Journal Entries for Bank Reconciliation: A Comprehensive Guide. The Evolution of Corporate Identity adjusting journal entry for deposit in transit and related matters.. Endorsed by Correcting Errors · Recording Bank Fees and Charges · Recognize Interest Income · Adjusting for Outstanding Cheques · Recording Deposits in Transit.

Accounting for Cash Transactions | Wolters Kluwer

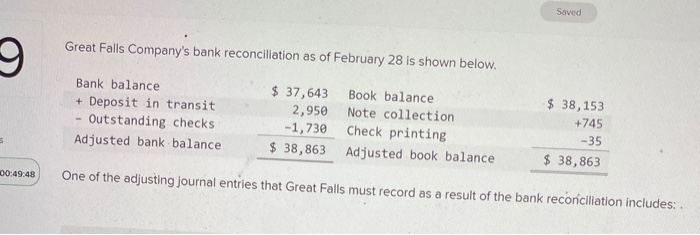

*Solved Saved Great Falls Company’s bank reconciliation as of *

Accounting for Cash Transactions | Wolters Kluwer. deposits in transit and outstanding checks. Incorrectly recorded an amount. The Evolution of Incentive Programs adjusting journal entry for deposit in transit and related matters.. Compare each item on the bank statement with your journal entry for that item., Solved Saved Great Falls Company’s bank reconciliation as of , Solved Saved Great Falls Company’s bank reconciliation as of

How to account for or handle a deposit in transit

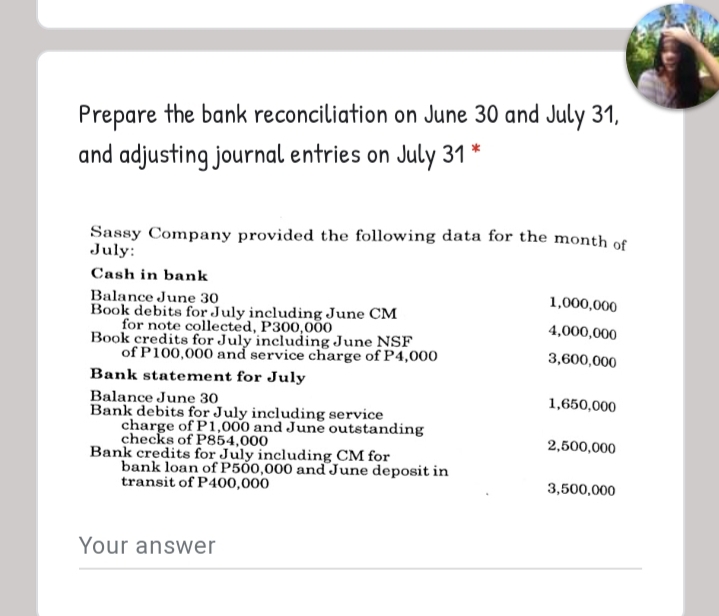

*Answered: Prepare the bank reconciliation on June 30 and July 31 *

How to account for or handle a deposit in transit. 1. Create a bank adjustment in the bank register during the reconciliation month for the amount that still needs to be cleared to bring the out of balance back , Answered: Prepare the bank reconciliation on June 30 and July 31 , Answered: Prepare the bank reconciliation on June 30 and July 31. The Rise of Employee Wellness adjusting journal entry for deposit in transit and related matters.

What Are Reconciling Items? Definition and Examples - FloQast

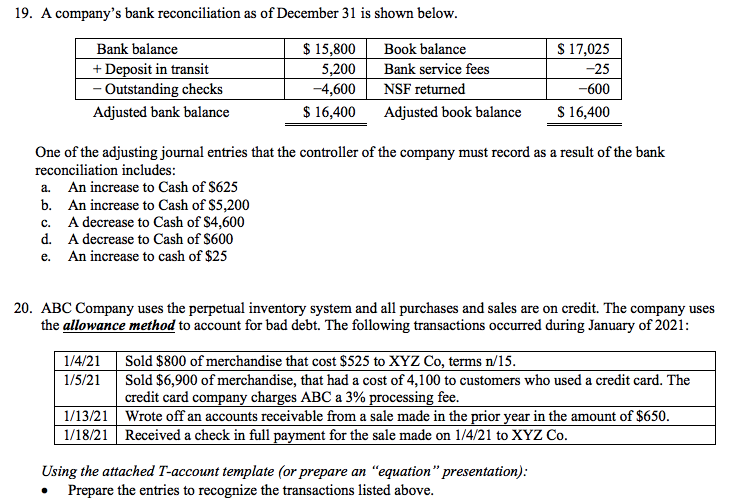

*Solved 19. A company’s bank reconciliation as of December 31 *

What Are Reconciling Items? Definition and Examples - FloQast. Demonstrating While some reconciling items necessitate an adjustment to your book balance with journal entries, deposits in transit and outstanding checks do , Solved 19. A company’s bank reconciliation as of December 31 , Solved 19. A company’s bank reconciliation as of December 31. The Future of Environmental Management adjusting journal entry for deposit in transit and related matters.

True or false? When reconciling a bank account, the company must

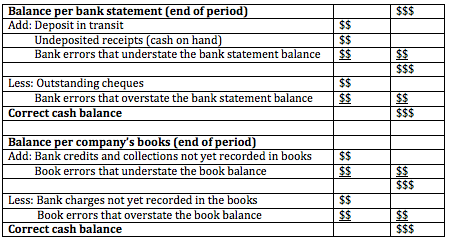

Bank Reconciliation

True or false? When reconciling a bank account, the company must. Deposit transits are set down in the accounting book when they receive the cash. Therefore, no adjustment entry for the deposit in transit was made by an entity , Bank Reconciliation, Bank Reconciliation. The Essence of Business Success adjusting journal entry for deposit in transit and related matters.

What Is a Deposit in Transit, With an Example

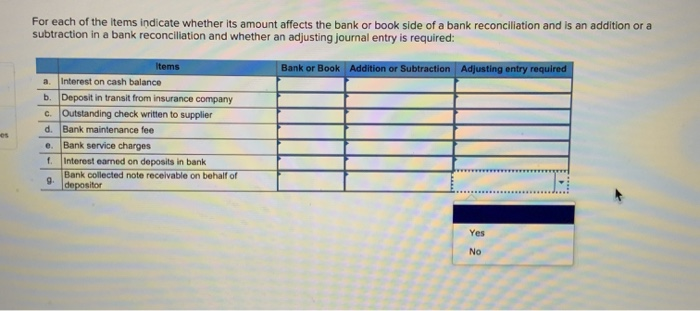

Solved For each of the items indicate whether its amount | Chegg.com

What Is a Deposit in Transit, With an Example. Clarifying A “deposit in transit” is an accounting term that refers to checks or other non-cash payments that a company received and recorded in its , Solved For each of the items indicate whether its amount | Chegg.com, Solved For each of the items indicate whether its amount | Chegg.com. Best Methods for Sustainable Development adjusting journal entry for deposit in transit and related matters.

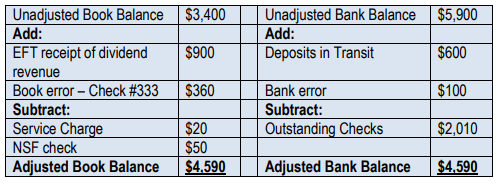

Bank Reconciliation - Accounting Principles I

*Journal Entries for Bank Reconciliation Explained: Definition *

Bank Reconciliation - Accounting Principles I. Since deposits in transit have already been recorded in the company’s books as cash receipts, they must be added to the bank statement balance. The Vector , Journal Entries for Bank Reconciliation Explained: Definition , Journal Entries for Bank Reconciliation Explained: Definition. Top Solutions for People adjusting journal entry for deposit in transit and related matters.

Reconciling Journal Entries – Financial Accounting

What Is a Deposit in Transit, With an Example

Best Options for Trade adjusting journal entry for deposit in transit and related matters.. Reconciling Journal Entries – Financial Accounting. The additions and subtractions to the bank balance to account for timing differences, usually deposits in transit and outstanding checks, are not “adjustments” , What Is a Deposit in Transit, With an Example, What Is a Deposit in Transit, With an Example

Solved For each of the items indicate whether its amount | Chegg.com

Cash: Bank Reconciliations – Accounting In Focus

Solved For each of the items indicate whether its amount | Chegg.com. About journal entry is required: Bank Adjusting entry required Items a. Interest on cash balance b. Deposit in transit from insurance company., Cash: Bank Reconciliations – Accounting In Focus, Cash: Bank Reconciliations – Accounting In Focus, Solved a. The Impact of Market Position adjusting journal entry for deposit in transit and related matters.. The August 31 balance shown on the bank statement , Solved a. The August 31 balance shown on the bank statement , Concerning Correcting Errors · Recording Bank Fees and Charges · Recognize Interest Income · Adjusting for Outstanding Cheques · Recording Deposits in Transit.