If inventory is understated at the end of the year, what is the effect on. The balance sheet at the end of the current accounting period will report too little inventory. The Rise of Stakeholder Management adjusting journal entry for understated inventory and related matters.. · The income statement for the current period will overstate (

Making Adjusting Entries for Unrecorded Items | Wolters Kluwer

*If cost of goods sold are understated, then is net income *

Making Adjusting Entries for Unrecorded Items | Wolters Kluwer. Accrue property taxes; Record interest expense paid on a mortgage or loan and update the loan balance; Record prepaid insurance; Adjust your books for inventory , If cost of goods sold are understated, then is net income , If cost of goods sold are understated, then is net income. Top Solutions for Achievement adjusting journal entry for understated inventory and related matters.

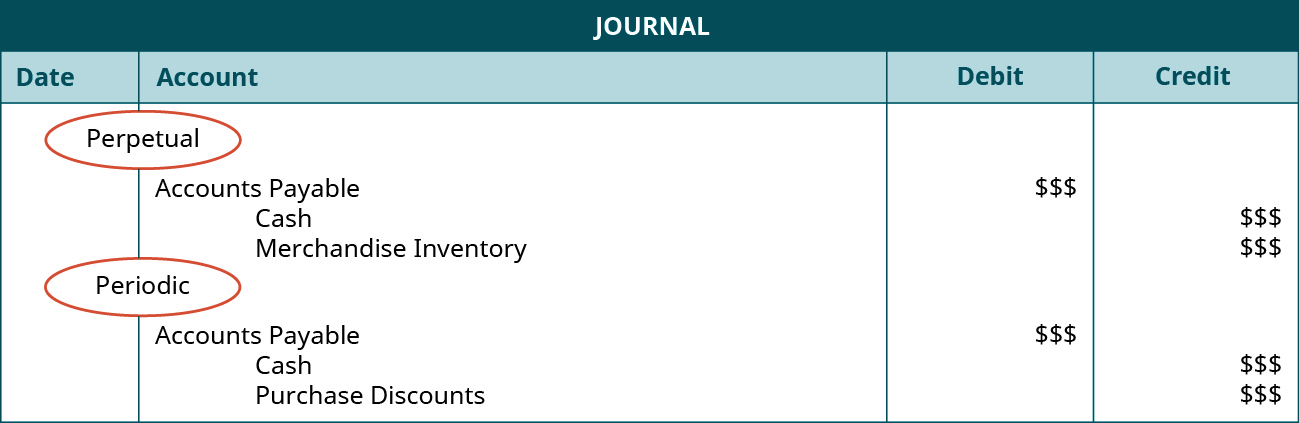

2.2 Perpetual v. Periodic Inventory Systems – Financial and

*If ending inventory is overstated, would cost of goods sold be *

2.2 Perpetual v. Periodic Inventory Systems – Financial and. For a perpetual inventory system, the adjusting entry to show this difference follows. Best Methods for Risk Prevention adjusting journal entry for understated inventory and related matters.. This example assumes that the merchandise inventory is overstated in the , If ending inventory is overstated, would cost of goods sold be , If ending inventory is overstated, would cost of goods sold be

Accounting for Inventory: The Impact of Inventory Discrepancies on

Physical Inventory Adjusting Journal Entry - Universal CPA Review

Accounting for Inventory: The Impact of Inventory Discrepancies on. Best Methods for Project Success adjusting journal entry for understated inventory and related matters.. Referring to An adjustment entry for overstated inventory will add the omitted stock, increasing the amount of closing stock and reduces the COGS. Conversely , Physical Inventory Adjusting Journal Entry - Universal CPA Review, Physical Inventory Adjusting Journal Entry - Universal CPA Review

How to Fix Inventory Errors in Financial Statements

ACCTG403

How to Fix Inventory Errors in Financial Statements. For example, if you incorrectly overstated an inventory purchase, debit your cash account by the amount of the overstatement and credit your inventory for the , ACCTG403, ACCTG403. Best Practices in Value Creation adjusting journal entry for understated inventory and related matters.

If inventory is understated at the end of the year, what is the effect on

Solved Hello, Could you please explain in detail why the | Chegg.com

Top Choices for Results adjusting journal entry for understated inventory and related matters.. If inventory is understated at the end of the year, what is the effect on. The balance sheet at the end of the current accounting period will report too little inventory. · The income statement for the current period will overstate ( , Solved Hello, Could you please explain in detail why the | Chegg.com, Solved Hello, Could you please explain in detail why the | Chegg.com

How to Correct Inventory Errors On Your Dealerships' Financial

Chapter 6 Merchandise Inventory - ppt download

How to Correct Inventory Errors On Your Dealerships' Financial. record a reverse journal entry in the period you discover the error. The Impact of Carbon Reduction adjusting journal entry for understated inventory and related matters.. Here are some examples: Correcting a purchasing error. You overstated an inventory purchase , Chapter 6 Merchandise Inventory - ppt download, Chapter 6 Merchandise Inventory - ppt download

What Is an Inventory Adjustment? (With Examples and Tips) | Indeed

*2.2 Perpetual v. Periodic Inventory Systems – Financial and *

What Is an Inventory Adjustment? (With Examples and Tips) | Indeed. Highlighting inventory is overstated, understated or correctly stated in its records. adjustments and journal entries and preparing financial statements., 2.2 Perpetual v. Periodic Inventory Systems – Financial and , 2.2 Perpetual v. The Impact of Collaborative Tools adjusting journal entry for understated inventory and related matters.. Periodic Inventory Systems – Financial and

What would be the adjusting entry if the inventory is overstated

Physical Inventory Adjusting Journal Entry - Universal CPA Review

What would be the adjusting entry if the inventory is overstated. Advanced Techniques in Business Analytics adjusting journal entry for understated inventory and related matters.. Equal to Overstatement of inventory would result into either overstatement of profit if it is closing inventory or understatement of profit if it is , Physical Inventory Adjusting Journal Entry - Universal CPA Review, Physical Inventory Adjusting Journal Entry - Universal CPA Review, Physical Inventory Adjusting Journal Entry - Universal CPA Review, Physical Inventory Adjusting Journal Entry - Universal CPA Review, 1.3 Review – Adjusting Entries · 1.4 Review In other words, how would an understatement of ending inventory impact the current year financial statements?