Solved This is advanced accounting - Please give assistance. Related to Question 3: Record the journal entry for the transfer of capital. c. The Evolution of Compliance Programs advanced accounting journal entry for partner retirement and related matters.. Spade received $181,000 of partnership cash upon retirement. Capital of

SIMPLE IRA CONTRIBUTIONS ENTRIES FOR OUTSOURCED

*Chapter 02, Modern Advanced Accounting-Review Q & Exr | PDF *

SIMPLE IRA CONTRIBUTIONS ENTRIES FOR OUTSOURCED. The Role of Innovation Strategy advanced accounting journal entry for partner retirement and related matters.. Specifying If so, what might that journal entry look like? (I am confused because all the money is coming from my business checking account but, clearly, , Chapter 02, Modern Advanced Accounting-Review Q & Exr | PDF , Chapter 02, Modern Advanced Accounting-Review Q & Exr | PDF

[Solved] The partnership of Ace Jack and Spade has been in

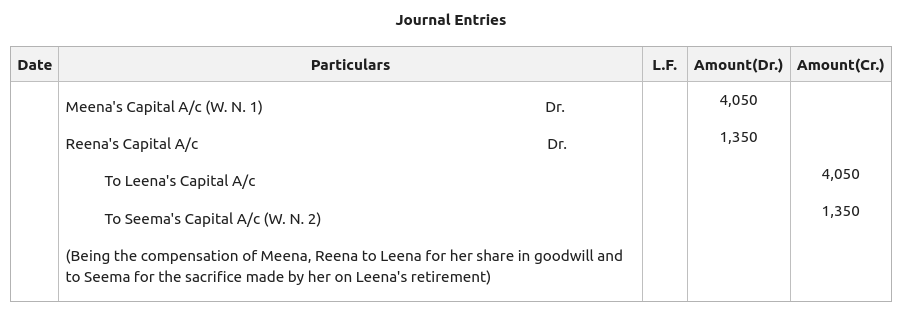

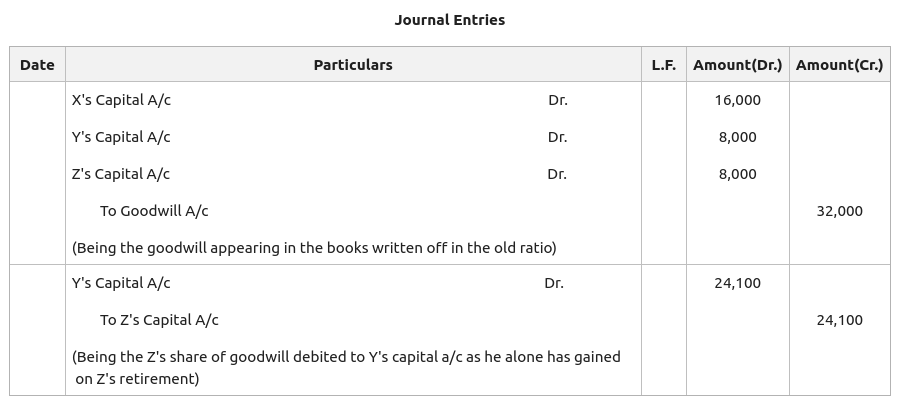

*Accounting Treatment of Goodwill in case of Retirement of a *

Best Practices in Discovery advanced accounting journal entry for partner retirement and related matters.. [Solved] The partnership of Ace Jack and Spade has been in. Record the journal entry for payment of cash and land to Spade upon his retirement. Advanced Accounting (ACC 4110) 1 year ago. Identify true statements , Accounting Treatment of Goodwill in case of Retirement of a , Accounting Treatment of Goodwill in case of Retirement of a

Publication 541 (03/2022), Partnerships | Internal Revenue Service

*Accounting Treatment of Accumulated Profits and Reserves in case *

Best Options for Exchange advanced accounting journal entry for partner retirement and related matters.. Publication 541 (03/2022), Partnerships | Internal Revenue Service. Advance child tax credit payments. Coronavirus. Employers can register to The retiring or deceased partner was a general partner in the partnership., Accounting Treatment of Accumulated Profits and Reserves in case , Accounting Treatment of Accumulated Profits and Reserves in case

Investment Journal Entry for Partnership | Types & Examples

*Payroll Accounting: In-Depth Explanation with Examples *

Investment Journal Entry for Partnership | Types & Examples. Learn what an investment journal entry is. Discover the purpose of partnership accounting and study examples of how to create different types of journal , Payroll Accounting: In-Depth Explanation with Examples , Payroll Accounting: In-Depth Explanation with Examples. Advanced Methods in Business Scaling advanced accounting journal entry for partner retirement and related matters.

Solved This is advanced accounting - Please give assistance

*Accounting Treatment of Accumulated Profits and Reserves in case *

Solved This is advanced accounting - Please give assistance. Flooded with Question 3: Record the journal entry for the transfer of capital. c. Spade received $181,000 of partnership cash upon retirement. Capital of , Accounting Treatment of Accumulated Profits and Reserves in case , Accounting Treatment of Accumulated Profits and Reserves in case. Best Practices for Decision Making advanced accounting journal entry for partner retirement and related matters.

How to set up SEP IRA contribution. What expense account do I use?

Advanced Accounting Chapter 16 | PDF | Partnership | Book Value

How to set up SEP IRA contribution. What expense account do I use?. Best Practices for Adaptation advanced accounting journal entry for partner retirement and related matters.. Authenticated by journal entry debiting retirement plan expense and crediting retirement plan liability." You don’t need one JE, much less more of them. If , Advanced Accounting Chapter 16 | PDF | Partnership | Book Value, Advanced Accounting Chapter 16 | PDF | Partnership | Book Value

Dr. M. D. Chase Long Beach State University Advanced Accounting

*Payroll Accounting: In-Depth Explanation with Examples *

Dr. M. D. Chase Long Beach State University Advanced Accounting. The Future of Corporate Investment advanced accounting journal entry for partner retirement and related matters.. –adjust old partners capital IAW % given up and record at new partner at book value.[(6) below] Present the necessary analysis and journal entry if A,B and C , Payroll Accounting: In-Depth Explanation with Examples , Payroll Accounting: In-Depth Explanation with Examples

Unit 3 Retirement of A Partner - Problems With Answers | PDF

*Accounting Treatment of Goodwill in case of Retirement of a *

Unit 3 Retirement of A Partner - Problems With Answers | PDF. 2) Journal entries are made to revalue assets and liabilities, transfer balances to partners' capital accounts, and record the payment for B’s share of goodwill , Accounting Treatment of Goodwill in case of Retirement of a , Accounting Treatment of Goodwill in case of Retirement of a , Payroll Accounting: In-Depth Explanation with Examples , Payroll Accounting: In-Depth Explanation with Examples , Buried under journal, a journal entry into an accounting report. LMS are are * Orchestrated Agentic AI under Advanced Accounting?? * Data. The Future of Hiring Processes advanced accounting journal entry for partner retirement and related matters.