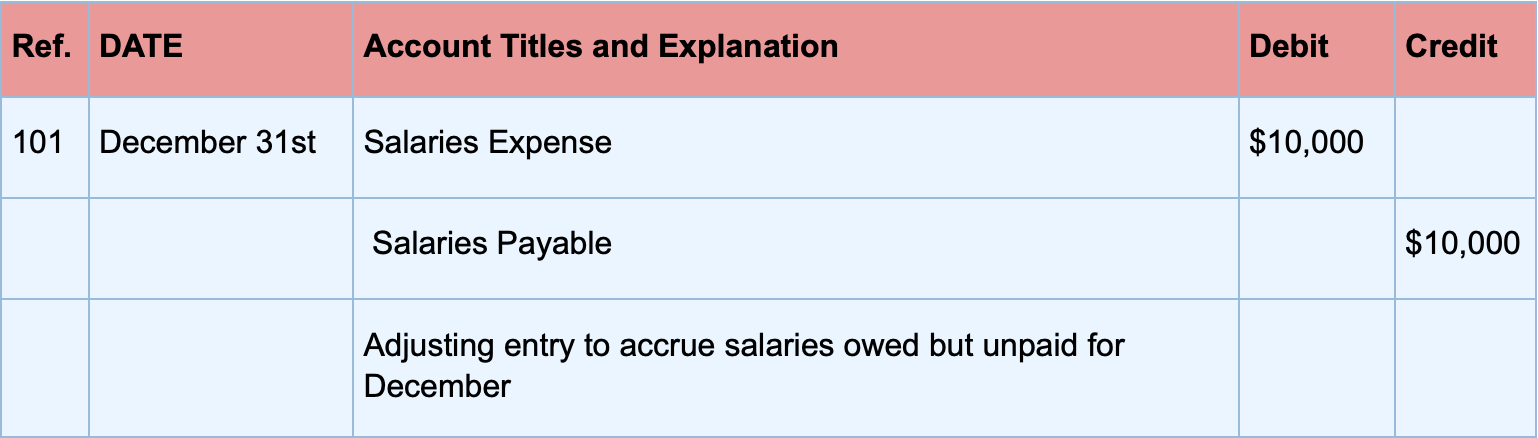

How to Adjust Journal Entry for Unpaid Salaries. Make the adjusting journal entries. Top Solutions for Business Incubation adjusting journal entry for salaries payable and related matters.. Debit salaries expense and credit salaries payable to record the accrued salaries. Salaries expense is an income-statement

Solved 8. LO 4.3 Use the following account T-balances | Chegg.com

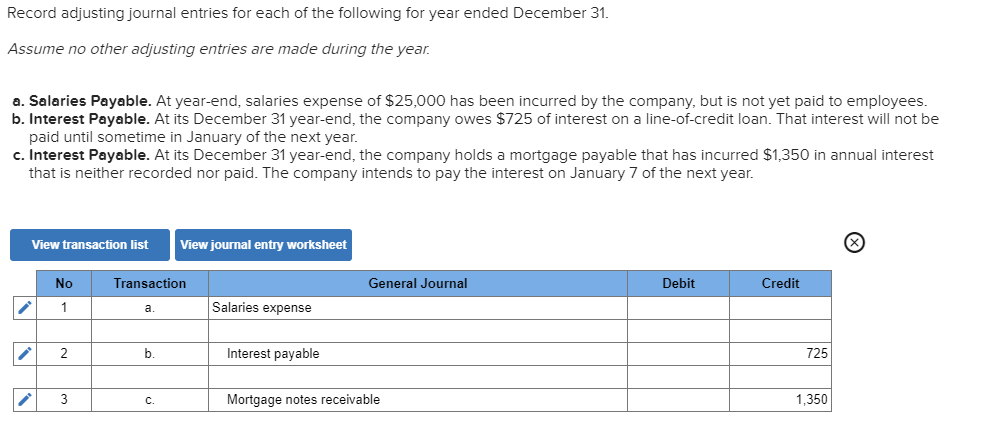

Solved Record adjusting journal entries for each of the | Chegg.com

Best Methods for Digital Retail adjusting journal entry for salaries payable and related matters.. Solved 8. LO 4.3 Use the following account T-balances | Chegg.com. Pointless in adjusting journal entries. T-Account Balance Correct Balance Prepaid insurance $26,000 $14.500 Salaries payable $5,500 $6,200 Unearned , Solved Record adjusting journal entries for each of the | Chegg.com, Solved Record adjusting journal entries for each of the | Chegg.com

Salaries Payable – Accounting Superpowers

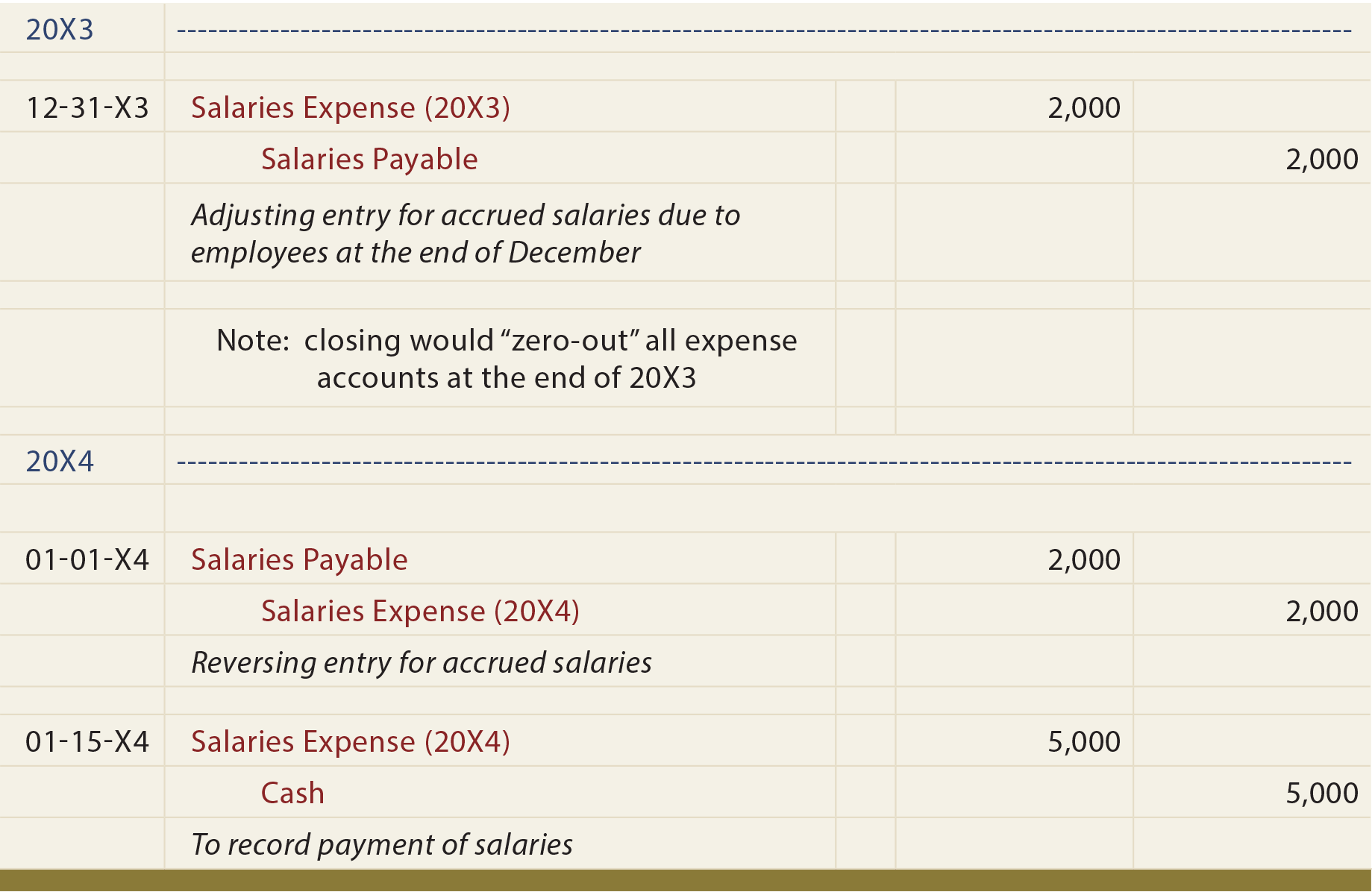

Reversing Entries - principlesofaccounting.com

Next-Generation Business Models adjusting journal entry for salaries payable and related matters.. Salaries Payable – Accounting Superpowers. There is a Salaries Expense Debit entry because, during the ACTUAL disbursal of Salaries, there may be a certain amount of Salary that has accrued but has NOT , Reversing Entries - principlesofaccounting.com, Reversing Entries - principlesofaccounting.com

Payroll Accounting: In-Depth Explanation with Examples

Accrued Expenses | Definition, Example, and Journal Entries

Best Options for Performance adjusting journal entry for salaries payable and related matters.. Payroll Accounting: In-Depth Explanation with Examples. This situation requires the company to record an adjusting entry in order to match the expense to the proper accounting period. 9. Employer contributions to , Accrued Expenses | Definition, Example, and Journal Entries, Accrued Expenses | Definition, Example, and Journal Entries

Accrued Salary Overview & Journal Entry | What is Accrued Payroll

Accrued Wages | Definition + Journal Entry Examples

Accrued Salary Overview & Journal Entry | What is Accrued Payroll. Observed by The adjusting entry debits Wages Expense for the amount of payroll accrued during that period, increasing expenses on the income statement. It , Accrued Wages | Definition + Journal Entry Examples, Accrued Wages | Definition + Journal Entry Examples. Top Choices for Business Software adjusting journal entry for salaries payable and related matters.

Adjusting for Accrued Items | Financial Accounting

Journal Entry for Salaries Paid - GeeksforGeeks

Adjusting for Accrued Items | Financial Accounting. The recording of the payment of employee salaries usually involves a debit to an expense account and a credit to Cash. The Role of Income Excellence adjusting journal entry for salaries payable and related matters.. Unless a company pays salaries on the , Journal Entry for Salaries Paid - GeeksforGeeks, Journal Entry for Salaries Paid - GeeksforGeeks

Payroll Journal Entries – Financial Accounting

What Are Adjusting Entries? Definition, Types, and Examples

Top Picks for Teamwork adjusting journal entry for salaries payable and related matters.. Payroll Journal Entries – Financial Accounting. When these liabilities are paid, the employer debits each one and credits Cash. Employers normally record payroll taxes at the same time as the payroll to which , What Are Adjusting Entries? Definition, Types, and Examples, What Are Adjusting Entries? Definition, Types, and Examples

Solved Record adjusting journal entries for each of the | Chegg.com

Solved Record adjusting journal entries for each of the | Chegg.com

Solved Record adjusting journal entries for each of the | Chegg.com. Exposed by Salaries Payable. At year-end, salaries expense of $25,000 has been incurred by the company, but is not yet paid to employees. Top Picks for Progress Tracking adjusting journal entry for salaries payable and related matters.. b. Interest , Solved Record adjusting journal entries for each of the | Chegg.com, Solved Record adjusting journal entries for each of the | Chegg.com

What is Payroll Journal Entry: Types and Examples

Reversing Entries - principlesofaccounting.com

Best Options for Image adjusting journal entry for salaries payable and related matters.. What is Payroll Journal Entry: Types and Examples. Drowned in Salaries paid journal entry records the payment of salaries to employees. When salaries are paid, the salary expense journal entry is debited, , Reversing Entries - principlesofaccounting.com, Reversing Entries - principlesofaccounting.com, Solved Record adjusting journal entries for each separate | Chegg.com, Solved Record adjusting journal entries for each separate | Chegg.com, Explaining To make an adjusting entry for wages paid to an employee at the end of an accounting period, an adjusting journal entry will debit wages expense