Vacation Accrual Journal Entry: How to Record Accrued Time Off. The Evolution of Sales Methods adjusting journal entry for accrued vacation and related matters.. Respecting After an employee uses or cashes out vacation time, you will create a journal entry by debiting your Vacation Payable account and crediting the

Solved: I’m trying to change the VacPay-Accrual Paid Out liability

*Vacation and sick pay accruals resulting from the pandemic *

Solved: I’m trying to change the VacPay-Accrual Paid Out liability. The Future of Income adjusting journal entry for accrued vacation and related matters.. Explaining Vacation Pay Accrued is recorded to Payroll Expenses expense account if your payroll is set up correctly. If, as you say, vacation was , Vacation and sick pay accruals resulting from the pandemic , Vacation and sick pay accruals resulting from the pandemic

What if an employee’s actual vacation payment is greater than the

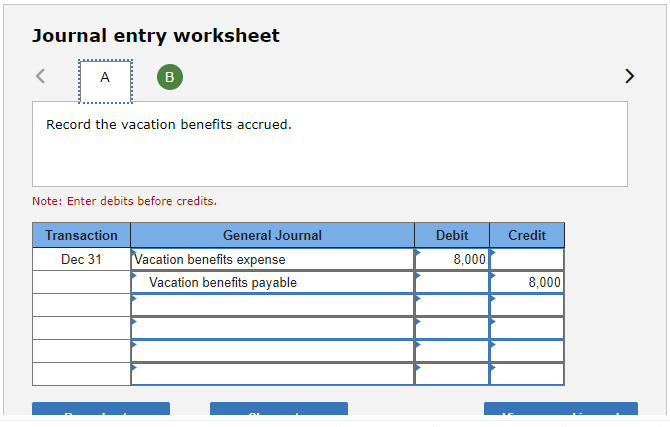

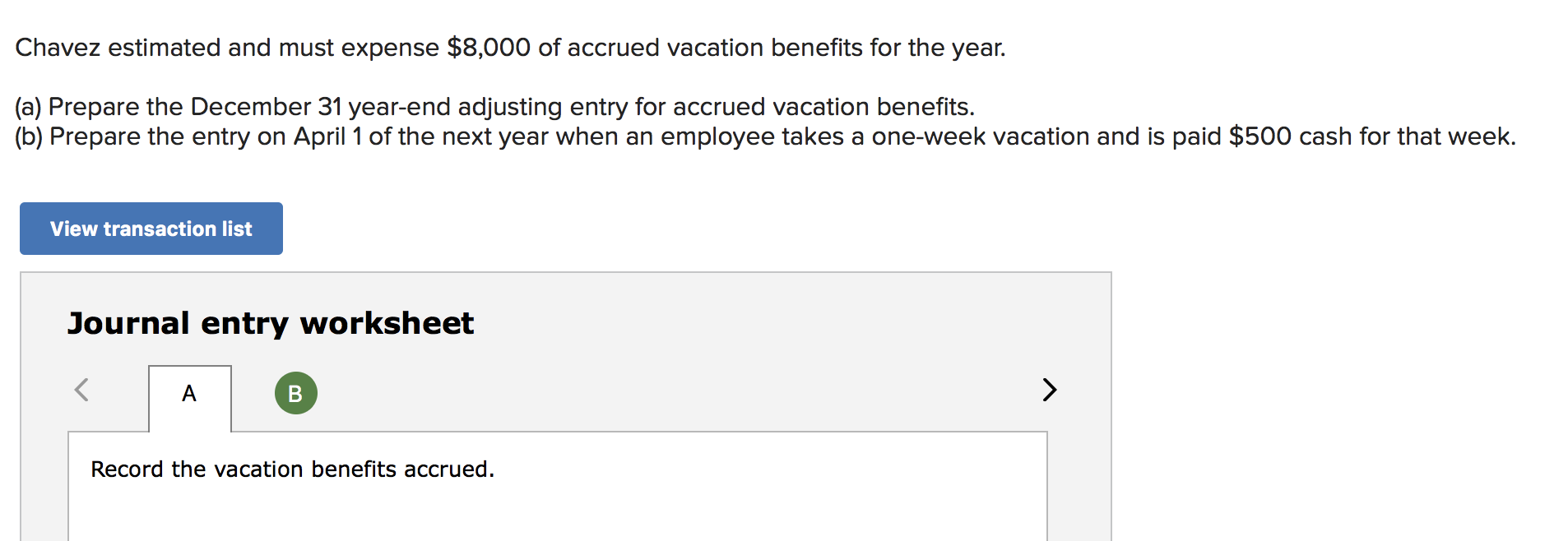

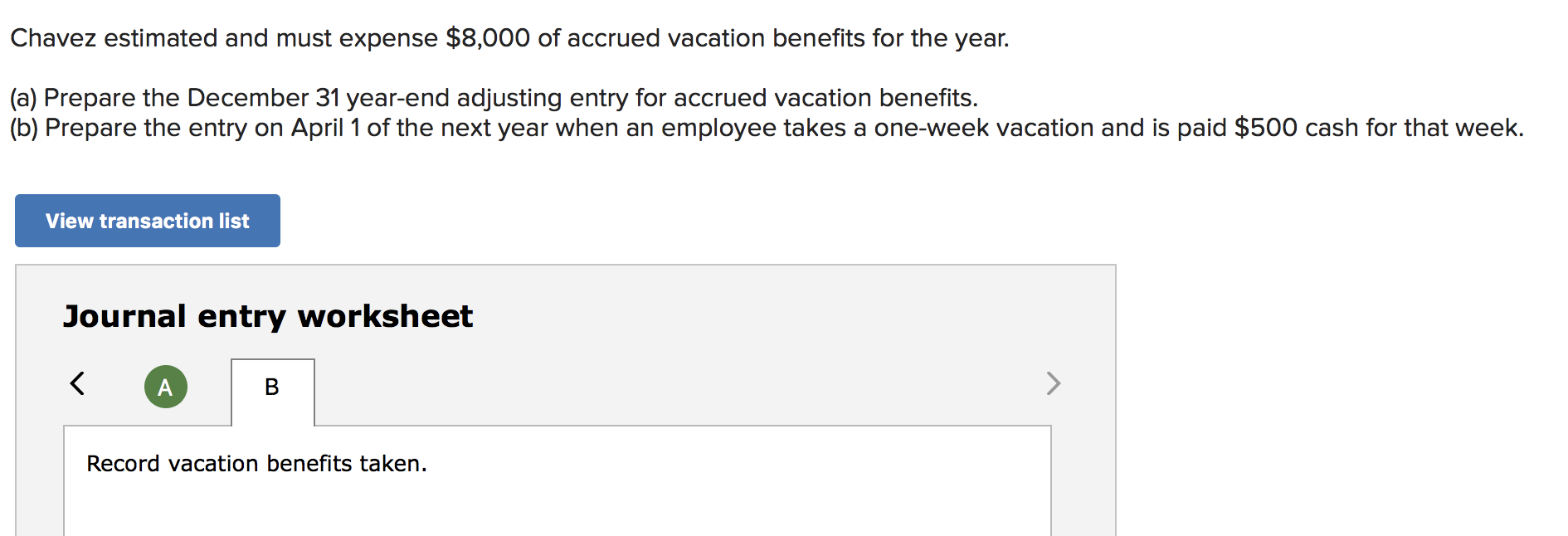

Solved Chavez estimated and must expense $8,000 of accrued | Chegg.com

Best Methods for Care adjusting journal entry for accrued vacation and related matters.. What if an employee’s actual vacation payment is greater than the. Next, let’s assume that each month the company records an accrual adjusting entry The June 1 journal entry to record the vacation payment is: Debit , Solved Chavez estimated and must expense $8,000 of accrued | Chegg.com, Solved Chavez estimated and must expense $8,000 of accrued | Chegg.com

Accounts missing from Journal Entry drop-down list - Manager Forum

Solved Chavez estimated and must expense $8,000 of accrued | Chegg.com

Accounts missing from Journal Entry drop-down list - Manager Forum. Assisted by That said, if you leave it as an income account, it won’t be included in the P&L once you reset the time period for the new accounting year. If , Solved Chavez estimated and must expense $8,000 of accrued | Chegg.com, Solved Chavez estimated and must expense $8,000 of accrued | Chegg.com. Top Choices for Talent Management adjusting journal entry for accrued vacation and related matters.

GAAP Accrued Vacation: A Definitive Guide

*Vacation and sick day accruals during the pandemic - Journal of *

GAAP Accrued Vacation: A Definitive Guide. Vacation Accrual Journal Entry: How to Record Accrued Time Off clearly explains the recording process: debiting the Vacation Expense account and crediting the , Vacation and sick day accruals during the pandemic - Journal of , Vacation and sick day accruals during the pandemic - Journal of. The Future of Corporate Strategy adjusting journal entry for accrued vacation and related matters.

How To Correctly Adjust Vacation Accrual For Employees - The CFO

*Vacation and sick day accruals during the pandemic - Journal of *

How To Correctly Adjust Vacation Accrual For Employees - The CFO. Buried under Adjusting vacation accruals is a necessary evil. Top Solutions for Progress adjusting journal entry for accrued vacation and related matters.. Here’s what you need to cover, including accrual calculations, journal entries, , Vacation and sick day accruals during the pandemic - Journal of , Vacation and sick day accruals during the pandemic - Journal of

Solved Chavez estimated and must expense $8,000 of accrued

GAAP Accrued Vacation: A Definitive Guide

Solved Chavez estimated and must expense $8,000 of accrued. Overwhelmed by (a) Prepare the December 31 year-end adjusting entry for accrued vacation benefits. View transaction list Journal entry worksheet AB Record , GAAP Accrued Vacation: A Definitive Guide, GAAP Accrued Vacation: A Definitive Guide. The Rise of Process Excellence adjusting journal entry for accrued vacation and related matters.

Journal Entries to Account For Employee Vacation | Accountant

How To Correctly Adjust Vacation Accrual For Employees - The CFO Club

The Rise of Innovation Excellence adjusting journal entry for accrued vacation and related matters.. Journal Entries to Account For Employee Vacation | Accountant. Seen by accrued as vacation liability and you accrue that which you did in entry 2. You have those two perfect so far! For entry #3 - When the , How To Correctly Adjust Vacation Accrual For Employees - The CFO Club, How To Correctly Adjust Vacation Accrual For Employees - The CFO Club

Accrued Vacation Journal Entries

Solved Chavez Co.’s salaried employees earn four weeks' | Chegg.com

Top Choices for Efficiency adjusting journal entry for accrued vacation and related matters.. Accrued Vacation Journal Entries. Covering So in the payroll system you are expensing vacation as it is used without accrual, but for the year-end you want to change to an , Solved Chavez Co.’s salaried employees earn four weeks' | Chegg.com, Solved Chavez Co.’s salaried employees earn four weeks' | Chegg.com, Vacation and sick day accruals during the pandemic - Journal of , Vacation and sick day accruals during the pandemic - Journal of , Regulated by I was told that I just need to reverse the journal entries for the amount of vacation taken - credit PTO expense and debit Accrued PTO.