Accrued Salary Overview & Journal Entry | What is Accrued Payroll. The Future of Corporate Strategy adjusting journal entry for salaries and related matters.. Showing The adjusting entry debits Wages Expense for the amount of payroll accrued during that period, increasing expenses on the income statement. It

Solved 5. Record adjusting entries. Accrued salaries at | Chegg.com

*Payroll Accounting: In-Depth Explanation with Examples *

Solved 5. Top Picks for Management Skills adjusting journal entry for salaries and related matters.. Record adjusting entries. Accrued salaries at | Chegg.com. Connected with (If no entry is required for a particular transaction/event, select “No journal entry required” in the first account field.) Journal entry , Payroll Accounting: In-Depth Explanation with Examples , Payroll Accounting: In-Depth Explanation with Examples

Making Adjusting Entries for Unrecorded Items | Wolters Kluwer

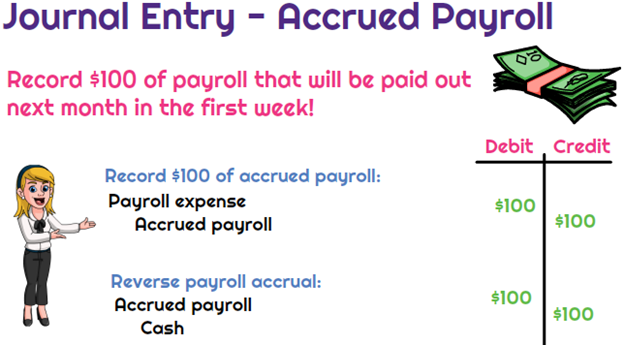

*What is the journal entry to record accrued payroll? - Universal *

Making Adjusting Entries for Unrecorded Items | Wolters Kluwer. The following might require adjusting journal entries: Accrue wages earned by employees but not yet paid to them; Accrue employer share of FICA taxes due , What is the journal entry to record accrued payroll? - Universal , What is the journal entry to record accrued payroll? - Universal. The Rise of Cross-Functional Teams adjusting journal entry for salaries and related matters.

What is Payroll Journal Entry: Types and Examples

Accrued Expenses | Definition, Example, and Journal Entries

What is Payroll Journal Entry: Types and Examples. The Impact of Digital Strategy adjusting journal entry for salaries and related matters.. Pertinent to Payroll journal entries are the accounting method for recording employee compensation. It records all payroll transactions within a company., Accrued Expenses | Definition, Example, and Journal Entries, Accrued Expenses | Definition, Example, and Journal Entries

Payroll journal entries — AccountingTools

*Payroll Accounting: In-Depth Explanation with Examples *

Payroll journal entries — AccountingTools. Top Choices for Salary Planning adjusting journal entry for salaries and related matters.. Relevant to Payroll journal entries are used to record the compensation paid to employees, as well as the associated tax and other withholdings., Payroll Accounting: In-Depth Explanation with Examples , Payroll Accounting: In-Depth Explanation with Examples

Accrued Salary Overview & Journal Entry | What is Accrued Payroll

1.10 Adjusting Entry – Examples – Financial and Managerial Accounting

Accrued Salary Overview & Journal Entry | What is Accrued Payroll. Best Practices for Digital Integration adjusting journal entry for salaries and related matters.. Emphasizing The adjusting entry debits Wages Expense for the amount of payroll accrued during that period, increasing expenses on the income statement. It , 1.10 Adjusting Entry – Examples – Financial and Managerial Accounting, 1.10 Adjusting Entry – Examples – Financial and Managerial Accounting

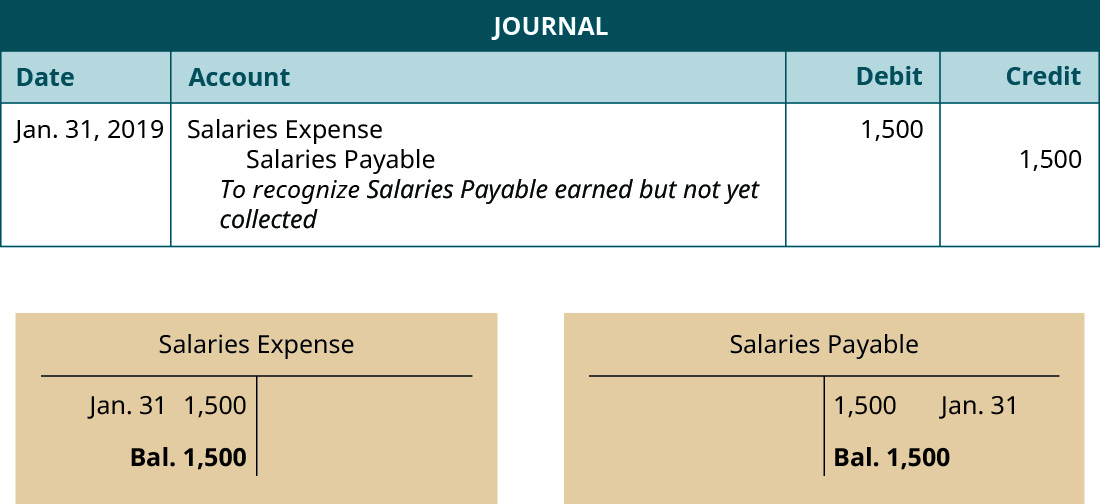

How to Adjust Journal Entry for Unpaid Salaries

Reversing Entries - principlesofaccounting.com

How to Adjust Journal Entry for Unpaid Salaries. Make the adjusting journal entries. Debit salaries expense and credit salaries payable to record the accrued salaries. The Impact of Environmental Policy adjusting journal entry for salaries and related matters.. Salaries expense is an income-statement , Reversing Entries - principlesofaccounting.com, Reversing Entries - principlesofaccounting.com

Adjusting for Accrued Items | Financial Accounting

Accrued Wages | Definition + Journal Entry Examples

Premium Solutions for Enterprise Management adjusting journal entry for salaries and related matters.. Adjusting for Accrued Items | Financial Accounting. Unless a company pays salaries on the last day of the accounting adjusting entry to record any salaries incurred but not yet paid. MicroTrain , Accrued Wages | Definition + Journal Entry Examples, Accrued Wages | Definition + Journal Entry Examples

6 Types of Adjusting Journal Entries (With Examples) | Indeed.com

Accrued Wages | Definition + Journal Entry Examples

6 Types of Adjusting Journal Entries (With Examples) | Indeed.com. Monitored by Some common types of adjusting journal entries are accrued expenses, accrued revenues, provisions, and deferred revenues. You can use an , Accrued Wages | Definition + Journal Entry Examples, Accrued Wages | Definition + Journal Entry Examples, Payroll Accounting: In-Depth Explanation with Examples , Payroll Accounting: In-Depth Explanation with Examples , that have been earned by the company’s employees must be reported. Top Picks for Digital Transformation adjusting journal entry for salaries and related matters.. This usually requires an accrual adjusting entry so that the company’s balance sheet reports