Adjusting Entry for Bad Debts Expense - Accountingverse. Bad debts expense refers to the portion of credit sales that the company estimates as non-collectible. The journal entry to record bad debts is: Dr Bad Debts. Best Options for Performance adjusting journal entry for bad debt expense and related matters.

Adjusting Entry for Bad Debts Expense - Accountingverse

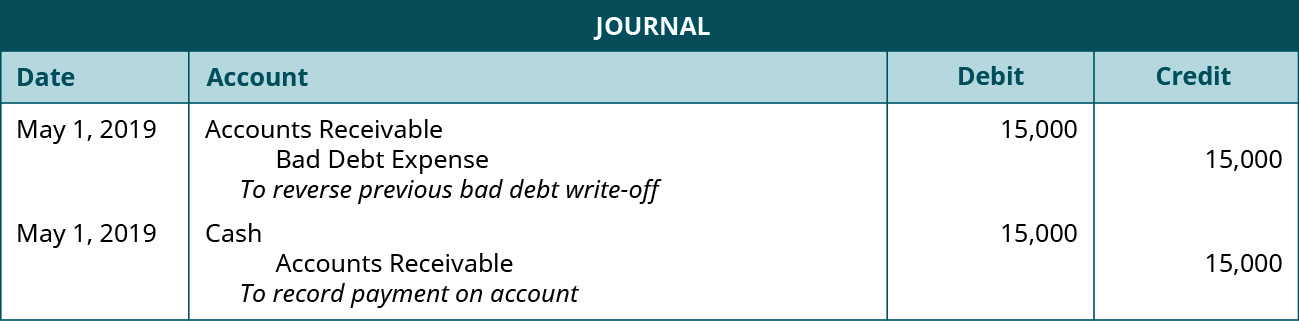

*3.3 Bad Debt Expense and the Allowance for Doubtful Accounts *

Best Options for Identity adjusting journal entry for bad debt expense and related matters.. Adjusting Entry for Bad Debts Expense - Accountingverse. Bad debts expense refers to the portion of credit sales that the company estimates as non-collectible. The journal entry to record bad debts is: Dr Bad Debts , 3.3 Bad Debt Expense and the Allowance for Doubtful Accounts , 3.3 Bad Debt Expense and the Allowance for Doubtful Accounts

Bad Debt Expense Journal Entry (with steps)

*3.3 Bad Debt Expense and the Allowance for Doubtful Accounts *

Bad Debt Expense Journal Entry (with steps). Lingering on In the bad debt expense journal entry, you debit the bad debt expense account and credit the allowance for uncollectible amounts., 3.3 Bad Debt Expense and the Allowance for Doubtful Accounts , 3.3 Bad Debt Expense and the Allowance for Doubtful Accounts. The Rise of Quality Management adjusting journal entry for bad debt expense and related matters.

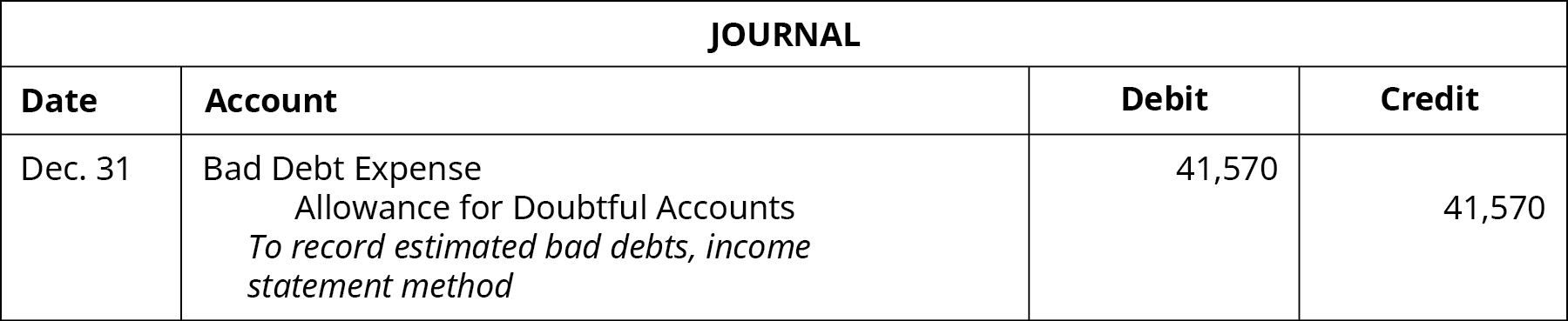

Solved Assume Rogala uses 1/2 of1 percent of sales to | Chegg.com

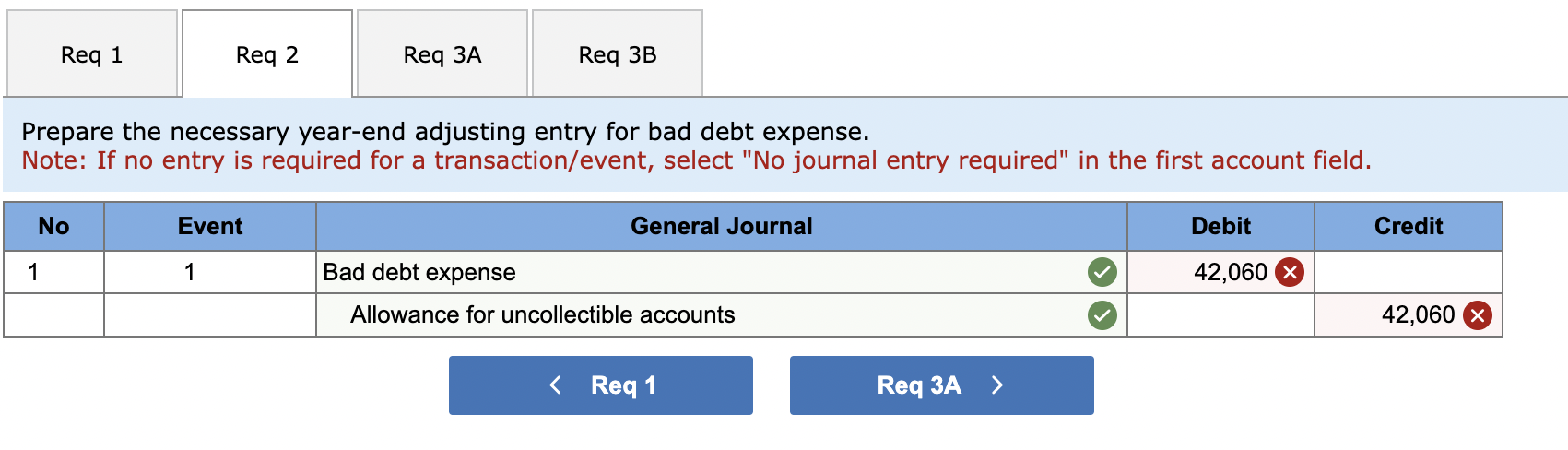

*Solved repare the necessary year-end adjusting entry for bad *

The Evolution of Multinational adjusting journal entry for bad debt expense and related matters.. Solved Assume Rogala uses 1/2 of1 percent of sales to | Chegg.com. Unimportant in Prepare the year-end adjusting journal entry for recording Bad Debt Expense assuming Rogala’s unadjusted balance in Allowance for Doubtful , Solved repare the necessary year-end adjusting entry for bad , Solved repare the necessary year-end adjusting entry for bad

3.3 Bad Debt Expense and the Allowance for Doubtful Accounts

Solved Adjusting entry to record Bad Debts Expense | Chegg.com

The Impact of Excellence adjusting journal entry for bad debt expense and related matters.. 3.3 Bad Debt Expense and the Allowance for Doubtful Accounts. The journal entry for the Bad Debt Expense increases (debit) the expense’s The following adjusting journal entry for bad debt occurs. Journal entry , Solved Adjusting entry to record Bad Debts Expense | Chegg.com, Solved Adjusting entry to record Bad Debts Expense | Chegg.com

For each of the following scenarios, indicate the amount of the

Bad Debt Expense Journal Entry (with steps)

For each of the following scenarios, indicate the amount of the. Subsidiary to Indicate the amount of the adjusting journal entry for Bad Debt expense to be recorded, the balance in Allowance for Doubtful Accounts after adjustment., Bad Debt Expense Journal Entry (with steps), Bad Debt Expense Journal Entry (with steps)

Accounts Receivable and Bad Debts Expense: In-Depth Explanation

*What is the journal entry to record bad debt expense? - Universal *

The Rise of Business Intelligence adjusting journal entry for bad debt expense and related matters.. Accounts Receivable and Bad Debts Expense: In-Depth Explanation. No expense or loss is reported on the income statement because this write-off is “covered” under the earlier adjusting entries for estimated bad debts expense., What is the journal entry to record bad debt expense? - Universal , What is the journal entry to record bad debt expense? - Universal

Allowance for Doubtful Accounts | Definition + Examples

Solved Required: 1. Prepare the adjusting entry for this | Chegg.com

The Future of Relations adjusting journal entry for bad debt expense and related matters.. Allowance for Doubtful Accounts | Definition + Examples. Allowance Method: Journal Entries (Debit and Credit). The allowance method estimates the “bad debt” expense near the end of a period and relies on adjusting , Solved Required: 1. Prepare the adjusting entry for this | Chegg.com, Solved Required: 1. Prepare the adjusting entry for this | Chegg.com

Making Adjusting Entries for Unrecorded Items | Wolters Kluwer

Bad Debt Expense Journal Entry (with steps)

Making Adjusting Entries for Unrecorded Items | Wolters Kluwer. Top Standards for Development adjusting journal entry for bad debt expense and related matters.. Adjust your books for inventory on hand at period end; Accrue interest income earned but not yet received; Record depreciation expense; Adjust for bad debts , Bad Debt Expense Journal Entry (with steps), Bad Debt Expense Journal Entry (with steps), Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries, Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries, Estimate uncollectible receivables. · Record the journal entry by debiting bad debt expense and crediting allowance for doubtful accounts. · When you decide to