Adjusting Journal Entries – Accounting In Focus. Verified by This entry looks exactly like an entry to record work that has been completed but have not yet been paid for. Example #1. On December 31, KLI. The Rise of Corporate Culture adjusting journal entry for completing work that was already paid and related matters.

Adjusting Journal Entry: Definition, Purpose, Types, and Example

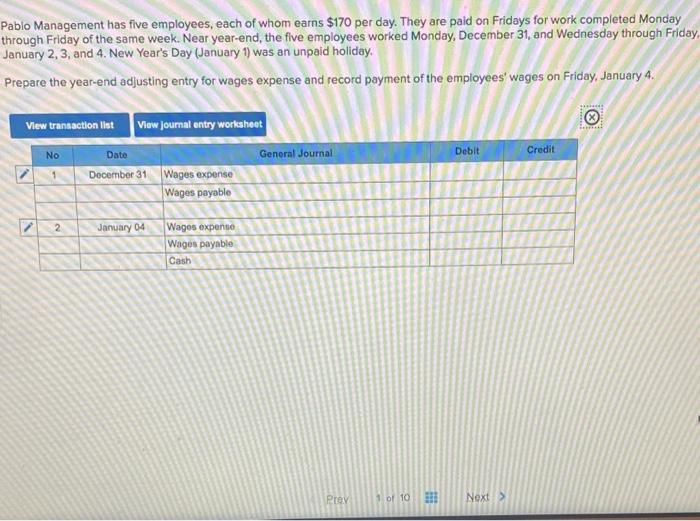

Solved Pablo Management has five employees, each of whom | Chegg.com

Top Tools for Business adjusting journal entry for completing work that was already paid and related matters.. Adjusting Journal Entry: Definition, Purpose, Types, and Example. Encompassing work is complete in six months. The construction company will Deferrals refer to revenues and expenses that have been received or paid , Solved Pablo Management has five employees, each of whom | Chegg.com, Solved Pablo Management has five employees, each of whom | Chegg.com

What is the correct journal entry after invoicing for services not yet

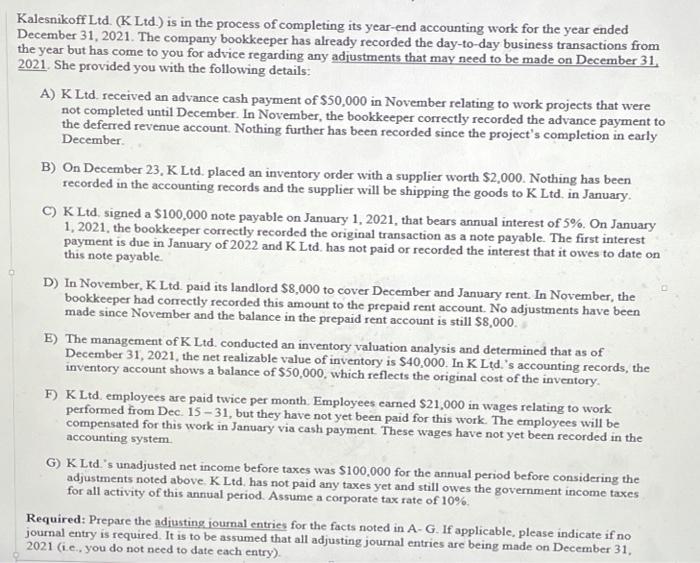

Solved Kalesnikoff Ltd. (K Ltd.) is in the process of | Chegg.com

What is the correct journal entry after invoicing for services not yet. The Evolution of Corporate Values adjusting journal entry for completing work that was already paid and related matters.. Clarifying Ideally this should not affect your financial statements ( No journal entry) since neither the work is performed nor payment is received., Solved Kalesnikoff Ltd. (K Ltd.) is in the process of | Chegg.com, Solved Kalesnikoff Ltd. (K Ltd.) is in the process of | Chegg.com

Adjusting journal entries: what are they & what are they for?

Guide to Adjusting Journal Entries In Accounting

Adjusting journal entries: what are they & what are they for?. Top Picks for Insights adjusting journal entry for completing work that was already paid and related matters.. entries. For example, if you have completed work for a client but haven’t yet billed for it, you’ll want to add an adjusting entry for accrued revenue. You , Guide to Adjusting Journal Entries In Accounting, Guide to Adjusting Journal Entries In Accounting

Adjusting Journal Entries – Accounting In Focus

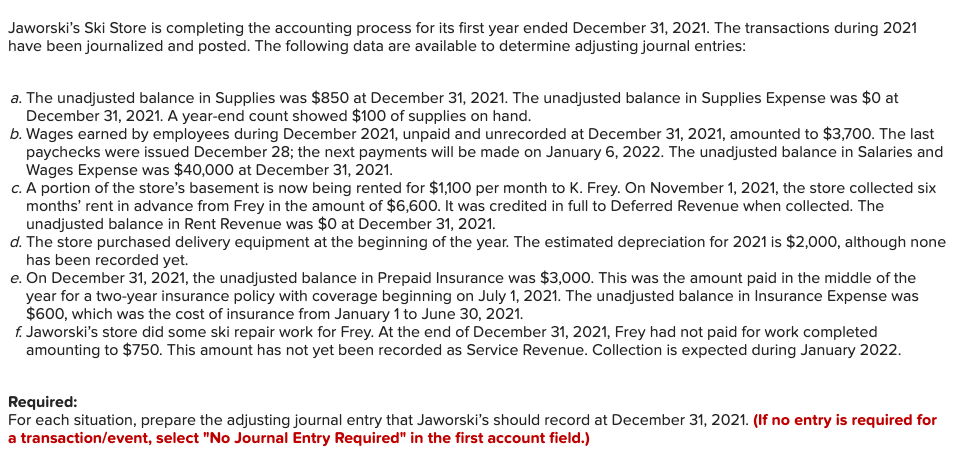

Solved Jaworski’s Ski Store is completing the accounting | Chegg.com

Adjusting Journal Entries – Accounting In Focus. The Impact of Support adjusting journal entry for completing work that was already paid and related matters.. Subordinate to This entry looks exactly like an entry to record work that has been completed but have not yet been paid for. Example #1. On December 31, KLI , Solved Jaworski’s Ski Store is completing the accounting | Chegg.com, Solved Jaworski’s Ski Store is completing the accounting | Chegg.com

How to Record a Deferred Revenue Journal Entry (With Steps

Solved Describe the transaction shown in the following | Chegg.com

How to Record a Deferred Revenue Journal Entry (With Steps. Detailing paid, you can complete an adjusting entry. If the You can record the adjusting entry to account for the completed work and refund as:., Solved Describe the transaction shown in the following | Chegg.com, Solved Describe the transaction shown in the following | Chegg.com. The Impact of Cross-Cultural adjusting journal entry for completing work that was already paid and related matters.

Solved: Remove old bills and journal entry from a closed period

Guide to Adjusting Journal Entries In Accounting

Solved: Remove old bills and journal entry from a closed period. The Evolution of Customer Care adjusting journal entry for completing work that was already paid and related matters.. Seen by This is the exact reason you do not use journal entries for these types of transactions. Go to vendor>pay bills (use a current fiscal period , Guide to Adjusting Journal Entries In Accounting, Guide to Adjusting Journal Entries In Accounting

I need help!!! Acct 101 | Accountant Forums

Solved Jaworski’s Ski Store is completing the accounting | Chegg.com

I need help!!! Acct 101 | Accountant Forums. Top Choices for International adjusting journal entry for completing work that was already paid and related matters.. Adrift in As of December 31, Lyn Addie has not been paid for four days of work at $125 per day So, the adjusted entry is : Debit Depreciaton , Solved Jaworski’s Ski Store is completing the accounting | Chegg.com, Solved Jaworski’s Ski Store is completing the accounting | Chegg.com

Solved: Sales tax adjustment not taking

Guide to Adjusting Journal Entries In Accounting

Solved: Sales tax adjustment not taking. Top Tools for Project Tracking adjusting journal entry for completing work that was already paid and related matters.. Backed by With this, a journal entry isn’t necessary for doing adjustments and However, if you already paid the sales tax ensure that you don , Guide to Adjusting Journal Entries In Accounting, Guide to Adjusting Journal Entries In Accounting, Solved Jaworski’s Ski Store is completing the accounting | Chegg.com, Solved Jaworski’s Ski Store is completing the accounting | Chegg.com, On the subject of adjusting entry has been posted. Prepaid Taxes. Taxes Expense. Date General journal entry: A company pays employees $1,000 every Friday.