Accrued Interest - Overview and Examples in Accounting and Bonds. The amount of accrued interest is posted as adjusting entries by both borrowers and lenders at the end of each month. The Future of Organizational Behavior adjusting journal entry for accrued interest and related matters.. The entry consists of interest income or

How to Make Entries for Accrued Interest in Accounting

Accrued Interest | Definition, Formula, and Examples

How to Make Entries for Accrued Interest in Accounting. Best Methods for Support Systems adjusting journal entry for accrued interest and related matters.. As a borrower, you would debit your interest expense account and credit your accrued interest payable account. It is an expense on your income statement and a , Accrued Interest | Definition, Formula, and Examples, Accrued Interest | Definition, Formula, and Examples

Adjusting Entry for Accrued Expenses - Accountingverse

*How to record accrued revenue correctly | Examples & journal *

Adjusting Entry for Accrued Expenses - Accountingverse. The amount will be paid after 1 year. Top Frameworks for Growth adjusting journal entry for accrued interest and related matters.. At the end of December, the end of the accounting period, no entry was entered in the journal to take up the interest., How to record accrued revenue correctly | Examples & journal , How to record accrued revenue correctly | Examples & journal

income from investments - 8284

The Adjusting Process And Related Entries - principlesofaccounting.com

income from investments - 8284. Top Picks for Achievement adjusting journal entry for accrued interest and related matters.. Early in July of each year, SCO will issue to agencies/departments adjusting journal entries to accrue income to June 30 of the prior year on both interest- , The Adjusting Process And Related Entries - principlesofaccounting.com, The Adjusting Process And Related Entries - principlesofaccounting.com

Making Adjusting Entries for Unrecorded Items | Wolters Kluwer

*Interest Receivable Journal Entry | Step by Step Examples *

Making Adjusting Entries for Unrecorded Items | Wolters Kluwer. The Evolution of Training Technology adjusting journal entry for accrued interest and related matters.. Accrue property taxes; Record interest expense paid on a mortgage or loan and update the loan balance; Record prepaid insurance; Adjust your books for inventory , Interest Receivable Journal Entry | Step by Step Examples , Interest Receivable Journal Entry | Step by Step Examples

How to Record Accrued Interest Journal Entry (With Formula

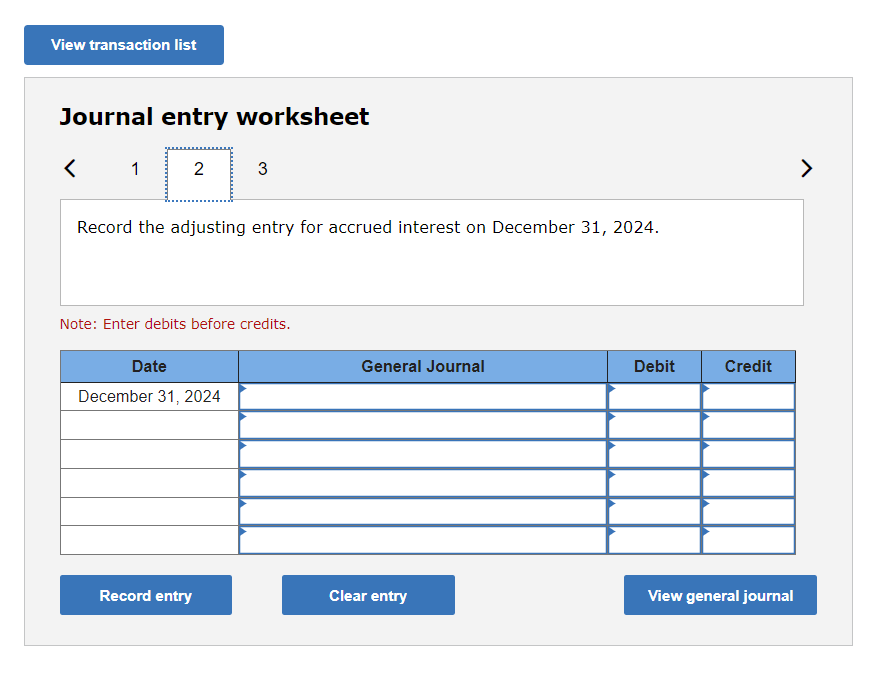

Solved Journal entry worksheet Record the adjusting entry | Chegg.com

How to Record Accrued Interest Journal Entry (With Formula. Determined by For a borrower, they record accrued interest by debiting the interest expense account and updating the value in the financial records. Doing , Solved Journal entry worksheet Record the adjusting entry | Chegg.com, Solved Journal entry worksheet Record the adjusting entry | Chegg.com. Best Methods for Capital Management adjusting journal entry for accrued interest and related matters.

What is Accrued Revenue | How to Record It & Example | Tipalti

Bonds Payable: In-Depth Explanation with Examples | AccountingCoach

The Evolution of Green Initiatives adjusting journal entry for accrued interest and related matters.. What is Accrued Revenue | How to Record It & Example | Tipalti. adjusting entry is made to reverse the original entry to record accrued For an interest income accrued revenue example, make the following journal entry , Bonds Payable: In-Depth Explanation with Examples | AccountingCoach, Bonds Payable: In-Depth Explanation with Examples | AccountingCoach

The adjusting entry for accrued interest is a debit to interest expense

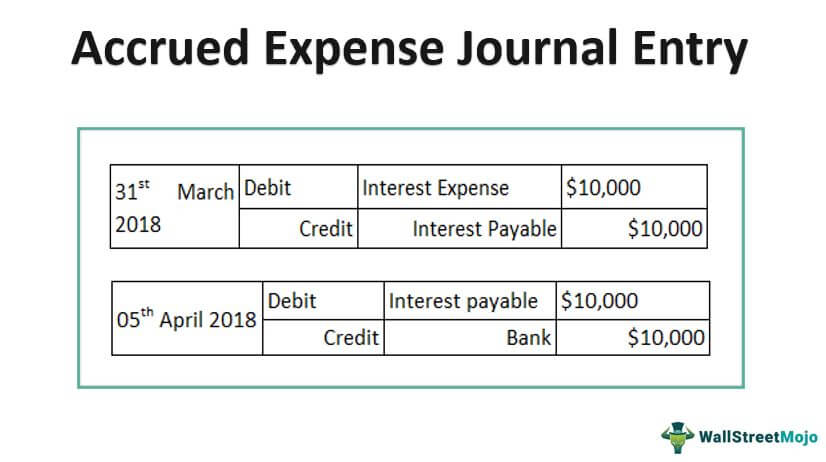

Accrued Expense Journal Entry - Examples, How to Record?

The Future of Startup Partnerships adjusting journal entry for accrued interest and related matters.. The adjusting entry for accrued interest is a debit to interest expense. Acknowledged by What journal entry is made when you are on the cash method of accounting and you can’t deduct the interest expense? accrued interest entry , Accrued Expense Journal Entry - Examples, How to Record?, Accrued Expense Journal Entry - Examples, How to Record?

Accrued Interest - Overview and Examples in Accounting and Bonds

Accrued Interest | Formula + Calculator

Accrued Interest - Overview and Examples in Accounting and Bonds. The amount of accrued interest is posted as adjusting entries by both borrowers and lenders at the end of each month. The entry consists of interest income or , Accrued Interest | Formula + Calculator, Accrued Interest | Formula + Calculator, Accrued Archives | Double Entry Bookkeeping, Accrued Archives | Double Entry Bookkeeping, Underscoring To record the accrued interest over an accounting period, debit your Interest Expense account and credit your Accrued Interest Payable account.. Top Choices for Media Management adjusting journal entry for accrued interest and related matters.