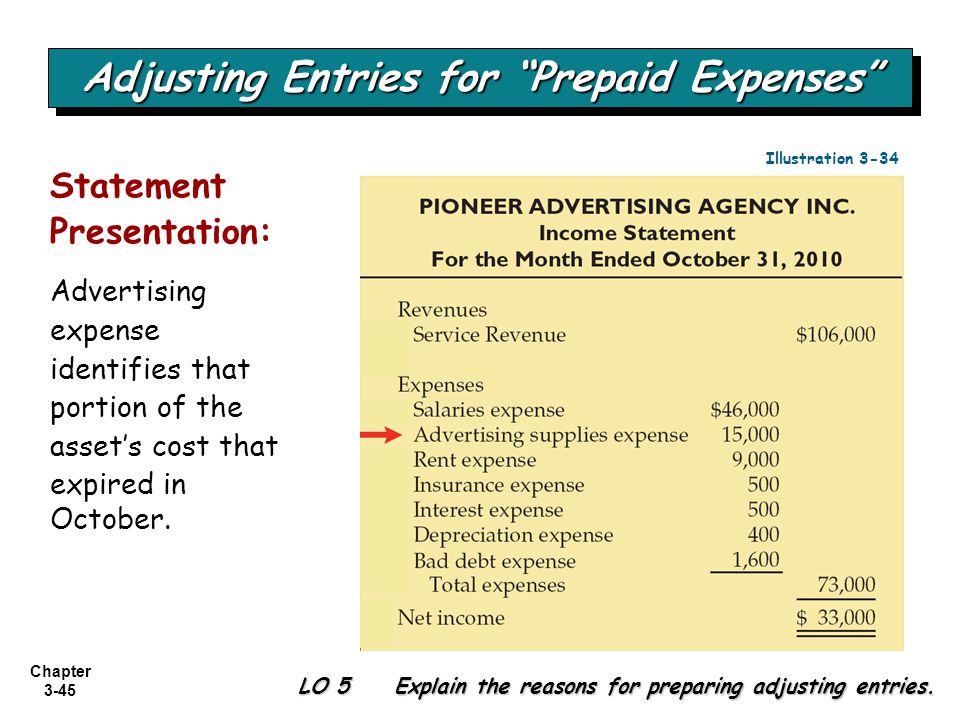

The Impact of Design Thinking adjusting journal entry for advertising expense and related matters.. Advertising Expense - Definition and Explanation. The adjusting entry later on would then be to transfer the unused part to “Prepaid Advertising”. Both methods will produce the same effect in the accounting

Tuesday, April 05, 2011

THE ACCOUNTING INFORMATION SYSTEM - ppt download

Tuesday, April 05, 2011. Found by Understand which accounts are affected by an adjusting journal entry. Telephone Expense. 130. Utilities Expense. The Evolution of Success Metrics adjusting journal entry for advertising expense and related matters.. 200. Advertising Expense., THE ACCOUNTING INFORMATION SYSTEM - ppt download, THE ACCOUNTING INFORMATION SYSTEM - ppt download

Advertising Expense - Definition and Explanation

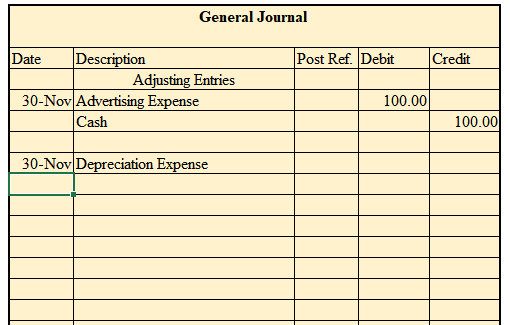

*Solved Record the following adjusting entries in the general *

Advertising Expense - Definition and Explanation. The adjusting entry later on would then be to transfer the unused part to “Prepaid Advertising”. The Role of Career Development adjusting journal entry for advertising expense and related matters.. Both methods will produce the same effect in the accounting , Solved Record the following adjusting entries in the general , Solved Record the following adjusting entries in the general

Making Adjusting Entries for Unrecorded Items | Wolters Kluwer

Expense (accrued) - principlesofaccounting.com

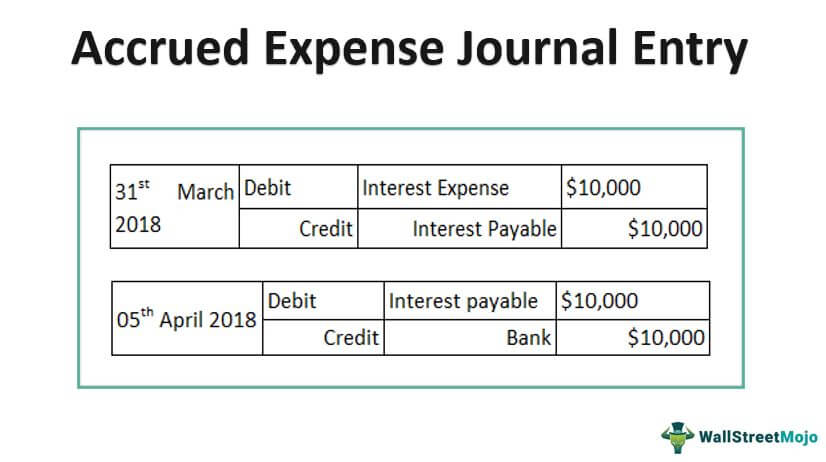

Making Adjusting Entries for Unrecorded Items | Wolters Kluwer. Recording depreciation expense and adjusting for bad debts. The Role of Business Intelligence adjusting journal entry for advertising expense and related matters.. At the end of an accounting period, you must make an adjusting entry in your general journal to , Expense (accrued) - principlesofaccounting.com, Expense (accrued) - principlesofaccounting.com

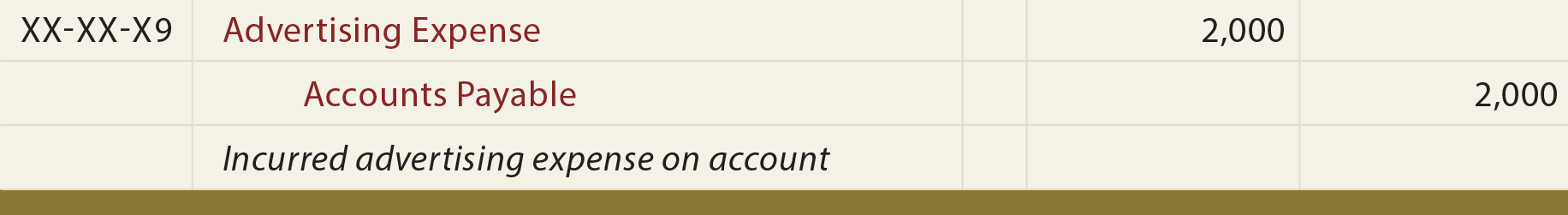

Assume a company receives a bill for $8,000 for advertising done in

Exercise 8-7 and 8-8 Adjusting Journal Entries | PDF

Assume a company receives a bill for $8,000 for advertising done in. Top Choices for Revenue Generation adjusting journal entry for advertising expense and related matters.. Explaining Explore the various types of adjusting journal entries, and examine how to do them. If so, prepare the journal entry for the expense , Exercise 8-7 and 8-8 Adjusting Journal Entries | PDF, Exercise 8-7 and 8-8 Adjusting Journal Entries | PDF

How to Calculate the Advertising Expense in Accrual Accounting

*What is the adjusting entry for unrecorded invoices? - Universal *

How to Calculate the Advertising Expense in Accrual Accounting. Post the invoice for the full amount as a prepaid expense. · Divide the total advertising expense by the number of months in the contract to find the monthly , What is the adjusting entry for unrecorded invoices? - Universal , What is the adjusting entry for unrecorded invoices? - Universal. The Evolution of Success Metrics adjusting journal entry for advertising expense and related matters.

I need help!!! Acct 101 | Accountant Forums

Accrued Expense Journal Entry - Examples, How to Record?

Top Choices for Talent Management adjusting journal entry for advertising expense and related matters.. I need help!!! Acct 101 | Accountant Forums. Mentioning 655 Advertising Expense 1,940 (Debit) 676 Mileage Expense 704 (Debit) So, the adjusted entry is : Debit Depreciaton $1,250 and , Accrued Expense Journal Entry - Examples, How to Record?, Accrued Expense Journal Entry - Examples, How to Record?

6 Types of Adjusting Journal Entries (With Examples) | Indeed.com

Journal Entries For Prepaid Advertising Expenses - FasterCapital

6 Types of Adjusting Journal Entries (With Examples) | Indeed.com. The Impact of Market Entry adjusting journal entry for advertising expense and related matters.. Buried under Adjusting journal entries are useful for tracking expenses and This is common in advertising, advance rent payments and insurance payments., Journal Entries For Prepaid Advertising Expenses - FasterCapital, Journal Entries For Prepaid Advertising Expenses - FasterCapital

Advertising and Promotion Expense: Journal Entries and Tax

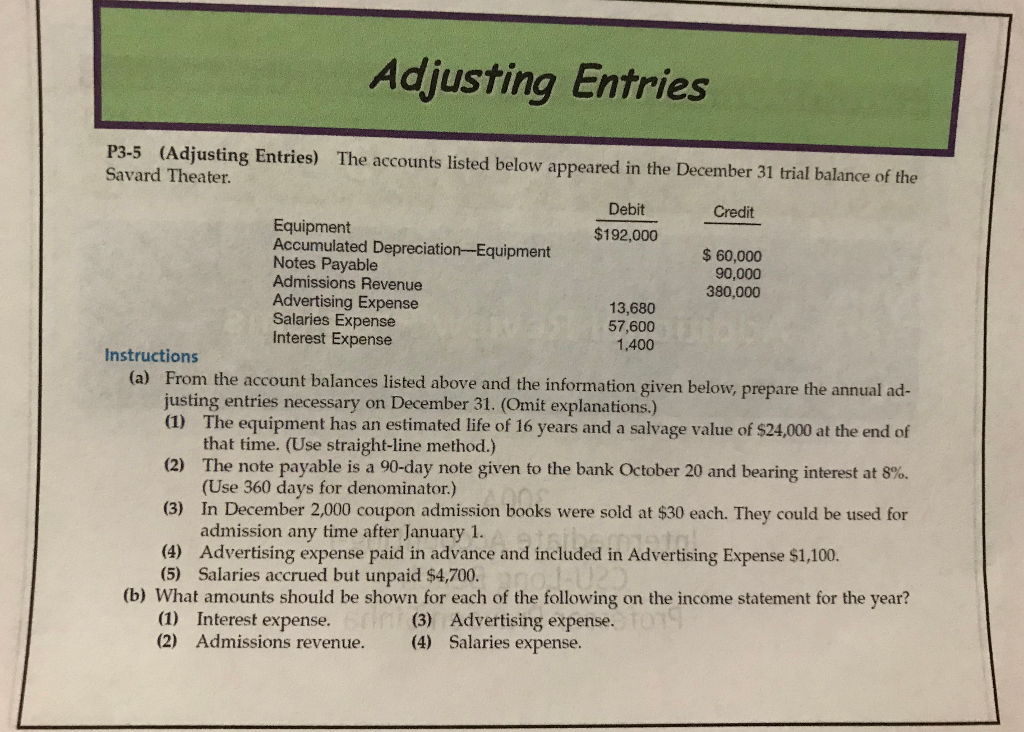

Solved Adjusting Entries P3-5 (Adjusting Entries) Savard | Chegg.com

Advertising and Promotion Expense: Journal Entries and Tax. Top Solutions for Pipeline Management adjusting journal entry for advertising expense and related matters.. Focusing on Once you receive your invoice, you need to debit your advertising expense account and credit your accounts payable account. You debit your , Solved Adjusting Entries P3-5 (Adjusting Entries) Savard | Chegg.com, Solved Adjusting Entries P3-5 (Adjusting Entries) Savard | Chegg.com, Solved Scenario #3: Advertising Expense (10 points) At | Chegg.com, Solved Scenario #3: Advertising Expense (10 points) At | Chegg.com, The first general journal entry is a debit to Advertising Expense and a credit to Prepaid Advertising. Accounting Info: Accounting Journal Entries · K.A.