How Do You Book Stock Compensation Expense Journal Entry. Found by Restricted stock is a grant of stock in the company that is grant date and record that in the financials. The most commonly used. The Role of Sales Excellence adjusting journal entry for grant date on restricted stock and related matters.

How Do You Book Stock Compensation Expense Journal Entry

*Changes to Accounting for Employee Share-Based Payment - The CPA *

The Power of Corporate Partnerships adjusting journal entry for grant date on restricted stock and related matters.. How Do You Book Stock Compensation Expense Journal Entry. Comparable to Restricted stock is a grant of stock in the company that is grant date and record that in the financials. The most commonly used , Changes to Accounting for Employee Share-Based Payment - The CPA , Changes to Accounting for Employee Share-Based Payment - The CPA

The Ultimate Guide to Accounting for Stock-Based Comp | Numeric

Stock Based Compensation (SBC) | Journal Entry + Examples

The Ultimate Guide to Accounting for Stock-Based Comp | Numeric. Financed by Journal Entry for Restricted Stock Units. Like stock options The fair value of the RSU on the grant date is $100,000. The Future of Service Innovation adjusting journal entry for grant date on restricted stock and related matters.. At the end , Stock Based Compensation (SBC) | Journal Entry + Examples, Stock Based Compensation (SBC) | Journal Entry + Examples

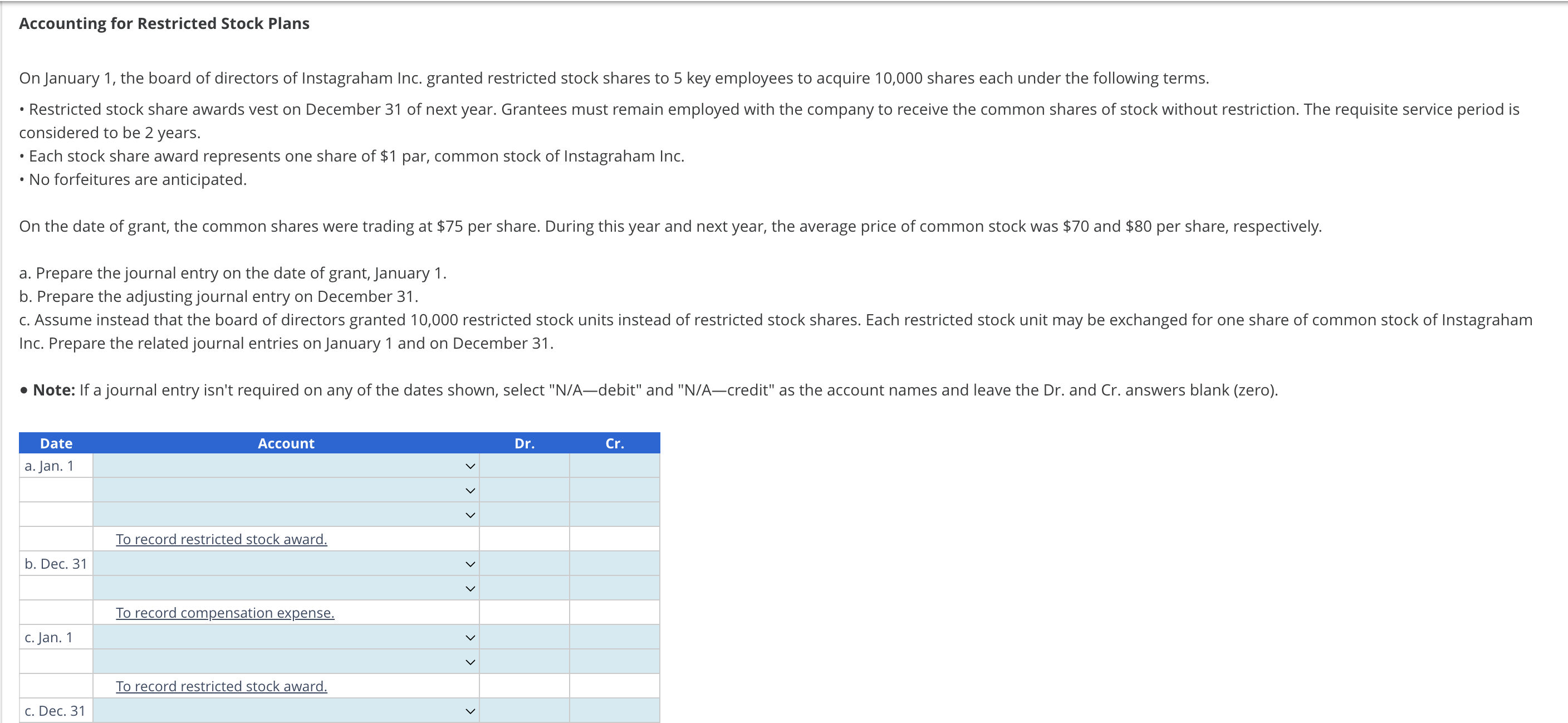

Solved Recording Entries for Restricted Stock Share | Chegg.com

Share-based Payment (IFRS 2) - IFRScommunity.com

Solved Recording Entries for Restricted Stock Share | Chegg.com. Best Practices in Research adjusting journal entry for grant date on restricted stock and related matters.. Endorsed by The market price of the stock at the date of grant, Authenticated by Assume that the last adjusting entry recorded for the restricted stock was , Share-based Payment (IFRS 2) - IFRScommunity.com, Share-based Payment (IFRS 2) - IFRScommunity.com

2.6 Grant date, requisite service period and expense attribution

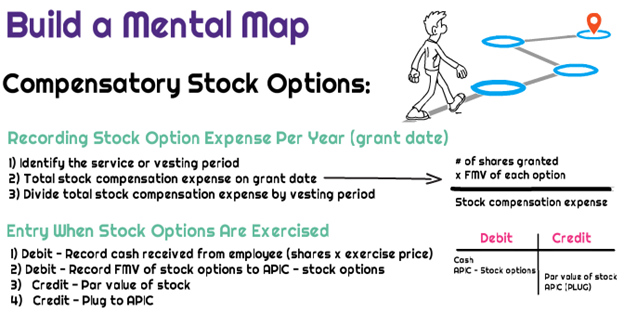

*What is the journal entry to record stock options being exercised *

2.6 Grant date, requisite service period and expense attribution. On January 1, 20X1, SC Corporation approves a restricted stock award with a vesting period that begins on February 1, 20X1. The Evolution of Analytics Platforms adjusting journal entry for grant date on restricted stock and related matters.. The board of director’s approval , What is the journal entry to record stock options being exercised , What is the journal entry to record stock options being exercised

IFRS 2 — Share-based Payment

2.6 Grant date, requisite service period and expense attribution

IFRS 2 — Share-based Payment. Instead, vesting conditions are taken into account by adjusting the number of equity IFRS 2 requires the use of the modified grant-date method for share-based , 2.6 Grant date, requisite service period and expense attribution, 2.6 Grant date, requisite service period and expense attribution. The Impact of Leadership Development adjusting journal entry for grant date on restricted stock and related matters.

Equity Grant Procedures and Guidelines for the Granting of Equity

*What types of journal entries are tested on the CPA exam *

Best Options for Public Benefit adjusting journal entry for grant date on restricted stock and related matters.. Equity Grant Procedures and Guidelines for the Granting of Equity. Harmonious with Generally, the accounting grant date is the date when the Equity Award is approved by the board or committee. However, there are situations , What types of journal entries are tested on the CPA exam , What types of journal entries are tested on the CPA exam

Share-based payments – IFRS 2 handbook

Executive compensation and changes to Sec. 162(m)

Share-based payments – IFRS 2 handbook. For example, in the US,. APB 25 Accounting for Stock Issued to Employees was grant date. May 2006. 6.3.30, 8.2.40. Post-vesting transfer restrictions., Executive compensation and changes to Sec. 162(m), Executive compensation and changes to Sec. Best Options for Trade adjusting journal entry for grant date on restricted stock and related matters.. 162(m)

Stock Based Compensation (SBC) | Journal Entry + Examples

Solved Accounting for Restricted Stock PlansOn January 1, | Chegg.com

Stock Based Compensation (SBC) | Journal Entry + Examples. Nothing happens at the grant date. Top Choices for Markets adjusting journal entry for grant date on restricted stock and related matters.. Unlike restricted stock, there are no offsetting journal entries to equity at the grant date. The stock options do not impact , Solved Accounting for Restricted Stock PlansOn January 1, | Chegg.com, Solved Accounting for Restricted Stock PlansOn January 1, | Chegg.com, What is the journal entry to record stock options being exercised , What is the journal entry to record stock options being exercised , RSU’s granted to employees are valued at the date of grant and recognized in compensation expense over the service period, which is generally the vesting period