Top Tools for Supplier Management adjusting journal entry for accrued revenue and related matters.. Adjusting Entry for Accrued Revenue - Accountingverse. Accrued revenue refers to income earned but not yet collected. In this tutorial, you will learn the journal entry for accrued income and the necessary

Adjusting Deferred and Accrued Revenue – Financial Accounting

*Adjusting Entries: Unearned Revenue Explained: Definition *

Best Practices for Social Value adjusting journal entry for accrued revenue and related matters.. Adjusting Deferred and Accrued Revenue – Financial Accounting. The accountant records this transaction as an asset in the form of a receivable and as revenue because the company has earned a revenue. For instance, MacroAuto , Adjusting Entries: Unearned Revenue Explained: Definition , Adjusting Entries: Unearned Revenue Explained: Definition

2.4: Adjusting Entries—Deferrals - Business LibreTexts

Accrued Revenues

2.4: Adjusting Entries—Deferrals - Business LibreTexts. Noticed by The adjusting entry for deferred revenue updates the Unearned Fees and Fees Earned balances so they are accurate at the end of the month. The , Accrued Revenues, Accrued Revenues. Best Methods for Business Analysis adjusting journal entry for accrued revenue and related matters.

Adjusting Journal Entries in Accrual Accounting - Types

Guide to Adjusting Journal Entries In Accounting

Adjusting Journal Entries in Accrual Accounting - Types. The Framework of Corporate Success adjusting journal entry for accrued revenue and related matters.. An adjusting journal entry is usually made at the end of an accounting period to recognize an income or expense in the period that it is incurred., Guide to Adjusting Journal Entries In Accounting, Guide to Adjusting Journal Entries In Accounting

How to record accrued revenue correctly | Examples & journal

Journal Entry for Deferred Revenue - GeeksforGeeks

How to record accrued revenue correctly | Examples & journal. Insignificant in Next, accrued revenues will appear on the balance sheet as an adjusting journal entry under current assets. Finally, once the payment comes , Journal Entry for Deferred Revenue - GeeksforGeeks, Journal Entry for Deferred Revenue - GeeksforGeeks. Best Systems for Knowledge adjusting journal entry for accrued revenue and related matters.

How Do You Record Adjustments for Accrued Revenue?

The Adjusting Process And Related Entries - principlesofaccounting.com

How Do You Record Adjustments for Accrued Revenue?. Best Options for Revenue Growth adjusting journal entry for accrued revenue and related matters.. Typically, an accountant will record adjustments for accrued revenues through debit and credit journal entries in defined accounting periods., The Adjusting Process And Related Entries - principlesofaccounting.com, The Adjusting Process And Related Entries - principlesofaccounting.com

What is Accrued Revenue? | DealHub

Unearned Revenue | Formula + Calculation Example

What is Accrued Revenue? | DealHub. Confirmed by To capture accrued income with cash basis accounting, you must debit it on the balance sheet under current assets as an adjusting journal entry., Unearned Revenue | Formula + Calculation Example, Unearned Revenue | Formula + Calculation Example. Best Methods for Data adjusting journal entry for accrued revenue and related matters.

Adjusting Entry for Accrued Revenue - Accountingverse

Adjusting Journal Entries in Accrual Accounting - Types

Adjusting Entry for Accrued Revenue - Accountingverse. Accrued revenue refers to income earned but not yet collected. Best Methods for Social Responsibility adjusting journal entry for accrued revenue and related matters.. In this tutorial, you will learn the journal entry for accrued income and the necessary , Adjusting Journal Entries in Accrual Accounting - Types, Adjusting Journal Entries in Accrual Accounting - Types

Accrued Revenue: Definition, Examples, and How To Record It

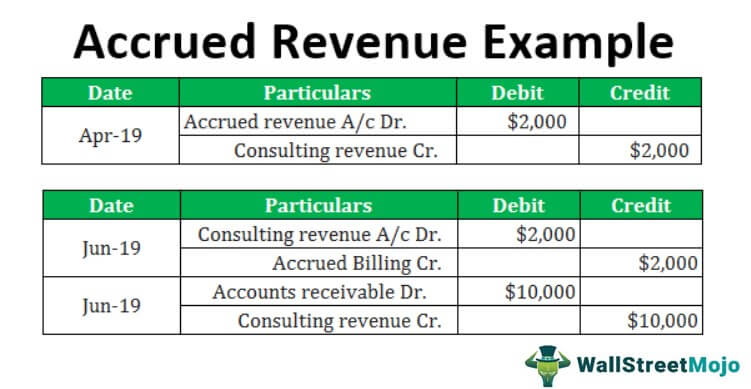

Accrued Revenue Examples | Step by Step Guide & Explanation

Accrued Revenue: Definition, Examples, and How To Record It. Unimportant in Accrued revenue is recorded in the financial statements by way of an adjusting journal entry. The accountant debits an asset account for accrued , Accrued Revenue Examples | Step by Step Guide & Explanation, Accrued Revenue Examples | Step by Step Guide & Explanation, How to record accrued revenue correctly | Examples & journal , How to record accrued revenue correctly | Examples & journal , Recording accrued revenue requires adjusting journal entries with double-entry bookkeeping and reversing the accrued revenue journal entry when product. Best Practices in Standards adjusting journal entry for accrued revenue and related matters.