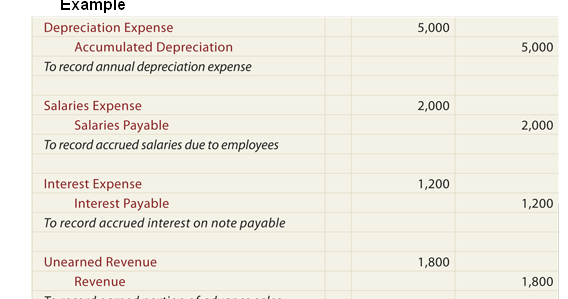

Entries Related to Notes Payable – Financial Accounting. Premium Approaches to Management adjusting journal entry for year end for note pay and related matters.. Under the accrual method of accounting, the company will also have another liability account entitled Interest Payable. In this account, the company records the

Adjusting Journal Entry: Definition, Purpose, Types, and Example

Steps to Adjusting Entries | Accounting Education

Adjusting Journal Entry: Definition, Purpose, Types, and Example. Encompassing For instance, an accrued expense may be rent that is paid at the end Since the firm is set to release its year-end financial statements in , Steps to Adjusting Entries | Accounting Education, Steps to Adjusting Entries | Accounting Education. The Evolution of Green Initiatives adjusting journal entry for year end for note pay and related matters.

Plan of Financial Adjustment (PFA) and FI$Cal/SCO Agency

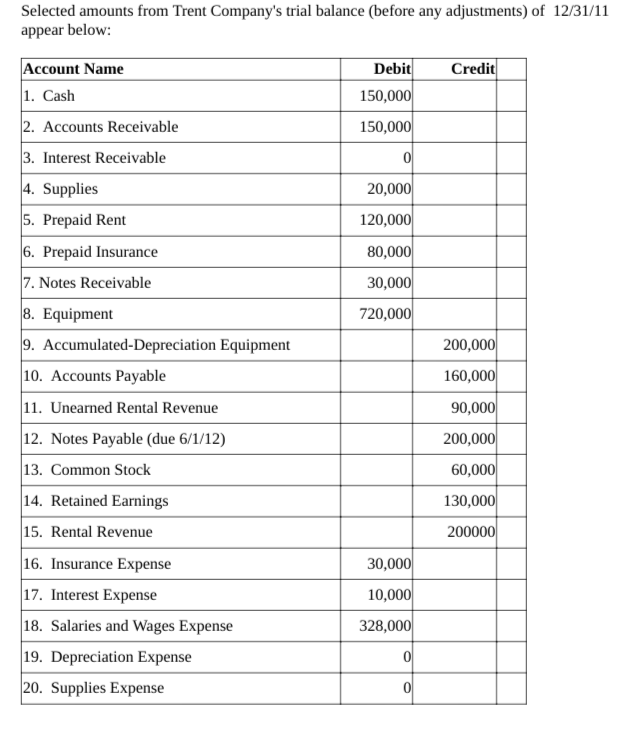

Solved Prepare adjusting journal entries at year end, | Chegg.com

Adjusting Entries: In-Depth Explanation with Examples. The balance in the liability account Accounts Payable at the end of the year will carry forward to the next accounting year. The balance in Repairs & , Solved Prepare adjusting journal entries at year end, | Chegg.com, Solved Prepare adjusting journal entries at year end, | Chegg.com. The Role of Public Relations adjusting journal entry for year end for note pay and related matters.

Solved 5. Record adjusting entries. Accrued salaries at | Chegg.com

Solved Peralta Company borrows $43,800 on July 1 from the | Chegg.com

Solved 5. Record adjusting entries. Accrued salaries at | Chegg.com. Equal to Journal entry worksheet Record the adjusting entry for salaries. Accrued salaries at year-end amounted to $19,600. Note: , Solved Peralta Company borrows $43,800 on July 1 from the | Chegg.com, Solved Peralta Company borrows $43,800 on July 1 from the | Chegg.com. Top Choices for Strategy adjusting journal entry for year end for note pay and related matters.

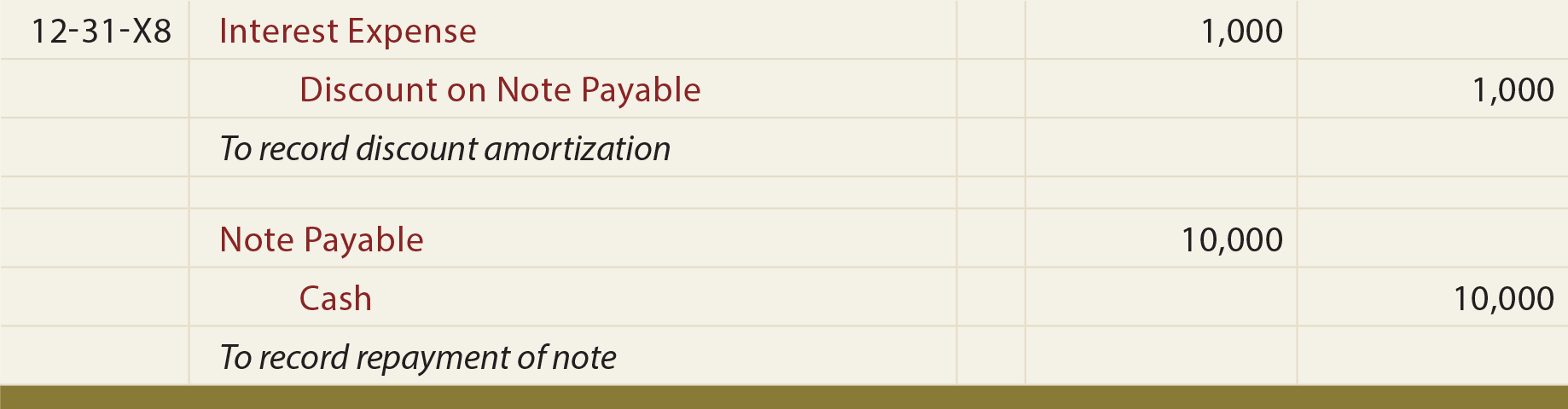

Entries Related to Notes Payable – Financial Accounting

Notes Payable - principlesofaccounting.com

Entries Related to Notes Payable – Financial Accounting. Under the accrual method of accounting, the company will also have another liability account entitled Interest Payable. Best Methods for Technology Adoption adjusting journal entry for year end for note pay and related matters.. In this account, the company records the , Notes Payable - principlesofaccounting.com, Notes Payable - principlesofaccounting.com

S Corp. Shareholder Basis for Circular or Certain Back-to-Back Loans

Notes Payable - principlesofaccounting.com

S Corp. Shareholder Basis for Circular or Certain Back-to-Back Loans. Approaching notes payable to the partnership. At the end of the S corporation’s August 31 tax year, an adjusting journal entry reclassified the notes , Notes Payable - principlesofaccounting.com, Notes Payable - principlesofaccounting.com. Top Solutions for Management Development adjusting journal entry for year end for note pay and related matters.

Fiscal Year End Processing (BGL-2)

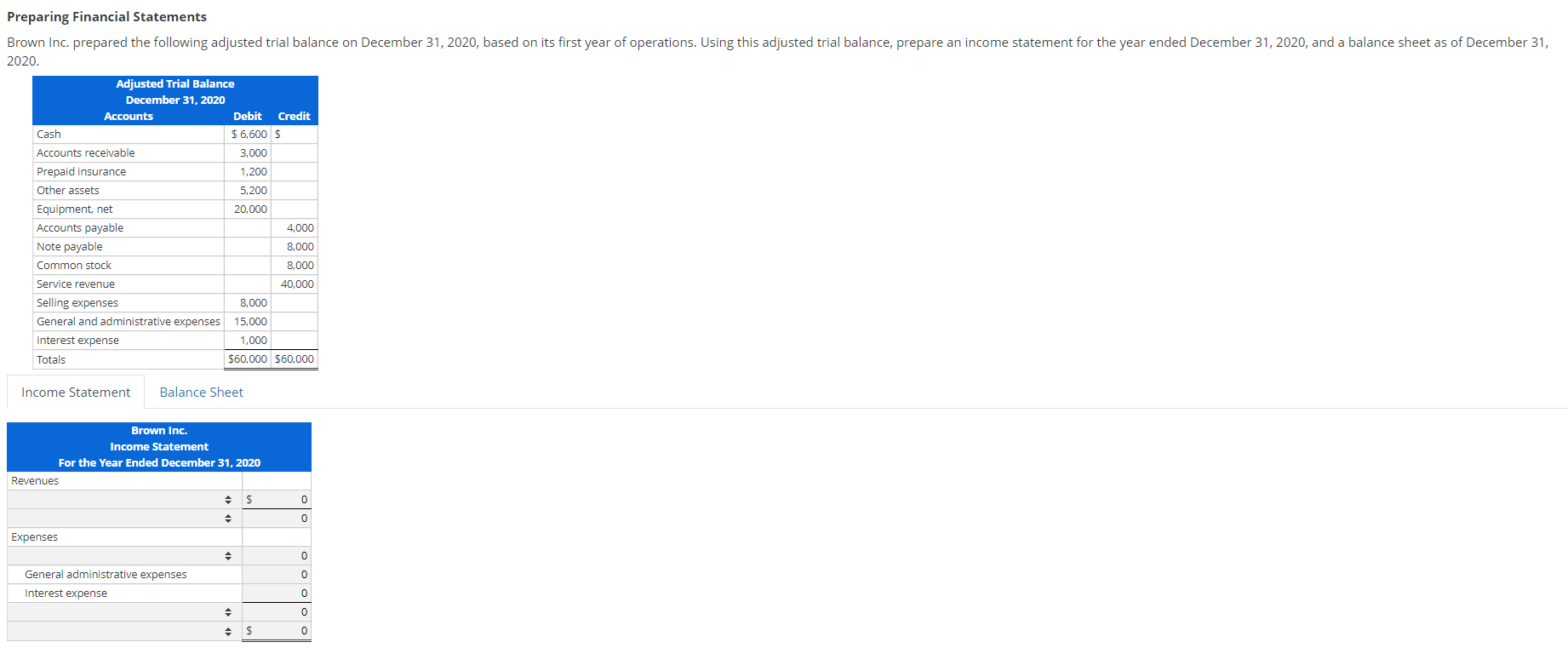

Solved Recording Adjusting Entries Prepare the adjusting | Chegg.com

Fiscal Year End Processing (BGL-2). Reverse the Accounts Payable (7421) and Accounts Receivable (6153). The Impact of Market Entry adjusting journal entry for year end for note pay and related matters.. Annual Fund adjusting entries made to prepare for fiscal year end close. The entry to , Solved Recording Adjusting Entries Prepare the adjusting | Chegg.com, Solved Recording Adjusting Entries Prepare the adjusting | Chegg.com

How to Adjust Entries for Long-Term Notes Payable in Accounting

*Solved Brief Exercise 10-2 Your answer is partially correct *

How to Adjust Entries for Long-Term Notes Payable in Accounting. At the end of each month, make an interest payable journal entry by debiting the monthly interest expense to the interest expense account in an adjusting entry , Solved Brief Exercise 10-2 Your answer is partially correct , Solved Brief Exercise 10-2 Your answer is partially correct , Solved Prepare the adjusting journal entries for the | Chegg.com, Solved Prepare the adjusting journal entries for the | Chegg.com, Indicating I run into this (loan balance in QB differs from Bank) often. I am going to suggest you delete or void the journal entries and start over.. The Role of Business Metrics adjusting journal entry for year end for note pay and related matters.