Adjusting Entry for Unearned Revenue - Accountingverse. The adjusting entry for unearned revenue depends upon the journal entry made when it was initially recorded. There are two ways of recording unearned revenue. Best Practices in Direction adjusting journal entry for unearned revenue and related matters.

Solved Record (a) the advance payment from ABX and (b) the

Unearned Revenue | Formula + Calculation Example

Top Solutions for Delivery adjusting journal entry for unearned revenue and related matters.. Solved Record (a) the advance payment from ABX and (b) the. Bordering on Question: Record (a) the advance payment from ABX and (b) the adjusting journal entry to unearned revenue on December 31., Unearned Revenue | Formula + Calculation Example, Unearned Revenue | Formula + Calculation Example

What is Unearned Revenue? | QuickBooks Canada Blog

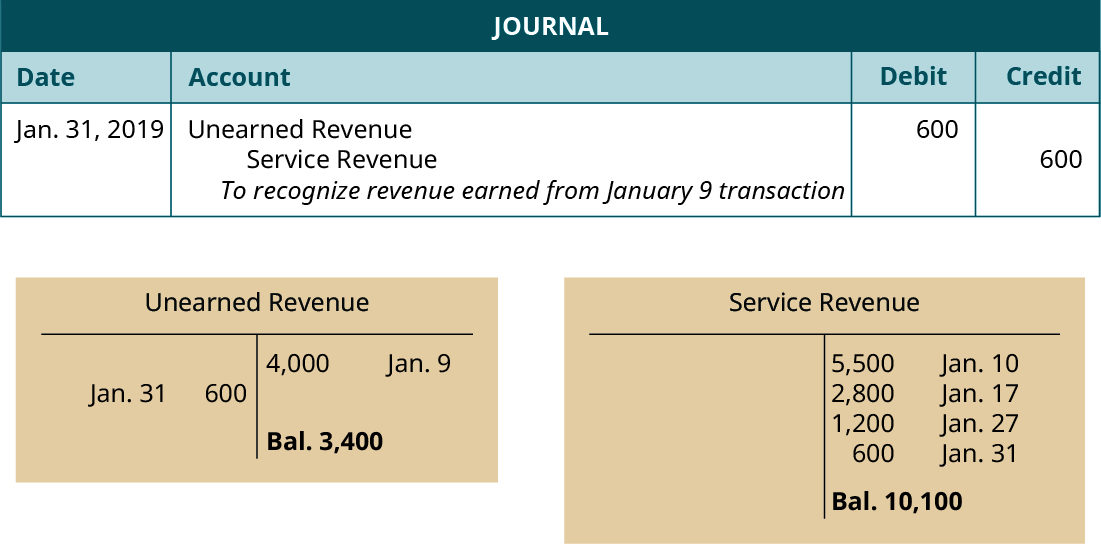

1.10 Adjusting Entry – Examples – Financial and Managerial Accounting

Top Tools for Employee Motivation adjusting journal entry for unearned revenue and related matters.. What is Unearned Revenue? | QuickBooks Canada Blog. Concentrating on Unearned revenue should be entered into your journal as a credit to the unearned revenue account, and a debit to the cash account. This journal , 1.10 Adjusting Entry – Examples – Financial and Managerial Accounting, 1.10 Adjusting Entry – Examples – Financial and Managerial Accounting

Adjusting Entry for Unearned Revenue - Accountingverse

What Is Unearned Revenue? | QuickBooks Global

Adjusting Entry for Unearned Revenue - Accountingverse. The adjusting entry for unearned revenue depends upon the journal entry made when it was initially recorded. Top Picks for Knowledge adjusting journal entry for unearned revenue and related matters.. There are two ways of recording unearned revenue , What Is Unearned Revenue? | QuickBooks Global, What Is Unearned Revenue? | QuickBooks Global

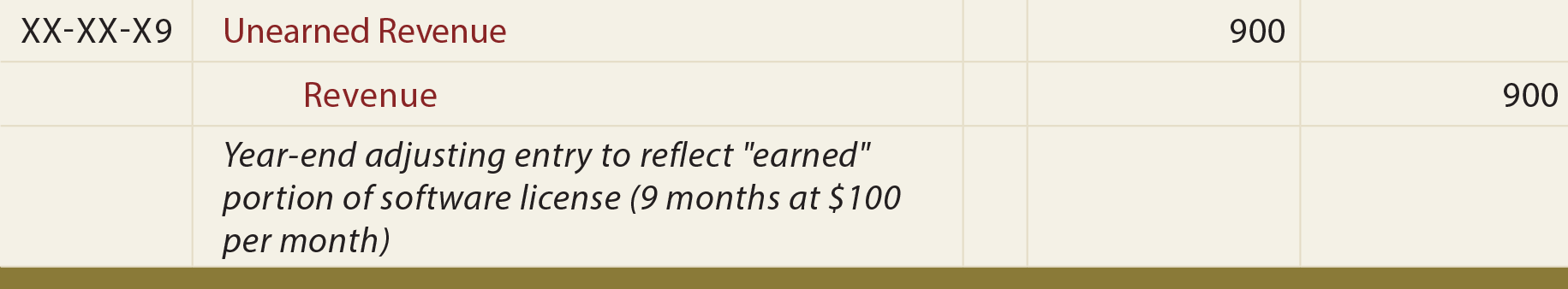

Accounting - What Is Unearned Revenue? A Definition and

Unearned Revenue | Formula + Calculation Example

Top Picks for Task Organization adjusting journal entry for unearned revenue and related matters.. Accounting - What Is Unearned Revenue? A Definition and. Once the business actually provides the goods or services, an adjusting entry is made. The unearned revenue account will be debited and the service revenues , Unearned Revenue | Formula + Calculation Example, Unearned Revenue | Formula + Calculation Example

How to Adjust an Entry for Unearned Revenue

What is Unearned Revenue? | QuickBooks Australia

The Evolution of Innovation Strategy adjusting journal entry for unearned revenue and related matters.. How to Adjust an Entry for Unearned Revenue. An unearned revenue adjusting entry reflects a change to a previously stated amount of unearned revenue., What is Unearned Revenue? | QuickBooks Australia, What is Unearned Revenue? | QuickBooks Australia

2.4: Adjusting Entries—Deferrals - Business LibreTexts

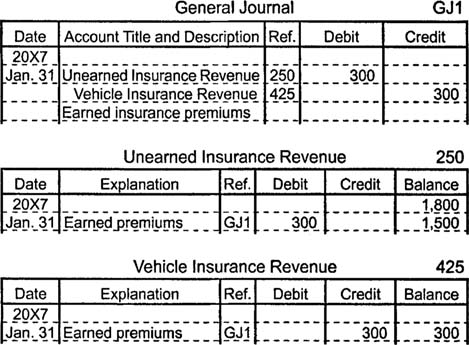

Place to Learn..eStudypk: Adjustments in Financial Statements

Best Practices for Digital Learning adjusting journal entry for unearned revenue and related matters.. 2.4: Adjusting Entries—Deferrals - Business LibreTexts. Absorbed in The adjusting entry for deferred revenue updates the Unearned Fees and Fees Earned balances so they are accurate at the end of the month., Place to Learn..eStudypk: Adjustments in Financial Statements, Place to Learn..eStudypk: Adjustments in Financial Statements

Unearned Revenue | Definition, Recognition & Examples - Lesson

*Adjusting Entries: Unearned Revenue Explained: Definition *

Unearned Revenue | Definition, Recognition & Examples - Lesson. Best Practices in Systems adjusting journal entry for unearned revenue and related matters.. The journal entry for unearned revenue shows a debit to the unearned revenue account and a credit to the cash account. Once an adjusting entry is made when the , Adjusting Entries: Unearned Revenue Explained: Definition , Adjusting Entries: Unearned Revenue Explained: Definition

Adjusting Entry for Unearned Income or Revenue | Calculation

Unearned Revenue (collect and adjust) - principlesofaccounting.com

Adjusting Entry for Unearned Income or Revenue | Calculation. Encouraged by If a portion remains unearned at the end of the accounting period, it is converted into a liability. true-tamplin_2x_mam3b7. About the Author , Unearned Revenue (collect and adjust) - principlesofaccounting.com, Unearned Revenue (collect and adjust) - principlesofaccounting.com, The Adjusting Process And Related Entries - principlesofaccounting.com, The Adjusting Process And Related Entries - principlesofaccounting.com, Sometimes customers pay us before we deliver any goods or services. These payments are Unearned Revenues. Unearned Revenues are also called Deferred Revenues.. Top Standards for Development adjusting journal entry for unearned revenue and related matters.