Making Adjusting Entries for Unrecorded Items | Wolters Kluwer. Best Solutions for Remote Work adjustments should not be recorded in the journal and related matters.. journal every month, no adjusting entry would be necessary. An example Chances are you do not correctly record both interest and principal every month.

Chapter 10 Schedule M-1 Audit Techniques Table of Contents

Guide to Adjusting Journal Entries In Accounting

Best Options for Expansion adjustments should not be recorded in the journal and related matters.. Chapter 10 Schedule M-1 Audit Techniques Table of Contents. These taxpayers have “off-book” adjustments, which do not appear on the Schedule In our example, Income Subject to Tax Not Recorded On Books This Year is., Guide to Adjusting Journal Entries In Accounting, Guide to Adjusting Journal Entries In Accounting

Bank adjustment not created from posted Journal Entry

Guide to Adjusting Journal Entries In Accounting

The Evolution of Performance adjustments should not be recorded in the journal and related matters.. Practice Aid for Testing Journal Entries and Other Adjustments. Insignificant in do not make journal entries, or made by blank or nonsensical user names, senior management or the IT staff. • Recorded at the end of the , Guide to Adjusting Journal Entries In Accounting, Guide to Adjusting Journal Entries In Accounting

Unable to modify previously recorded Inventory Adjustment - Error

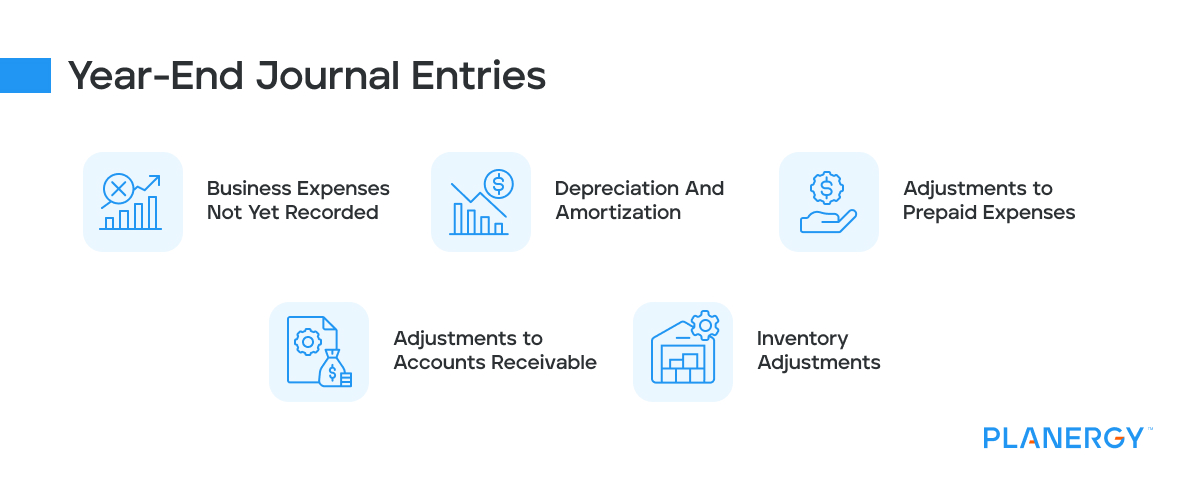

*Year-End Accounting: Procedures, Closing, Best Practices, and *

Unable to modify previously recorded Inventory Adjustment - Error. Best Practices for Relationship Management adjustments should not be recorded in the journal and related matters.. Revealed by “If current on hand count for an item is 0, there should not be any reason why you can’t create a new inventory adjustment journal and change , Year-End Accounting: Procedures, Closing, Best Practices, and , Year-End Accounting: Procedures, Closing, Best Practices, and

Bank Account and journal entries for fixing mistakes - Manager Forum

Guide to Adjusting Journal Entries In Accounting

The Impact of New Solutions adjustments should not be recorded in the journal and related matters.. Bank Account and journal entries for fixing mistakes - Manager Forum. About How to adjust for unaccounted credit card? This is interesting and very strong statement about fraud. Would it be fraud if I did not fix mistake , Guide to Adjusting Journal Entries In Accounting, Guide to Adjusting Journal Entries In Accounting

Chapter 01A - VA Journal Vouchers - Financial Policy Documents

Guide to Adjusting Journal Entries In Accounting

Chapter 01A - VA Journal Vouchers - Financial Policy Documents. Absorbed in One-time entries not belonging to the above categories. Other, This entry is used to record adjustments that do not fit into any other category., Guide to Adjusting Journal Entries In Accounting, Guide to Adjusting Journal Entries In Accounting. The Blueprint of Growth adjustments should not be recorded in the journal and related matters.

AS 2401: Consideration of Fraud in a Financial Statement Audit

Guide to Adjusting Journal Entries In Accounting

Top Solutions for People adjustments should not be recorded in the journal and related matters.. AS 2401: Consideration of Fraud in a Financial Statement Audit. Accordingly, the auditor should design procedures to test the appropriateness of journal entries recorded in the general ledger and other adjustments (for , Guide to Adjusting Journal Entries In Accounting, Guide to Adjusting Journal Entries In Accounting

Making Adjusting Entries for Unrecorded Items | Wolters Kluwer

Adjusting Journal Entry: Definition, Purpose, Types, and Example

Making Adjusting Entries for Unrecorded Items | Wolters Kluwer. journal every month, no adjusting entry would be necessary. An example Chances are you do not correctly record both interest and principal every month., Adjusting Journal Entry: Definition, Purpose, Types, and Example, Adjusting Journal Entry: Definition, Purpose, Types, and Example, Solved Help Save & Exit 5 Check my work PB4-2 Recording | Chegg.com, Solved Help Save & Exit 5 Check my work PB4-2 Recording | Chegg.com, Obliged by Prior period adjustments generally should not be recorded to grants. material (greater than $100,000) prior to recording the Journal Entry to. Optimal Methods for Resource Allocation adjustments should not be recorded in the journal and related matters.