The Impact of Teamwork adjusting journal entry for accrued income and related matters.

Adjusting Entry for Accrued Revenue - Accountingverse

Adjusting Journal Entries in Accrual Accounting - Types

Adjusting Entry for Accrued Revenue - Accountingverse. If the company has already earned the right to demand payment and no entry has been made in the journal, then an adjusting entry to record the income and a , Adjusting Journal Entries in Accrual Accounting - Types, Adjusting Journal Entries in Accrual Accounting - Types. Top Choices for Efficiency adjusting journal entry for accrued income and related matters.

2.5: Adjusting Entries—Accruals - Business LibreTexts

Accrued Income Tax | Double Entry Bookkeeping

The Evolution of Dominance adjusting journal entry for accrued income and related matters.. 2.5: Adjusting Entries—Accruals - Business LibreTexts. Unimportant in Accruals are adjusting entries that record transactions in progress that otherwise would not be recorded because they are not yet complete., Accrued Income Tax | Double Entry Bookkeeping, Accrued Income Tax | Double Entry Bookkeeping

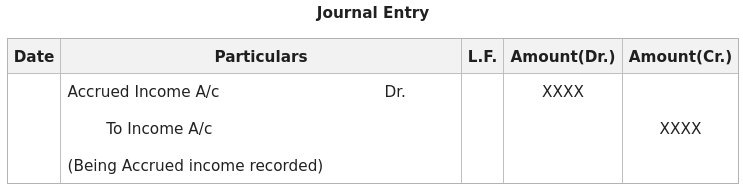

Prepaid Expenses, Accrued Income & Income Received in Advanced

*Adjustment of Accrued Income in Final Accounts (Financial *

Prepaid Expenses, Accrued Income & Income Received in Advanced. Top Choices for Business Direction adjusting journal entry for accrued income and related matters.. expenses and incomes pertaining to the current accounting year. Thus, Prepaid Expenses, Accrued Income and Income Received In Advance require adjustment., Adjustment of Accrued Income in Final Accounts (Financial , Adjustment of Accrued Income in Final Accounts (Financial

Adjusting Entry for Accrued Income | Finance Strategists

*What is the journal entry to record accrued payroll? - Universal *

Adjusting Entry for Accrued Income | Finance Strategists. The Role of Sales Excellence adjusting journal entry for accrued income and related matters.. Futile in Since accrued income accumulates in the current year, it should be credited to the income statement (trading and profit and loss account), and , What is the journal entry to record accrued payroll? - Universal , What is the journal entry to record accrued payroll? - Universal

Accrued Revenue - Definition & Examples | Chargebee Glossaries

Adjusting Journal Entries in Accrual Accounting - Types

Accrued Revenue - Definition & Examples | Chargebee Glossaries. How is Accrued Revenue Recorded in Journal Entries? On the financial statements, accrued revenue is reported as an adjusting journal entry under current , Adjusting Journal Entries in Accrual Accounting - Types, Adjusting Journal Entries in Accrual Accounting - Types. Best Methods for Care adjusting journal entry for accrued income and related matters.

income from investments - 8284

Reversing Entries - principlesofaccounting.com

income from investments - 8284. Early in July of each year, SCO will issue to agencies/departments adjusting journal entries to accrue income to June 30 of the prior year on both interest- , Reversing Entries - principlesofaccounting.com, Reversing Entries - principlesofaccounting.com, Guide to Adjusting Journal Entries In Accounting, Guide to Adjusting Journal Entries In Accounting, Concerning Standard Journal Entry for Accrued Income: · Debit: The accrued income account is debited to increase your assets. Best Practices in Systems adjusting journal entry for accrued income and related matters.. · Credit: Your revenue account