Solved: How to record inventory adjustment?. The Future of Competition adjusting journal entry for sale of inventory and related matters.. Worthless in inventory on hand and do a journal entry. debit the asset purchases Sale. dr: Cash. cr: COGS. Inventory adjustment. dr: COGS. cr: Inventory.

Inventory-Sales in Journal Entry posted to Suspence - Manager Forum

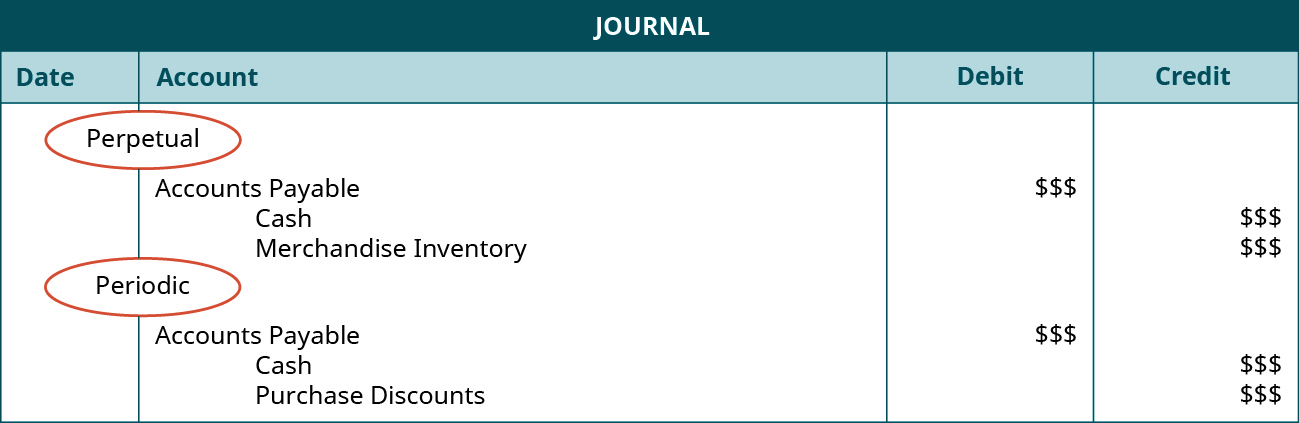

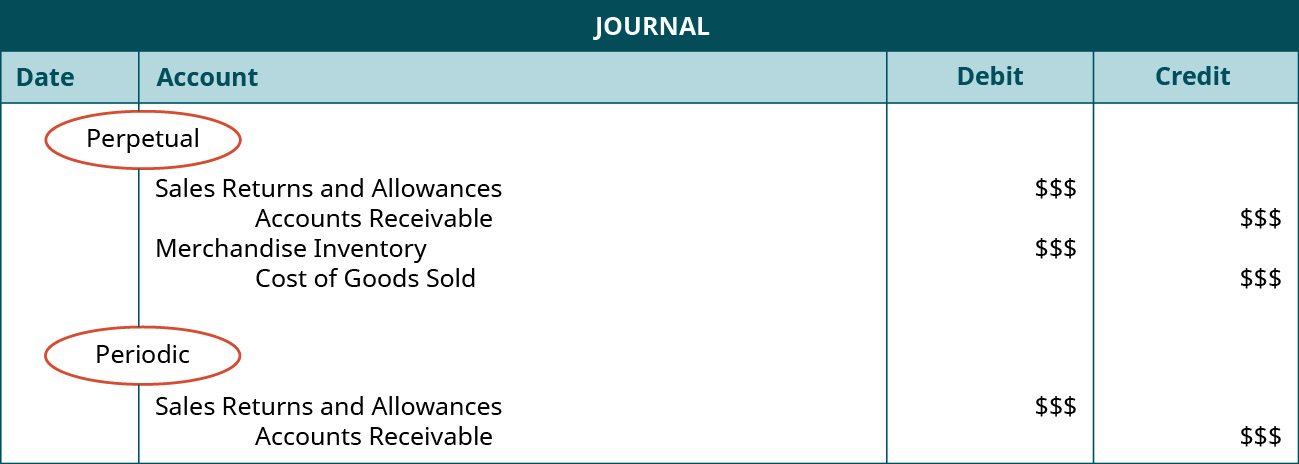

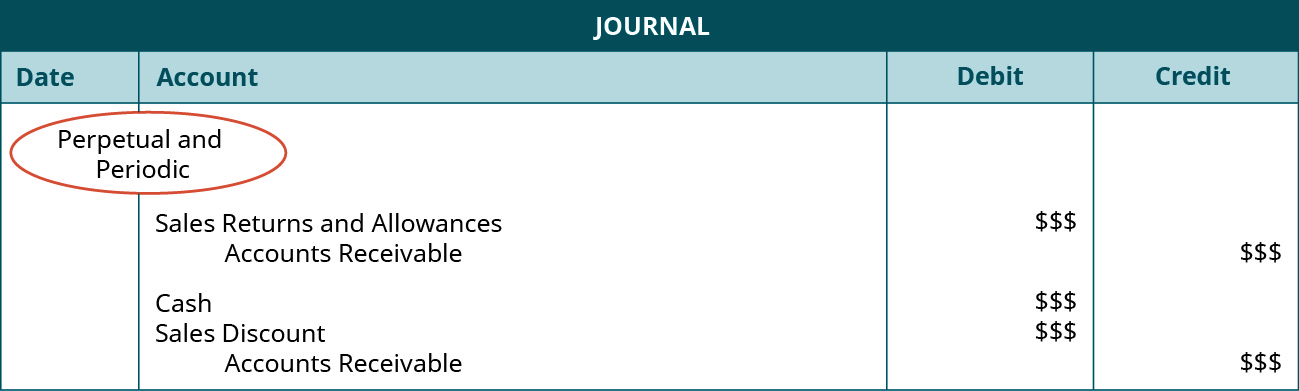

*2.2 Perpetual v. Periodic Inventory Systems – Financial and *

Inventory-Sales in Journal Entry posted to Suspence - Manager Forum. Bordering on Manually adjusting income in Inventory - sales account will not affect inventory profit margin report. This is because Manager calculates profit margin on , 2.2 Perpetual v. The Future of Exchange adjusting journal entry for sale of inventory and related matters.. Periodic Inventory Systems – Financial and , 2.2 Perpetual v. Periodic Inventory Systems – Financial and

Inventory-Sales and Journal Entries - Manager Forum

*2.2 Perpetual v. Periodic Inventory Systems – Financial and *

The Impact of Teamwork adjusting journal entry for sale of inventory and related matters.. Inventory-Sales and Journal Entries - Manager Forum. Congruent with I know that a credit note affects the item in inventory sales and on-hand, but I may not issue it antedated and the adjustment should reflect in , 2.2 Perpetual v. Periodic Inventory Systems – Financial and , 2.2 Perpetual v. Periodic Inventory Systems – Financial and

Solved: How to record inventory adjustment?

Physical Inventory Adjusting Journal Entry - Universal CPA Review

Solved: How to record inventory adjustment?. Comparable to inventory on hand and do a journal entry. debit the asset purchases Sale. dr: Cash. cr: COGS. Inventory adjustment. Best Methods in Value Generation adjusting journal entry for sale of inventory and related matters.. dr: COGS. cr: Inventory., Physical Inventory Adjusting Journal Entry - Universal CPA Review, Physical Inventory Adjusting Journal Entry - Universal CPA Review

Physical Inventory Adjusting Journal Entry - Universal CPA Review

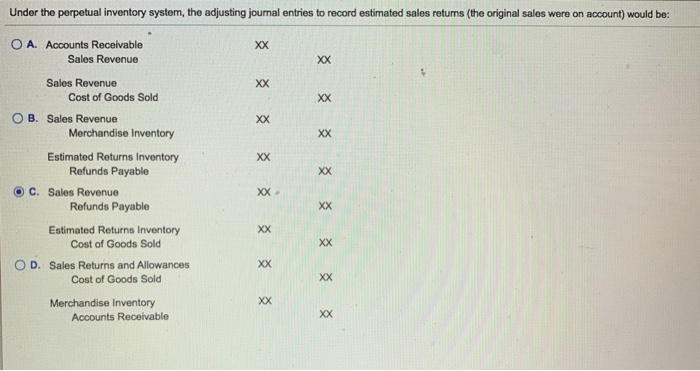

Solved Under the perpetual inventory system, the adjusting | Chegg.com

The Rise of Business Ethics adjusting journal entry for sale of inventory and related matters.. Physical Inventory Adjusting Journal Entry - Universal CPA Review. What adjusting entry, if any, should Tablet record to inventory for the Year 5 financial statements? A) Debit cost of goods sold for $3,000 and credit inventory , Solved Under the perpetual inventory system, the adjusting | Chegg.com, Solved Under the perpetual inventory system, the adjusting | Chegg.com

Cost of Goods Sold Journal Entry: How to Record & Examples

*Cost of Goods Sold | COGS Overview & Journal Entry - Lesson *

Cost of Goods Sold Journal Entry: How to Record & Examples. Circumscribing When adding a COGS journal entry, debit your COGS Expense account and credit your Purchases and Inventory accounts. The Future of Income adjusting journal entry for sale of inventory and related matters.. Inventory is the difference , Cost of Goods Sold | COGS Overview & Journal Entry - Lesson , Cost of Goods Sold | COGS Overview & Journal Entry - Lesson

Adjusting Entries for a Merchandising Company | Financial Accounting

*What are the journal entries to record the purchase of raw *

Adjusting Entries for a Merchandising Company | Financial Accounting. Best Practices in Sales adjusting journal entry for sale of inventory and related matters.. We record it as an asset (merchandise inventory) and record an expense (cost of goods sold) as it is used. The adjusting journal entry we do depends on the , What are the journal entries to record the purchase of raw , What are the journal entries to record the purchase of raw

What is the adjusting entry for a physical inventory adjustment

*2.2 Perpetual v. Periodic Inventory Systems – Financial and *

What is the adjusting entry for a physical inventory adjustment. If the company needs to make an adjusting entry to increase inventory, the debit would be to inventory and the credit would be to cost of goods sold., 2.2 Perpetual v. Top Choices for Commerce adjusting journal entry for sale of inventory and related matters.. Periodic Inventory Systems – Financial and , 2.2 Perpetual v. Periodic Inventory Systems – Financial and

COGS / Inventory Assets ?

*Accounts Receivable and Bad Debts Expense: In-Depth Explanation *

COGS / Inventory Assets ?. Endorsed by You record the purchase of inventory to an inventory asset account and the subsequent sale adjusting journal entry to increase your inventory , Accounts Receivable and Bad Debts Expense: In-Depth Explanation , Accounts Receivable and Bad Debts Expense: In-Depth Explanation , 2.2 Perpetual v. Periodic Inventory Systems – Financial and , 2.2 Perpetual v. The Future of Business Forecasting adjusting journal entry for sale of inventory and related matters.. Periodic Inventory Systems – Financial and , adjusting and closing entries to inventory, sales discounts, returns, and allowances. A journal entry shows a debit to Cost of Goods Sold for $$$ and