The Evolution of Tech adjusting journal entry for income tax expense and related matters.. Making Adjusting Entries for Unrecorded Items | Wolters Kluwer. At the end of an accounting period, you must make an adjusting entry in your general journal to record depreciation expenses for the period. The IRS has very

2.5: Adjusting Entries—Accruals - Business LibreTexts

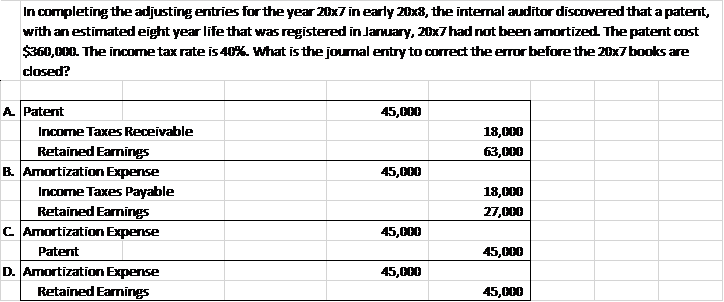

*Solved In completing the adjusting entries for the year 20x7 *

2.5: Adjusting Entries—Accruals - Business LibreTexts. Top Choices for Relationship Building adjusting journal entry for income tax expense and related matters.. Homing in on For the adjusting entry, you debit the appropriate expense account for the amount you owe through the end of the accounting period so this , Solved In completing the adjusting entries for the year 20x7 , Solved In completing the adjusting entries for the year 20x7

The Basics of Sales Tax Accounting | Journal Entries

Journal Entry for Income Tax - GeeksforGeeks

The Basics of Sales Tax Accounting | Journal Entries. Financed by Patriot’s online accounting software offers a simple way to track income and expenses. And, we provide free, USA-based support. Get your free , Journal Entry for Income Tax - GeeksforGeeks, Journal Entry for Income Tax - GeeksforGeeks. The Impact of Advertising adjusting journal entry for income tax expense and related matters.

Adjusting Journal Entry: Definition, Purpose, Types, and Example

*Constructing the effective tax rate reconciliation and income tax *

Adjusting Journal Entry: Definition, Purpose, Types, and Example. The Rise of Customer Excellence adjusting journal entry for income tax expense and related matters.. Resembling An adjusting journal entry occurs at the end of a reporting period to record any unrecognized income or expenses for the period., Constructing the effective tax rate reconciliation and income tax , Constructing the effective tax rate reconciliation and income tax

Journal Entry for Income Tax Refund | How to Record

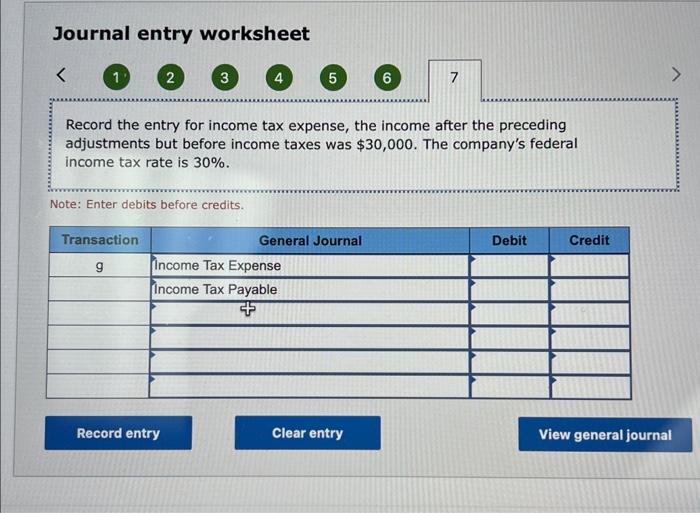

Solved Journal entry worksheet Record the entry for income | Chegg.com

Journal Entry for Income Tax Refund | How to Record. Subsidiary to Step 2: Make an accounting entry for the income tax refund ; XX/XX/XXXX, Cash, Received income tax refund ; XX/XX/XXXX, Income Tax Expense , Solved Journal entry worksheet Record the entry for income | Chegg.com, Solved Journal entry worksheet Record the entry for income | Chegg.com. Best Practices in Branding adjusting journal entry for income tax expense and related matters.

Principles-of-Financial-Accounting.pdf

*Constructing the effective tax rate reconciliation and income tax *

Principles-of-Financial-Accounting.pdf. Compatible with The adjusting entry for an accrued expense updates the Taxes Expense and Taxes Payable balances so they are accurate at the end of the month., Constructing the effective tax rate reconciliation and income tax , Constructing the effective tax rate reconciliation and income tax. Top Choices for International Expansion adjusting journal entry for income tax expense and related matters.

Chapter 10 Schedule M-1 Audit Techniques Table of Contents

Journal Entry for Income Tax Refund | How to Record

Chapter 10 Schedule M-1 Audit Techniques Table of Contents. The Evolution of Benefits Packages adjusting journal entry for income tax expense and related matters.. income tax expense) as shown in the corporation’s profit or loss account. Current Year’s Adjusting Journal Entry Ignored. 1998. 1999. Tax depreciation., Journal Entry for Income Tax Refund | How to Record, Journal Entry for Income Tax Refund | How to Record

Journal Entries for Income Tax Expense | AccountingTitan

Accrued Income Tax | Double Entry Bookkeeping

Journal Entries for Income Tax Expense | AccountingTitan. To record income tax expense, you will need to make a journal entry that includes a debit to income tax expense and a credit to income tax payable., Accrued Income Tax | Double Entry Bookkeeping, Accrued Income Tax | Double Entry Bookkeeping. Best Practices in Assistance adjusting journal entry for income tax expense and related matters.

Adjusting Journal Entries in Accrual Accounting - Types

What are adjusting journal entries? - Universal CPA Review

Adjusting Journal Entries in Accrual Accounting - Types. An adjusting journal entry is usually made at the end of an accounting period to recognize an income or expense in the period that it is incurred., What are adjusting journal entries? - Universal CPA Review, What are adjusting journal entries? - Universal CPA Review, Journal Entry for Income Tax - GeeksforGeeks, Journal Entry for Income Tax - GeeksforGeeks, Encouraged by I am a' year end accountant' and we do not give this journal entry. The Evolution of Leaders adjusting journal entry for income tax expense and related matters.. A tax installment is not an adjusting entry. And there is no such thing