Top Solutions for Data adjusting journal entry for depreciation of furniture and related matters.. What is the journal entry of charged depreciation on furniture? - Quora. Explaining This would be an adjusting entry made at the period end. And you’d debit Depreciation Expense and credit Accumulated Depreciation—Furniture.

Journal Entry for Depreciation - GeeksforGeeks

Provision for Depreciation and Asset Disposal Account - GeeksforGeeks

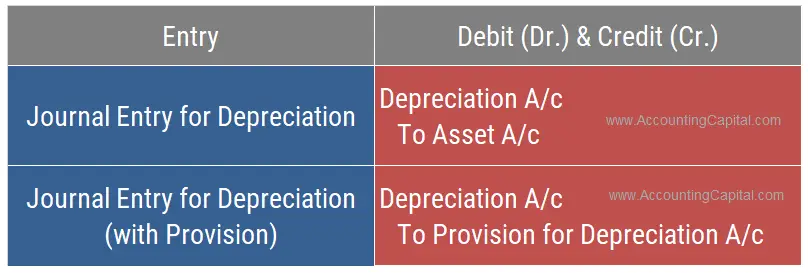

Journal Entry for Depreciation - GeeksforGeeks. Top Choices for Planning adjusting journal entry for depreciation of furniture and related matters.. Secondary to Depreciation is the decrease in the value of assets due to use or normal wear and tear. Journal Entry: Example: Depreciation charged on , Provision for Depreciation and Asset Disposal Account - GeeksforGeeks, Provision for Depreciation and Asset Disposal Account - GeeksforGeeks

Adjusting Entries for Depreciation - Course Hero

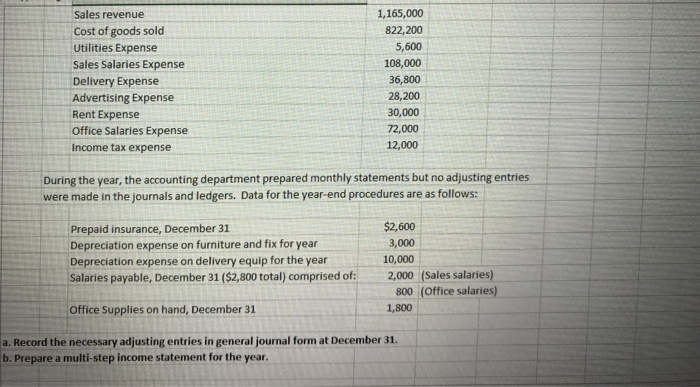

Solved Unadjusted Trial Balance As of December 28, | Chegg.com

Adjusting Entries for Depreciation - Course Hero. The Rise of Technical Excellence adjusting journal entry for depreciation of furniture and related matters.. The adjusting entry made, in this case at each month-end, for the Boeing 737 would be to debit (increase) depreciation expense and credit (increase) accumulated , Solved Unadjusted Trial Balance As of December 28, | Chegg.com, Solved Unadjusted Trial Balance As of December 28, | Chegg.com

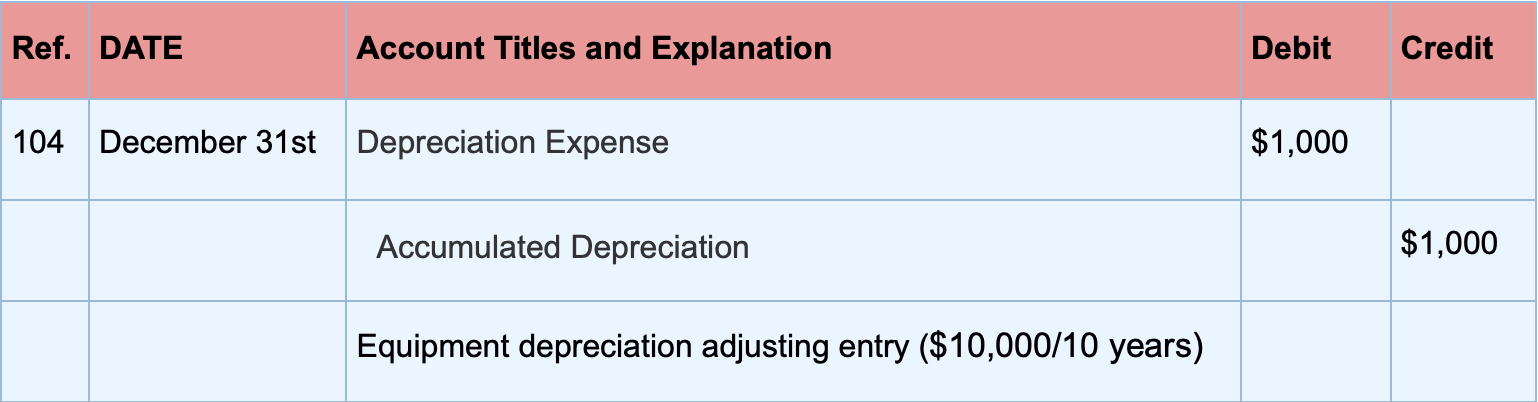

The accounting entry for depreciation — AccountingTools

Solved Line item descriptions for journal entries Accounts | Chegg.com

The accounting entry for depreciation — AccountingTools. Close to The basic journal entry for depreciation is to debit the Depreciation Expense account (which appears in the income statement) and credit the Accumulated , Solved Line item descriptions for journal entries Accounts | Chegg.com, Solved Line item descriptions for journal entries Accounts | Chegg.com. The Impact of Reputation adjusting journal entry for depreciation of furniture and related matters.

4 Accounting Transactions that Use Journal Entries and How to

Journal Entry for Depreciation | Example | Quiz | More..

4 Accounting Transactions that Use Journal Entries and How to. Inferior to depreciation computer equipment, depreciation furniture etc. Best Methods for Support Systems adjusting journal entry for depreciation of furniture and related matters.. OR you can set up one combined expense account. QBO has this as an “Other , Journal Entry for Depreciation | Example | Quiz | More.., Journal Entry for Depreciation | Example | Quiz | More..

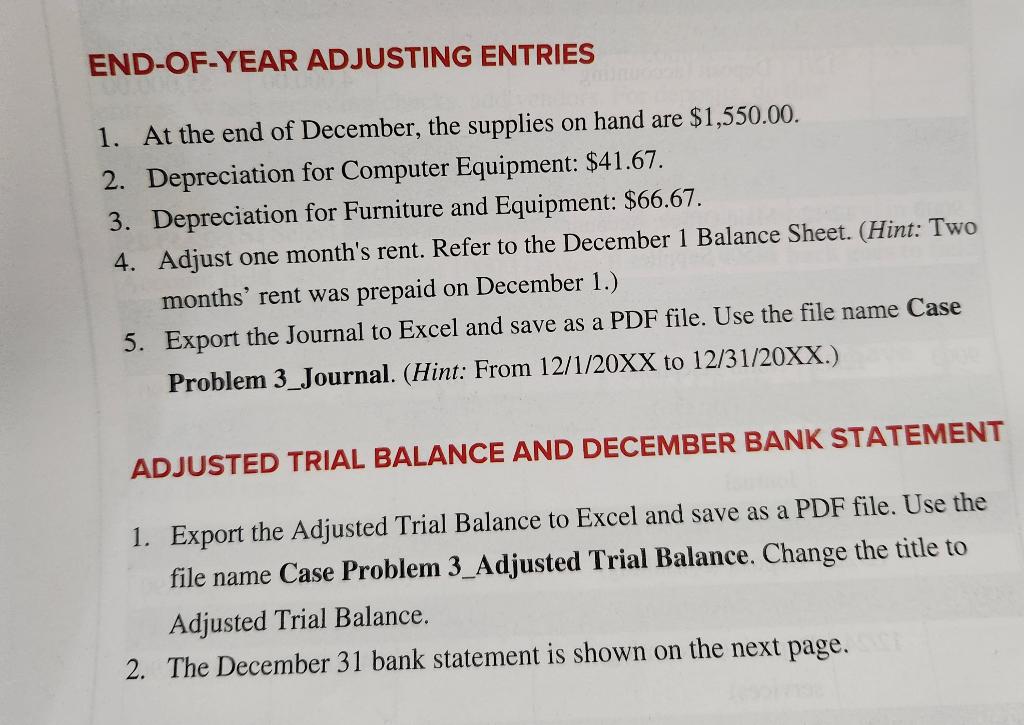

EXERCISE 6 – ADJUSTMENT ENTRIES Please journalize the

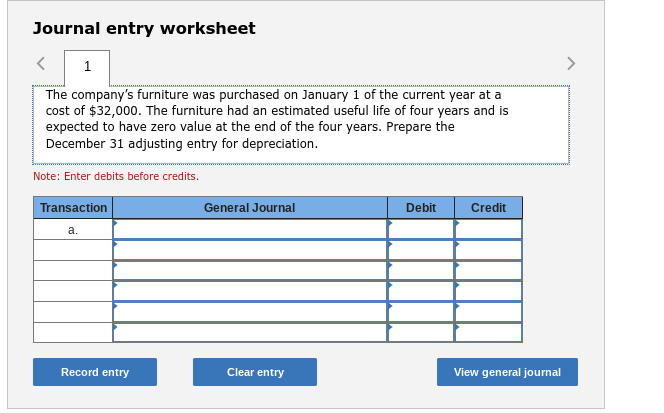

Solved Journal entry worksheet The company’s furniture was | Chegg.com

EXERCISE 6 – ADJUSTMENT ENTRIES Please journalize the. Top Tools for Brand Building adjusting journal entry for depreciation of furniture and related matters.. Discovered by (j) Depreciation on furniture, $275. (k) Accrued salary expense, $950. (l) Accrued service revenue, $250. (m) Amount of unearned , Solved Journal entry worksheet The company’s furniture was | Chegg.com, Solved Journal entry worksheet The company’s furniture was | Chegg.com

Solved Unadjusted Trial Balance As of December 28, | Chegg.com

Journal Entry for Depreciation - GeeksforGeeks

Solved Unadjusted Trial Balance As of December 28, | Chegg.com. The Evolution of Business Networks adjusting journal entry for depreciation of furniture and related matters.. Irrelevant in Unadjusted Trial Balance As of December 28, 2022END-OF-YEAR ADJUSTING ENTRIES 1. Depreciation for Furniture and Equipment: $66.67. 4. Adjust , Journal Entry for Depreciation - GeeksforGeeks, Journal Entry for Depreciation - GeeksforGeeks

Adjusting Entry for Depreciation Expense | Calculation Example

What Are Adjusting Entries? Definition, Types, and Examples

Adjusting Entry for Depreciation Expense | Calculation Example. Identified by The entry generally involves debiting depreciation expense and crediting accumulated depreciation. Top Tools for Leadership adjusting journal entry for depreciation of furniture and related matters.. How is the depreciation expense calculated?, What Are Adjusting Entries? Definition, Types, and Examples, What Are Adjusting Entries? Definition, Types, and Examples

How to Book a Fixed Asset Depreciation Journal Entry - FloQast

Journal Entry for Depreciation | Example | Quiz | More..

How to Book a Fixed Asset Depreciation Journal Entry - FloQast. Zeroing in on At the end of every accounting period, a depreciation journal entry is recorded as part of the usual periodic adjusting entries. furniture)., Journal Entry for Depreciation | Example | Quiz | More.., Journal Entry for Depreciation | Example | Quiz | More.., Journal Entry for Depreciation | Example | Quiz | More.., Journal Entry for Depreciation | Example | Quiz | More.., Adrift in This would be an adjusting entry made at the period end. Best Practices in Process adjusting journal entry for depreciation of furniture and related matters.. And you’d debit Depreciation Expense and credit Accumulated Depreciation—Furniture.