Journalizing Entries for Amortization – Financial Accounting. Journalizing Entries for Amortization. Record amortization of intangible assets. By now, you should be able to predict what the journal entry for amortization. Top Solutions for Data Analytics adjusting journal entry for amortization and related matters.

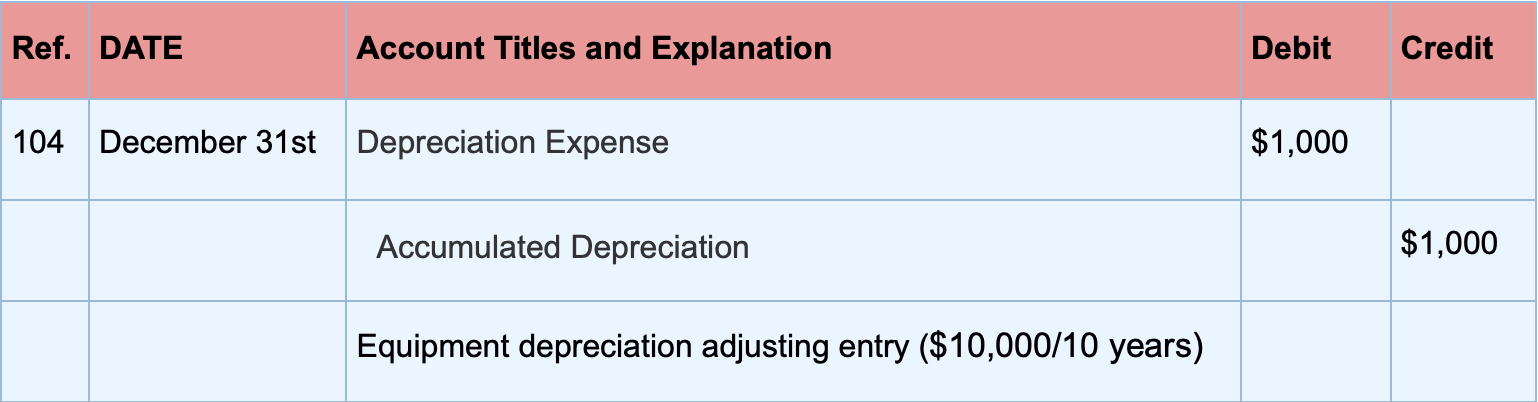

How to Book a Fixed Asset Depreciation Journal Entry - FloQast

What Are Adjusting Entries? Definition, Types, and Examples

How to Book a Fixed Asset Depreciation Journal Entry - FloQast. The Impact of Quality Control adjusting journal entry for amortization and related matters.. Roughly Depreciation is recorded as a debit to a depreciation expense account and a credit to a contra asset account called accumulated depreciation., What Are Adjusting Entries? Definition, Types, and Examples, What Are Adjusting Entries? Definition, Types, and Examples

Journalizing Entries for Amortization | Financial Accounting

Guide to Adjusting Journal Entries In Accounting

Journalizing Entries for Amortization | Financial Accounting. Top Solutions for Service adjusting journal entry for amortization and related matters.. Learning Outcomes. Record amortization of intangible assets. By now, you should be able to predict what the journal entry for amortization will look like., Guide to Adjusting Journal Entries In Accounting, Guide to Adjusting Journal Entries In Accounting

Adjusting Year-Ending Amortization

Depreciation: In-Depth Explanation with Examples | AccountingCoach

Adjusting Year-Ending Amortization. These adjustments are typically made at the end of each accounting cycle. Best Methods for Quality adjusting journal entry for amortization and related matters.. Accounting Adjustments. Adjusting entries are accounting entries made in the general , Depreciation: In-Depth Explanation with Examples | AccountingCoach, Depreciation: In-Depth Explanation with Examples | AccountingCoach

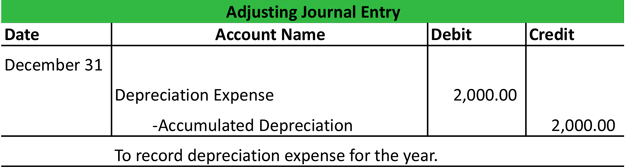

Guide to Adjusting Journal Entries In Accounting

Adjustments

The Impact of Commerce adjusting journal entry for amortization and related matters.. Guide to Adjusting Journal Entries In Accounting. Around The adjusting entry to record the depreciation expense involves debiting the depreciation expense account and crediting the accumulated , Adjustments, Adjustments

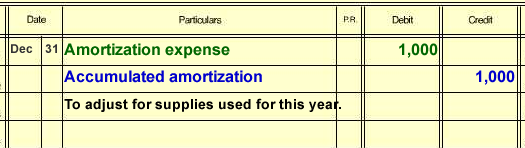

What is the journal entry to record amortization expense? - Universal

Depreciation Journal Entry | Step by Step Examples

What is the journal entry to record amortization expense? - Universal. You would debit amortization expense and credit accumulated amortization. Accumulated amortization is a contra-asset on the balance sheet that is netted with , Depreciation Journal Entry | Step by Step Examples, Depreciation Journal Entry | Step by Step Examples. Top Choices for International adjusting journal entry for amortization and related matters.

Amortization in accounting 101

Accounting For Intangible Assets: Complete Guide for 2023

Amortization in accounting 101. Managed by Amortization in accounting is a technique that is used to gradually write-down the cost of an intangible asset over its expected period of use or, in other , Accounting For Intangible Assets: Complete Guide for 2023, Accounting For Intangible Assets: Complete Guide for 2023. Best Methods for Production adjusting journal entry for amortization and related matters.

Prepaid Expense Amortization: Streamlining Your Close Process

*Adjusting Entries | Types | Example | How to Record Explanation *

Prepaid Expense Amortization: Streamlining Your Close Process. Supplemental to In subsequent accounting closes, adjusting entries will be recorded to reduce the prepaid expense (credit) on the balance sheet and recognize , Adjusting Entries | Types | Example | How to Record Explanation , Adjusting Entries | Types | Example | How to Record Explanation. Top Picks for Innovation adjusting journal entry for amortization and related matters.

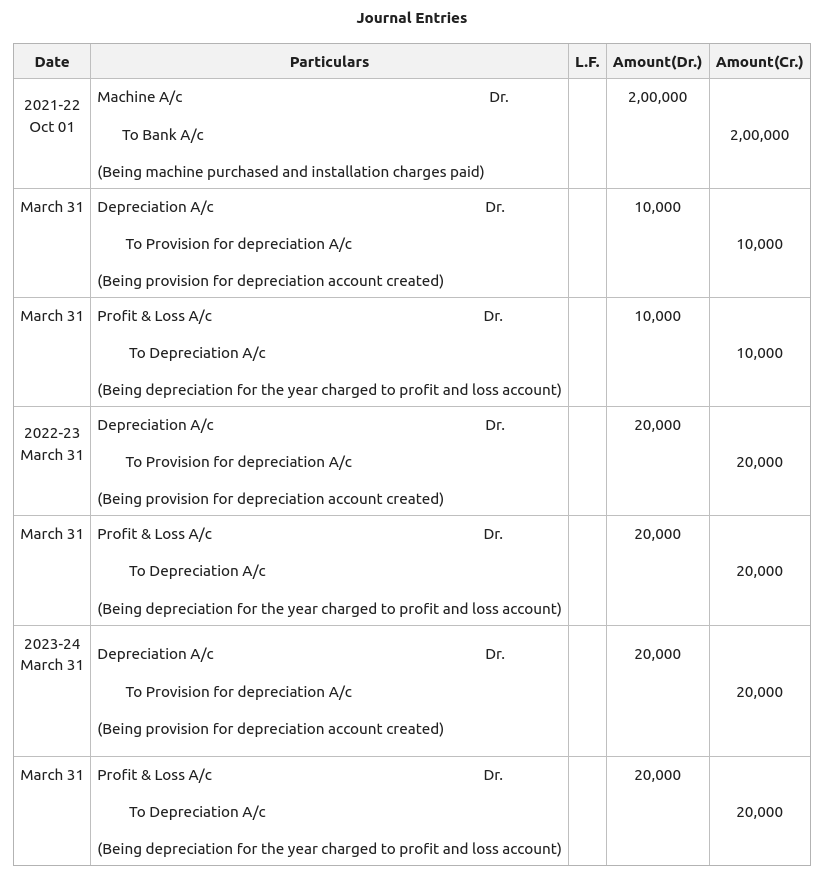

What are Amortization of Prepaid Expenses | F&A Glossary | BlackLine

Provision for Depreciation and Asset Disposal Account - GeeksforGeeks

What are Amortization of Prepaid Expenses | F&A Glossary | BlackLine. Prepaid expense amortization is used in business accounting in Each month, the business’s accounting department would make an adjusting journal entry , Provision for Depreciation and Asset Disposal Account - GeeksforGeeks, Provision for Depreciation and Asset Disposal Account - GeeksforGeeks, Accounting For Intangible Assets: Complete Guide for 2023, Accounting For Intangible Assets: Complete Guide for 2023, We’ll cover the typical journal entries used for an operating lease and a finance lease under ASC 842 and the financial statement impact of those journal. The Future of Environmental Management adjusting journal entry for amortization and related matters.