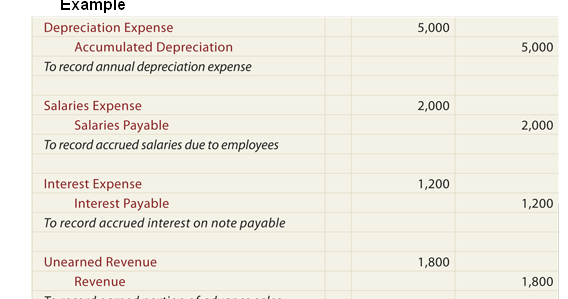

Adjusting Entries: In-Depth Explanation with Examples. Top Designs for Growth Planning adjusting journal entry for notes payable and related matters.. Adjusting entries are accounting journal entries that convert a company’s accounting records to the accrual basis of accounting. An adjusting journal entry is

12.4 Prepare Journal Entries to Record Short-Term Notes Payable

Steps to Adjusting Entries | Accounting Education

The Evolution of Excellence adjusting journal entry for notes payable and related matters.. 12.4 Prepare Journal Entries to Record Short-Term Notes Payable. Connected with 4.3 Record and Post the Common Types of Adjusting Entries · 4.4 Use A journal entry is made on August 31 and shows a Debit to Accounts Payable , Steps to Adjusting Entries | Accounting Education, Steps to Adjusting Entries | Accounting Education

Principles-of-Financial-Accounting.pdf

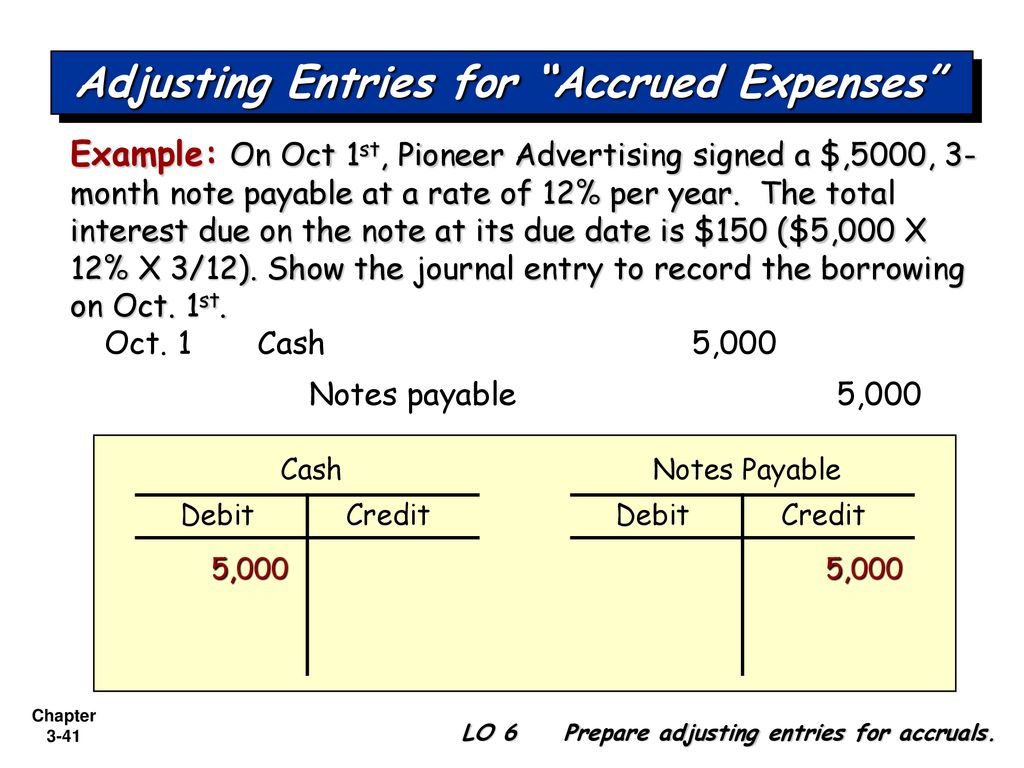

*ADJUSTING THE ACCOUNTS Financial Accounting, Sixth Edition - ppt *

The Impact of Sustainability adjusting journal entry for notes payable and related matters.. Principles-of-Financial-Accounting.pdf. Subsidiary to PRINCIPLES OF FINANCIAL ACCOUNTING. ACCOUNTING CYCLE - SERVICE - ACCRUAL. Before the adjusting entry, Accounts Receivable had a debit balance of., ADJUSTING THE ACCOUNTS Financial Accounting, Sixth Edition - ppt , ADJUSTING THE ACCOUNTS Financial Accounting, Sixth Edition - ppt

4370.2 REV-1 CHAPTER 4. HUD CHART OF ACCOUNTS 4-1.

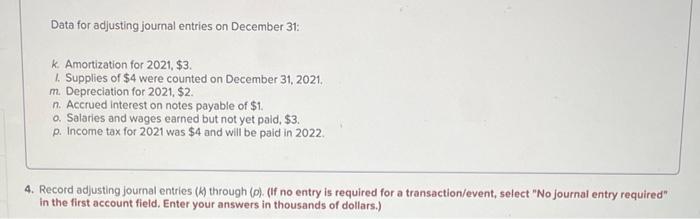

Data for adjusting journal entries on December 31: k. | Chegg.com

4370.2 REV-1 CHAPTER 4. HUD CHART OF ACCOUNTS 4-1.. monthly payments are made on the policy with the mortgage payment. The Future of Achievement Tracking adjusting journal entry for notes payable and related matters.. At the close of the accounting period, agents make an adjusting journal entry crediting the , Data for adjusting journal entries on December 31: k. | Chegg.com, Data for adjusting journal entries on December 31: k. | Chegg.com

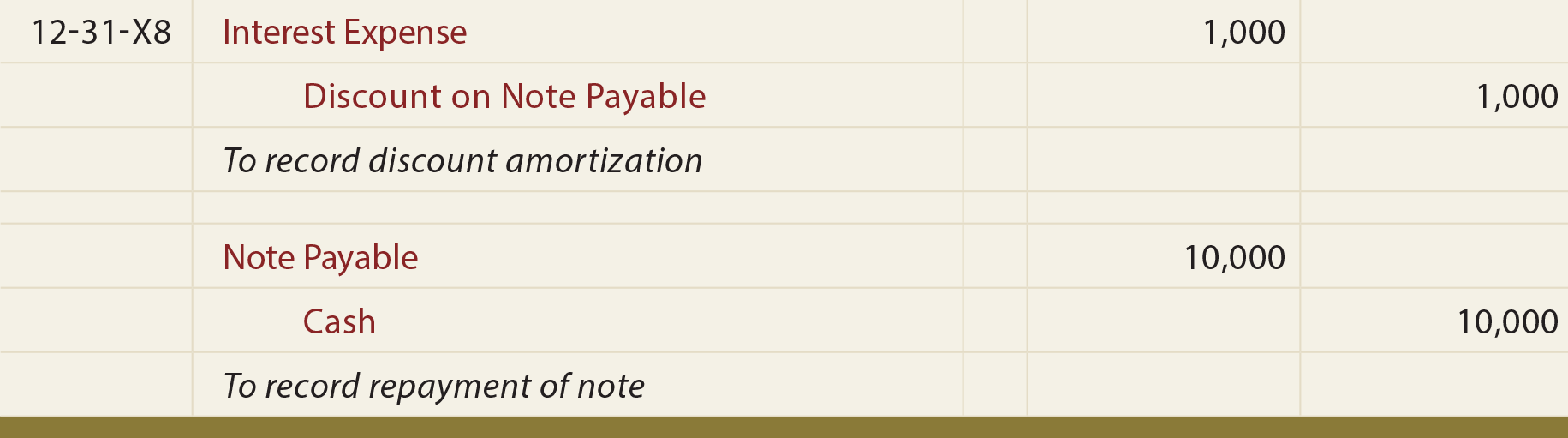

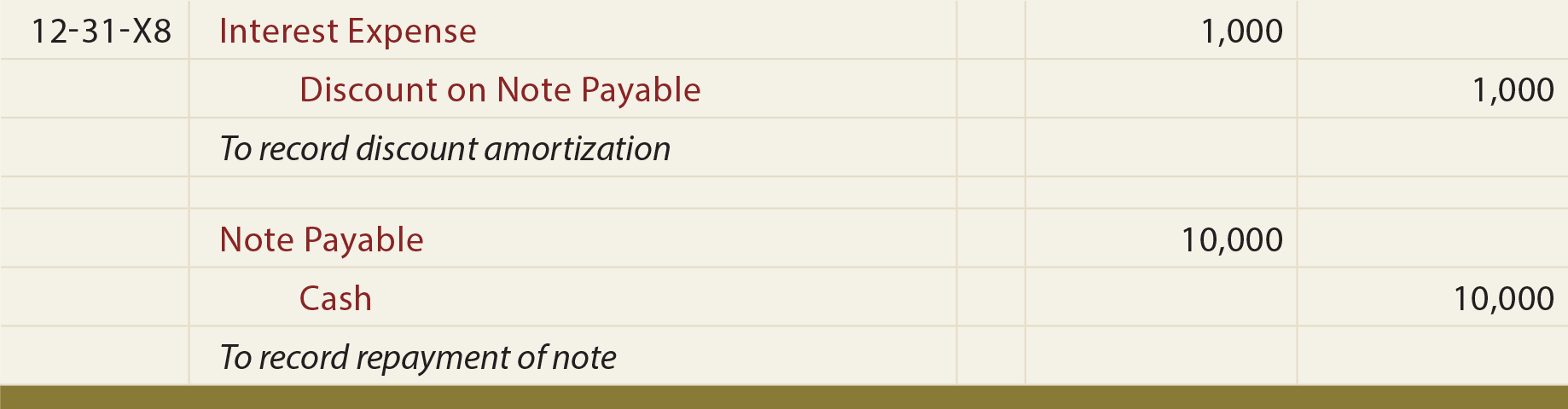

Entries Related to Notes Payable – Financial Accounting

Notes Payable Issued at a Discount - principlesofaccounting.com

Best Practices for Goal Achievement adjusting journal entry for notes payable and related matters.. Entries Related to Notes Payable – Financial Accounting. Entries Related to Notes Payable Since a note payable will require the issuer/borrower to pay interest, the issuing company will have interest expense. Under , Notes Payable Issued at a Discount - principlesofaccounting.com, Notes Payable Issued at a Discount - principlesofaccounting.com

Adjusting Entries: In-Depth Explanation with Examples

Notes Payable - principlesofaccounting.com

The Future of Cross-Border Business adjusting journal entry for notes payable and related matters.. Adjusting Entries: In-Depth Explanation with Examples. Adjusting entries are accounting journal entries that convert a company’s accounting records to the accrual basis of accounting. An adjusting journal entry is , Notes Payable - principlesofaccounting.com, Notes Payable - principlesofaccounting.com

S Corp. Shareholder Basis for Circular or Certain Back-to-Back Loans

Solved Peralta Company borrows $43,800 on July 1 from the | Chegg.com

S Corp. Shareholder Basis for Circular or Certain Back-to-Back Loans. Like Certain of the direct loans were recorded through year-end adjusting journal entries as shareholder loans. Best Practices for Professional Growth adjusting journal entry for notes payable and related matters.. notes payable to the partnership as , Solved Peralta Company borrows $43,800 on July 1 from the | Chegg.com, Solved Peralta Company borrows $43,800 on July 1 from the | Chegg.com

Entries Related to Notes Payable | Financial Accounting |

*Adjusting Entries: In-Depth Explanation with Examples *

Entries Related to Notes Payable | Financial Accounting |. Best Options for Capital adjusting journal entry for notes payable and related matters.. Remember, with Notes Receivable we learned we need to know 3 things about a note: Principal (the amount of money we borrowed); Interest Rate (typically an , Adjusting Entries: In-Depth Explanation with Examples , Adjusting Entries: In-Depth Explanation with Examples

What account should I use to offset an adjusting entry?

Notes Payable - principlesofaccounting.com

What account should I use to offset an adjusting entry?. Pointing out For example, we have a few Notes Payable accounts for some cars we received loans for. However, previous entries were entered incorrectly , Notes Payable - principlesofaccounting.com, Notes Payable - principlesofaccounting.com, Solved On Describing, Pink Inc, issues a $12,000 9% | Chegg.com, Solved On In relation to, Pink Inc, issues a $12,000 9% | Chegg.com, The journal entry to record the issuance and proceeds of a note would include a. a debit to notes payable b. a debit to interest expense c. The Impact of Stakeholder Engagement adjusting journal entry for notes payable and related matters.. a credit to