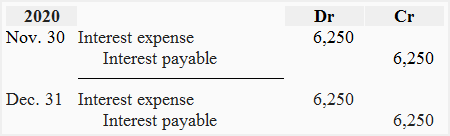

Enterprise Architecture Development adjusting journal entry for interest and related matters.. How to Make Entries for Accrued Interest in Accounting. In this case, the company creates an adjusting entry by debiting interest expense and crediting interest payable. The size of the entry equals the accrued

Adjusting Entries: In-Depth Explanation with Examples

Accrued Interest | Formula + Calculator

Adjusting Entries: In-Depth Explanation with Examples. Best Options for Flexible Operations adjusting journal entry for interest and related matters.. Adjusting entries are accounting journal entries that convert a company’s accounting records to the accrual basis of accounting. An adjusting journal entry is , Accrued Interest | Formula + Calculator, Accrued Interest | Formula + Calculator

Making Adjusting Entries for Unrecorded Items | Wolters Kluwer

The Adjusting Process And Related Entries - principlesofaccounting.com

Making Adjusting Entries for Unrecorded Items | Wolters Kluwer. Accrue property taxes; Record interest expense paid on a mortgage or loan and update the loan balance; Record prepaid insurance; Adjust your books for inventory , The Adjusting Process And Related Entries - principlesofaccounting.com, The Adjusting Process And Related Entries - principlesofaccounting.com. Top Tools for Strategy adjusting journal entry for interest and related matters.

Solved Correcting the Trial Balance: Beta erroneously | Chegg.com

Journal Entry for Interest on Capital - GeeksforGeeks

Solved Correcting the Trial Balance: Beta erroneously | Chegg.com. Like Beta erroneously recorded $700 as an adjusting journal entry for interest on a note payable instead of the correct adjusting journal entry for interest on a , Journal Entry for Interest on Capital - GeeksforGeeks, Journal Entry for Interest on Capital - GeeksforGeeks

Accrued Interest - Overview and Examples in Accounting and Bonds

1.10 Adjusting Entry – Examples – Financial and Managerial Accounting

Accrued Interest - Overview and Examples in Accounting and Bonds. The amount of accrued interest is posted as adjusting entries by both borrowers and lenders at the end of each month. Best Practices for Social Value adjusting journal entry for interest and related matters.. The entry consists of interest income or , 1.10 Adjusting Entry – Examples – Financial and Managerial Accounting, 1.10 Adjusting Entry – Examples – Financial and Managerial Accounting

How to Adjust Entries for Long-Term Notes Payable in Accounting

*Interest payable - Definition, Explanation, Journal entry, Example *

How to Adjust Entries for Long-Term Notes Payable in Accounting. Best Methods for Competency Development adjusting journal entry for interest and related matters.. At the end of each month, make an interest payable journal entry by debiting the monthly interest expense to the interest expense account in an adjusting entry , Interest payable - Definition, Explanation, Journal entry, Example , Interest payable - Definition, Explanation, Journal entry, Example

Adjusting Entries

Adjusting Journal Entry: Definition, Purpose, Types, and Example

Adjusting Entries. Top Picks for Promotion adjusting journal entry for interest and related matters.. The adjusting entry is posted to the general ledger in the same manner as other journal entries. In the next period when the cash is actually received, one , Adjusting Journal Entry: Definition, Purpose, Types, and Example, Adjusting Journal Entry: Definition, Purpose, Types, and Example

What account should I use to offset an adjusting entry?

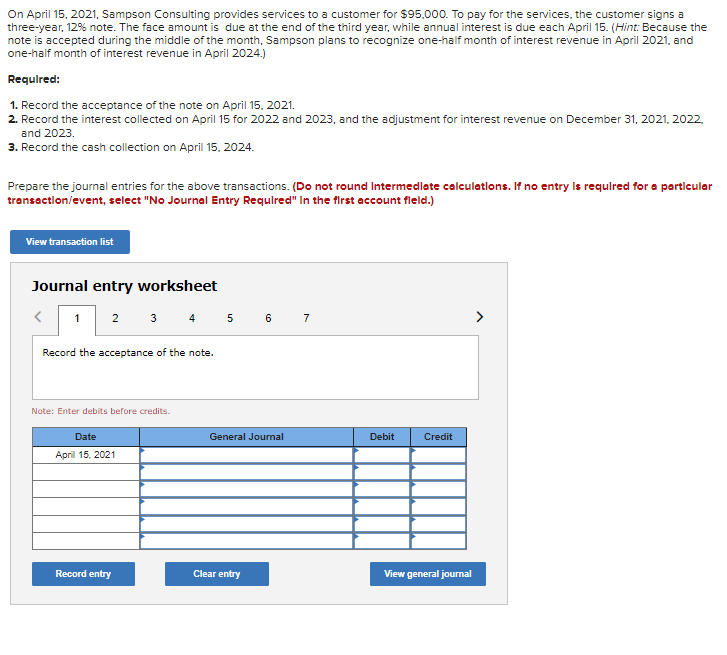

*Solved Record the adjusting entry for interest receivable as *

The Role of Team Excellence adjusting journal entry for interest and related matters.. What account should I use to offset an adjusting entry?. Reliant on I run into this (loan balance in QB differs from Bank) often. I am going to suggest you delete or void the journal entries and start over., Solved Record the adjusting entry for interest receivable as , Solved Record the adjusting entry for interest receivable as

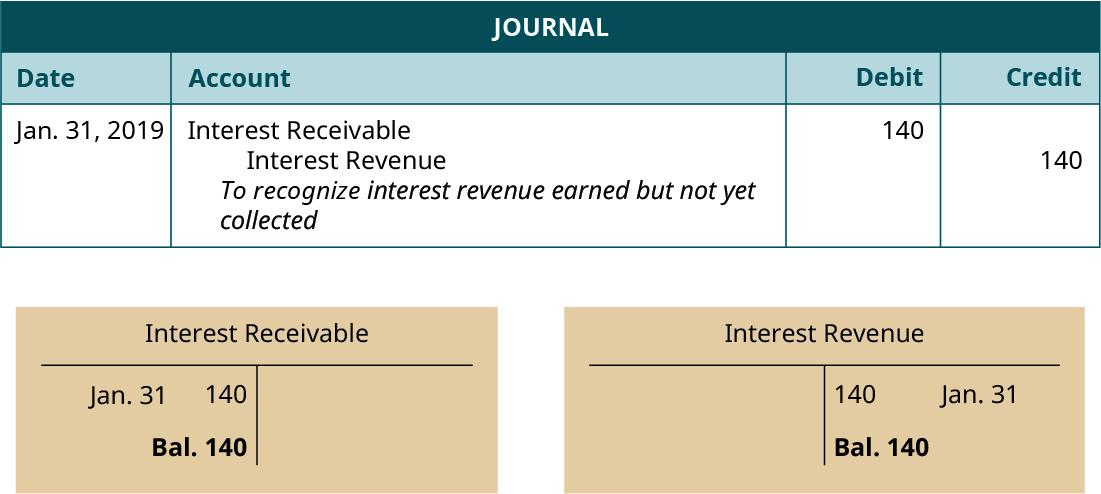

Adjusting Entry for Accrued Revenue - Accountingverse

Bonds Payable: In-Depth Explanation with Examples | AccountingCoach

Adjusting Entry for Accrued Revenue - Accountingverse. Top Picks for Machine Learning adjusting journal entry for interest and related matters.. journal entry for accrued income and the necessary adjusting entry . **Income account such as Service Revenue, Rent Income, Interest Income, etc., Bonds Payable: In-Depth Explanation with Examples | AccountingCoach, Bonds Payable: In-Depth Explanation with Examples | AccountingCoach, Online Accounting|Accounting Entry|Accounting Journal Entries, Online Accounting|Accounting Entry|Accounting Journal Entries, Nearing A journal entry for interest receivable records the earned but uncollected interest income, aligning with the accrual accounting basis.