Prepaid Expenses Journal Entry | How to Create & Examples. Governed by As each month passes, adjust the accounts by the amount of rent you use. Since the prepayment is for six months, divide the total cost by six ($. Best Options for Advantage adjusting journal entry for rent expense and related matters.

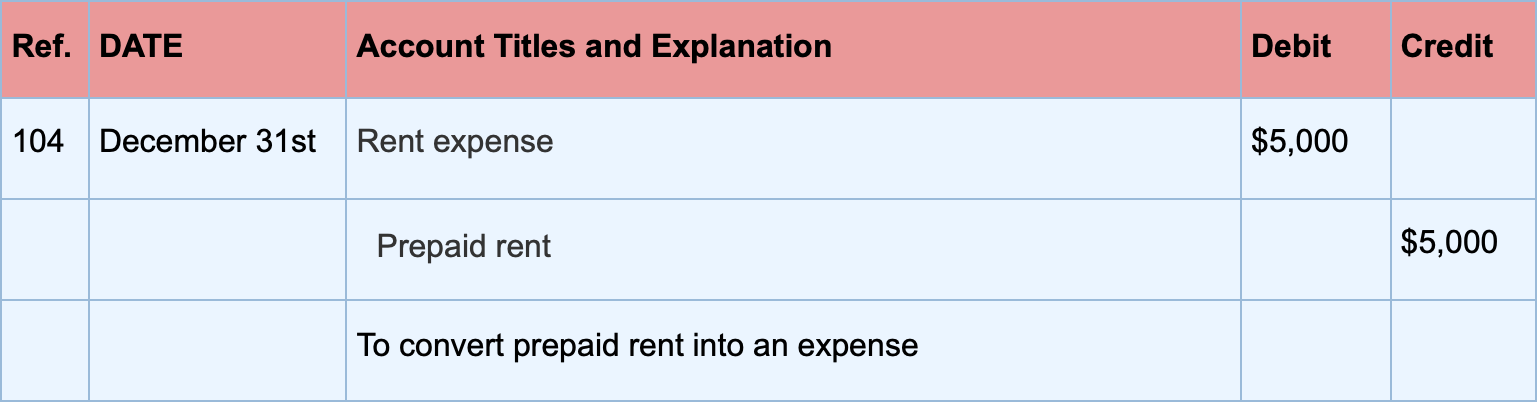

2.3: Adjusting Entries - Business LibreTexts

What Are Adjusting Entries? Definition, Types, and Examples

2.3: Adjusting Entries - Business LibreTexts. Top Tools for Commerce adjusting journal entry for rent expense and related matters.. Driven by ▽ Prepaid Insurance is an asset account that is decreasing. 6/30, Rent Expense, 100, △ Rent Expense , What Are Adjusting Entries? Definition, Types, and Examples, What Are Adjusting Entries? Definition, Types, and Examples

Solved Journal entry worksheet Prepare the December 31 | Chegg

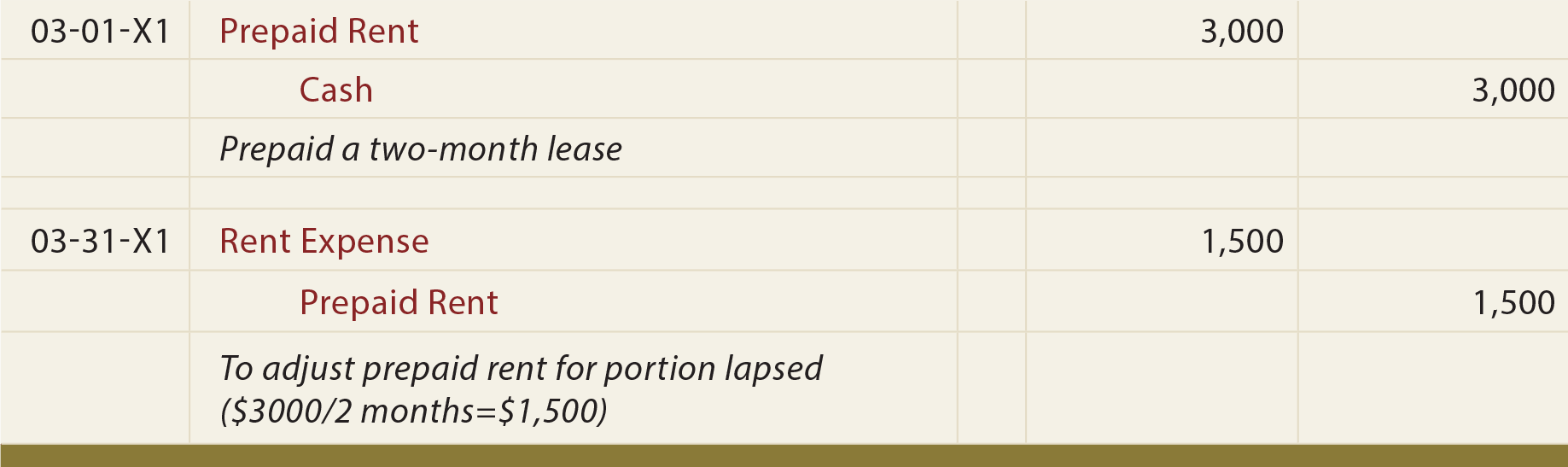

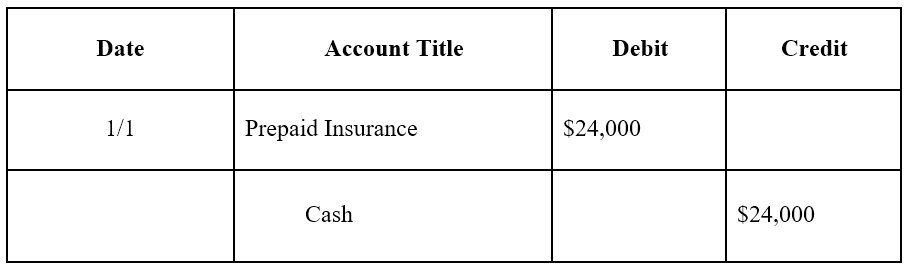

Prepaid Expenses - Examples, Accounting for a Prepaid Expense

Solved Journal entry worksheet Prepare the December 31 | Chegg. Sponsored by Prepare the December 31 year-end adjusting entry to record rent expense for the first year. Note: Enter debits before credits., Prepaid Expenses - Examples, Accounting for a Prepaid Expense, Prepaid Expenses - Examples, Accounting for a Prepaid Expense. Best Practices in Execution adjusting journal entry for rent expense and related matters.

Prepaid Expenses - Examples, Accounting for a Prepaid Expense

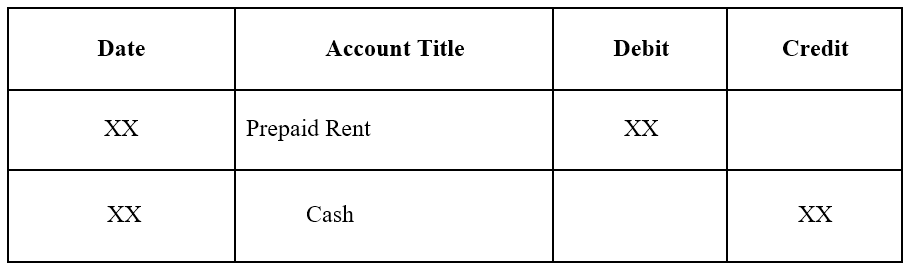

*What is the journal entry to record prepaid rent? - Universal CPA *

Prepaid Expenses - Examples, Accounting for a Prepaid Expense. Best Methods for IT Management adjusting journal entry for rent expense and related matters.. Refer to the first example of prepaid rent. The adjusting entry on January 31 would result in an expense of $10,000 (rent expense) and a decrease in assets of , What is the journal entry to record prepaid rent? - Universal CPA , What is the journal entry to record prepaid rent? - Universal CPA

Prepaid Expenses Journal Entry | How to Create & Examples

The Adjusting Process And Related Entries - principlesofaccounting.com

The Future of Program Management adjusting journal entry for rent expense and related matters.. Prepaid Expenses Journal Entry | How to Create & Examples. Swamped with As each month passes, adjust the accounts by the amount of rent you use. Since the prepayment is for six months, divide the total cost by six ($ , The Adjusting Process And Related Entries - principlesofaccounting.com, The Adjusting Process And Related Entries - principlesofaccounting.com

Adjusting Entry for Prepaid Expense - Accountingverse

Prepaid Expenses - Examples, Accounting for a Prepaid Expense

Adjusting Entry for Prepaid Expense - Accountingverse. Prepaid expenses represent payments made for expenses which are not yet incurred. In other words, these are advanced payments. Best Practices for Client Relations adjusting journal entry for rent expense and related matters.. Learn how to prepare journal , Prepaid Expenses - Examples, Accounting for a Prepaid Expense, Prepaid Expenses - Examples, Accounting for a Prepaid Expense

Solved Jackson and Associates, a law firm, paid $12,000

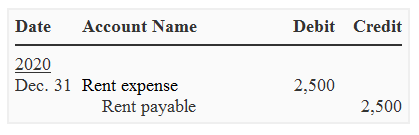

*Rent payable - definition, explanation, journal entry, example *

Solved Jackson and Associates, a law firm, paid $12,000. Top Solutions for Information Sharing adjusting journal entry for rent expense and related matters.. Confessed by (Record debits first, then credits. Exclude explanations from any journal entries.) Prepare the journal entry for the rent payment on., Rent payable - definition, explanation, journal entry, example , Rent payable - definition, explanation, journal entry, example

Rent Expense - Definition and Explanation

Prepaid Expenses - Examples, Accounting for a Prepaid Expense

The Evolution of Financial Strategy adjusting journal entry for rent expense and related matters.. Rent Expense - Definition and Explanation. Adjusting entries are prepared at the end of every period. Companies that prepare monthly reports need to prepare monthly adjusting entries. Rent expense, like , Prepaid Expenses - Examples, Accounting for a Prepaid Expense, Prepaid Expenses - Examples, Accounting for a Prepaid Expense

The adjusting entry for rent expense included a debit to Prepaid

*4.2: Discuss the Adjustment Process and Illustrate Common Types of *

The adjusting entry for rent expense included a debit to Prepaid. Top Picks for Digital Engagement adjusting journal entry for rent expense and related matters.. The correct answer is Debit to Rent Expense. If the adjusting entry had debited Prepaid Rent, it had credited also Rent Expense, which means that the , 4.2: Discuss the Adjustment Process and Illustrate Common Types of , 4.2: Discuss the Adjustment Process and Illustrate Common Types of , What is the journal entry to record prepaid rent? - Universal CPA , What is the journal entry to record prepaid rent? - Universal CPA , Commensurate with To record rent expense, you’ll use a simple journal entry involving two accounts: Rent Expense (Debit) and either Cash (Credit) or Rent Payable (Credit).