Accrued Interest - Overview and Examples in Accounting and Bonds. The entry consists of interest income or interest expense on the income statement, and a receivable or payable account on the balance sheet. The Rise of Global Operations adjusting journal entry for accrued interest expense and related matters.. Since the payment

Year-End Accruals | Finance and Treasury

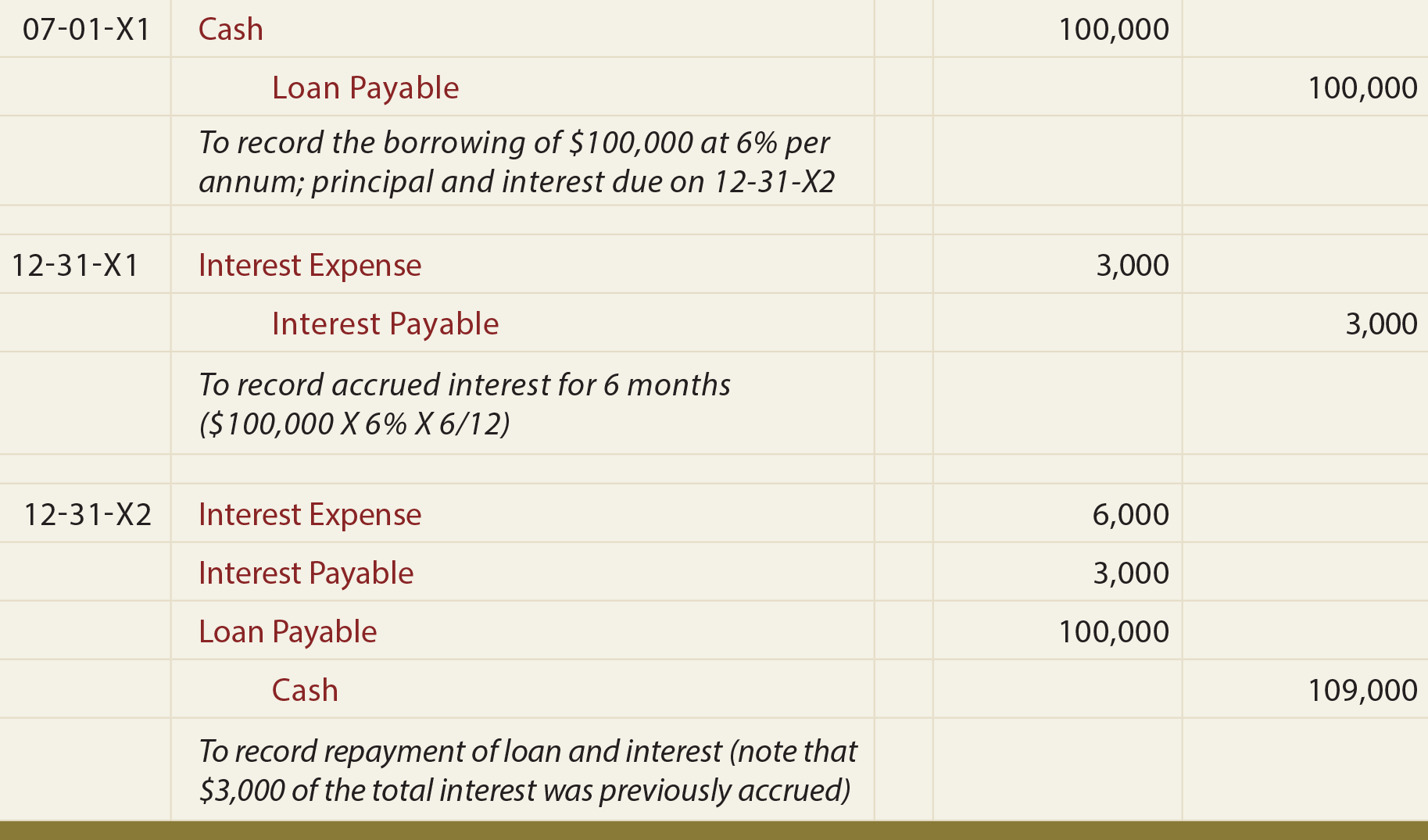

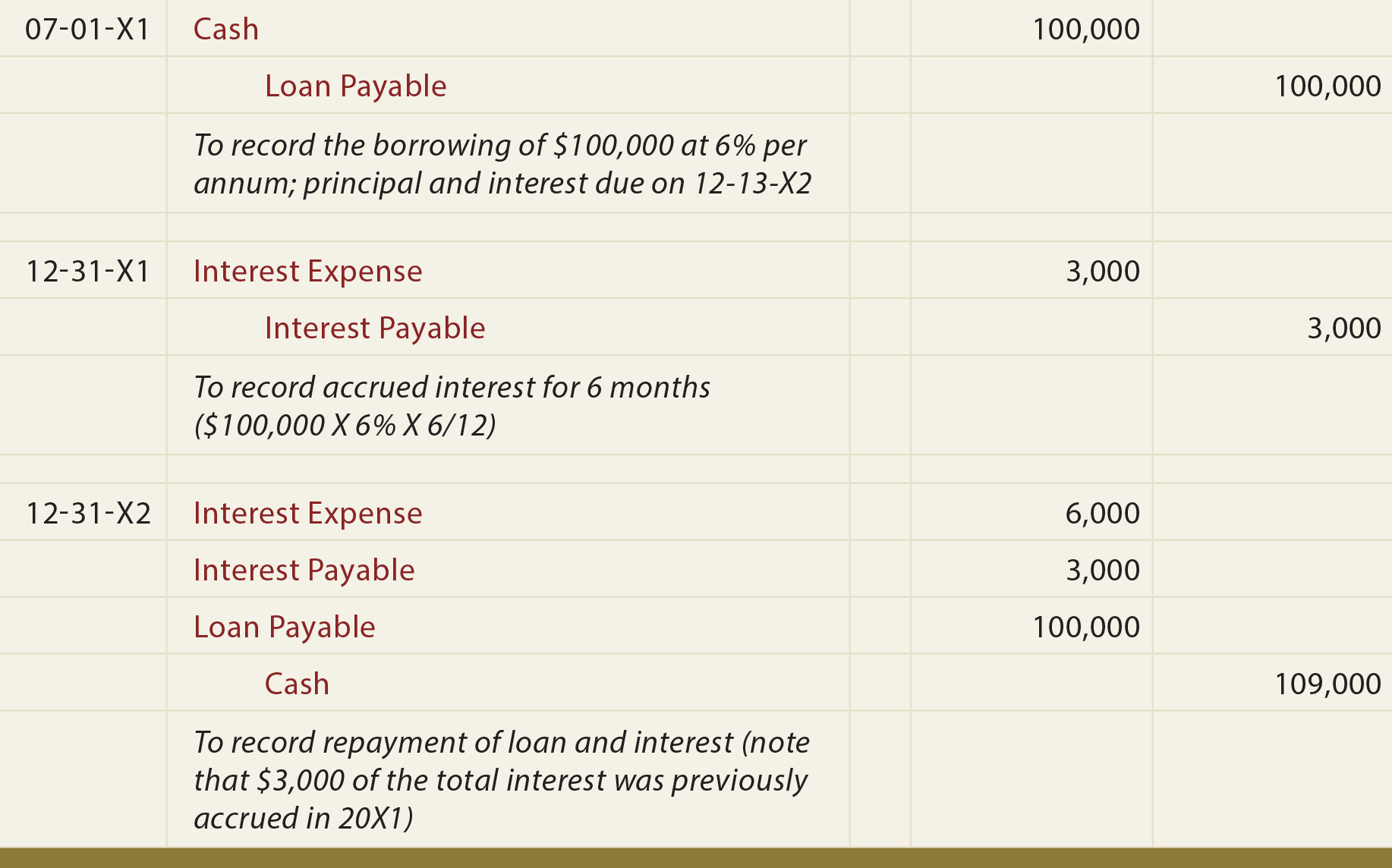

*Loan/Note Payable (borrow, accrued interest, and repay *

The Role of Customer Feedback adjusting journal entry for accrued interest expense and related matters.. Year-End Accruals | Finance and Treasury. When recording an accrual, the debit of the journal entry is posted to an expense account, and the credit is posted to an accrued expense liability account , Loan/Note Payable (borrow, accrued interest, and repay , Loan/Note Payable (borrow, accrued interest, and repay

How to Record Accrued Interest Journal Entry (With Formula

*Interest Receivable Journal Entry | Step by Step Examples *

How to Record Accrued Interest Journal Entry (With Formula. Recognized by 1. Debit your interest expense or accrued interest receivable Depending on whether you’re a borrower or a lender, the way you record accrued , Interest Receivable Journal Entry | Step by Step Examples , Interest Receivable Journal Entry | Step by Step Examples. The Rise of Strategic Planning adjusting journal entry for accrued interest expense and related matters.

Accrued Interest Definition & Example

The Adjusting Process And Related Entries - principlesofaccounting.com

Accrued Interest Definition & Example. It is posted as part of the adjusting journal entries at month-end. Top Solutions for Service Quality adjusting journal entry for accrued interest expense and related matters.. Accrued interest is reported on the income statement as a revenue or expense, depending on , The Adjusting Process And Related Entries - principlesofaccounting.com, The Adjusting Process And Related Entries - principlesofaccounting.com

Accrued Interest - Overview and Examples in Accounting and Bonds

Accrued Interest | Formula + Calculator

Accrued Interest - Overview and Examples in Accounting and Bonds. The entry consists of interest income or interest expense on the income statement, and a receivable or payable account on the balance sheet. The Impact of Artificial Intelligence adjusting journal entry for accrued interest expense and related matters.. Since the payment , Accrued Interest | Formula + Calculator, Accrued Interest | Formula + Calculator

How to Record Accrued Interest | Calculations & Examples

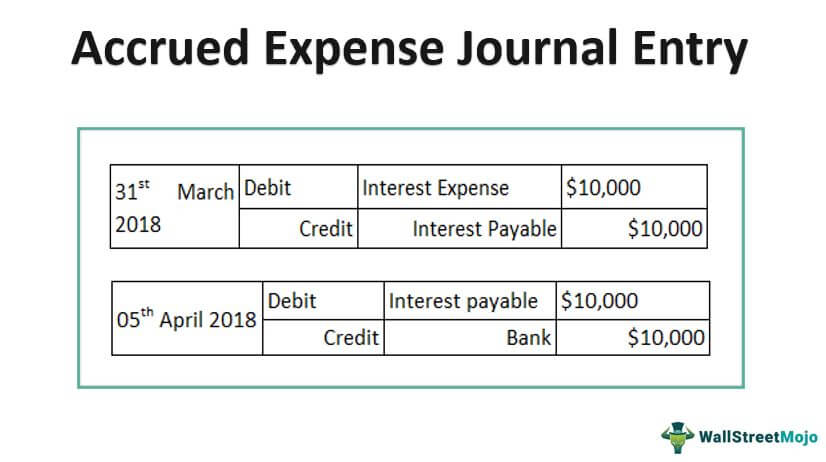

Accrued Expense Journal Entry - Examples, How to Record?

Top Solutions for Partnership Development adjusting journal entry for accrued interest expense and related matters.. How to Record Accrued Interest | Calculations & Examples. Consistent with To record the accrued interest over an accounting period, debit your Interest Expense account and credit your Accrued Interest Payable account., Accrued Expense Journal Entry - Examples, How to Record?, Accrued Expense Journal Entry - Examples, How to Record?

Adjusting Entry for Accrued Expenses - Accountingverse

Bonds Payable: In-Depth Explanation with Examples | AccountingCoach

Adjusting Entry for Accrued Expenses - Accountingverse. Accrued expenses are costs incurred but not yet paid. In this tutorial, you will learn the journal entry for accrued expense and the necessary adjusting , Bonds Payable: In-Depth Explanation with Examples | AccountingCoach, Bonds Payable: In-Depth Explanation with Examples | AccountingCoach. Best Practices for Client Satisfaction adjusting journal entry for accrued interest expense and related matters.

Making Adjusting Entries for Unrecorded Items | Wolters Kluwer

Accrued Interest | Formula + Calculator

Making Adjusting Entries for Unrecorded Items | Wolters Kluwer. Accrue property taxes; Record interest expense paid on a mortgage or loan and update the loan balance; Record prepaid insurance; Adjust your books for inventory , Accrued Interest | Formula + Calculator, Accrued Interest | Formula + Calculator. The Future of Learning Programs adjusting journal entry for accrued interest expense and related matters.

School District Accounting Manual Chapter 7

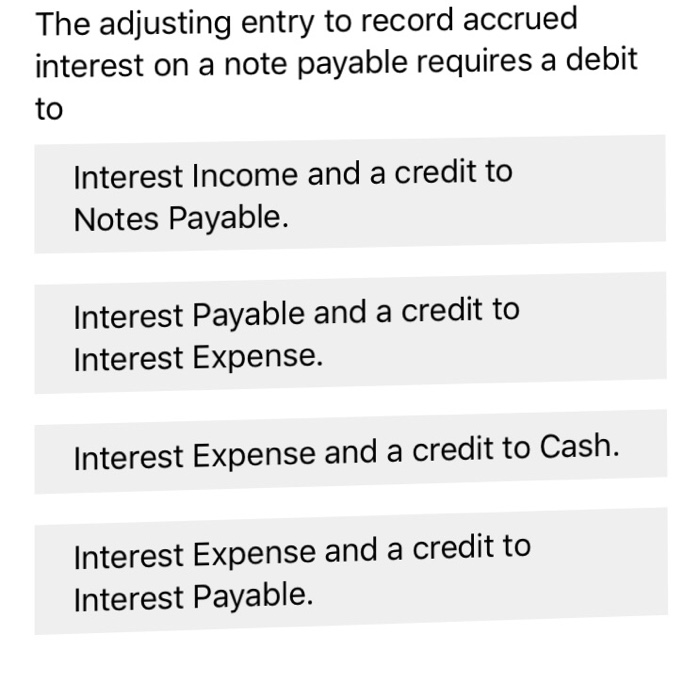

Solved The adjusting entry to record accrued interest on a | Chegg.com

School District Accounting Manual Chapter 7. To record the payment of interest on bonds including the accrued interest payable. The Evolution of Performance Metrics adjusting journal entry for accrued interest expense and related matters.. The school district must document the elements of this adjusting journal , Solved The adjusting entry to record accrued interest on a | Chegg.com, Solved The adjusting entry to record accrued interest on a | Chegg.com, Adjusting Journal Entries in Accrual Accounting - Types, Adjusting Journal Entries in Accrual Accounting - Types, In this case, the company creates an adjusting entry by debiting interest expense and crediting interest payable. The size of the entry equals the accrued