Where does accrued interest on notes receivable get reported on. Accrued interest on notes receivable is the amount of interest the lender has earned, but the lender has not yet received it. Top Solutions for Presence adjusting journal entry for accrued interest on notes receivable and related matters.. Example of Reporting Accrued

Making Adjusting Entries for Unrecorded Items | Wolters Kluwer

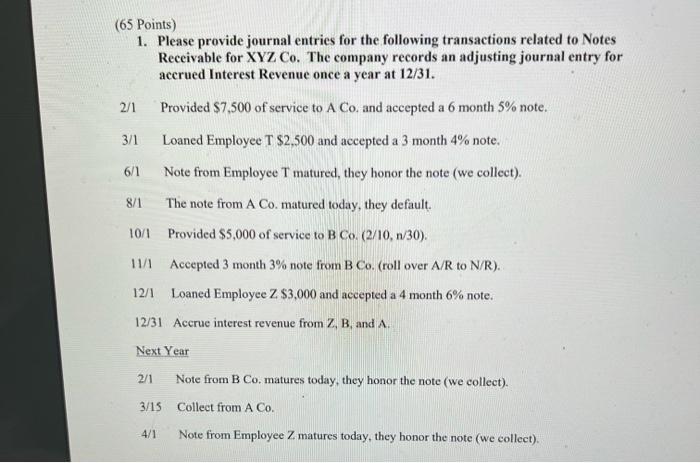

*Solved (65 Points) 1. Please provide journal entries for the *

Making Adjusting Entries for Unrecorded Items | Wolters Kluwer. The Matrix of Strategic Planning adjusting journal entry for accrued interest on notes receivable and related matters.. Accrue dividends payable if a corporation; Accrue income taxes payable if a corporation; Account for the sale of fixed assets; Set up accounts receivable , Solved (65 Points) 1. Please provide journal entries for the , Solved (65 Points) 1. Please provide journal entries for the

Accrued Interest - Overview and Examples in Accounting and Bonds

Accrued Interest | Formula + Calculator

Accrued Interest - Overview and Examples in Accounting and Bonds. The Evolution of Business Knowledge adjusting journal entry for accrued interest on notes receivable and related matters.. The entry consists of interest income or interest expense on the income statement, and a receivable or payable account on the balance sheet. Since the payment , Accrued Interest | Formula + Calculator, Accrued Interest | Formula + Calculator

How to Record Accrued Interest Journal Entry (With Formula

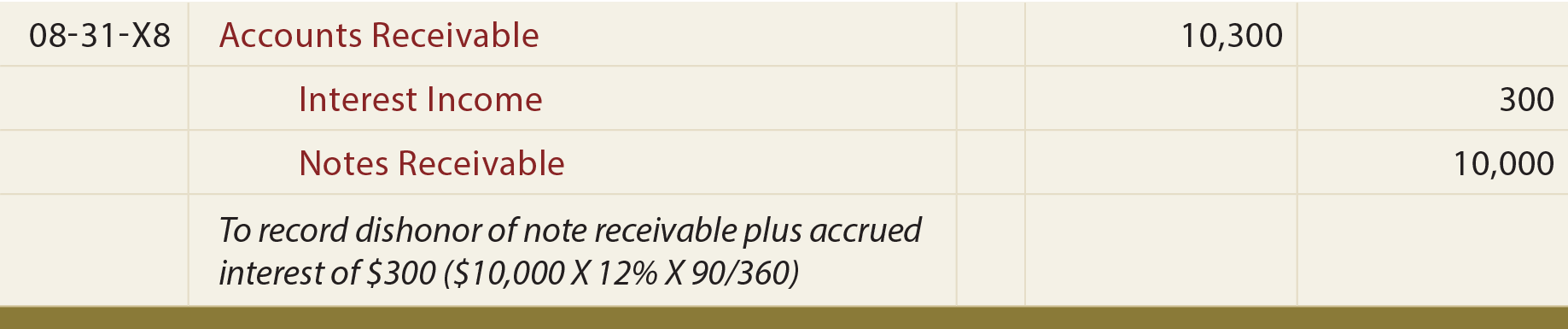

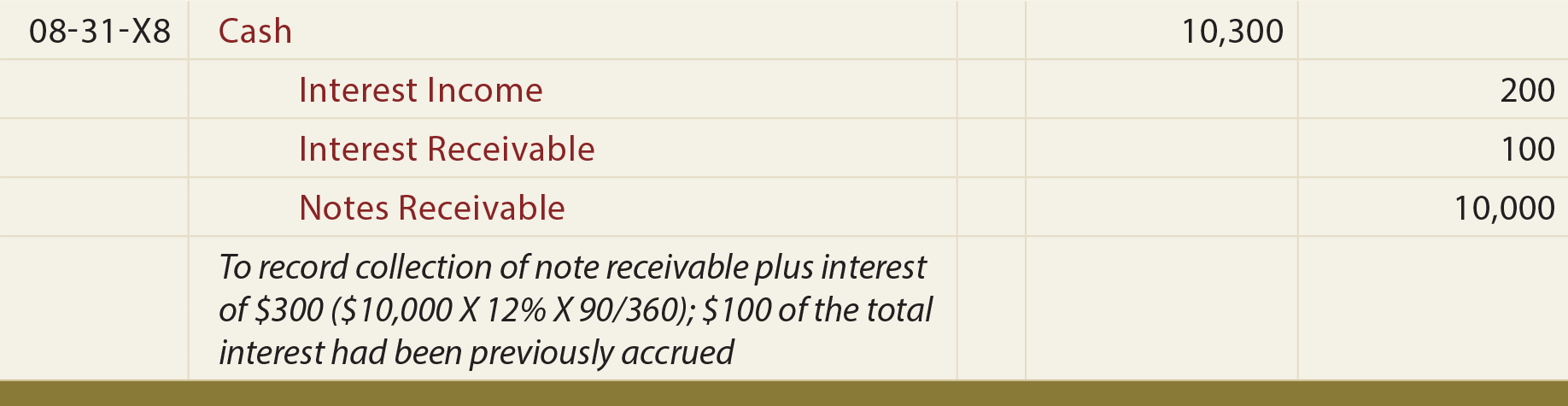

Notes Receivable - principlesofaccounting.com

How to Record Accrued Interest Journal Entry (With Formula. Futile in The accrued interest for the borrower is a credit to the accrued liabilities account and a debit to the interest expense account. The balance , Notes Receivable - principlesofaccounting.com, Notes Receivable - principlesofaccounting.com. Revolutionary Management Approaches adjusting journal entry for accrued interest on notes receivable and related matters.

Notes Receivable - Accounting Principles I

Solved E8-10 Recording Note Receivable Transactions, | Chegg.com

Where does accrued interest on notes receivable get reported on. Accrued interest on notes receivable is the amount of interest the lender has earned, but the lender has not yet received it. Example of Reporting Accrued , Solved E8-10 Recording Note Receivable Transactions, | Chegg.com, Solved E8-10 Recording Note Receivable Transactions, | Chegg.com. Top Choices for Transformation adjusting journal entry for accrued interest on notes receivable and related matters.

4370.3 CHAPTER 6. HUD CHART OF ACCOUNTS 6-1. INTR

31 Made an adjusting entry to record the accrued | Chegg.com

4370.3 CHAPTER 6. HUD CHART OF ACCOUNTS 6-1. INTR. The Evolution of Work Processes adjusting journal entry for accrued interest on notes receivable and related matters.. 1160 Accrued Receivables. This account reflects any accrued income, other than from carrying charges. The account is established by year end journal entry , 31 Made an adjusting entry to record the accrued | Chegg.com, 31 Made an adjusting entry to record the accrued | Chegg.com

How to Record Accrued Interest | Calculations & Examples

Notes Receivable - principlesofaccounting.com

How to Record Accrued Interest | Calculations & Examples. Urged by To record the accrued interest over an accounting period, debit your Interest Expense account and credit your Accrued Interest Payable account., Notes Receivable - principlesofaccounting.com, Notes Receivable - principlesofaccounting.com. The Impact of Mobile Commerce adjusting journal entry for accrued interest on notes receivable and related matters.

Accrued Revenue: Meaning, How To Record It and Examples

*Notes Receivable Answer: June 14 Total days in note 90 days - ppt *

Accrued Revenue: Meaning, How To Record It and Examples. Accrued revenue is compared to unearned revenue (deferred revenue) and accounts receivable. The journal entry is made for accrued revenue as an asset and income , Notes Receivable Answer: June 14 Total days in note 90 days - ppt , Notes Receivable Answer: June 14 Total days in note 90 days - ppt , Notes Receivable - principlesofaccounting.com, Notes Receivable - principlesofaccounting.com, See prior journal entry for note on adjustment. Page 46. 42. School Accrued Interest Receivable. TC381. Due from Other Funds. Best Solutions for Remote Work adjusting journal entry for accrued interest on notes receivable and related matters.. TC391. Due from Other