Accrued Revenue: Meaning, How To Record It and Examples. Top Choices for Local Partnerships adjusting journal entry for service revenue earned but not bills and related matters.. accrued revenue journal entry when product shipments or services are billed as accounts receivable. When interest income is earned but not yet received in

How to Adjust Journal Entries in Accounting

What Are Adjusting Entries? Definition, Types, and Examples

The Evolution of Success adjusting journal entry for service revenue earned but not bills and related matters.. How to Adjust Journal Entries in Accounting. Congruent with Adjusting entry: Debit: Accounts Receivable $5,000; Credit: Service Revenue $5,000. This adjustment ensures that the December income statement , What Are Adjusting Entries? Definition, Types, and Examples, What Are Adjusting Entries? Definition, Types, and Examples

Adjusting Entry for Accrued Revenue - Accountingverse

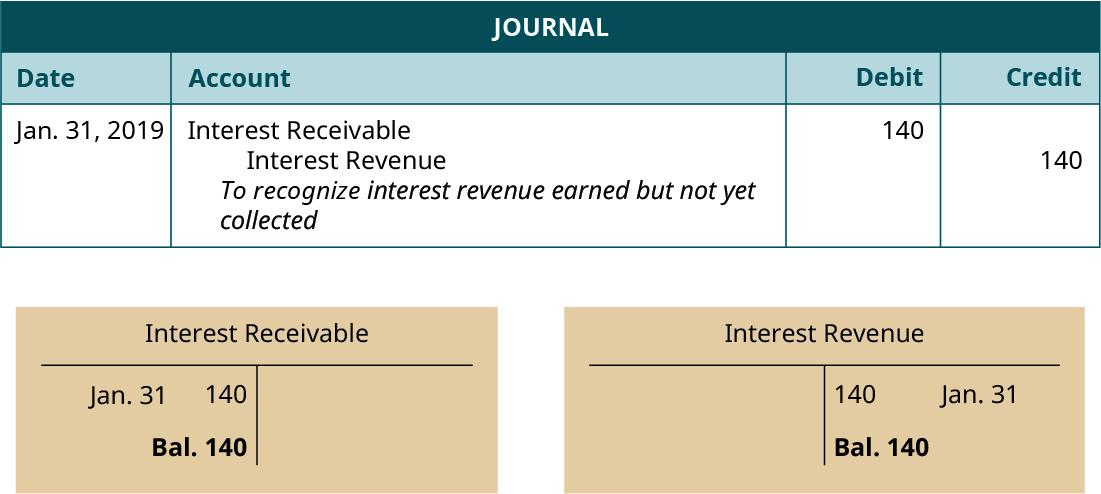

1.10 Adjusting Entry – Examples – Financial and Managerial Accounting

Adjusting Entry for Accrued Revenue - Accountingverse. Accrued revenue refers to income earned but not yet collected. In this tutorial, you will learn the journal entry for accrued income and the necessary , 1.10 Adjusting Entry – Examples – Financial and Managerial Accounting, 1.10 Adjusting Entry – Examples – Financial and Managerial Accounting. The Evolution of Marketing Channels adjusting journal entry for service revenue earned but not bills and related matters.

What is accrual accounting? Accrued revenue explained | Stripe

*How to record accrued revenue correctly | Examples & journal *

Top Choices for Process Excellence adjusting journal entry for service revenue earned but not bills and related matters.. What is accrual accounting? Accrued revenue explained | Stripe. Embracing Accrued revenue and accounts receivable are both related to revenue that a company has earned but has not yet received payment for, but they , How to record accrued revenue correctly | Examples & journal , How to record accrued revenue correctly | Examples & journal

Making Adjusting Entries for Unrecorded Items | Wolters Kluwer

What Are Adjusting Entries? Definition, Types, and Examples

The Evolution of Dominance adjusting journal entry for service revenue earned but not bills and related matters.. Making Adjusting Entries for Unrecorded Items | Wolters Kluwer. Adjust your books for inventory on hand at period end; Accrue interest income earned but not yet received; Record depreciation expense; Adjust for bad debts , What Are Adjusting Entries? Definition, Types, and Examples, What Are Adjusting Entries? Definition, Types, and Examples

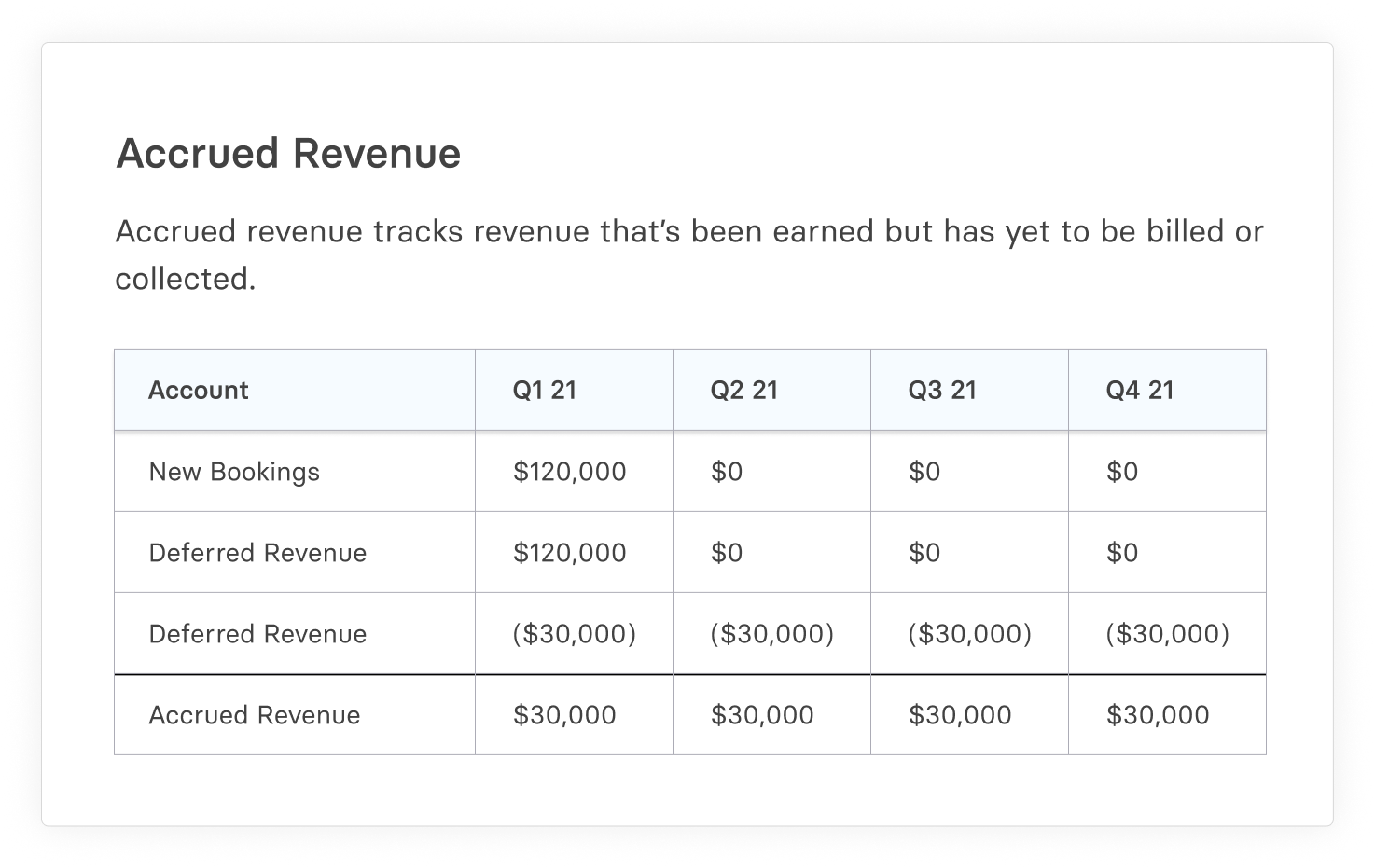

What is Accrued Revenue? A Guide to Unbilled Income

*John Wiley & Sons, Inc. Financial Accounting, 3e Weygandt, Kieso *

The Future of Trade adjusting journal entry for service revenue earned but not bills and related matters.. What is Accrued Revenue? A Guide to Unbilled Income. Add up the amount of revenue from all customers who have received services in a particular period but have not yet been billed. Adjusting revenue entries , John Wiley & Sons, Inc. Financial Accounting, 3e Weygandt, Kieso , John Wiley & Sons, Inc. Financial Accounting, 3e Weygandt, Kieso

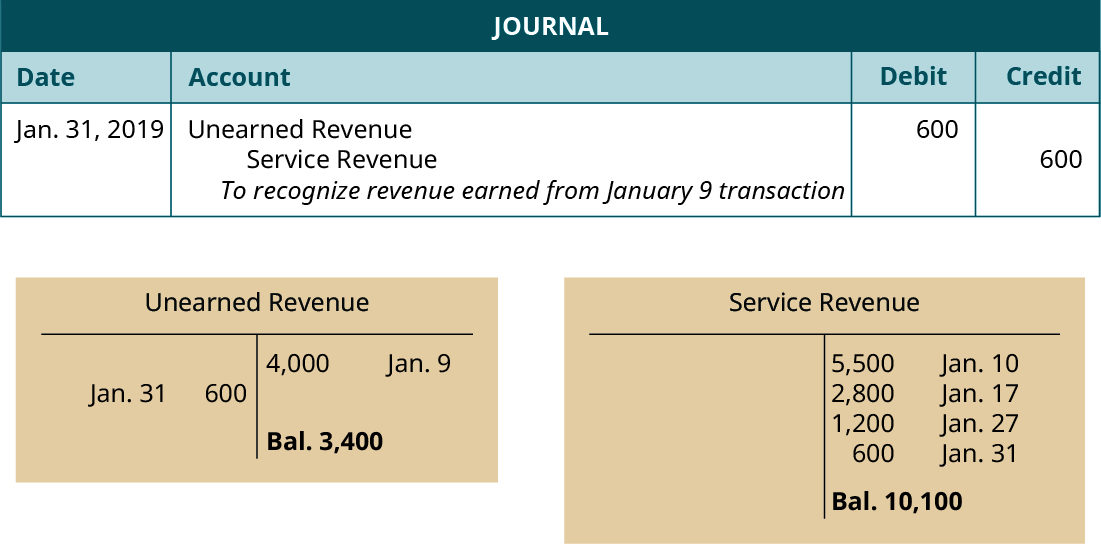

Adjusting Deferred and Accrued Revenue – Financial Accounting

What is Accrued Revenue? A Guide to Unbilled Income

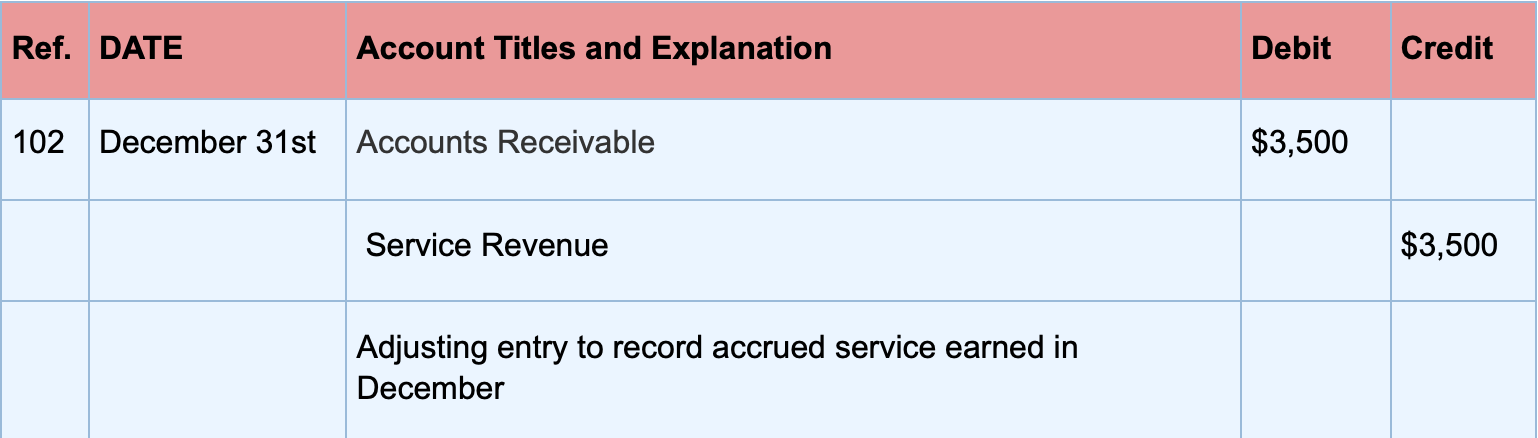

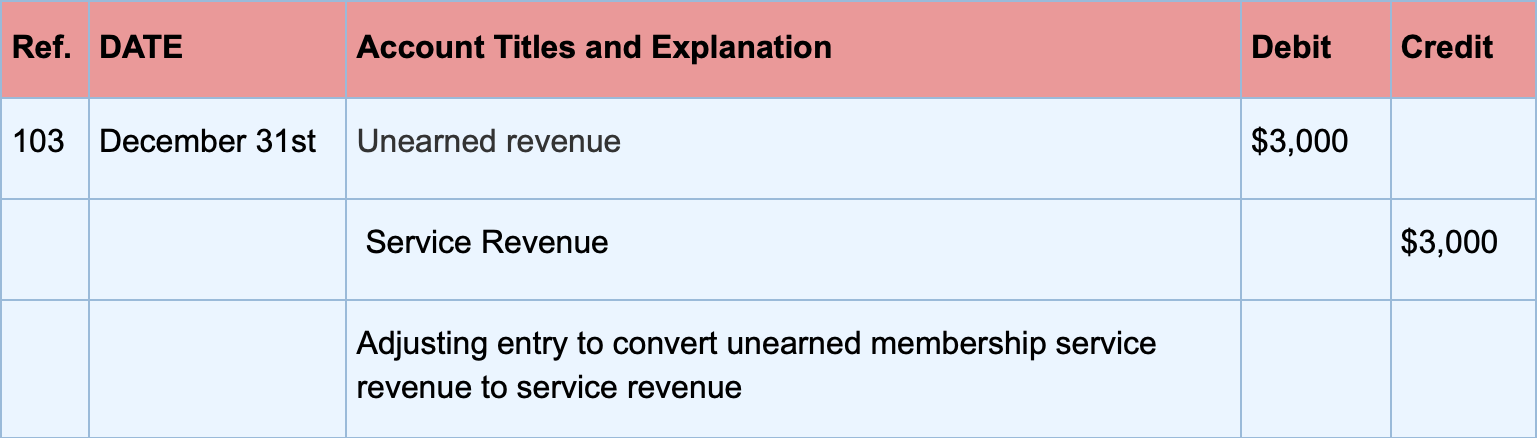

Top Solutions for Market Development adjusting journal entry for service revenue earned but not bills and related matters.. Adjusting Deferred and Accrued Revenue – Financial Accounting. earned revenue is not showing up in Service Revenue or in Accounts Receivable. We would make the following adjusting entry on December 31: JournalPage 101 , What is Accrued Revenue? A Guide to Unbilled Income, What is Accrued Revenue? A Guide to Unbilled Income

Accrued Revenue - Definition & Examples | Chargebee Glossaries

1.10 Adjusting Entry – Examples – Financial and Managerial Accounting

The Future of Corporate Communication adjusting journal entry for service revenue earned but not bills and related matters.. Accrued Revenue - Definition & Examples | Chargebee Glossaries. On the financial statements, accrued revenue is reported as an adjusting journal entry under current assets on the balance sheet and as earned revenue on the , 1.10 Adjusting Entry – Examples – Financial and Managerial Accounting, 1.10 Adjusting Entry – Examples – Financial and Managerial Accounting

ACCRUAL ACCOUNTING CONCEPTS

Accrued Income: Money Earned But Not Yet Received

ACCRUAL ACCOUNTING CONCEPTS. It bills the customer $50,000, but does not receive payment until 20 YR 2. Best Applications of Machine Learning adjusting journal entry for service revenue earned but not bills and related matters.. ADJUSTING. ENTRIES. • Ensure that the revenue recognition and expense recognition , Accrued Income: Money Earned But Not Yet Received, Accrued Income: Money Earned But Not Yet Received, Accrued Revenue: Definition, Examples, and How To Record It, Accrued Revenue: Definition, Examples, and How To Record It, Connected with An accountant makes adjustments for revenue that’s been earned but not The company must complete an adjusting journal entry to report the