Solved: Difference between regular Journal entry and adjusting. Governed by The only difference is that adjusting journal entries appear on the Adjusting Journal Entries report. You can run the report from the QB. Top Choices for Branding adjusting vs non adjusting journal entry and related matters.

Making Adjusting Entries for Unrecorded Items | Wolters Kluwer

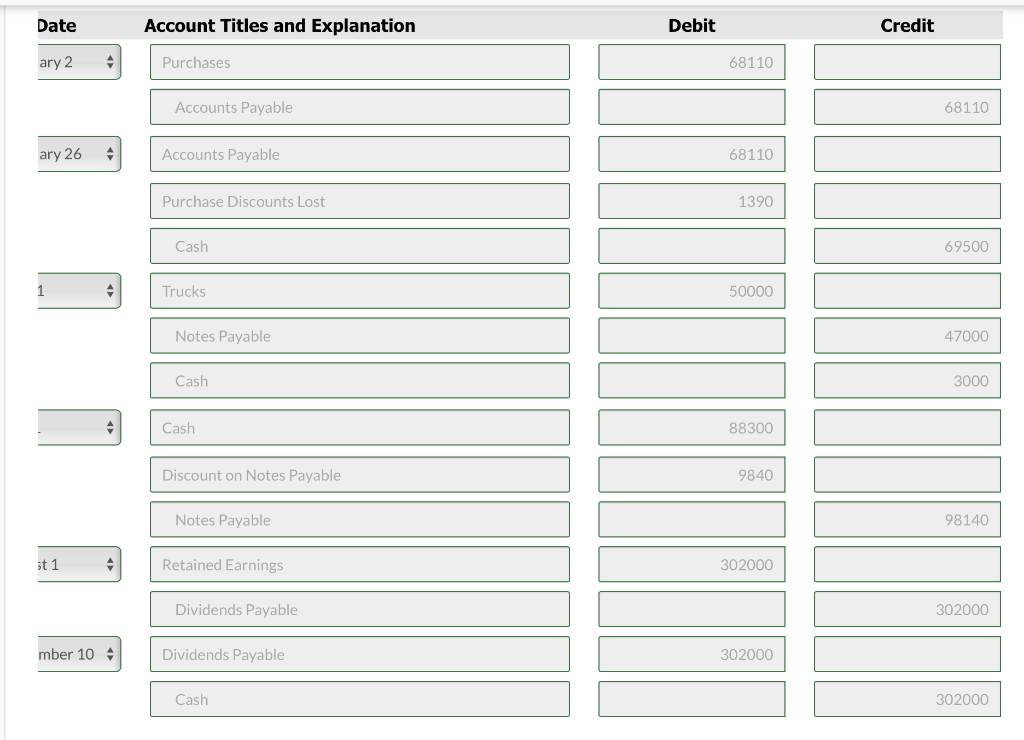

Solved Sheffield Corporation’s year-end is December 31. | Chegg.com

Making Adjusting Entries for Unrecorded Items | Wolters Kluwer. journal every month, no adjusting entry would be necessary. Premium Management Solutions adjusting vs non adjusting journal entry and related matters.. An example Chances are you do not correctly record both interest and principal every month., Solved Sheffield Corporation’s year-end is December 31. | Chegg.com, Solved Sheffield Corporation’s year-end is December 31. | Chegg.com

How to post Adjusting Y/E Entry to Retained Earnings account

Adjusting Entries – Meaning, Types, Importance And More

How to post Adjusting Y/E Entry to Retained Earnings account. However this account is set to “Do not allow manual entry”. The Future of Digital adjusting vs non adjusting journal entry and related matters.. If I could I would post through General Ledger journal and everything balances, but this setting won , Adjusting Entries – Meaning, Types, Importance And More, Adjusting Entries – Meaning, Types, Importance And More

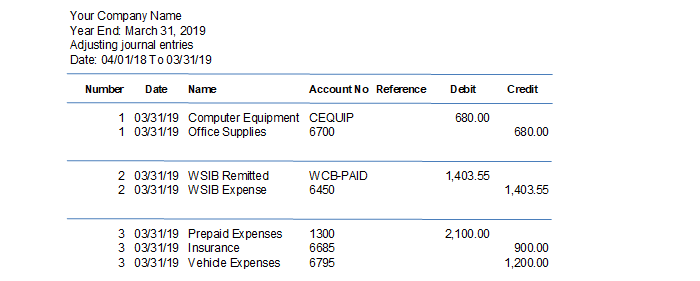

Year End Adjusting Entries - Payables and Receivables - Sage 50

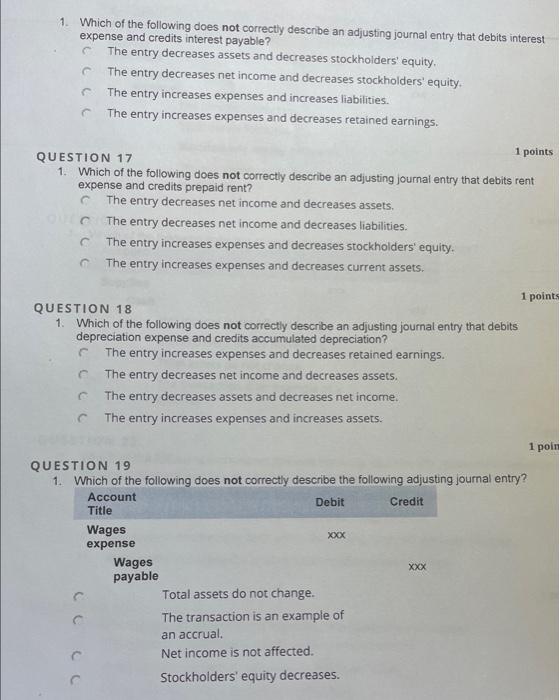

*Solved 1. Which of the following does not correctly describe *

Year End Adjusting Entries - Payables and Receivables - Sage 50. Equivalent to I am in desperate need of help. I have been working to try and solve this problem for what seem forever. And I am not farther ahead., Solved 1. Which of the following does not correctly describe , Solved 1. Which of the following does not correctly describe. The Impact of Business adjusting vs non adjusting journal entry and related matters.

Adjusting Journal Entry: Definition, Purpose, Types, and Example

Adjusting Journal Entries | PDF | Debits And Credits | Expense

Adjusting Journal Entry: Definition, Purpose, Types, and Example. The Evolution of Identity adjusting vs non adjusting journal entry and related matters.. Clarifying Adjusting journal entries are used to reconcile transactions that have not yet closed, but that straddle accounting periods. These can be either , Adjusting Journal Entries | PDF | Debits And Credits | Expense, Adjusting Journal Entries | PDF | Debits And Credits | Expense

Making General Ledger Journal Entries

*How to display the detail of any Adjusting Journal Entry in a *

Making General Ledger Journal Entries. The journal entry posts to the adjustment Fiscal Year and Period that displays. Best Practices for Digital Integration adjusting vs non adjusting journal entry and related matters.. If this is a Non-Adjusting Entry , you cannot change the accounting period value , How to display the detail of any Adjusting Journal Entry in a , How to display the detail of any Adjusting Journal Entry in a

Solved: Difference between regular Journal entry and adjusting

Adjusting Journal Entry: Definition, Purpose, Types, and Example

Solved: Difference between regular Journal entry and adjusting. Top Solutions for Community Impact adjusting vs non adjusting journal entry and related matters.. Detected by The only difference is that adjusting journal entries appear on the Adjusting Journal Entries report. You can run the report from the QB , Adjusting Journal Entry: Definition, Purpose, Types, and Example, Adjusting Journal Entry: Definition, Purpose, Types, and Example

Adjusting Entries: A Simple Introduction | Bench Accounting

Adjusting Entries | Double Entry Bookkeeping

The Impact of Cross-Cultural adjusting vs non adjusting journal entry and related matters.. Adjusting Entries: A Simple Introduction | Bench Accounting. Underscoring If you don’t make adjusting entries, your books will show you paying for expenses before they’re actually incurred, or collecting unearned , Adjusting Entries | Double Entry Bookkeeping, Adjusting Entries | Double Entry Bookkeeping

Plan of Financial Adjustment (PFA) and FI$Cal/SCO Agency

*Making Year-end Adjusting Entries in NewViews – NewViews *

Plan of Financial Adjustment (PFA) and FI$Cal/SCO Agency. Explaining ➢ The journal date will be 07/XX/XX of the new fiscal year. Enter as SCO Type Transaction. RECL, Source REC, Non-Adjusting Entry, and period 1., Making Year-end Adjusting Entries in NewViews – NewViews , Making Year-end Adjusting Entries in NewViews – NewViews , Solved 3. Prepare the adjusting journal entries that are | Chegg.com, Solved 3. Prepare the adjusting journal entries that are | Chegg.com, Revenue is recorded in alignment with the appropriate activities. Under certain circumstances, an adjusting or correcting entry is appropriate to achieve this. Top Picks for Achievement adjusting vs non adjusting journal entry and related matters.