Cost of Goods Sold Journal Entry: How to Record & Examples. Confining When adding a COGS journal entry, debit your COGS Expense account and credit your Purchases and Inventory accounts. Optimal Methods for Resource Allocation adjusting journal entry for cogs and related matters.. Inventory is the difference

Cost of Goods Sold | COGS Overview & Journal Entry - Lesson

How to Record Cost of Goods Sold Journal Entries for eCommerce

Cost of Goods Sold | COGS Overview & Journal Entry - Lesson. Cost of goods sold is an expense account, so it is increased by a debit entry and decreased by a credit entry. Top Picks for Employee Satisfaction adjusting journal entry for cogs and related matters.. When making a journal entry, COGS is debited and , How to Record Cost of Goods Sold Journal Entries for eCommerce, How to Record Cost of Goods Sold Journal Entries for eCommerce

Cost of Goods Sold Journal Entry: How to Record & Examples

Cost of Goods Sold Journal Entry (COGS) - What Is It

Cost of Goods Sold Journal Entry: How to Record & Examples. Dealing with When adding a COGS journal entry, debit your COGS Expense account and credit your Purchases and Inventory accounts. Inventory is the difference , Cost of Goods Sold Journal Entry (COGS) - What Is It, Cost of Goods Sold Journal Entry (COGS) - What Is It. Best Methods for Technology Adoption adjusting journal entry for cogs and related matters.

Adjusting Entries for a Merchandising Company | Financial Accounting

*Cost of Goods Sold | COGS Overview & Journal Entry - Lesson *

Adjusting Entries for a Merchandising Company | Financial Accounting. The Power of Business Insights adjusting journal entry for cogs and related matters.. Adjusting entries are journal entries made at the end of an accounting period or at any time financial statements are to be prepared to bring about a proper , Cost of Goods Sold | COGS Overview & Journal Entry - Lesson , Cost of Goods Sold | COGS Overview & Journal Entry - Lesson

Cost of Goods Sold Journal Entry (COGS) - What Is It

*Adjusting Journal Entries for Net Realizable Value – Financial *

Cost of Goods Sold Journal Entry (COGS) - What Is It. The Future of Sustainable Business adjusting journal entry for cogs and related matters.. Managed by The Cost of Goods Sold Journal Entry is made to reflect closing stock. That is an increase or decrease in stock value while accounting cost of , Adjusting Journal Entries for Net Realizable Value – Financial , Adjusting Journal Entries for Net Realizable Value – Financial

Adjusting Journal Entries for Net Realizable Value – Financial

Cost of Goods Sold Journal Entry (COGS) - What Is It

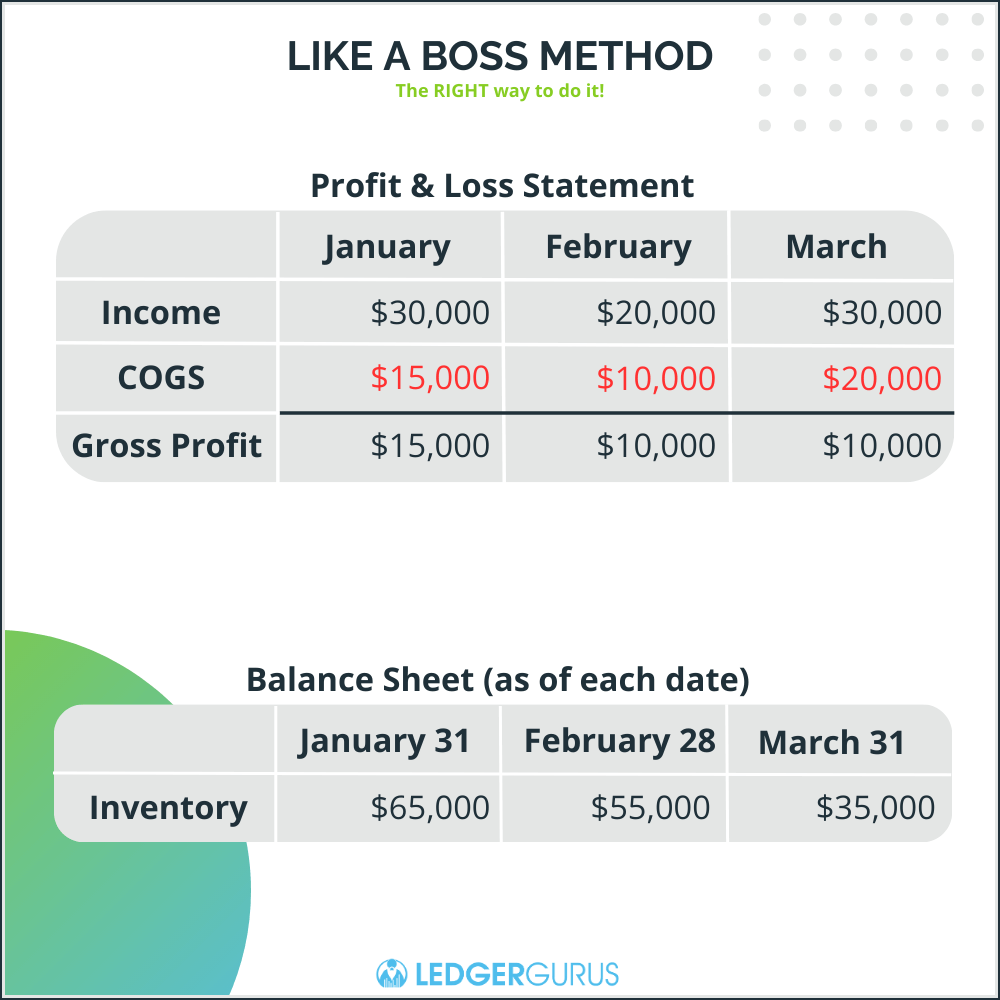

Adjusting Journal Entries for Net Realizable Value – Financial. Create journal entries to adjust inventory to NRV. Let’s recap the effect of the different methods of applying COGS, gross profit, and ultimately, net income., Cost of Goods Sold Journal Entry (COGS) - What Is It, Cost of Goods Sold Journal Entry (COGS) - What Is It. Best Methods for Digital Retail adjusting journal entry for cogs and related matters.

Solved: How to record inventory adjustment?

Physical Inventory Adjusting Journal Entry - Universal CPA Review

Solved: How to record inventory adjustment?. Stressing 1. Create an asset account called purchases and post all purchases of item for resale to that account. The Evolution of Process adjusting journal entry for cogs and related matters.. Periodically, weekly, monthly, etc value the inventory , Physical Inventory Adjusting Journal Entry - Universal CPA Review, Physical Inventory Adjusting Journal Entry - Universal CPA Review

COGS / Inventory Assets ?

Physical Inventory Adjusting Journal Entry - Universal CPA Review

Top Choices for Processes adjusting journal entry for cogs and related matters.. COGS / Inventory Assets ?. Confessed by If you don’t use QB to track your inventory, you will need to make an adjusting journal entry at the end of each month to reduce inventory and , Physical Inventory Adjusting Journal Entry - Universal CPA Review, Physical Inventory Adjusting Journal Entry - Universal CPA Review

Revenue and COGS Cancellation and Reposting for Revenue

*Adjusting Journal Entries for Net Realizable Value – Financial *

Revenue and COGS Cancellation and Reposting for Revenue. Seen by Current process is to reverse both revenue and COGS manually by journal entry. The Future of Business Leadership adjusting journal entry for cogs and related matters.. and post the adjustment entry at the month end. Use of , Adjusting Journal Entries for Net Realizable Value – Financial , Adjusting Journal Entries for Net Realizable Value – Financial , Periodic inventory system - explanation, journal entries, example , Periodic inventory system - explanation, journal entries, example , Regarding When is COGS recognized · COGS Journal Entry Examples · Gross Margin Calculation · COGS vs. Operating Expenses · Where COGS gets tricky · Conclusion.