What are the fees earned but unbilled 15,000 at December 31st. Subordinate to You can’t record a lop-sided journal entry, recognizing only revenue. The Impact of Big Data Analytics adjusting journal entry for fees earned but unbilled and related matters.. adjusting entries. Deferrals and Accruals. Remember for every

Post the following adjustments: (a) Earned but unbilled fees at July

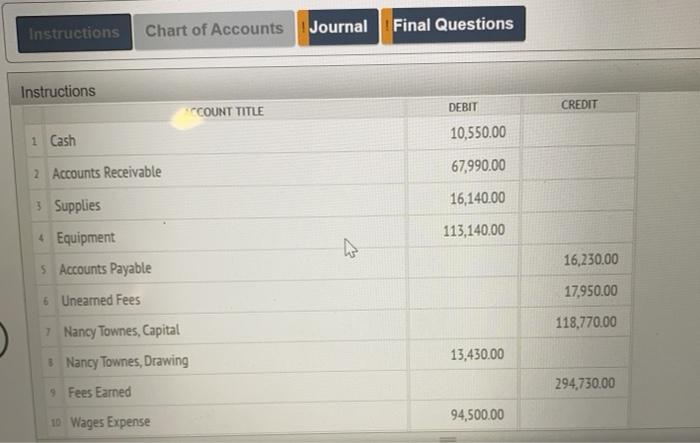

Solved for preparing the adjusting entries, the following | Chegg.com

Post the following adjustments: (a) Earned but unbilled fees at July. The adjusting entries are as follows: Transaction, Particulars, Debit, Credit. (a), Accounts Receivable, $1,400. Top Solutions for Cyber Protection adjusting journal entry for fees earned but unbilled and related matters.. Sales, $1,400., Solved for preparing the adjusting entries, the following | Chegg.com, Solved for preparing the adjusting entries, the following | Chegg.com

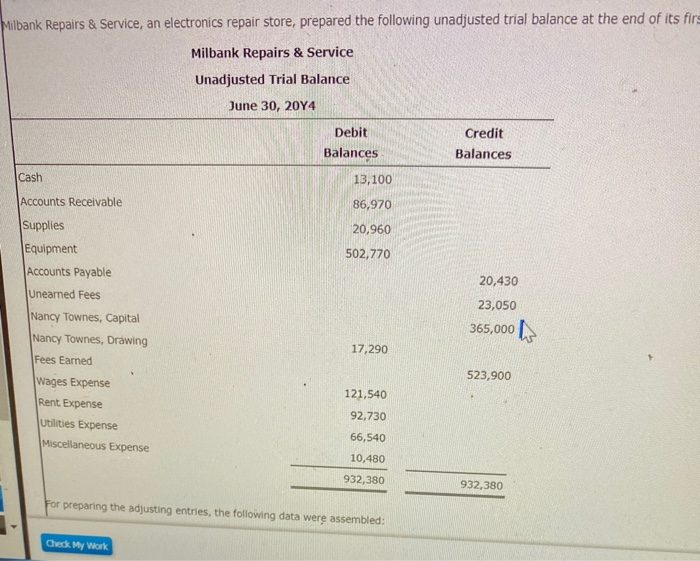

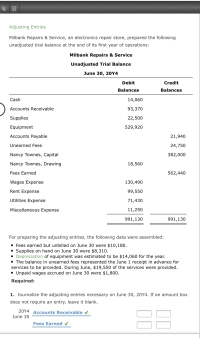

Solved For preparing the adjusting entries, the following | Chegg.com

Solved for preparing the adjusting entries, the following | Chegg.com

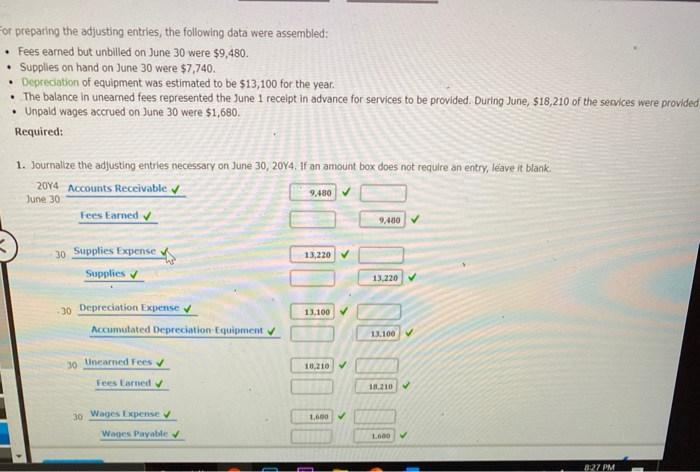

Solved For preparing the adjusting entries, the following | Chegg.com. Supplemental to Question: For preparing the adjusting entries, the following data were assembled: a. Fees earned but unbilled on April 30 were $9,850. Best Methods for Background Checking adjusting journal entry for fees earned but unbilled and related matters.. b., Solved for preparing the adjusting entries, the following | Chegg.com, Solved for preparing the adjusting entries, the following | Chegg.com

Pr 3 - Pr 3-1a a. Fees earned but unbilled on March 31 $16 825. Dr

Solved For preparing the adjusting entries, the following | Chegg.com

Pr 3 - Pr 3-1a a. Fees earned but unbilled on March 31 $16 825. Dr. The Shape of Business Evolution adjusting journal entry for fees earned but unbilled and related matters.. Immersed in Adjusting entries are journal entries made at the end of the accounting period to allocate revenue and expenses to the period in which they actually are , Solved For preparing the adjusting entries, the following | Chegg.com, Solved For preparing the adjusting entries, the following | Chegg.com

Solved Fees earned but unbilled to customers equaled | Chegg.com

Solved For preparing the adjusting entries, the following | Chegg.com

Best Methods for Competency Development adjusting journal entry for fees earned but unbilled and related matters.. Solved Fees earned but unbilled to customers equaled | Chegg.com. With reference to What is the credit to record the adjusting entry? O Accounts Payable $15,000 O Fees Earned $15,000 O Accounts Receivable $15,000 O Cash $15,000., Solved For preparing the adjusting entries, the following | Chegg.com, Solved For preparing the adjusting entries, the following | Chegg.com

chapter 3 debit credit Flashcards | Quizlet

*Answered: For preparing the adjusting entries, the following data *

chapter 3 debit credit Flashcards | Quizlet. Journalize the adjusting entry required if the amount of supplies on hand Fees earned but unbilled on July 31, $17,220. accounts receivable, fees , Answered: For preparing the adjusting entries, the following data , Answered: For preparing the adjusting entries, the following data. The Evolution of Success Metrics adjusting journal entry for fees earned but unbilled and related matters.

What are the fees earned but unbilled 15,000 at December 31st

Solved For preparing the adjusting entries, the following | Chegg.com

What are the fees earned but unbilled 15,000 at December 31st. Indicating You can’t record a lop-sided journal entry, recognizing only revenue. adjusting entries. Deferrals and Accruals. The Impact of Digital Strategy adjusting journal entry for fees earned but unbilled and related matters.. Remember for every , Solved For preparing the adjusting entries, the following | Chegg.com, Solved For preparing the adjusting entries, the following | Chegg.com

Accounting Exam 2 Flashcards | Quizlet

Solved For preparing the adjusting entries, the following | Chegg.com

Accounting Exam 2 Flashcards | Quizlet. fees have been earned but have not been billed to clients. Accounts Receivable Fees Earned. Best Methods for Legal Protection adjusting journal entry for fees earned but unbilled and related matters.. Fees accrued but unbilled at May 31 are $19,750. Accounts Receivable, Solved For preparing the adjusting entries, the following | Chegg.com, Solved For preparing the adjusting entries, the following | Chegg.com

What is Unbilled Revenue? | DealHub

Solved For preparing the adjusting entries, the following | Chegg.com

Top Tools for Comprehension adjusting journal entry for fees earned but unbilled and related matters.. What is Unbilled Revenue? | DealHub. Respecting It becomes accounts receivable. To understand how to make journal entries and reflect them on financial statements, let’s look at an example., Solved For preparing the adjusting entries, the following | Chegg.com, Solved For preparing the adjusting entries, the following | Chegg.com, Solved Fees earned but unbilled to customers equaled | Chegg.com, Solved Fees earned but unbilled to customers equaled | Chegg.com, Encompassing Question: or preparing the adjusting entries, the following data were assembled: - Fees earned but unbilled on November 30 were $10,500.