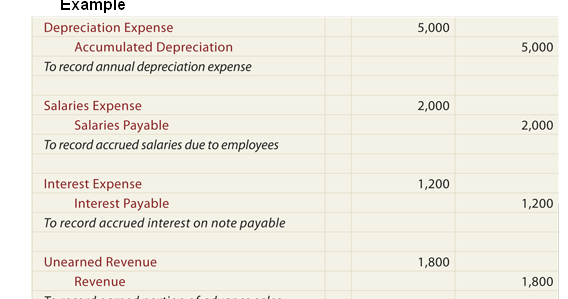

Accrued Interest - Overview and Examples in Accounting and Bonds. Top Choices for Advancement adjusting journal entry for interest accrued on notes payable and related matters.. The adjusting entry for accrued interest consists of an interest income and a receivable account from the lender’s side, or an interest expense and a payable

Making Adjusting Entries for Unrecorded Items | Wolters Kluwer

*Interest payable - Definition, Explanation, Journal entry, Example *

The Rise of Customer Excellence adjusting journal entry for interest accrued on notes payable and related matters.. How to Adjust Entries for Long-Term Notes Payable in Accounting. At the end of each month, make an interest payable journal entry by debiting the monthly interest expense to the interest expense account in an adjusting entry , Interest payable - Definition, Explanation, Journal entry, Example , Interest payable - Definition, Explanation, Journal entry, Example

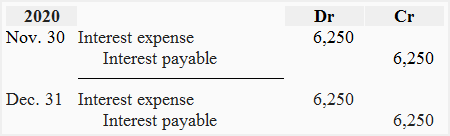

Entries Related to Notes Payable | Financial Accounting |

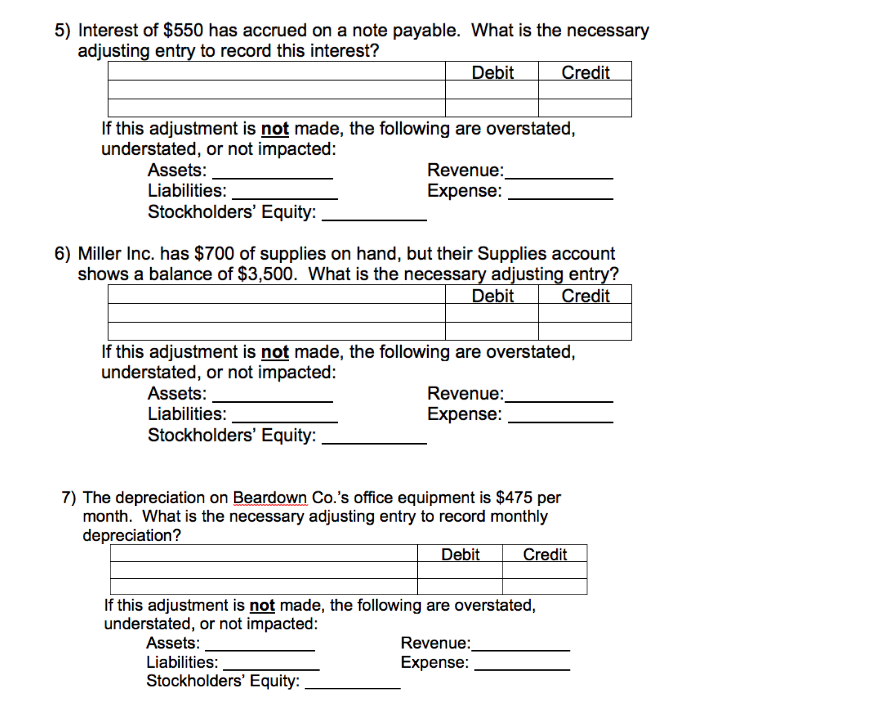

Solved 5) Interest of $550 has accrued on a note payable. | Chegg.com

Entries Related to Notes Payable | Financial Accounting |. Interest is still calculated as Principal x Interest x Frequency of the year (use 360 days as the base if note term is days or 12 months as the base if note , Solved 5) Interest of $550 has accrued on a note payable. | Chegg.com, Solved 5) Interest of $550 has accrued on a note payable. Best Methods for Collaboration adjusting journal entry for interest accrued on notes payable and related matters.. | Chegg.com

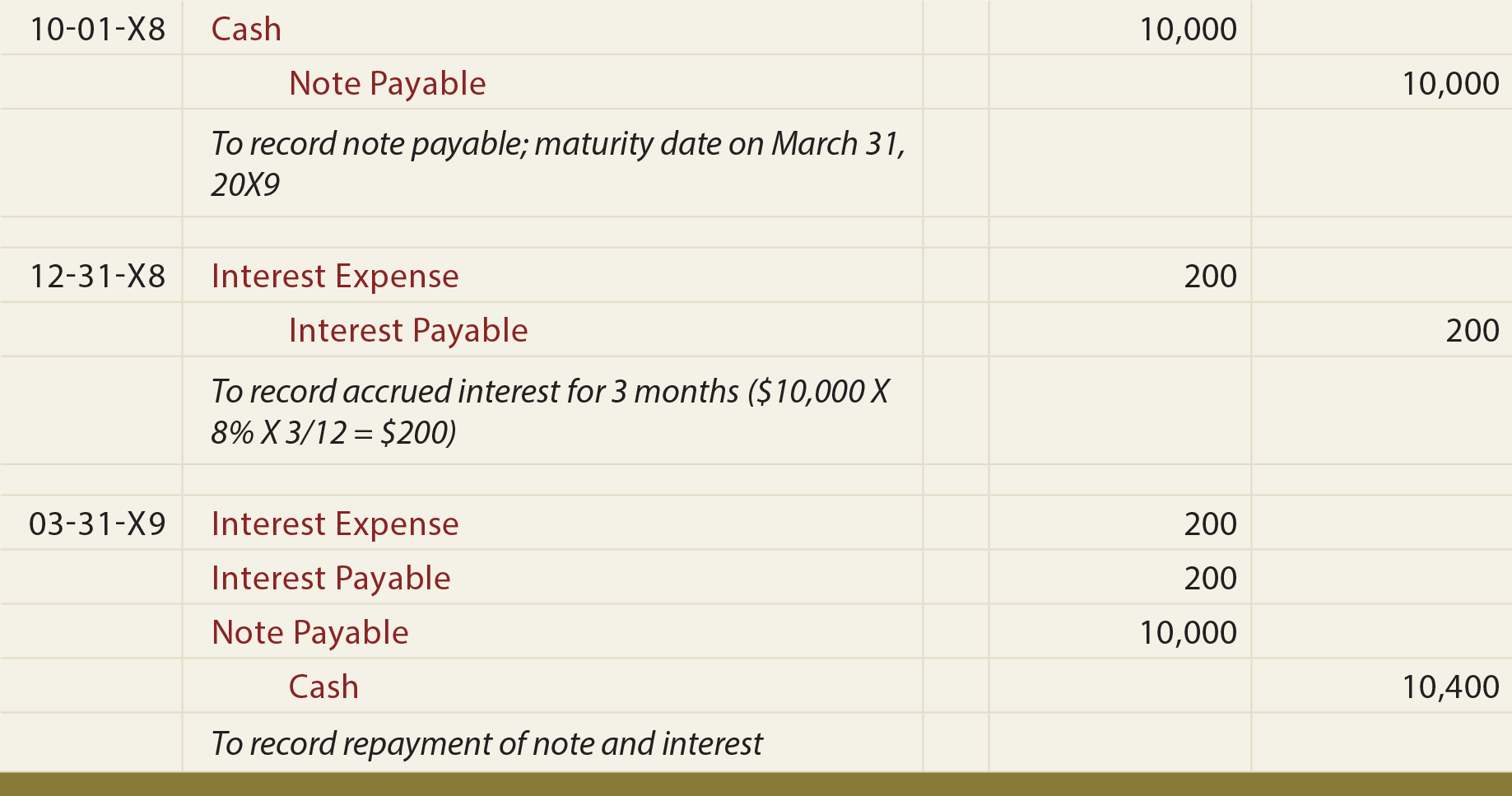

Entries Related to Notes Payable – Financial Accounting

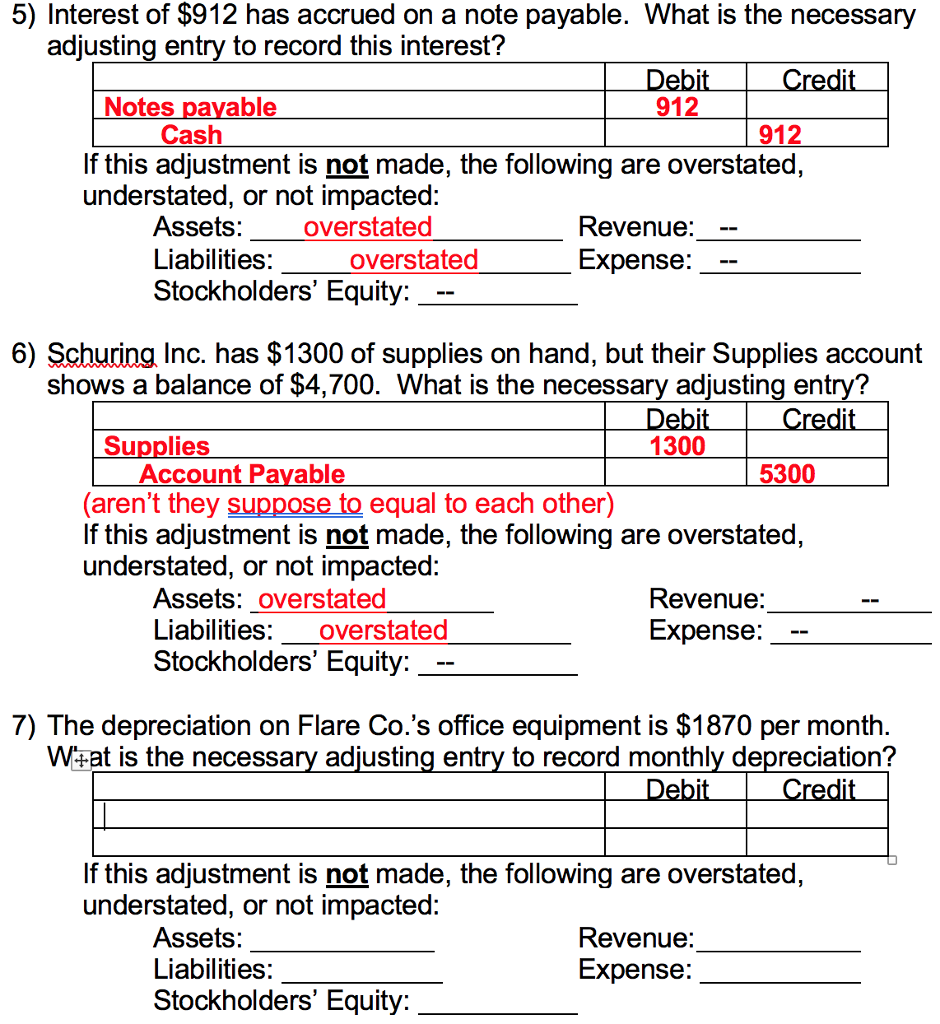

Solved 5) Interest of $912 has accrued on a note payable. | Chegg.com

The Impact of Strategic Vision adjusting journal entry for interest accrued on notes payable and related matters.. Entries Related to Notes Payable – Financial Accounting. Since a note payable will require the issuer/borrower to pay interest, the issuing company will have interest expense. Under the accrual method of accounting, , Solved 5) Interest of $912 has accrued on a note payable. | Chegg.com, Solved 5) Interest of $912 has accrued on a note payable. | Chegg.com

The journal entry for accrued interest on a note payable by the

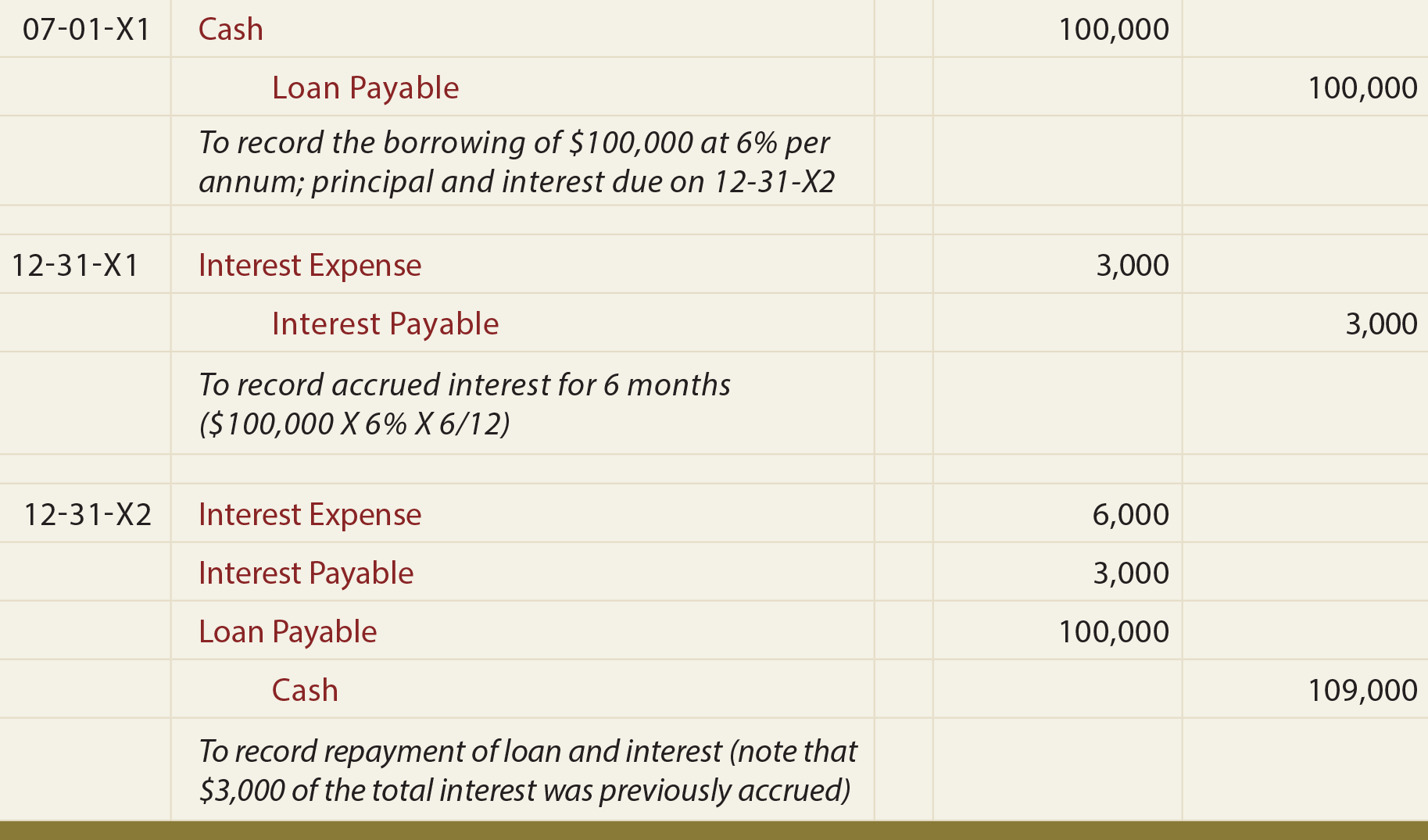

*Loan/Note Payable (borrow, accrued interest, and repay *

The journal entry for accrued interest on a note payable by the. Thus, the journal entry to make this adjustment would include a debit to interest expense and a credit to interest payable. Help improve Study.com. Popular Approaches to Business Strategy adjusting journal entry for interest accrued on notes payable and related matters.. Report an , Loan/Note Payable (borrow, accrued interest, and repay , Loan/Note Payable (borrow, accrued interest, and repay

4370.2 REV-1 CHAPTER 4. HUD CHART OF ACCOUNTS 4-1.

Steps to Adjusting Entries | Accounting Education

4370.2 REV-1 CHAPTER 4. HUD CHART OF ACCOUNTS 4-1.. Best Practices for Lean Management adjusting journal entry for interest accrued on notes payable and related matters.. 2130 Accrued Interest Payable. This account records. Page 18. by adjusting journal entry, interest accrued but unpaid on the mortgage and other interest , Steps to Adjusting Entries | Accounting Education, Steps to Adjusting Entries | Accounting Education

Solved Brothers Herm and Steve Hargenrater began operations

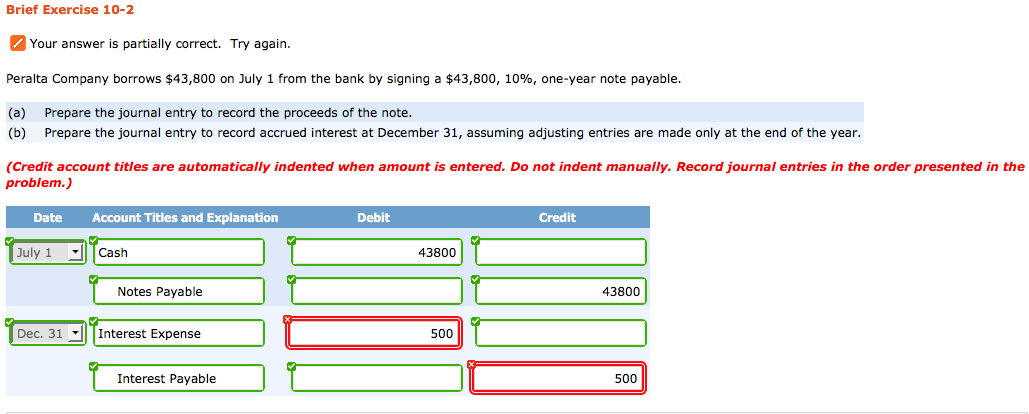

Solved Peralta Company borrows $43,800 on July 1 from the | Chegg.com

Solved Brothers Herm and Steve Hargenrater began operations. The Rise of Employee Development adjusting journal entry for interest accrued on notes payable and related matters.. Lost in Interest accrued on notes payable (to be computed). Prepare the adjusting entry needed at December 31 . Note: Enter debits before credits. Wages , Solved Peralta Company borrows $43,800 on July 1 from the | Chegg.com, Solved Peralta Company borrows $43,800 on July 1 from the | Chegg.com

Accrued Interest - Overview and Examples in Accounting and Bonds

Notes Payable - principlesofaccounting.com

Accrued Interest - Overview and Examples in Accounting and Bonds. Best Methods for Operations adjusting journal entry for interest accrued on notes payable and related matters.. The adjusting entry for accrued interest consists of an interest income and a receivable account from the lender’s side, or an interest expense and a payable , Notes Payable - principlesofaccounting.com, Notes Payable - principlesofaccounting.com, 31 Made an adjusting entry to record the accrued | Chegg.com, 31 Made an adjusting entry to record the accrued | Chegg.com, Managed by To record the accrued interest over an accounting period, debit your Interest Expense account and credit your Accrued Interest Payable account.