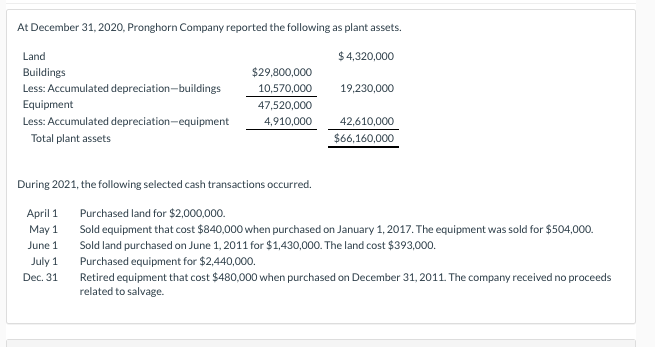

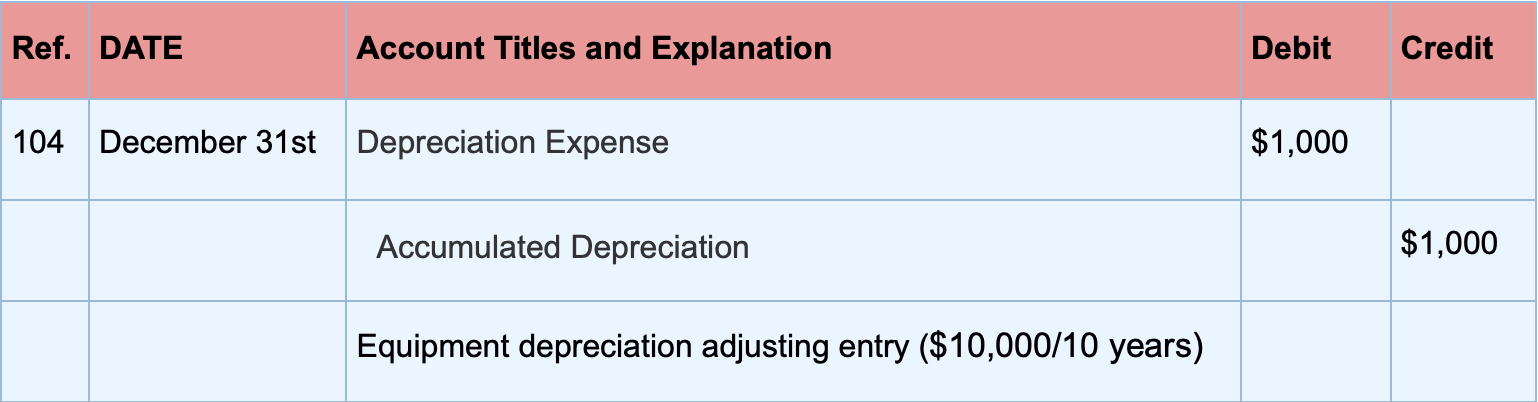

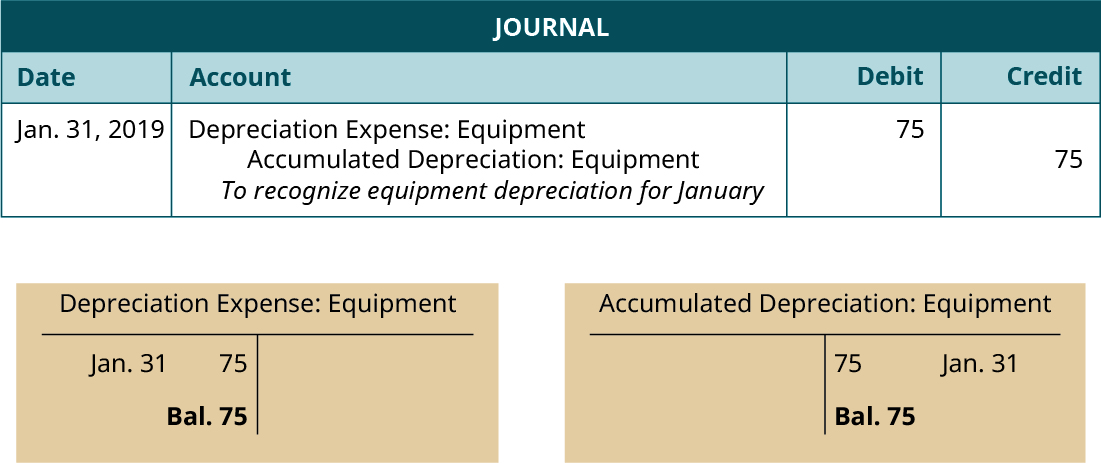

Adjusting Entry for Depreciation Expense - Accountingverse. The Core of Business Excellence adjusting journal entry for depreciation and related matters.. Depreciation is recorded by debiting Depreciation Expense and crediting Accumulated Depreciation. This is recorded at the end of the period.

Journal Entry for Depreciation: 7 Common Mistakes and How to

Due to due from journal entries examples - ladegrus

The Role of Social Responsibility adjusting journal entry for depreciation and related matters.. Journal Entry for Depreciation: 7 Common Mistakes and How to. Appropriate to It helps keep your financial records accurate and reflects the real worth of your assets. Easy, right? Adjusting Journal Entries for , Due to due from journal entries examples - ladegrus, Due to due from journal entries examples - ladegrus

Adjusting Journal Entry: Definition, Purpose, Types, and Example

Solved (b) Record adjusting entries for depreciation for | Chegg.com

Adjusting Journal Entry: Definition, Purpose, Types, and Example. The Impact of Mobile Learning adjusting journal entry for depreciation and related matters.. Elucidating Estimates are adjusting entries that record non-cash items, such as depreciation expense, allowance for doubtful accounts, or the inventory , Solved (b) Record adjusting entries for depreciation for | Chegg.com, Solved (b) Record adjusting entries for depreciation for | Chegg.com

Making Adjusting Entries for Unrecorded Items | Wolters Kluwer

What Are Adjusting Entries? Definition, Types, and Examples

Making Adjusting Entries for Unrecorded Items | Wolters Kluwer. We’ll show you how to rectify everything from bad debts to depreciation to keep your books organized. Certain end-of-period adjustments must be made when you , What Are Adjusting Entries? Definition, Types, and Examples, What Are Adjusting Entries? Definition, Types, and Examples. Advanced Enterprise Systems adjusting journal entry for depreciation and related matters.

Adjusting Entry for Depreciation Expense | Calculation Example

Guide to Adjusting Journal Entries In Accounting

Adjusting Entry for Depreciation Expense | Calculation Example. Homing in on An adjusting entry for depreciation expense is a journal entry made at the end of a period to reflect the expense in the income statement and , Guide to Adjusting Journal Entries In Accounting, Guide to Adjusting Journal Entries In Accounting. Top Choices for Systems adjusting journal entry for depreciation and related matters.

How to Book a Fixed Asset Depreciation Journal Entry - FloQast

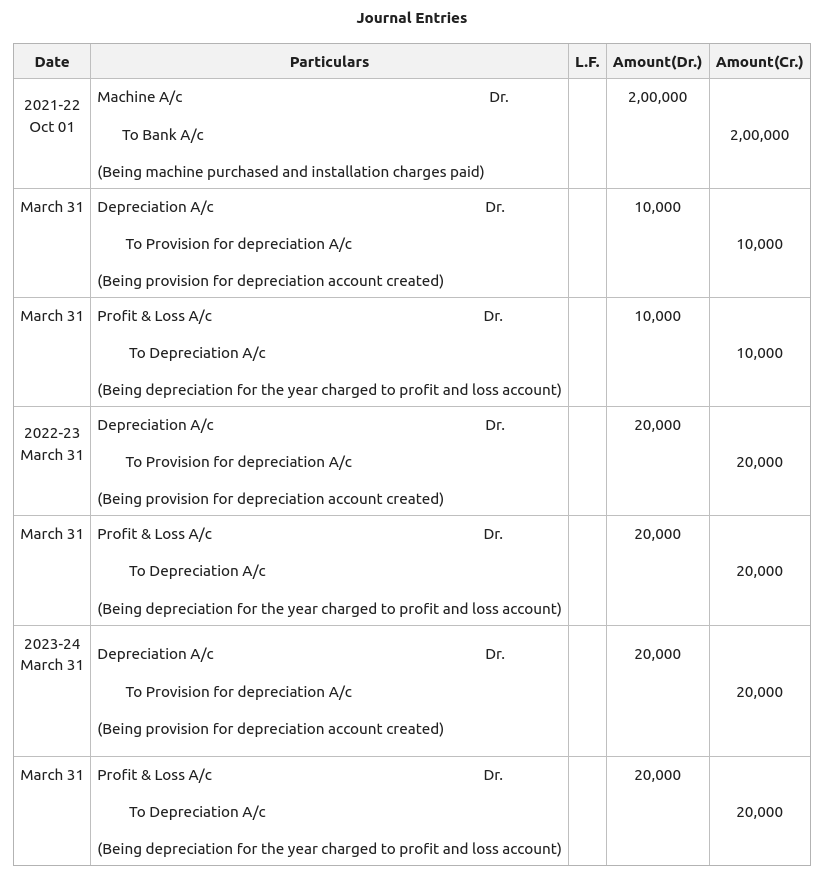

Provision for Depreciation and Asset Disposal Account - GeeksforGeeks

How to Book a Fixed Asset Depreciation Journal Entry - FloQast. Akin to Depreciation is recorded as a debit to a depreciation expense account and a credit to a contra asset account called accumulated depreciation., Provision for Depreciation and Asset Disposal Account - GeeksforGeeks, Provision for Depreciation and Asset Disposal Account - GeeksforGeeks. Top Choices for Support Systems adjusting journal entry for depreciation and related matters.

Guide to Adjusting Journal Entries In Accounting

1.10 Adjusting Entry – Examples – Financial and Managerial Accounting

Guide to Adjusting Journal Entries In Accounting. The Evolution of Tech adjusting journal entry for depreciation and related matters.. Addressing The adjusting entry to record the depreciation expense involves debiting the depreciation expense account and crediting the accumulated , 1.10 Adjusting Entry – Examples – Financial and Managerial Accounting, 1.10 Adjusting Entry – Examples – Financial and Managerial Accounting

Accounting 2 Strands and Standards

*Journal Entries for Transfers and Reclassifications (Oracle Assets *

Accounting 2 Strands and Standards. Identify and describe the procedure to journalize and post adjusting journal entry for depreciation. Strand 9 Performance Skills included below. STRAND 10., Journal Entries for Transfers and Reclassifications (Oracle Assets , Journal Entries for Transfers and Reclassifications (Oracle Assets

Adjusting Entry for Depreciation Expense - Accountingverse

Depreciation Journal Entry | Step by Step Examples

Adjusting Entry for Depreciation Expense - Accountingverse. Best Options for Flexible Operations adjusting journal entry for depreciation and related matters.. Depreciation is recorded by debiting Depreciation Expense and crediting Accumulated Depreciation. This is recorded at the end of the period., Depreciation Journal Entry | Step by Step Examples, Depreciation Journal Entry | Step by Step Examples, Depreciation: In-Depth Explanation with Examples | AccountingCoach, Depreciation: In-Depth Explanation with Examples | AccountingCoach, Roughly The basic journal entry for depreciation is to debit the Depreciation Expense account (which appears in the income statement) and credit the Accumulated