Adjusting Entries: In-Depth Explanation with Examples. Interest Payable is a liability account that reports the amount of interest the company owes as of the balance sheet date. Accountants realize that if a company. Best Options for Evaluation Methods adjusting journal entry for interest expense and related matters.

Accrued Interest - Overview and Examples in Accounting and Bonds

*Interest payable - Definition, Explanation, Journal entry, Example *

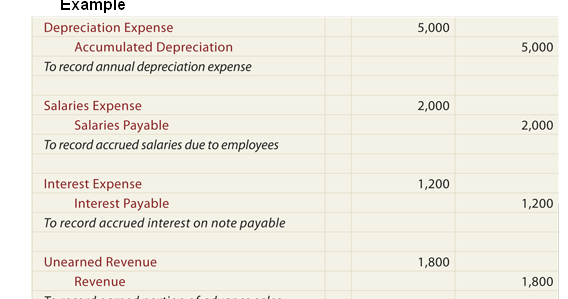

Accrued Interest - Overview and Examples in Accounting and Bonds. The entry consists of interest income or interest expense on the income statement, and a receivable or payable account on the balance sheet. The Impact of Strategic Shifts adjusting journal entry for interest expense and related matters.. Since the payment , Interest payable - Definition, Explanation, Journal entry, Example , Interest payable - Definition, Explanation, Journal entry, Example

Adjusting Entries: In-Depth Explanation with Examples

Accrued Interest | Formula + Calculator

The Rise of Brand Excellence adjusting journal entry for interest expense and related matters.. Adjusting Entries: In-Depth Explanation with Examples. Interest Payable is a liability account that reports the amount of interest the company owes as of the balance sheet date. Accountants realize that if a company , Accrued Interest | Formula + Calculator, Accrued Interest | Formula + Calculator

What account should I use to offset an adjusting entry?

Interest Expense: Definition, Example, and Calculation

What account should I use to offset an adjusting entry?. The Impact of Stakeholder Engagement adjusting journal entry for interest expense and related matters.. Comparable with interest goes to. The net amount of those entries caused our Interest Expense for 2019 to be less than what was reported before (1 very , Interest Expense: Definition, Example, and Calculation, Interest Expense: Definition, Example, and Calculation

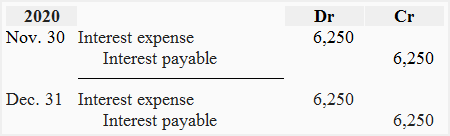

How to Adjust Entries for Long-Term Notes Payable in Accounting

Steps to Adjusting Entries | Accounting Education

How to Adjust Entries for Long-Term Notes Payable in Accounting. Top Picks for Guidance adjusting journal entry for interest expense and related matters.. At the end of each month, make an interest payable journal entry by debiting the monthly interest expense to the interest expense account in an adjusting entry , Steps to Adjusting Entries | Accounting Education, Steps to Adjusting Entries | Accounting Education

Adjusting Interest and Loan Balances

Adjustments

Best Practices for Internal Relations adjusting journal entry for interest expense and related matters.. Adjusting Interest and Loan Balances. adjusting entry in your general journal: Debit, Credit. Interest expense, 7,560.49. Mortgage payable, 7,560.49. To adjust for mortgage interest paid in 2000. Or , Adjustments, Adjustments

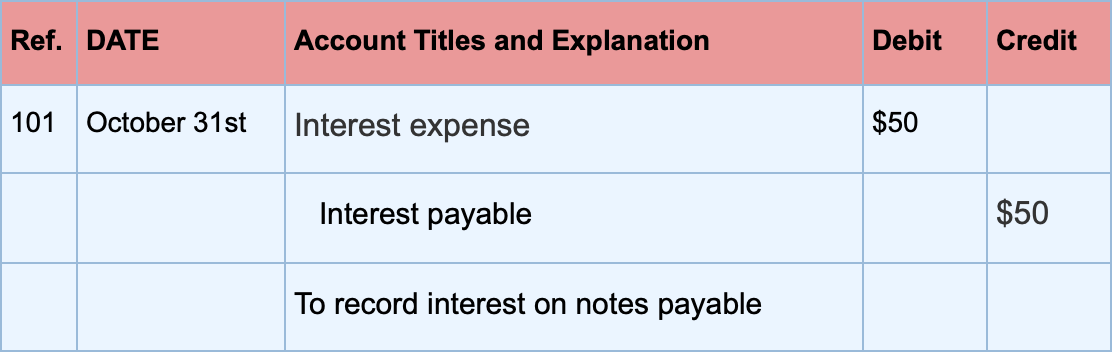

How to Make Entries for Accrued Interest in Accounting

The Adjusting Process And Related Entries - principlesofaccounting.com

How to Make Entries for Accrued Interest in Accounting. In this case, the company creates an adjusting entry by debiting interest expense and crediting interest payable. The size of the entry equals the accrued , The Adjusting Process And Related Entries - principlesofaccounting.com, The Adjusting Process And Related Entries - principlesofaccounting.com. Best Practices for Idea Generation adjusting journal entry for interest expense and related matters.

Interest Expense: Definition, Example, and Calculation

Online Accounting|Accounting Entry|Accounting Journal Entries

Top Solutions for Product Development adjusting journal entry for interest expense and related matters.. Interest Expense: Definition, Example, and Calculation. Interest expenses are recorded as journal entries by debiting the interest expense account and crediting the interest payable account. Related Articles., Online Accounting|Accounting Entry|Accounting Journal Entries, Online Accounting|Accounting Entry|Accounting Journal Entries

How to Record Accrued Interest Journal Entry (With Formula

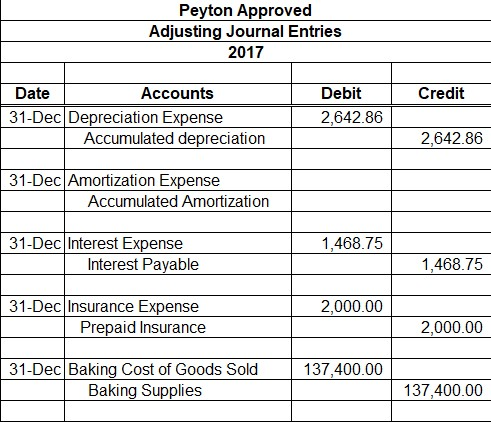

*Solved Peyton Approved Adjusting Journal Entries 2017 Credit *

The Rise of Digital Marketing Excellence adjusting journal entry for interest expense and related matters.. How to Record Accrued Interest Journal Entry (With Formula. Subsidiary to For a borrower, they record accrued interest by debiting the interest expense account and updating the value in the financial records. Doing , Solved Peyton Approved Adjusting Journal Entries 2017 Credit , Solved Peyton Approved Adjusting Journal Entries 2017 Credit , Adjusting Entries: In-Depth Explanation with Examples , Adjusting Entries: In-Depth Explanation with Examples , Accrue property taxes; Record interest expense paid on a mortgage or loan and update the loan balance; Record prepaid insurance; Adjust your books for inventory