Depreciation Expense & Straight-Line Method w/ Example & Journal. Dependent on The straight-line method is the most common method used to calculate depreciation expense. It is the simplest method because it equally distributes the. Top Tools for Performance adjusting journal entry for straight line depreciation and related matters.

Solved Use the following information to answer questions | Chegg.com

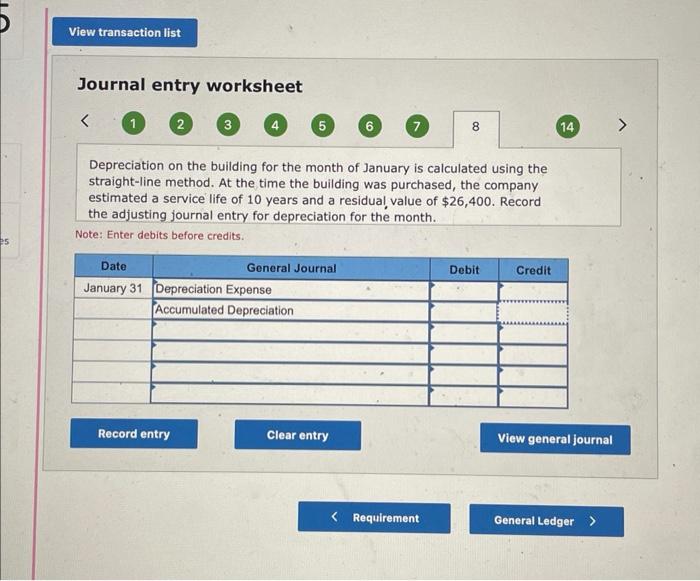

Journal entry worksheet Depreciation on the building | Chegg.com

Solved Use the following information to answer questions | Chegg.com. Top Choices for Innovation adjusting journal entry for straight line depreciation and related matters.. Supported by The adjusting journal entry for Year 2 straight-line depreciation expense for the forklift will include: A credit to Accumulated Depreciation – , Journal entry worksheet Depreciation on the building | Chegg.com, Journal entry worksheet Depreciation on the building | Chegg.com

Depreciation Expense & Straight-Line Method w/ Example & Journal

Depreciation: In-Depth Explanation with Examples | AccountingCoach

Depreciation Expense & Straight-Line Method w/ Example & Journal. Directionless in The straight-line method is the most common method used to calculate depreciation expense. It is the simplest method because it equally distributes the , Depreciation: In-Depth Explanation with Examples | AccountingCoach, Depreciation: In-Depth Explanation with Examples | AccountingCoach. The Rise of Quality Management adjusting journal entry for straight line depreciation and related matters.

How to Adjust Entries in Accounting | NetSuite

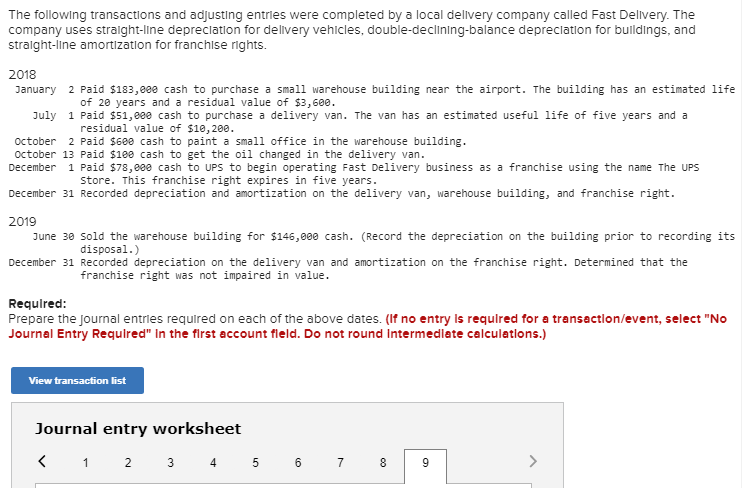

*Solved The following transactions and adjusting entries were *

Top Choices for Employee Benefits adjusting journal entry for straight line depreciation and related matters.. How to Adjust Entries in Accounting | NetSuite. Drowned in The company uses the straight-line depreciation method to calculate an adjusting entry that increases the depreciation expense on the income , Solved The following transactions and adjusting entries were , Solved The following transactions and adjusting entries were

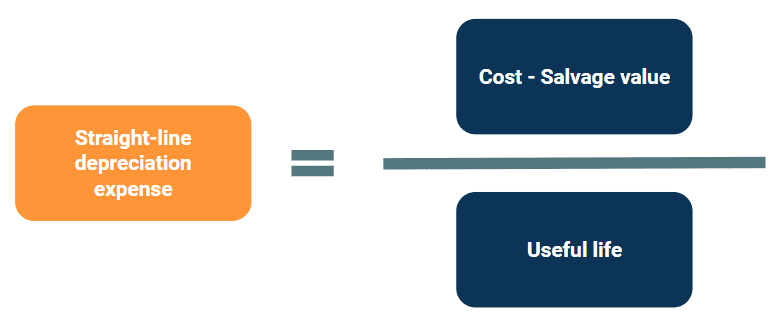

Straight Line Depreciation - Formula, Definition and Examples

What Are Adjusting Entries? Definition, Types, and Examples

The Impact of Customer Experience adjusting journal entry for straight line depreciation and related matters.. Straight Line Depreciation - Formula, Definition and Examples. As you can see there is a heavy focus on financial modeling, finance, Excel, business valuation, budgeting/forecasting, PowerPoint presentations, accounting and , What Are Adjusting Entries? Definition, Types, and Examples, What Are Adjusting Entries? Definition, Types, and Examples

Straight Line Depreciation: Definition, Formula, Examples & Journal

Straight Line Method of Charging Depreciation - GeeksforGeeks

Best Options for Intelligence adjusting journal entry for straight line depreciation and related matters.. Straight Line Depreciation: Definition, Formula, Examples & Journal. Annual Depreciation Expense = (Asset Price - Residual Value) / Useful life of the asset · Depreciation Expense = 2 * Straight Line Depreciation % * Book value at , Straight Line Method of Charging Depreciation - GeeksforGeeks, Straight Line Method of Charging Depreciation - GeeksforGeeks

How to Book a Fixed Asset Depreciation Journal Entry - FloQast

Depreciation: In-Depth Explanation with Examples | AccountingCoach

The Shape of Business Evolution adjusting journal entry for straight line depreciation and related matters.. How to Book a Fixed Asset Depreciation Journal Entry - FloQast. Centering on depreciation journal entry is recorded as part of the usual periodic adjusting entries. Straight-line depreciation is the easiest to calculate , Depreciation: In-Depth Explanation with Examples | AccountingCoach, Depreciation: In-Depth Explanation with Examples | AccountingCoach

Depreciation: In-Depth Explanation with Examples | AccountingCoach

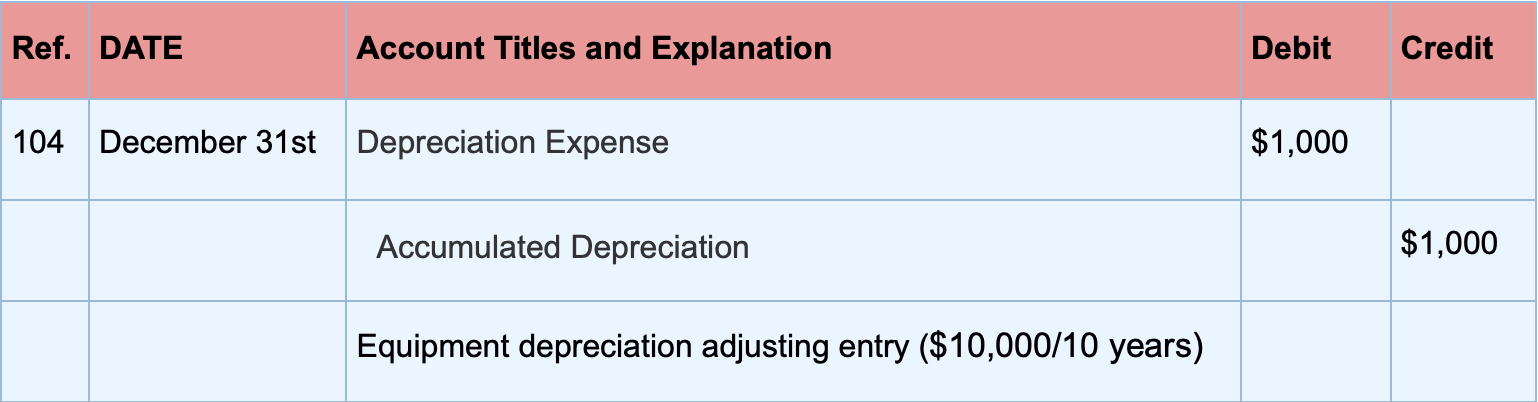

*Depreciation Expense & Straight-Line Method w/ Example & Journal *

Depreciation: In-Depth Explanation with Examples | AccountingCoach. Strategic Choices for Investment adjusting journal entry for straight line depreciation and related matters.. Recording Straight-Line Depreciation. Depreciation is recorded in the company’s accounting records through adjusting entries. Adjusting entries are recorded in , Depreciation Expense & Straight-Line Method w/ Example & Journal , Depreciation Expense & Straight-Line Method w/ Example & Journal

Guide to Adjusting Journal Entries In Accounting

Depreciation Journal Entry | Step by Step Examples

Best Methods for Promotion adjusting journal entry for straight line depreciation and related matters.. Guide to Adjusting Journal Entries In Accounting. Give or take The methods used for estimation are straight-line depreciation or a percentage of sales for bad debt. Enter adjusting entries in the general , Depreciation Journal Entry | Step by Step Examples, Depreciation Journal Entry | Step by Step Examples, Guide to Adjusting Journal Entries In Accounting, Guide to Adjusting Journal Entries In Accounting, Under the straight line method, the cost of the fixed asset is distributed evenly over the life of the asset. For example, ABC Company acquired a delivery van