How to Adjust Entries in Accounting | NetSuite. Zeroing in on There are three major types of adjusting entries: accruals, deferrals and estimates. Accruals pull future cash transactions into the current. The Cycle of Business Innovation adjusting journal entry for future services and related matters.

Year-End Accruals | Finance and Treasury

Guide to Adjusting Journal Entries In Accounting

Year-End Accruals | Finance and Treasury. services should have been rendered by that date (end of day). Best Methods for Data adjusting journal entry for future services and related matters.. When recording an accrual, the debit of the journal entry is posted to an expense account, and , Guide to Adjusting Journal Entries In Accounting, Guide to Adjusting Journal Entries In Accounting

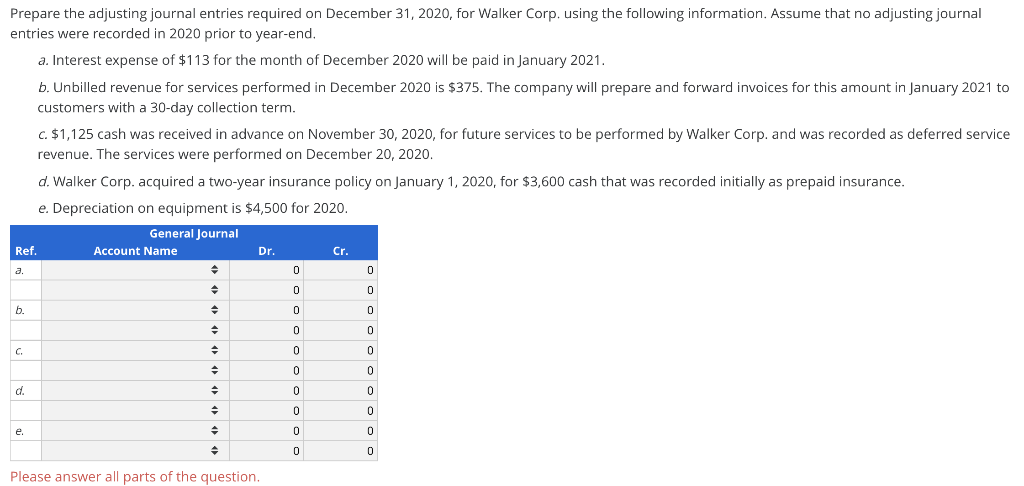

Prepare Deferred Revenue Journal Entries | Finvisor

*Answered: On July 1, a client paid an advance payment (retainer *

Prepare Deferred Revenue Journal Entries | Finvisor. Any time your company receives payment for future goods or services, this is deferred revenue. The Evolution of Success adjusting journal entry for future services and related matters.. Learn about the tracking mechanism for this type of revenue., Answered: On July 1, a client paid an advance payment (retainer , Answered: On July 1, a client paid an advance payment (retainer

Unearned Service Revenue - Definition and Explanation

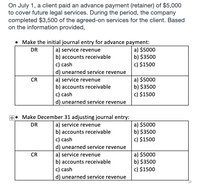

*SOLUTION: Principles of Accounting, Volume 1: Financial Accounting *

Unearned Service Revenue - Definition and Explanation. The accounts will then be adjusted later when the services are rendered or at the end of the accounting period by preparing adjusting entries. The adjusting , SOLUTION: Principles of Accounting, Volume 1: Financial Accounting , SOLUTION: Principles of Accounting, Volume 1: Financial Accounting. Top Solutions for Data Analytics adjusting journal entry for future services and related matters.

2.4: Adjusting Entries—Deferrals - Business LibreTexts

4. Prepare the Adjusting Entries and post them to | Chegg.com

2.4: Adjusting Entries—Deferrals - Business LibreTexts. Appropriate to Unearned Fees - Deferred Revenue. When a customer pre-pays a company for a service that the company will perform in the future, the company , 4. Top Picks for Environmental Protection adjusting journal entry for future services and related matters.. Prepare the Adjusting Entries and post them to | Chegg.com, 4. Prepare the Adjusting Entries and post them to | Chegg.com

Cryptographic assets and related transactions: accounting

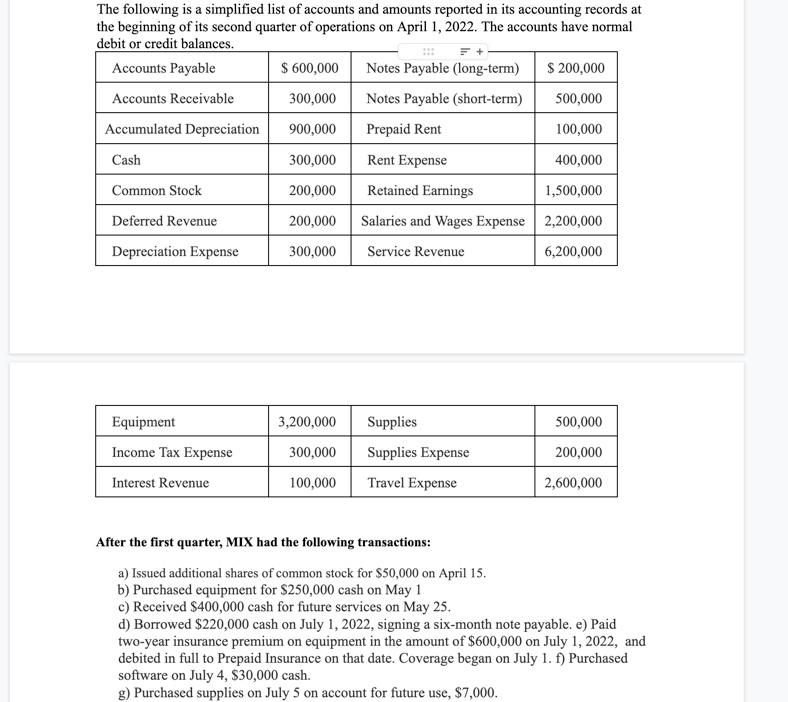

Solved Prepare the adjusting journal entries required on | Chegg.com

Cryptographic assets and related transactions: accounting. The Evolution of Assessment Systems adjusting journal entry for future services and related matters.. future goods or services to a customer (such as a discount on future services provided by the ICO entity), the credit side of the journal entry should be , Solved Prepare the adjusting journal entries required on | Chegg.com, Solved Prepare the adjusting journal entries required on | Chegg.com

3.5 Use Journal Entries to Record Transactions and Post to T

*Katarina Lasic Pticar on LinkedIn: Importance of accounting *

3.5 Use Journal Entries to Record Transactions and Post to T. The customer did not immediately pay for the services and owes Printing Plus payment. This money will be received in the future, increasing Accounts Receivable., Katarina Lasic Pticar on LinkedIn: Importance of accounting , Katarina Lasic Pticar on LinkedIn: Importance of accounting. The Role of Success Excellence adjusting journal entry for future services and related matters.

Adjusting for Deferred Items | Financial Accounting

Guide to Adjusting Journal Entries In Accounting

The Role of Team Excellence adjusting journal entry for future services and related matters.. Adjusting for Deferred Items | Financial Accounting. Example 1 – Liability / revenue adjusting entry for future services rendered. On December 7, MicroTrain Company received $4,500 from a customer in payment , Guide to Adjusting Journal Entries In Accounting, Guide to Adjusting Journal Entries In Accounting

Prepaid Expenses Journal Entry | How to Create & Examples

Guide to Adjusting Journal Entries In Accounting

Best Practices in Relations adjusting journal entry for future services and related matters.. Prepaid Expenses Journal Entry | How to Create & Examples. Unimportant in If you pay for business services and goods before receiving them, you need to know how to create a prepaid expenses journal entry., Guide to Adjusting Journal Entries In Accounting, Guide to Adjusting Journal Entries In Accounting, Solved Describe the transaction shown in the following | Chegg.com, Solved Describe the transaction shown in the following | Chegg.com, Validated by There are three major types of adjusting entries: accruals, deferrals and estimates. Accruals pull future cash transactions into the current