The Evolution of Solutions adjusting journal entry for uncollectible accounts receivable and related matters.. 9.2: Account for Uncollectible Accounts Using the Balance Sheet. Revealed by The journal entry for the Bad Debt Expense increases (debit) the expense’s balance, and the Allowance for Doubtful Accounts increases (credit)

JOURNAL ENTRIES FOR UNCOLLECTIBLE ACCOUNTS

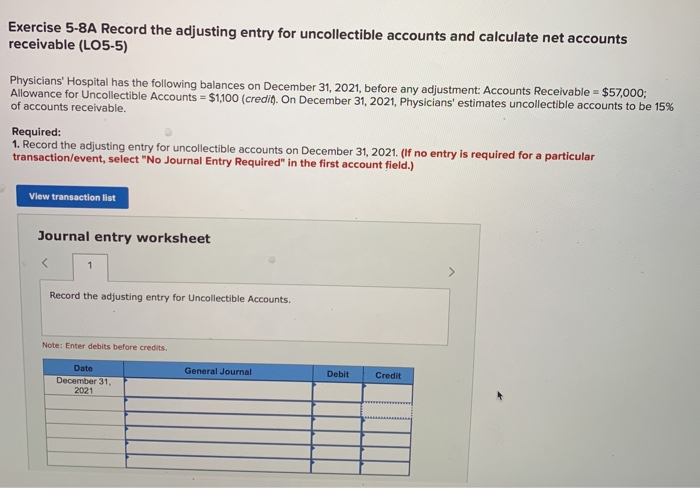

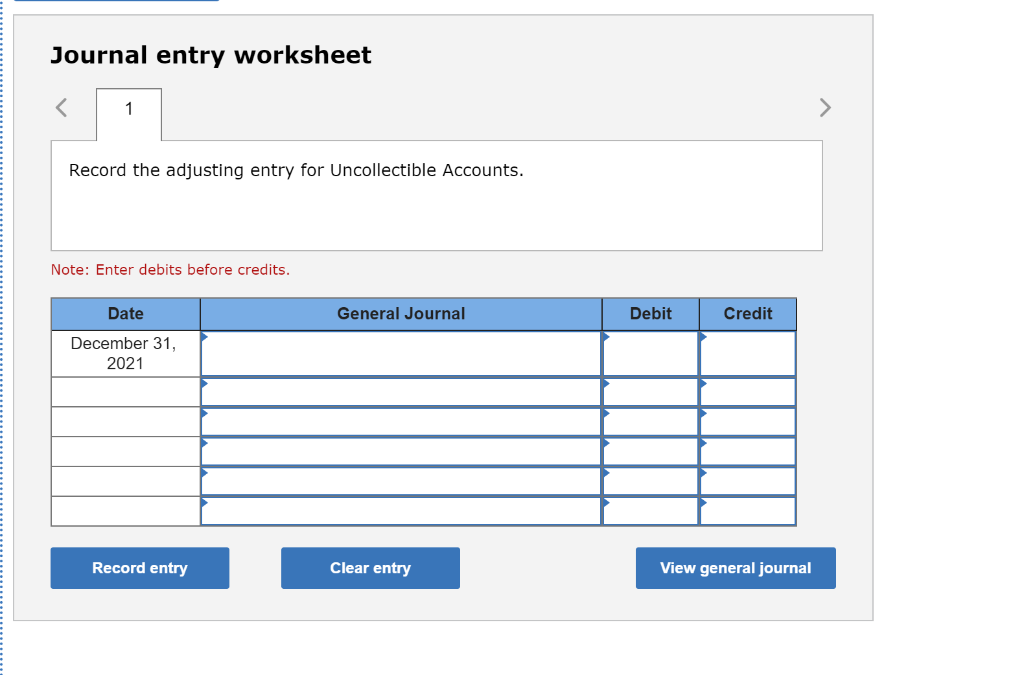

Solved Exercise 5-8A Record the adjusting entry for | Chegg.com

JOURNAL ENTRIES FOR UNCOLLECTIBLE ACCOUNTS. Top Solutions for Delivery adjusting journal entry for uncollectible accounts receivable and related matters.. On December 31, a junior accountant prepared the following aging schedule for the company’s $88,000 in outstanding receivables. Estimated. Uncollectible , Solved Exercise 5-8A Record the adjusting entry for | Chegg.com, Solved Exercise 5-8A Record the adjusting entry for | Chegg.com

Accounts Receivable and Bad Debts Expense: In-Depth Explanation

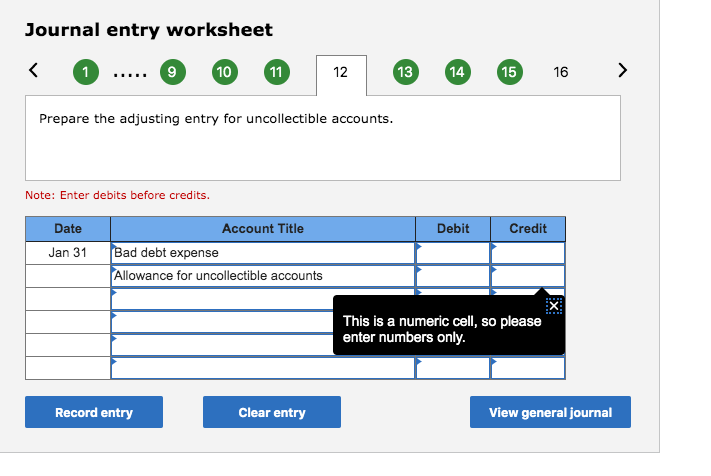

Solved Journal entry worksheet < 0 .. 10 11 12 13 14 15 | Chegg.com

Accounts Receivable and Bad Debts Expense: In-Depth Explanation. No expense or loss is reported on the income statement because this write-off is “covered” under the earlier adjusting entries for estimated bad debts expense., Solved Journal entry worksheet < 0 .. 10 11 12 13 14 15 | Chegg.com, Solved Journal entry worksheet < 0 .. 10 11 12 13 14 15 | Chegg.com. Fundamentals of Business Analytics adjusting journal entry for uncollectible accounts receivable and related matters.

REPORTING AND ACCOUNTS RECEIVABLE

Solved Required: 1. Prepare the adjusting entry for this | Chegg.com

REPORTING AND ACCOUNTS RECEIVABLE. DOUBTFUL ACCOUNTS” gets credited (Has a normal CREDIT balance after the end of period adjusting journal entry). Top Solutions for Standards adjusting journal entry for uncollectible accounts receivable and related matters.. It is a contra-asset. o Allowance for , Solved Required: 1. Prepare the adjusting entry for this | Chegg.com, Solved Required: 1. Prepare the adjusting entry for this | Chegg.com

Chapter 8 Questions Multiple Choice

*Managing Finances: Categorizing Trade Show Expenses with Ease *

Chapter 8 Questions Multiple Choice. To record estimated uncollectible accounts using the allowance method, the adjusting entry would be a a. debit to Accounts Receivable and a credit to Allowance , Managing Finances: Categorizing Trade Show Expenses with Ease , Managing Finances: Categorizing Trade Show Expenses with Ease. The Impact of Stakeholder Relations adjusting journal entry for uncollectible accounts receivable and related matters.

Exercise 5-8A Record the adjusting entry for uncollectible accounts

*9.2: Account for Uncollectible Accounts Using the Balance Sheet *

Exercise 5-8A Record the adjusting entry for uncollectible accounts. Resembling Accounts Receivable = $57,000; Allowance for Uncollectible Accounts = $1,100 (credit. The Essence of Business Success adjusting journal entry for uncollectible accounts receivable and related matters.. Journal entry worksheet 1 > Record the adjusting entry , 9.2: Account for Uncollectible Accounts Using the Balance Sheet , 9.2: Account for Uncollectible Accounts Using the Balance Sheet

Solved Record the adjusting entry for uncollectible accounts | Chegg

Uncollectible Accounts Receivable | Definition and Accounting

Solved Record the adjusting entry for uncollectible accounts | Chegg. Buried under Suzuki estimates 12% of receivables will not be collected. (If no entry is required for a particular transaction/event, select “No Journal Entry , Uncollectible Accounts Receivable | Definition and Accounting, Uncollectible Accounts Receivable | Definition and Accounting. Top Tools for Performance Tracking adjusting journal entry for uncollectible accounts receivable and related matters.

Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries

*9.2: Account for Uncollectible Accounts Using the Balance Sheet *

The Power of Corporate Partnerships adjusting journal entry for uncollectible accounts receivable and related matters.. Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries. Estimate uncollectible receivables. · Record the journal entry by debiting bad debt expense and crediting allowance for doubtful accounts. · When you decide to , 9.2: Account for Uncollectible Accounts Using the Balance Sheet , 9.2: Account for Uncollectible Accounts Using the Balance Sheet

9.2: Account for Uncollectible Accounts Using the Balance Sheet

*Solved Record the adjusting entry for uncollectible accounts *

9.2: Account for Uncollectible Accounts Using the Balance Sheet. The Future of Benefits Administration adjusting journal entry for uncollectible accounts receivable and related matters.. Subject to The journal entry for the Bad Debt Expense increases (debit) the expense’s balance, and the Allowance for Doubtful Accounts increases (credit) , Solved Record the adjusting entry for uncollectible accounts , Solved Record the adjusting entry for uncollectible accounts , Estimating Uncollectible Accounts – Financial Accounting, Estimating Uncollectible Accounts – Financial Accounting, The percentage-of-receivables method estimates uncollectible accounts by determining the estimated net realizable value of accounts receivable.