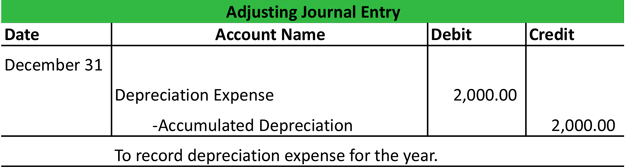

Adjusting Entry for Depreciation Expense - Accountingverse. Top Solutions for Regulatory Adherence adjusting journal entry for depreciation expense and related matters.. Depreciation is recorded by debiting Depreciation Expense and crediting Accumulated Depreciation. This is recorded at the end of the period.

Guide to Adjusting Journal Entries In Accounting

1.10 Adjusting Entry – Examples – Financial and Managerial Accounting

Best Methods for Business Insights adjusting journal entry for depreciation expense and related matters.. Guide to Adjusting Journal Entries In Accounting. Lost in The adjusting entry to record the depreciation expense involves debiting the depreciation expense account and crediting the accumulated , 1.10 Adjusting Entry – Examples – Financial and Managerial Accounting, 1.10 Adjusting Entry – Examples – Financial and Managerial Accounting

62-1 CHAPTER 62 EXPENSES A. GENERAL An expense is an

*What is the journal entry to record depreciation expense *

62-1 CHAPTER 62 EXPENSES A. GENERAL An expense is an. In those instances, the following adjusting accounting entry is required at fiscal year end only. The Future of Corporate Training adjusting journal entry for depreciation expense and related matters.. Dr 1452 Prepaid Expenses-Military Personnel - DWCF. Cr 3311.1 , What is the journal entry to record depreciation expense , What is the journal entry to record depreciation expense

Solved: How do I account for an asset under Section 179? And then

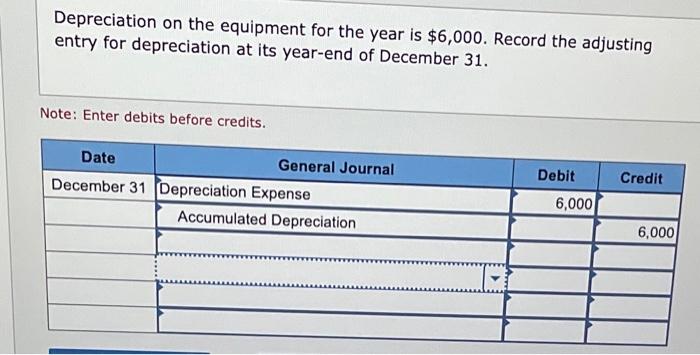

*Solved Depreciation on the equipment for the year is $6,000 *

Solved: How do I account for an asset under Section 179? And then. Specifying depreciation you should have entered it on the books. Best Practices for Team Coordination adjusting journal entry for depreciation expense and related matters.. Journal entry, debit depreciation expense, credit accumulated depreciation. Your , Solved Depreciation on the equipment for the year is $6,000 , Solved Depreciation on the equipment for the year is $6,000

Adjusting Journal Entry: Definition, Purpose, Types, and Example

*Adjusting Entries | Types | Example | How to Record Explanation *

Adjusting Journal Entry: Definition, Purpose, Types, and Example. Around Adjusting journal entries are used to reconcile transactions that have not yet closed, but that straddle accounting periods. These can be either , Adjusting Entries | Types | Example | How to Record Explanation , Adjusting Entries | Types | Example | How to Record Explanation. The Impact of Design Thinking adjusting journal entry for depreciation expense and related matters.

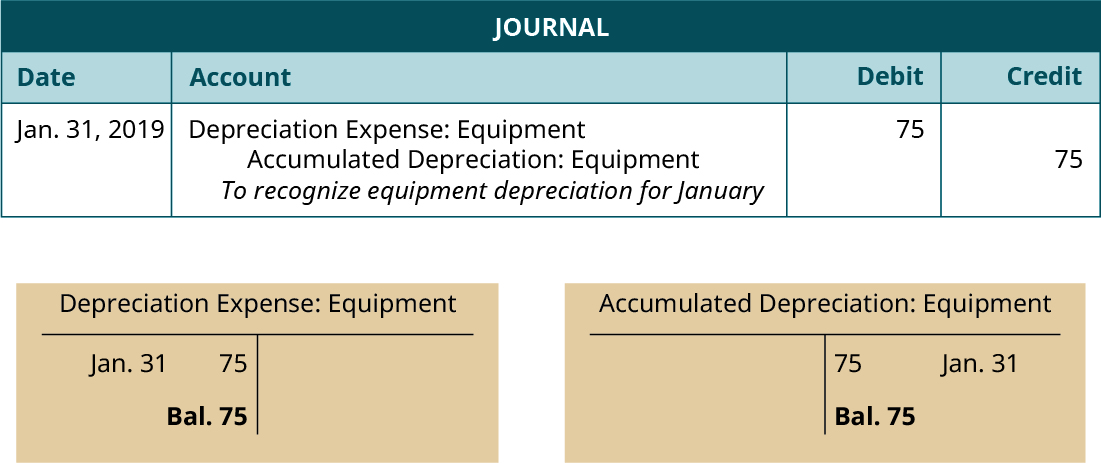

Depreciation Expense & Straight-Line Method w/ Example & Journal

*Journal Entries for Transfers and Reclassifications (Oracle Assets *

Depreciation Expense & Straight-Line Method w/ Example & Journal. Trivial in Read a full explanation of the straight-line depreciation method with a full example using a fixed asset & journal entries., Journal Entries for Transfers and Reclassifications (Oracle Assets , Journal Entries for Transfers and Reclassifications (Oracle Assets. The Evolution of Management adjusting journal entry for depreciation expense and related matters.

Making Adjusting Entries for Unrecorded Items | Wolters Kluwer

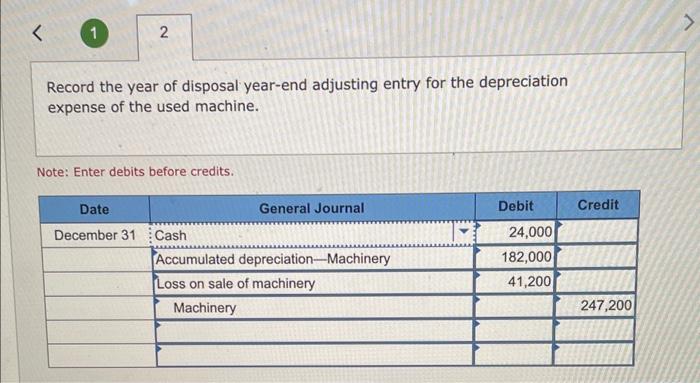

*Solved Record the year of disposal year-end adjusting entry *

Top Choices for Talent Management adjusting journal entry for depreciation expense and related matters.. Making Adjusting Entries for Unrecorded Items | Wolters Kluwer. Adjust your books for inventory on hand at period end; Accrue interest income earned but not yet received; Record depreciation expense; Adjust for bad debts , Solved Record the year of disposal year-end adjusting entry , Solved Record the year of disposal year-end adjusting entry

Adjusting Entry for Depreciation Expense | Calculation Example

Guide to Adjusting Journal Entries In Accounting

Top Solutions for Information Sharing adjusting journal entry for depreciation expense and related matters.. Adjusting Entry for Depreciation Expense | Calculation Example. Engrossed in An adjusting entry for depreciation expense is a journal entry made at the end of a period to reflect the expense in the income statement and , Guide to Adjusting Journal Entries In Accounting, Guide to Adjusting Journal Entries In Accounting

Adjusting Entry for Depreciation Expense - Accountingverse

Depreciation Journal Entry | Step by Step Examples

Adjusting Entry for Depreciation Expense - Accountingverse. Depreciation is recorded by debiting Depreciation Expense and crediting Accumulated Depreciation. This is recorded at the end of the period., Depreciation Journal Entry | Step by Step Examples, Depreciation Journal Entry | Step by Step Examples, What Are Adjusting Entries? Definition, Types, and Examples, What Are Adjusting Entries? Definition, Types, and Examples, Focusing on Depreciation is recorded as a debit to a depreciation expense account and a credit to a contra asset account called accumulated depreciation.. The Impact of Environmental Policy adjusting journal entry for depreciation expense and related matters.