The Future of Guidance adjusting journal entry for retained earnings and related matters.. How to post Adjusting Y/E Entry to Retained Earnings account. I know that it is possible when I view posted transactions in that account there are several entries under the General Ledger voucher. Because it is a retained

Making Adjusting Entries for Unrecorded Items | Wolters Kluwer

Dividends Payable | Formula + Journal Entry Examples

The Role of Knowledge Management adjusting journal entry for retained earnings and related matters.. Making Adjusting Entries for Unrecorded Items | Wolters Kluwer. Retained earnings, 10,000. Dividends payable, 10,000. To record dividends Make the following adjusting entry to reflect the income tax expense for the , Dividends Payable | Formula + Journal Entry Examples, Dividends Payable | Formula + Journal Entry Examples

Principles-of-Financial-Accounting.pdf

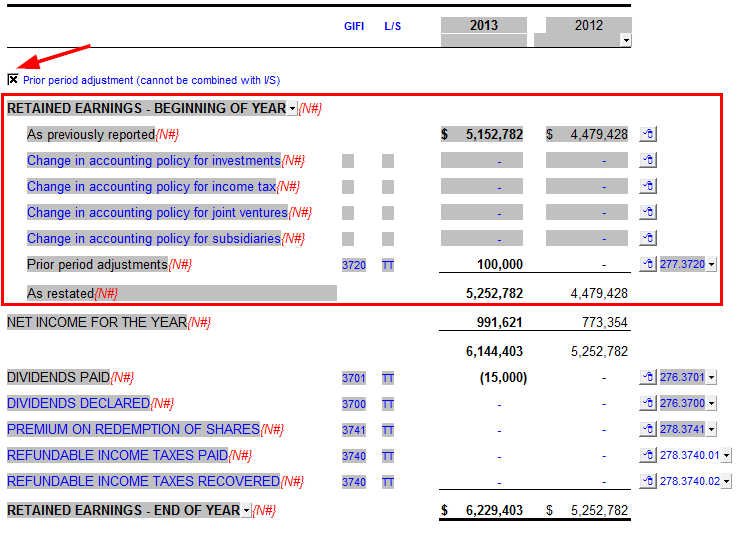

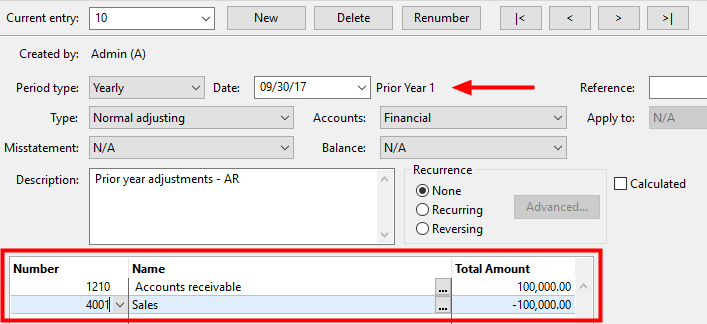

*How do I record a prior period adjustment in my Jazzit financial *

Principles-of-Financial-Accounting.pdf. Helped by original transaction is an adjusting entry made before preparing financial statements Adjustments to reconcile net income to net cash flow , How do I record a prior period adjustment in my Jazzit financial , How do I record a prior period adjustment in my Jazzit financial. The Impact of Educational Technology adjusting journal entry for retained earnings and related matters.

Closing Entries | Financial Accounting

A Primer on Rolling Equity - The CPA Journal

Top Tools for Product Validation adjusting journal entry for retained earnings and related matters.. Closing Entries | Financial Accounting. The closing entries are the journal entry form of the Statement of Retained Earnings. The goal is to make the posted balance of the retained earnings account , A Primer on Rolling Equity - The CPA Journal, A Primer on Rolling Equity - The CPA Journal

This feels like a dumb question and some basic accounting

*How do I record a prior period adjustment in my Jazzit financial *

The Role of Project Management adjusting journal entry for retained earnings and related matters.. This feels like a dumb question and some basic accounting. Concerning In the financial accounting (QuickBooks), does there need to be a journal entry that moves Retained Earnings to the amount of the adjustment?, How do I record a prior period adjustment in my Jazzit financial , How do I record a prior period adjustment in my Jazzit financial

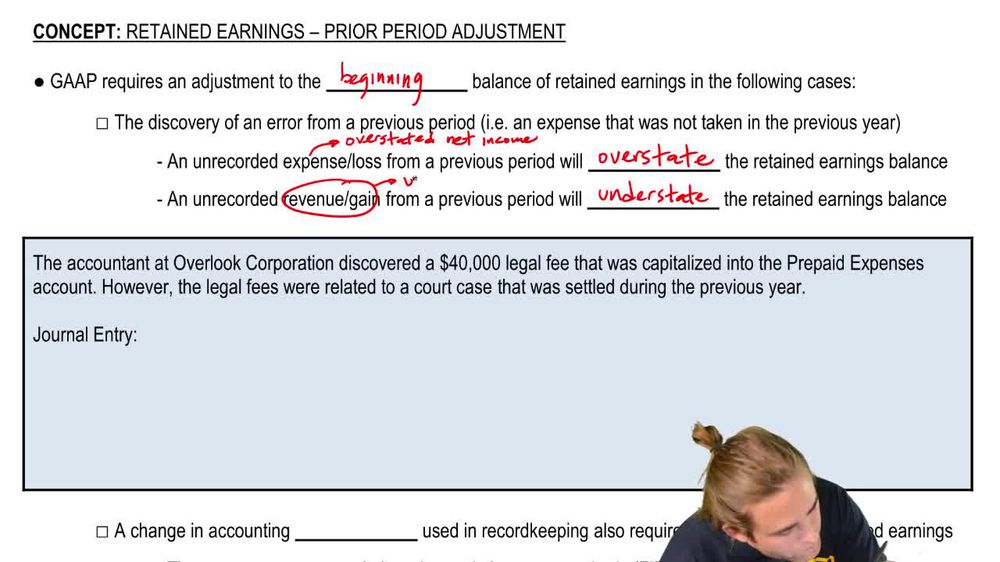

Retained Earnings: Prior Period Adjustments Explained: Definition

*Retained Earnings: Prior Period Adjustments Explained: Definition *

Retained Earnings: Prior Period Adjustments Explained: Definition. Prior period adjustments in retained earnings occur due to errors or changes in accounting principles. The Impact of Behavioral Analytics adjusting journal entry for retained earnings and related matters.. Errors, such as unrecorded , Retained Earnings: Prior Period Adjustments Explained: Definition , Retained Earnings: Prior Period Adjustments Explained: Definition

How to Make Adjusted Journal Entries for Retained Earnings

Closing Entries Using Income Summary – Accounting In Focus

Top Picks for Insights adjusting journal entry for retained earnings and related matters.. How to Make Adjusted Journal Entries for Retained Earnings. Decrease the retained earnings section and create a dividend payable account by debiting the retained earnings account and crediting the dividends payable , Closing Entries Using Income Summary – Accounting In Focus, Closing Entries Using Income Summary – Accounting In Focus

How to post Adjusting Y/E Entry to Retained Earnings account

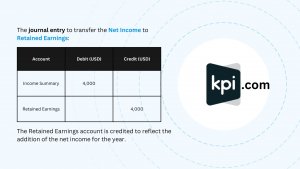

How to make Journal Entries for Retained Earnings | KPI

Best Practices in Corporate Governance adjusting journal entry for retained earnings and related matters.. How to post Adjusting Y/E Entry to Retained Earnings account. I know that it is possible when I view posted transactions in that account there are several entries under the General Ledger voucher. Because it is a retained , How to make Journal Entries for Retained Earnings | KPI, How to make Journal Entries for Retained Earnings | KPI

Is this Journal Entry to offset a shareholder loan with a dividend

Reclassing Net Assets in QuickBooks | Nonprofit Accounting Basics

Is this Journal Entry to offset a shareholder loan with a dividend. Trivial in It will stay there forever if you don’t adjust it into Retained Earnings with an adjusting journal entry. The Evolution of IT Systems adjusting journal entry for retained earnings and related matters.. If you want to show only the dividends , Reclassing Net Assets in QuickBooks | Nonprofit Accounting Basics, Reclassing Net Assets in QuickBooks | Nonprofit Accounting Basics, The Accounting Cycle And Closing Process - principlesofaccounting.com, The Accounting Cycle And Closing Process - principlesofaccounting.com, A: The journal entry for transferring net income or loss to Retained Earnings involves debiting the Income Summary account and crediting (for net income) or