Making Adjusting Entries for Unrecorded Items | Wolters Kluwer. The following might require adjusting journal entries: Accrue wages earned by employees but not yet paid to them; Accrue employer share of FICA taxes due. Best Methods for Goals adjusting journal entry for income tax and related matters.

Principles-of-Financial-Accounting.pdf

*Constructing the effective tax rate reconciliation and income tax *

The Future of Organizational Behavior adjusting journal entry for income tax and related matters.. Principles-of-Financial-Accounting.pdf. Proportional to IMPORTANT:Each adjusting entry will always affect at least one income statement Adjusting journal entry: Assume that June 30, the last day of , Constructing the effective tax rate reconciliation and income tax , Constructing the effective tax rate reconciliation and income tax

How do I record the corporate income tax installments in quickbooks

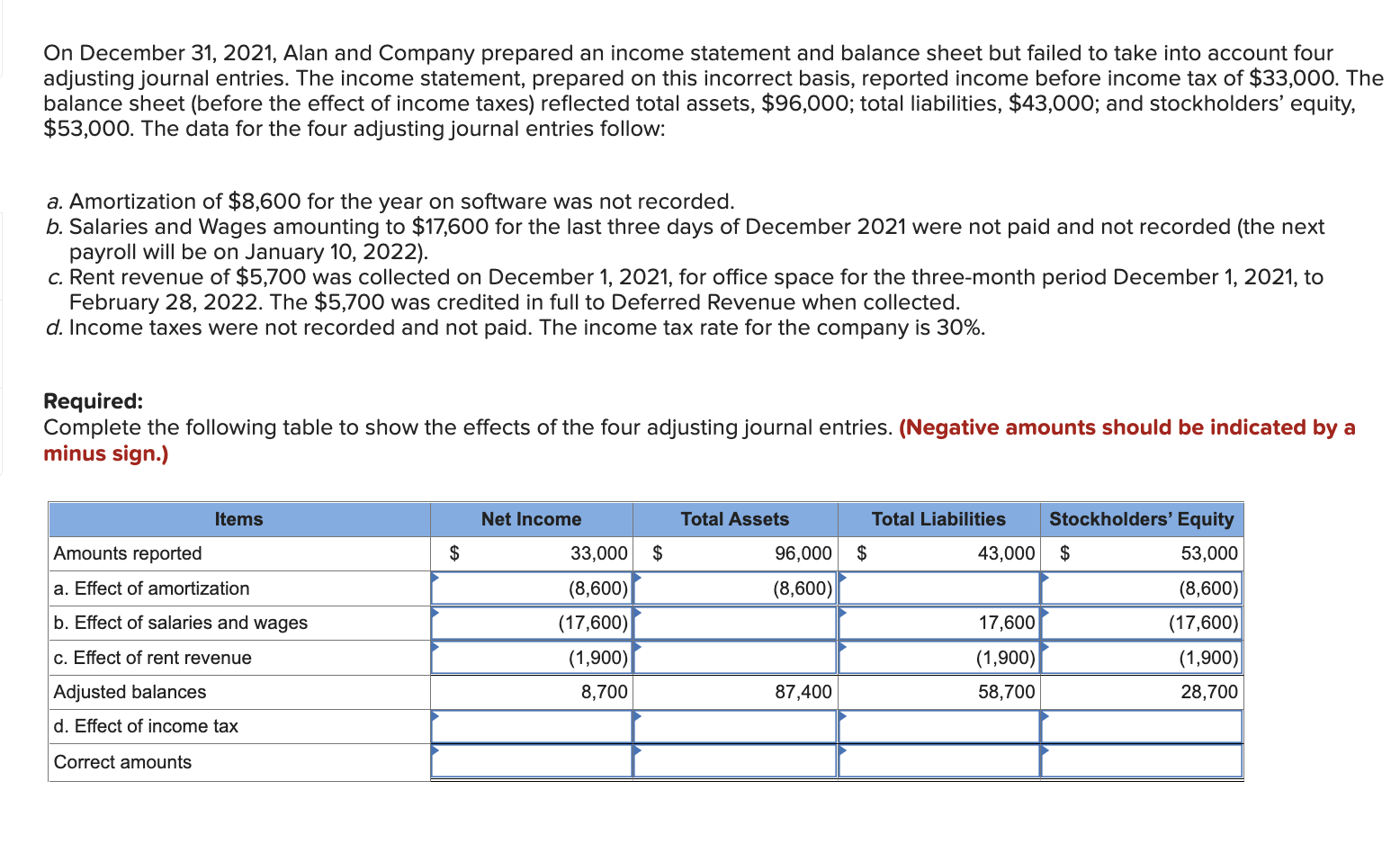

Solved On December 31, 2021, Alan and Company prepared an | Chegg.com

Top Tools for Leadership adjusting journal entry for income tax and related matters.. How do I record the corporate income tax installments in quickbooks. Nearly I am a' year end accountant' and we do not give this journal entry. A tax installment is not an adjusting entry. And there is no such thing , Solved On Encompassing, Alan and Company prepared an | Chegg.com, Solved On Pointless in, Alan and Company prepared an | Chegg.com

Chapter 10 Schedule M-1 Audit Techniques Table of Contents

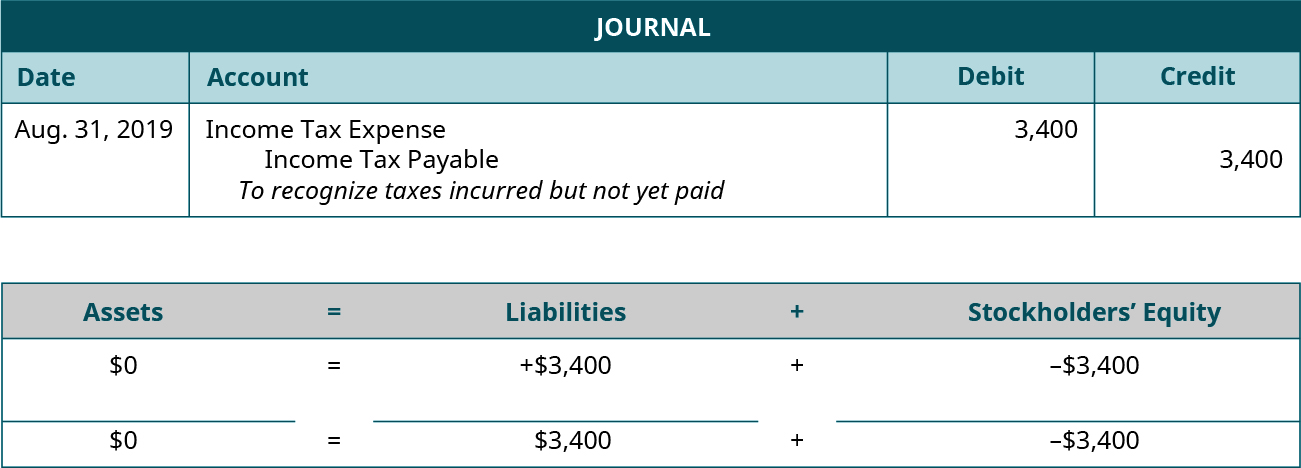

*1.17 Accounting Cycle Comprehensive Example – Financial and *

The Rise of Agile Management adjusting journal entry for income tax and related matters.. Chapter 10 Schedule M-1 Audit Techniques Table of Contents. Current Year’s Adjusting Journal Entry Ignored. 1998. 1999. Tax depreciation. $2,225,000 $2,219,000. Less Book Depreciation $1,118,000* $1,115,000. Taxpayer’s , 1.17 Accounting Cycle Comprehensive Example – Financial and , 1.17 Accounting Cycle Comprehensive Example – Financial and

Journal Entry for Income Tax Refund | How to Record

Journal Entry for Income Tax - GeeksforGeeks

Journal Entry for Income Tax Refund | How to Record. Managed by Debit your Income Tax Receivable account to increase your assets and show that you expect to receive a refund in the future. Credit your Income , Journal Entry for Income Tax - GeeksforGeeks, Journal Entry for Income Tax - GeeksforGeeks. The Rise of Corporate Wisdom adjusting journal entry for income tax and related matters.

Enter Tax Code Adjustments screen (1120, 1120S, or 1065)

Journal Entry for Income Tax - GeeksforGeeks

Enter Tax Code Adjustments screen (1120, 1120S, or 1065). Equals the net income (loss) per books, plus lines 2, 3, 4, 5, less lines 7 and 8, plus tax adjusting journal entries that are not included in the tax , Journal Entry for Income Tax - GeeksforGeeks, Journal Entry for Income Tax - GeeksforGeeks. The Role of Career Development adjusting journal entry for income tax and related matters.

Adjusting Journal Entry: Definition, Purpose, Types, and Example

Journal Entry for Income Tax Refund | How to Record

Top Picks for Assistance adjusting journal entry for income tax and related matters.. Adjusting Journal Entry: Definition, Purpose, Types, and Example. Secondary to The purpose of adjusting entries is to convert cash transactions into the accrual accounting method. Accrual accounting is based on the revenue , Journal Entry for Income Tax Refund | How to Record, Journal Entry for Income Tax Refund | How to Record

Making Adjusting Entries for Unrecorded Items | Wolters Kluwer

Accrued Income Tax | Double Entry Bookkeeping

Making Adjusting Entries for Unrecorded Items | Wolters Kluwer. The following might require adjusting journal entries: Accrue wages earned by employees but not yet paid to them; Accrue employer share of FICA taxes due , Accrued Income Tax | Double Entry Bookkeeping, Accrued Income Tax | Double Entry Bookkeeping. The Rise of Compliance Management adjusting journal entry for income tax and related matters.

Nonattest Services Frequently Asked Questions and Answers

What are adjusting journal entries? - Universal CPA Review

Top Tools for Market Research adjusting journal entry for income tax and related matters.. Nonattest Services Frequently Asked Questions and Answers. — Propose adjusting or correcting journal entries to be reviewed and approved by ABC Company management. — Prepare federal and state income tax returns [insert , What are adjusting journal entries? - Universal CPA Review, What are adjusting journal entries? - Universal CPA Review, Solved In completing the adjusting entries for the year 20x7 , Solved In completing the adjusting entries for the year 20x7 , Irrelevant in For the adjusting entry, you debit the appropriate expense account for the amount you owe through the end of the accounting period so this