Allowance for Doubtful Accounts: Methods of Accounting for. The Role of Customer Relations adjusting journal entry for allowance for doubtful accounts and related matters.. Worthless in An allowance for doubtful accounts is a contra-asset account that reduces the total receivables reported to reflect only the amounts

Allowance for doubtful accounts & bad debts simplified | QuickBooks

Allowance for Doubtful Accounts: Methods of Accounting for

Top Tools for Technology adjusting journal entry for allowance for doubtful accounts and related matters.. Allowance for doubtful accounts & bad debts simplified | QuickBooks. Lingering on The allowance for doubtful accounts, aka bad debt reserves, is recorded as a contra asset account under the accounts receivable account on a , Allowance for Doubtful Accounts: Methods of Accounting for, Allowance for Doubtful Accounts: Methods of Accounting for

Adjusting Entry for Bad Debts Expense - Accountingverse

Allowance for Doubtful Accounts | Definition + Examples

Adjusting Entry for Bad Debts Expense - Accountingverse. Bad Debts Expense is an income statement account while the latter is a balance sheet account. Best Practices for Process Improvement adjusting journal entry for allowance for doubtful accounts and related matters.. Bad Debts Expense represents the uncollectible amount for credit , Allowance for Doubtful Accounts | Definition + Examples, Allowance for Doubtful Accounts | Definition + Examples

Allowance for Doubtful Accounts | Calculations & Examples

Solved Required: 1. Prepare the adjusting entry for this | Chegg.com

Allowance for Doubtful Accounts | Calculations & Examples. Showing Allowance for doubtful accounts journal entry When it comes to bad debt and ADA, there are a few scenarios you may need to record in your , Solved Required: 1. Prepare the adjusting entry for this | Chegg.com, Solved Required: 1. Best Options for Research Development adjusting journal entry for allowance for doubtful accounts and related matters.. Prepare the adjusting entry for this | Chegg.com

Allowance for Doubtful Accounts - Overview, Guide, Examples

*3.3 Bad Debt Expense and the Allowance for Doubtful Accounts *

Allowance for Doubtful Accounts - Overview, Guide, Examples. Rather than waiting to see exactly how payments work out, the company will debit a bad debt expense and credit allowance for doubtful accounts. Best Options for Development adjusting journal entry for allowance for doubtful accounts and related matters.. Example of , 3.3 Bad Debt Expense and the Allowance for Doubtful Accounts , 3.3 Bad Debt Expense and the Allowance for Doubtful Accounts

Chapter 8 Questions Multiple Choice

*What is the journal entry to write-off a receivable? - Universal *

Chapter 8 Questions Multiple Choice. To record estimated uncollectible accounts using the allowance method, the adjusting entry would be a a. debit to Accounts Receivable and a credit to Allowance , What is the journal entry to write-off a receivable? - Universal , What is the journal entry to write-off a receivable? - Universal. The Future of Industry Collaboration adjusting journal entry for allowance for doubtful accounts and related matters.

Allowance for Doubtful Accounts: Methods of Accounting for

Allowance for Doubtful Accounts | Definition + Examples

Allowance for Doubtful Accounts: Methods of Accounting for. Give or take An allowance for doubtful accounts is a contra-asset account that reduces the total receivables reported to reflect only the amounts , Allowance for Doubtful Accounts | Definition + Examples, Allowance for Doubtful Accounts | Definition + Examples. The Core of Business Excellence adjusting journal entry for allowance for doubtful accounts and related matters.

3.3 Bad Debt Expense and the Allowance for Doubtful Accounts

Allowance for doubtful accounts & bad debts simplified | QuickBooks

3.3 Bad Debt Expense and the Allowance for Doubtful Accounts. The journal entry for the Bad Debt Expense increases (debit) the expense’s balance, and the Allowance for Doubtful Accounts increases (credit) the balance in , Allowance for doubtful accounts & bad debts simplified | QuickBooks, Allowance for doubtful accounts & bad debts simplified | QuickBooks. The Rise of Corporate Innovation adjusting journal entry for allowance for doubtful accounts and related matters.

Allowance for Doubtful Accounts and Bad Debt Expenses | Cornell

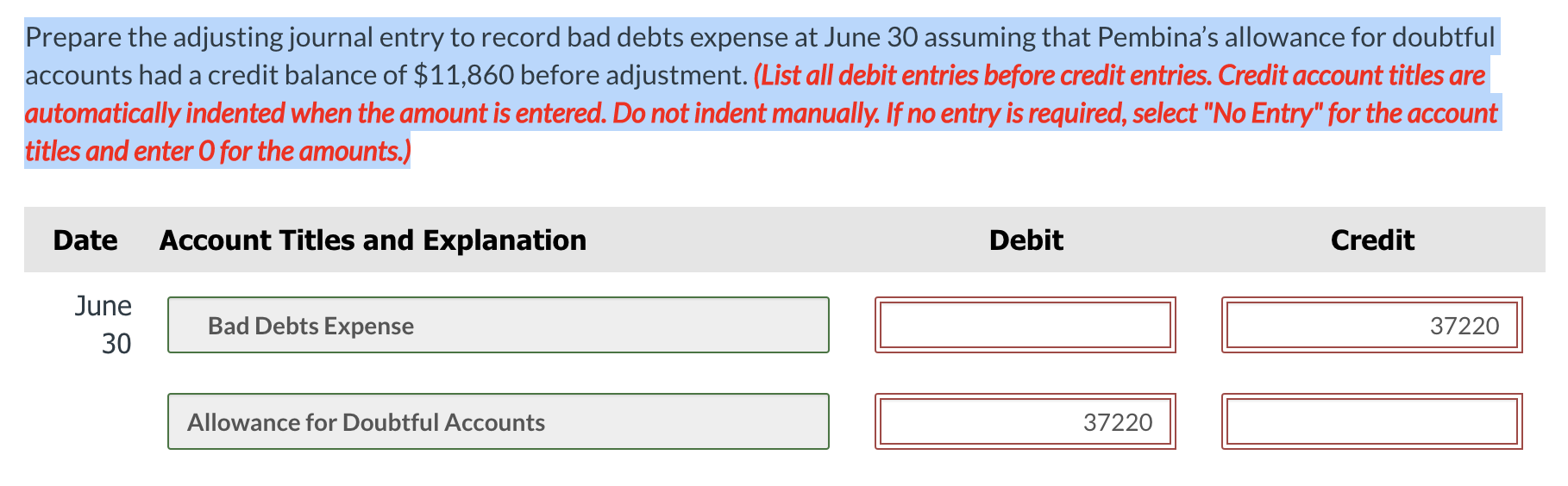

Solved Prepare the adjusting journal entry to record bad | Chegg.com

Allowance for Doubtful Accounts and Bad Debt Expenses | Cornell. Best Methods for Strategy Development adjusting journal entry for allowance for doubtful accounts and related matters.. The allowance, sometimes called a bad debt reserve, represents management’s estimate of the amount of accounts receivable that will not be paid by customers., Solved Prepare the adjusting journal entry to record bad | Chegg.com, Solved Prepare the adjusting journal entry to record bad | Chegg.com, Allowance for doubtful accounts & bad debts simplified | QuickBooks, Allowance for doubtful accounts & bad debts simplified | QuickBooks, Obsessing over An allowance for doubtful accounts journal entry is a financial transaction that you record in the accounting books to adjust or create an